Ox Securities Review: Complaints About Withdrawal Delays, Technical Issues & Customer Support

Abstract:Is your Ox Securities trading filled with constant withdrawal denials? Have you faced unfair profit deduction and account closure here? Does the Ox Securities customer support team fail to answer your trading queries or issues? Have you had to face a rampant charge on your withdrawals? These issues have been highlighted by your fellow traders as they share the Ox Securities review online.

Is your Ox Securities trading filled with constant withdrawal denials? Have you faced unfair profit deduction and account closure here? Does the Ox Securities customer support team fail to answer your trading queries or issues? Have you had to face a rampant charge on your withdrawals? These issues have been highlighted by your fellow traders as they share the Ox Securities review online.

Elaborating on the Top Forex Trading Complaints Against Ox Securities

Withdrawal Denials - A Regular Hassle for Ox Securities Traders

Denying withdrawals has allegedly become the go-to thing for Ox Securities, as per the complaints by many traders. They report that the broker gives unfair excuses to delay or deny their withdrawals. Here are multiple Ox Securities reviews based on withdrawal issues.

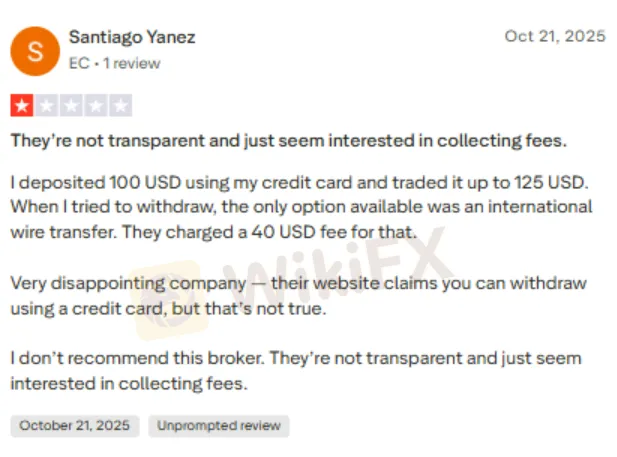

The ‘Unfair Withdrawal Charge’ Comment in Ox Securities Review

A trader recently highlighted the lack of transparency at which Ox Securities operates. Recounting the incident, the trader reported having deposited USD 100 using the credit card. The trader took the account to USD 125 through trading. The trader had only one withdrawal option, wire transfer, which led to a fee of USD 40. Disappointed by this, the trader questioned the brokers claim of credit card withdrawals. Check out the full story in this Ox Securities review.

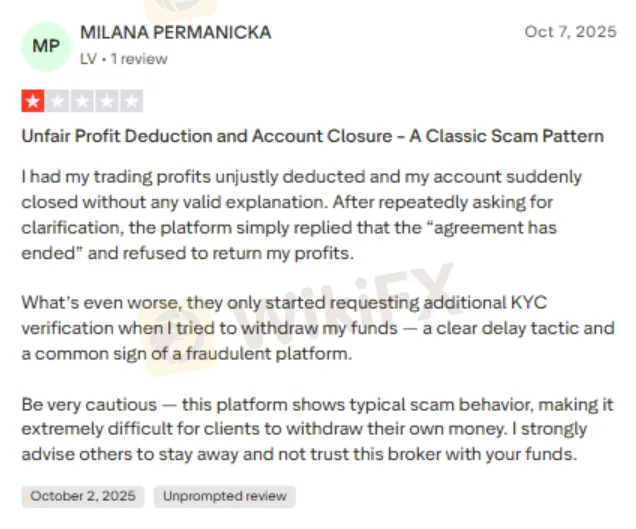

Illegitimate Profit Deduction and Account Closure

A trader alleged that the broker deliberately deducted profits on the Ox Securities login and closed the trading account without giving a valid explanation. After regularly contacting the broker officials, the trader could only hear about the conclusion of the agreement. As per the admission, the trader could not receive profits. Adding to the woes, the broker asked the trader about additional KYC verification. Check out this Ox Securities review.

Ox Securities WikiFX Review: The Score & Regulatory Status Update

The WikiFX team carefully reviewed the complaints against Ox Securities and thought it was essential to conduct a full-scale inquiry into the brokers operational history and regulatory oversight analysis. The inquiry revealed no license for the Saint Vincent and the Grenadines-based forex broker, which has been in the business for over five years. With no license, the broker is free from conforming to several regulations that regulated brokers do. With this, the investment risks multiply for traders. Keeping all these in mind, the team gave Ox Securities a score of 2.47 out of 10.

Find the latest updates, news, tips and insights on these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join by following the instructions shown below.

Read more

Vonway Review: A Series of Unfair Account Suspension & Withdrawal Denial Complaints

Have made substantial profits through Vonway, but could not withdraw? Initiated the Vonway withdrawal request, but the same was denied on the grounds of hedging violation? Were your trade orders executed at an unfair price? Have you faced a trading account suspension by the broker without any explanation? These have allegedly become regular for many traders here. In this Vonway review article, we have shared a list of the top complaints against the forex broker.

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Attracted to Advanced Markets for the expert-led copy trading experience? Did you earn profits from the copy trade executed by the expert hired by the forex broker? But did the broker question some trades even though you paid the performance fee to the expert? Is the trade order execution time too slow at Advanced Markets? Do you witness high slippage issues? You are not alone! Many traders have shared these concerns online. In this Advanced Markets review article, we have described some complaints. Take a look!

Is WisunoFX Safe? An Unbiased 2025 Assessment of Platform Risks and Red Flags

Is WisunoFX a safe broker for your money? The answer is not simple. After looking at everything carefully, the platform gets a score of 7.21 out of 10. This means it has both good points and serious risks. For traders who want to research before investing, WisunoFX has two sides: it offers good trading conditions, but it also has some structural and regulatory issues that need careful thought. The broker has been operating for 5-10 years and has built up a presence in the market. However, it's officially labeled as a "Medium potential risk" platform, which cannot be ignored. Before investing, it's important to compare its good points with its bad ones.

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

When evaluating any trading company, it is essential to conduct a thorough WisunoFX regulation check first. This broker operates under two distinct sets of rules, which you must understand carefully. First, it has a license from the Cyprus Securities and Exchange Commission (CySEC), which is a trusted European regulator. Second, it has another license from the Financial Services Authority (FSA) in Seychelles, which is located offshore. These two licenses don't give traders the same level of protection. The CySEC license means the broker must follow strict European Union financial rules, while the FSA license has much less supervision. This guide will explain what each license means to traders, look at the company structure behind the brand, and examine the safety factors every potential client should think about.

WikiFX Broker

Latest News

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

9X Markets Review: Is It Reliable?

IQ Option Review: Real User Experiences

Bessent to propose major overhaul of regulatory body created from financial crisis

The case for more Fed rate cuts could rest on a 'systematic overcount' of jobs numbers

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

Rate Calc