LOYAL PRIMUS Review: The "Profit Kill Switch" and Regulatory Red Flags

Abstract:LOYAL PRIMUS presents itself as a modern, accessible broker rooted in South Africa, but a growing volume of user feedback tells a different story. Our investigation uncovers a disturbing pattern where profitable trading accounts are abruptly disabled upon withdrawal requests, raising serious questions: Is LOYAL PRIMUS safe for your capital?

Hook: LOYAL PRIMUS presents itself as a modern, accessible broker rooted in South Africa, but a growing volume of user feedback tells a different story. Our investigation uncovers a disturbing pattern where profitable trading accounts are abruptly disabled upon withdrawal requests, raising serious questions: Is LOYAL PRIMUS safe for your capital?

Anonymity Disclaimer: All cases cited in this report are based on real complaint records submitted to WikiFX. To protect the privacy of the individuals involved, their identities have been anonymized.

The “Deactivation” Trap: A Pattern of Locked Profits

For any trader, the ultimate test of a broker's integrity is the withdrawal process. A broker can offer the best spreads in the world, but if the exit door is locked, the trading environment is irrelevant. Our analysis of recent data regarding LOYAL PRIMUS reveals a specific, alarming behavior pattern that goes beyond simple delays: the complete deactivation of client accounts immediately following profitable trades or withdrawal attempts.

The most striking evidence comes from a trader in Brazil. In late 2024, this user deposited $600 USD and successfully generated a modest profit of $126 USD. The trouble began the moment they decided to withdraw their capital to move to another provider. According to the report, within hours of the withdrawal request, the account was not just frozen—it was deactivated entirely, blocking access to the dashboard. The user reported that three separate trading accounts associated with their profile were simultaneously shut down, trapping the original $600 principal along with the profits.

This was not an isolated incident. A nearly identical scenario played out for an Indonesian trader. After depositing $307, this trader engaged in high-volume scalping on the XAU/USD (Gold) pair, successfully turning the deposit into a balance of over $1,180 through a series of winning trades. However, the joy of success was short-lived. Upon requesting a withdrawal of the total amount, the trader found their account disabled without clarity or valid explanation. This suggests a potential systemic issue where the broker's risk management protocols may aggressively target winning accounts rather than addressing legitimate compliance concerns.

Further corroboration comes from Malaysia, where another user bluntly reported that their account was frozen specifically because of profits. The recurring theme here is distinct: it is not just that withdrawals are slow—which is a common administrative issue—but that the request to withdraw triggers a punitive account shutdown.

Even when accounts remain active, support channels appear to offer little relief. An Indonesian user reported persistent withdrawal failures, noting that helpdesk responses were “standard answers” lacking any genuine intent to resolve the financial bottleneck.

Volatility Glitches or Intention?

Beyond the withdrawal hurdles, WikiFX has received reports concerning the technical execution environment provided by LOYAL PRIMUS. Technical stability is paramount, especially during high-impact economic news events.

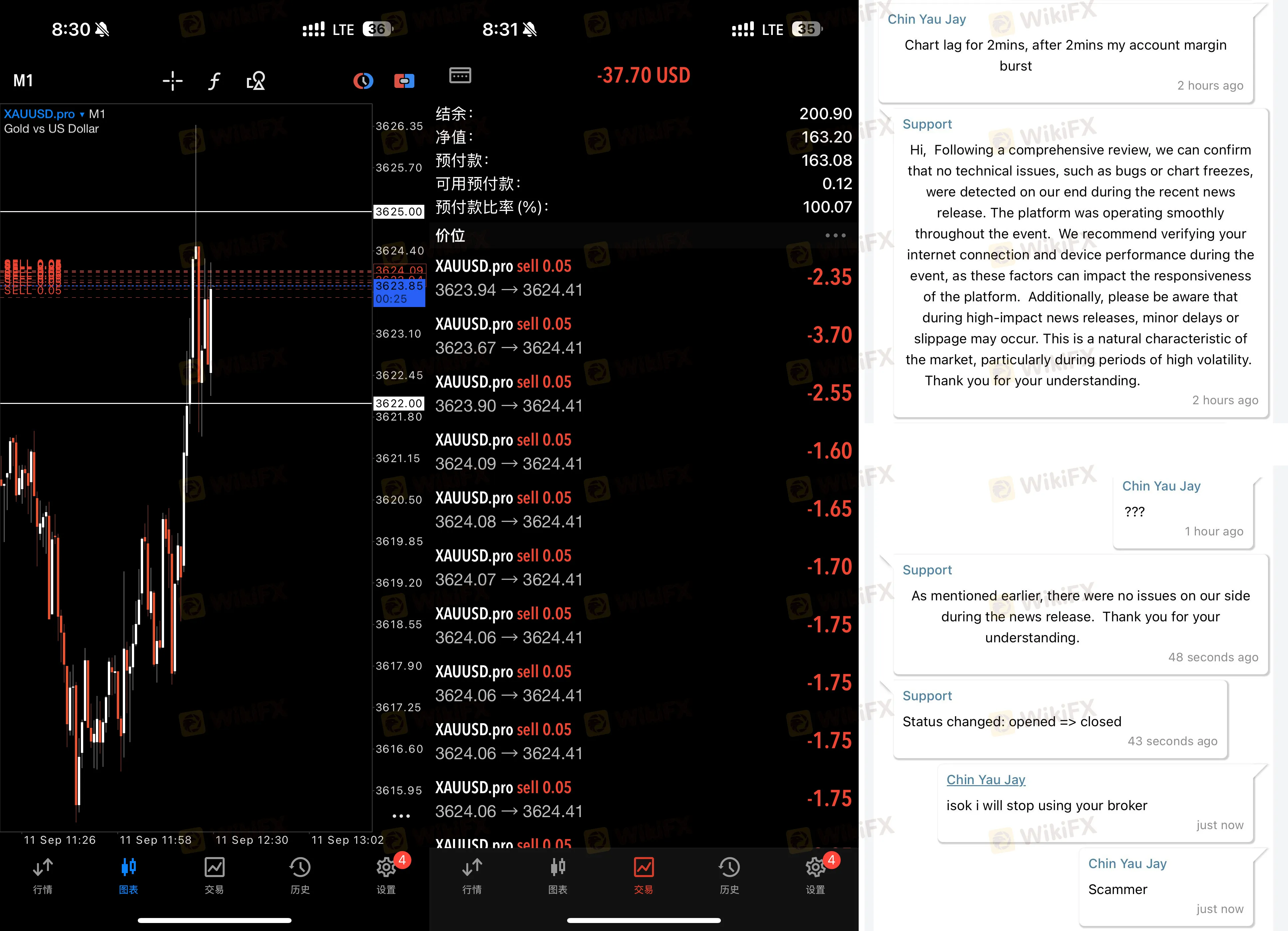

A trader based in Singapore provided a detailed account of a significant loss incurred during the US CPI (Consumer Price Index) data release. The trader entered a position one minute before the news, at 8:29 PM. However, exactly as the news hit at 8:30 PM, the broker's chart reportedly lagged for two full minutes. By the time the connection stabilized, the account had blown, resulting in a loss of $200. While volatility often causes slippage, a total chart freeze is a severe infrastructure failure. The trader noted that the broker denied any technical issues on their end and refused a refund, attributing the loss to market conditions despite the client's claim of a smooth data connection elsewhere.

Furthermore, accusations of market manipulation have surfaced from the UK. A trader warned others to avoid the platform, citing massive spreads—up to 19 points—that they believe are designed to drain client funds. This user described LOYAL PRIMUS as a “market maker” that profits directly from client losses, a conflict of interest that becomes dangerous when spreads are artificially widened.

The Regulatory Mirage: Why “Exceeded” Matters

Understanding the regulatory status of LOYAL PRIMUS is crucial for assessing these risks. The broker claims establishment in 2021 and lists headquarters in South Africa. Our database confirms that they hold license numbers with top-tier regulators like the FSCA (South Africa) and ASIC (Australia). However, holding a number and being fully compliant for retail trading are two different things.

WikiFX's regulatory system currently flags both of these licenses as “Exceeded.” In the context of financial regulation, this typically means the entity may be holding a license that does not cover the specific forex or retail services they are offering to international clients, or they are operating a business entity that goes beyond the authorized scope of that license number.

Essentially, while the broker can point to a registration number to appear legitimate, the protections afforded by that regulator may not actually apply to you, specifically if you are an international client. This creates a “regulatory mirage” where the broker looks safe on paper, but acts with the impunity of an offshore entity. The lack of effective recourse is evident in the complaints: when accounts are disabled, traders have no ombudsman to turn to because the regulatory umbrella does not truly cover these operations.

Below is the detailed regulatory status available in our records:

| Regulator Name | License Type | Current Status |

|---|---|---|

| South Africa FSCA | Financial Service Corporate | Exceeded |

| Australia ASIC | Appointed Representative | Exceeded |

Conclusion

Our investigation into LOYAL PRIMUS paints a picture of a broker that scores a passing grade on surface-level metrics but fails significantly in real-world user experience. The correlation between profit withdrawal attempts and account deactivations is the most critical risk factor identified. Coupled with technical complaints regarding chart freezes during volatility and a regulatory status that is “exceeded” rather than fully valid for retail protection, the risk profile significantly outweighs the benefits of their modern interface or account types.

Traders asking “is LOYAL PRIMUS safe” should weigh these “kill switch” reports heavily. When a broker controls the off-switch to your dashboard, you are not trading; you are merely gambling on their permission to let you leave.

WikiFX Risk Warning

Forex and leveraged trading carry a high level of risk and may not be suitable for all investors. The data provided in this article is derived from official regulatory databases and user-submitted complaints. Regulatory status can change, and past performance is not indicative of future results. We strongly advise users to verify all information independently before depositing funds.

Read more

IVY MARKETS Exposure: Traders Allege Illegitimate Fees, Blocked Withdrawal Orders & No Refunds

Did IVY Markets deduct unfair fees from your deposit amount? Has your forex trading account been deleted by the broker on your withdrawal request? Failed to withdraw your funds after accepting the IVY Markets deposit bonus? Did the broker fail to address your trading queries, whether via email or phone? Such issues have been affecting many traders, who have expressed their displeasure about these on broker review platforms. In this IVY Markets review article, we have investigated some complaints. Keep reading to know the same.

Zenstox Review: Do Traders Face Withdrawal Blocks & Fund Scams?

Does Zenstox give you good trading experience initially and later scam you with seemingly illicit contracts? Were you asked to pay an illegitimate clearance fee to access fund withdrawals? Drowned financially with a plethora of open trades and manipulated execution? Did you have to open trades when requesting Zenstox fund withdrawals? You have allegedly been scammed, like many other traders by the Seychelles-based forex broker. In this Zenstox review article, we have investigated multiple complaints against the broker. Have a look!

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

WikiFX Broker

Latest News

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

Oil Rout: Crude Plunges 3% as Geopolitical Risk Premium Evaporates

Geopolitical Risk: Trump Pauses Iran Strike, Markets Weigh "Tactical Delay" vs. De-escalation

USD/CAD Breaches 1.3900 as Loonie Succumbs to Oil Collapse and King Dollar

US Inflation Stickiness and Geopolitical Rift Keep Dollar Firm; Gold Volatile

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Gold Holds Record Highs as Geopolitical Fractures Widen from Arctic to Middle East

Goldman Sachs 2026 Outlook: Dollar Overvalued by 15%, Tech 'Exceptionalism' is Key Risk

Trump tells Hassett he wants to keep him where he is; Warsh Fed Chair odds jump

Rate Calc