DBG Markets: Market Report for Dec 11, 2025

Abstract:Hawkish Dot Plot, Dovish Undertones Dollar Under Pressure, Gold Eyes BreakoutHawkish Cut, Dovish UndertonesThe Federal Reserve delivered the widely expected 25 basis point rate cut overnight, lowering

Hawkish Dot Plot, Dovish Undertones Dollar Under Pressure, Gold Eyes Breakout

Hawkish Cut, Dovish Undertones

The Federal Reserve delivered the widely expected 25 basis point rate cut overnight, lowering the target range to 3.50%–3.75%. However, the market reaction was shaped less by the hawkishness in the projections and more by the dovish undertones in the statement.

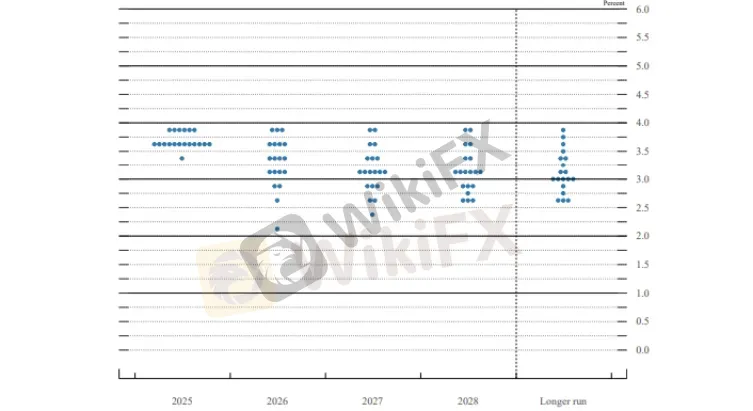

· The “Hawkish” Dot Plot: While the Fed cut rates to support the labor market, the updated Summary of Economic Projections (SEP) indicated a slower pace of easing for 2026. The median dot plot now suggests fewer cuts next year than the market had priced in, citing persistent inflation risks.

· Vote Split: 9 Cuts, 2 Holds, 1 50-Bps Cut;

· Market Verdict: This represented a classic “Hawkish Cut,” with aggressive 2026 easing bets being removed, as expected.

Despite the dot plot and vote splits (2 holds) signaling caution and some hawkish bias, the Fed statement and Powells messaging were not entirely hawkish.

Dovish Tilt Statement & Comment

Powell emphasized that currently, “no one views rate hikes as the baseline scenario,” signaling a clear dovish tone. He also noted that future cuts are “not on a preset course,” reiterating that the Fed will remain data-dependent. Powell acknowledged signs of a slowing labor market, which also points to a dovish underlying tone.

That said, although the dot plot shows only one cut in 2026 as in the median, this does not reflect the majority view of Fed officials, according to the released dot plot.

Fed Dot Plot December | Source: Federal Reserve

Powells comments on labor market conditions and the data-dependent policy path suggest the Fed remains open to further cuts if labor market and inflation conditions warrant it.

Additionally, the December Summary of Economic Projections forecasts PCE inflation to decline to 2.4% (headline) and 2.5% (core), reinforcing the backdrop for cautious policy adjustments.

Dollar Outlook: Bears Likely in Control

Although the dot plot and voting patterns suggest a hawkish cut, the underlying message can be interpreted differently. This sets the stage for potential dollar weakness, particularly if economic data support a dovish pivot outlook.

USD Index, H4 Chart

Technically, the US Dollar Index continues to face pressure below the 99 level, with a potential break of the recent low near 98.80. A breach of this level would signal that bears are in control.

Further labor data or signs of inflation slowdown could prompt the market to quickly reprice expectations for a dovish Fed, adding further pressure on the dollar.

Outlook: From a technical perspective, a break below 98.80 would confirm bearish momentum. Meanwhile, if upcoming data—such as todays initial jobless claims—point to labor market weakness, the dollar could face additional downside pressure.

Bank of Canada: Policy Divergence Widens

While the Fed cut rates, the Bank of Canada (BoC) held firm yesterday, creating a volatile setup for the Loonie.

The BoC kept rates unchanged, with Governor Tiff Macklem explicitly emphasizing a pause in the easing cycle to assess the impact of previous cuts on the robust Canadian housing and labor markets. This "hawkish pause" initially supported the CAD.

USDCAD, Daily Chart

USDCADs earlier break below 1.3900 suggests a resumption of the bearish cycle. With clear divergence between the two central banks, this is likely to contribute to further downside for the pair.

Technically, levels below 1.3900 continue to indicate a bearish outlook. As long as the Fed is perceived as leaning dovish, the pair remains biased to the downside.

Gold Outlook: Bulls Reclaim, But Not Enough

Following the Fed decision, gold found fresh buying interest, pushing back toward the 4240 level and testing previous highs. However, bulls appear to lack conviction at this stage, as gold pulled back after the Asian session opened.

XAU/USD, H4 Chart

With the Fed cuts confirmed and the dollar weakening, the path of least resistance is higher. Technically, however, bulls need to clear the 4240 breakout for further upside.

The outlook for gold remains consistent with our previous coverage. A breakout from the current consolidation is required to confirm a clear directional move. Everything is set in place, but buyers should wait for a decisive breakout before entering.

Bottom Line

The Fed‘s 25bps rate cut delivered a classic “hawkish cut,” with the dot plot signaling fewer 2026 cuts than markets had anticipated. Yet, Powell’s dovish messaging and data-dependent guidance leave the door open for further easing if conditions warrant.

The U.S. Dollar faces downside risk, particularly if upcoming economic data support a dovish pivot. Meanwhile, gold remains bullish but needs a decisive break above 4240 to confirm upward momentum. On the other end, divergence with the Bank of Canada further supports downside pressure on USDCAD, highlighting ongoing market volatility.

WikiFX Broker

Latest News

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

9X Markets Review: Is It Reliable?

IQ Option Review: Real User Experiences

Bessent to propose major overhaul of regulatory body created from financial crisis

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

The case for more Fed rate cuts could rest on a 'systematic overcount' of jobs numbers

Rate Calc