Sudden Liquidation: How Deriv's "Leverage Trick" and Withdrawal Blocks Are Wiping Out Trader Account

Abstract:The WikiFX Exposure Team has analyzed a surge of urgent complaints throughout 2025 concerning the broker Deriv. While the platform boasts high influence and multiple registrations, a darker pattern has emerged in the data: a sophisticated mechanism of sudden leverage reduction and "ghost" withdrawals that leaves traders with zero balance.

The WikiFX Exposure Team has analyzed a surge of urgent complaints throughout 2025 concerning the broker Deriv. While the platform boasts high influence and multiple registrations, a darker pattern has emerged in the data: a sophisticated mechanism of sudden leverage reduction and “ghost” withdrawals that leaves traders with zero balance.

Anonymity Disclaimer: To protect the privacy of those who have stepped forward, all trader names have been omitted. The accounts and incidents described below are based on verified complaints lodged with WikiFX in 2025.

The “Leverage Switch”: A Technical Trap?

In the world of trading, leverage is a double-edged sword, but traders expect the rules to remain constant once a trade is open. However, our analysis of recent logs reveals a disturbing anomaly affecting Deriv users: the mid-trade leverage reduction.

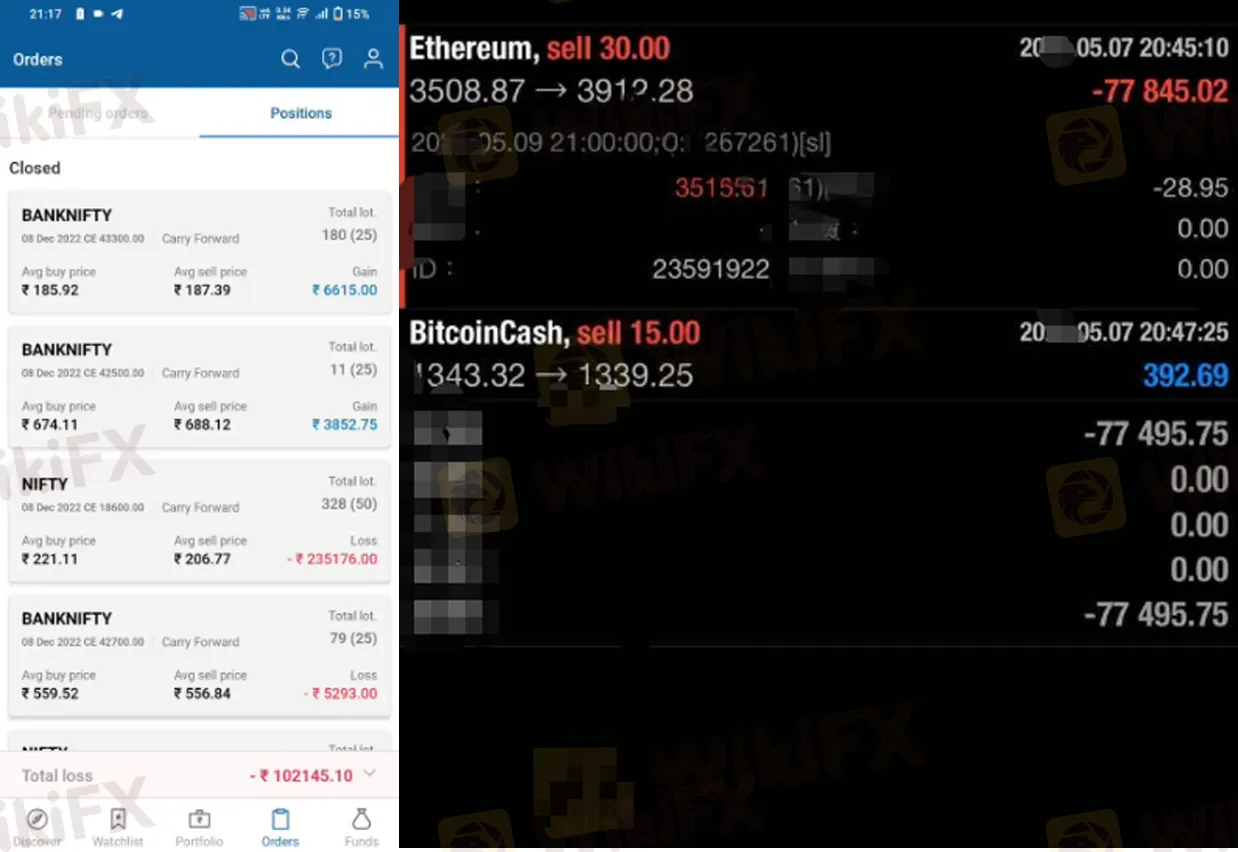

Multiple traders have reported identical scenarios occurring in late 2025. One trader, whose ordeal occurred in August, reported holding a long position on the USD/INR pair. They entered the trade based on the advertised leverage of 1:200. However, at 3:00 AM—while the market was active—the system allegedly adjusted the leverage down to 1:50 without prior warning.

The result was catastrophic. Because the account suddenly required four times the margin to hold the same position, the system triggered an immediate liquidation. The trader reported that although the market price had barely moved, the forced closure wiped out an investment of over 700,000 currency units.

Another user reported a similar incident where a 1:1000 leverage account was secretly adjusted to 1:50 during a crude oil trade, resulting in a forced loss of nearly 7,000 Australian dollars. This pattern suggests that users are not losing money to bad market calls, but to sudden changes in the platform's internal rules.

The “Ghost” Withdrawal Phenomenon

While the leverage issue destroys active trades, another issue is plaguing successful traders: the disappearance of funds during the withdrawal process.

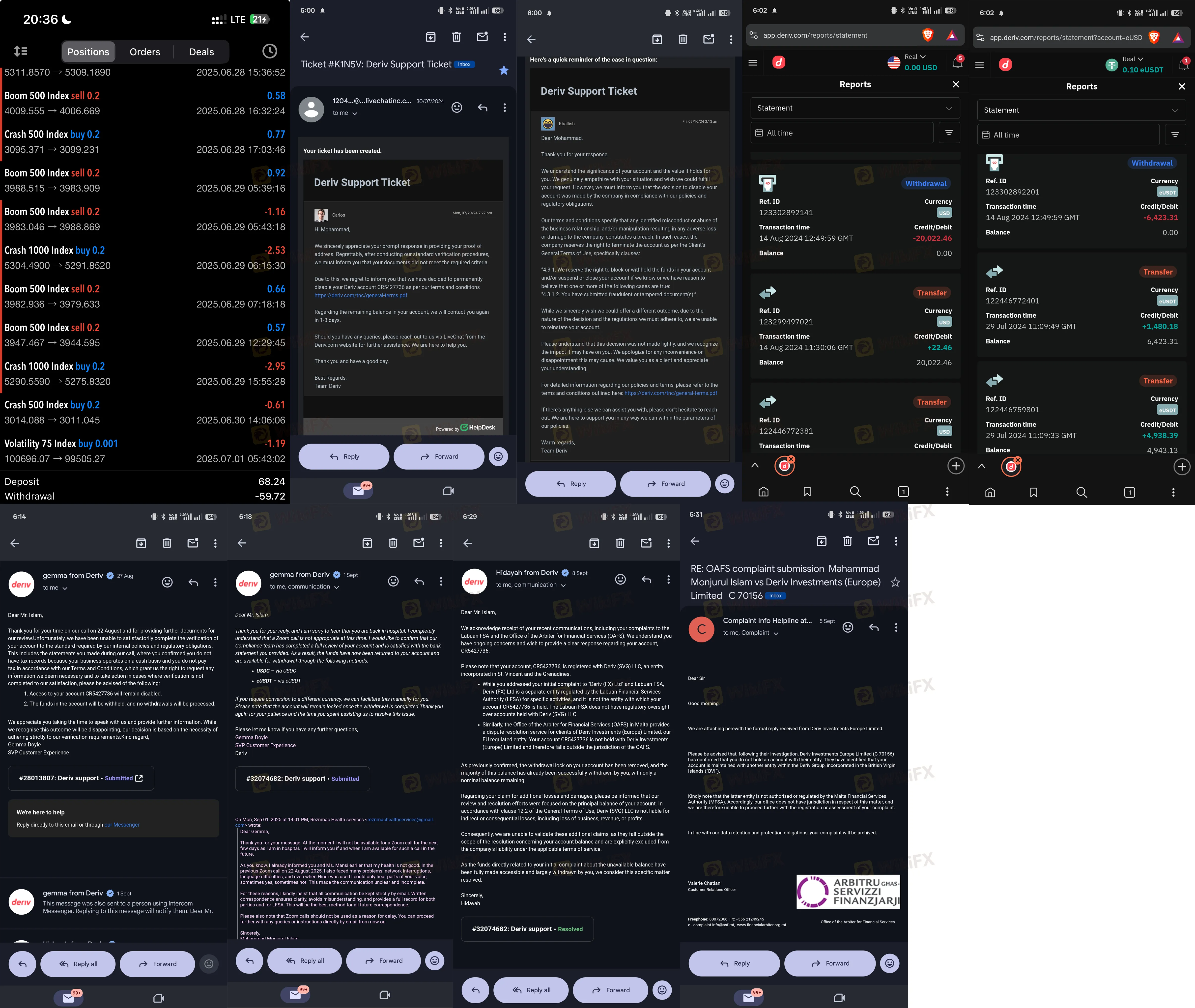

WikiFX has received numerous reports from the second half of 2025 describing a “debit without credit” error. Traders initiate a withdrawal, and the funds are immediately deducted from their Deriv trading balance. The transaction is marked as “successful” on the platform, yet the money never arrives in the user's bank account or digital wallet.

One user noted, “I made a profit and when I wanted to withdraw, they deducted money from my account but didn't credit my wallet. I complained, they said I must wait 10 business days. I still did not get my money.”

Even more alarming are reports of accounts being disabled entirely. A case recorded in September 2025 detailed how a trader's account was frozen with “false fraud allegations.” The broker allegedly unilaterally withdrew over $26,000 from the user's account without consent. It took 13 months of pressure and escalation to regulatory bodies before the user received a refund, highlighting that for some, the only way out is through external legal force.

The “KYC” Stall Tactic

When funds aren't simply missing, they are often held hostage behind a wall of bureaucratic demands. Traders have reported that after profitable periods, their accounts are frozen for “unusual trading.” To unlock the funds, Deriv support allegedly demands documentation that far exceeds standard Know Your Customer (KYC) protocols.

One trader reported being asked for six months of bank statements, proof of funds, and tax returns. Even after submitting these documents, the user was asked to pay a 10% “verification fee”—a classic red flag in the industry. Legitimate brokers deduct fees from the balance; they rarely ask for external payments to release existing funds.

Regulatory Audit: The Disconnect

Deriv presents itself as a highly regulated entity. However, a deep dive into the regulatory database shows a complex picture. While they hold several licenses, there are critical gaps and warnings that African traders must be aware of.

Deriv Regulatory Status Table

| Regulator Name | Country/Region | License Type/Status |

|---|---|---|

| Cayman Islands Monetary Authority (CIMA) | Cayman Islands | Exceeded (High Risk) |

| British Virgin Islands FSC | British Virgin Islands | Offshore Regulation |

| Vanuatu Financial Services Commission (VFSC) | Vanuatu | Offshore Regulation |

| Malta Financial Services Authority (MFSA) | Malta | Regulation in Progress |

| Labuan Financial Services Authority (LFSA) | Malaysia | Regulation in Progress |

| Securities and Commodities Authority (SCA) | UAE | Regulation in Progress |

Note: The status “Exceeded” for the Cayman Islands license indicates the broker may be operating outside the permitted scope of that specific license. Furthermore, regulatory disclosures show that Indonesian authorities (Bappebti) have previously blocked hundreds of domains associated with this entity for operating without local authorization.

A Pattern of “Price Jumps”

Beyond withdrawals and leverage, technical anomalies in price feeds have triggered accusations of manipulation. Analysis of trader logs from August 2025 shows complaints regarding “price jumps” in the final seconds of binary or options contracts.

One detailed report claimed that when prices approached critical profit levels, quotes would jump 0.2 to 0.5 pips in the opposite direction within the last five seconds. The user alleged this occurred in 77% of their tracked cases, turning wins into losses. While market volatility exists, consistent adverse movement in the final seconds of a contract raises serious questions about execution fairness.

Conclusion and Warning

The disparity between Deriv's “AAA” influence ranking and the experience of individual traders is stark. The data indicates that while the platform is massive and holds various offshore registrations, specific mechanisms—sudden leverage reduction, withdrawal freezes, and excessive documentation demands—are causing significant financial harm to traders.

WikiFX advises all investors to exercise extreme caution. The presence of valid offshore licenses does not automatically protect you from the operational irregularities described above.

Forex and CFD trading involves a high level of risk and may not be suitable for all investors. The data provided in this article is based on actual complaints and regulatory records lodged with WikiFX in 2025. Please prioritize the safety of your principal over potential profits.

Read more

Zenstox Review: Do Traders Face Withdrawal Blocks & Fund Scams?

Does Zenstox give you good trading experience initially and later scam you with seemingly illicit contracts? Were you asked to pay an illegitimate clearance fee to access fund withdrawals? Drowned financially with a plethora of open trades and manipulated execution? Did you have to open trades when requesting Zenstox fund withdrawals? You have allegedly been scammed, like many other traders by the Seychelles-based forex broker. In this Zenstox review article, we have investigated multiple complaints against the broker. Have a look!

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

24option Review: Is it Legit or a Scam? Find Out in This In-depth Investigation

Contemplating 24option as your forex trading companion? Want to explore its trading platforms? We appreciate your interest! But how about knowing the Hong Kong-based forex broker and its different aspects, such as withdrawals and deposits. More specifically, if we have to say, what’s the feedback of traders concerning 24option? Are they happy trading with the broker? From a healthy collection of over 200 reviews, the broker is found to be a SCAM! Many traders have expressed concerns over the illegitimate trading approach adopted by the broker. In the 24option review article, we have explored many complaints against the broker.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

ThinkMarkets Review 2025: Safety, Features, and Reliability

LMS Forex Broker Review (2026): Is LMS Legit or a Scam?

RockwellHalal User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

FXNovus Review: Traders Report Fund Scams & Illegitimate Tax Payment Demands on Withdrawals

Profit Wipeout: Why AccuIndex Traders Are losing Their Hard-Earned Money

Inside the Elite Committee: Talk with LadyChiun

US Imposes 25% Tariff on AI Chips, Elevating Tech Trade Tensions

Is DRW Legit or a Scam? 5 Key Questions Answered (2026)

Are You Trading Against the Central Banks? Know Your Competition

Rate Calc