FPG USDJPY Market Report December 8, 2025

Abstract:On the H4 chart, USDJPY continues to drift lower within a well-defined bearish channel, showing a consistent sequence of lower highs and lower lows. After the strong upward rally that pushed price tow

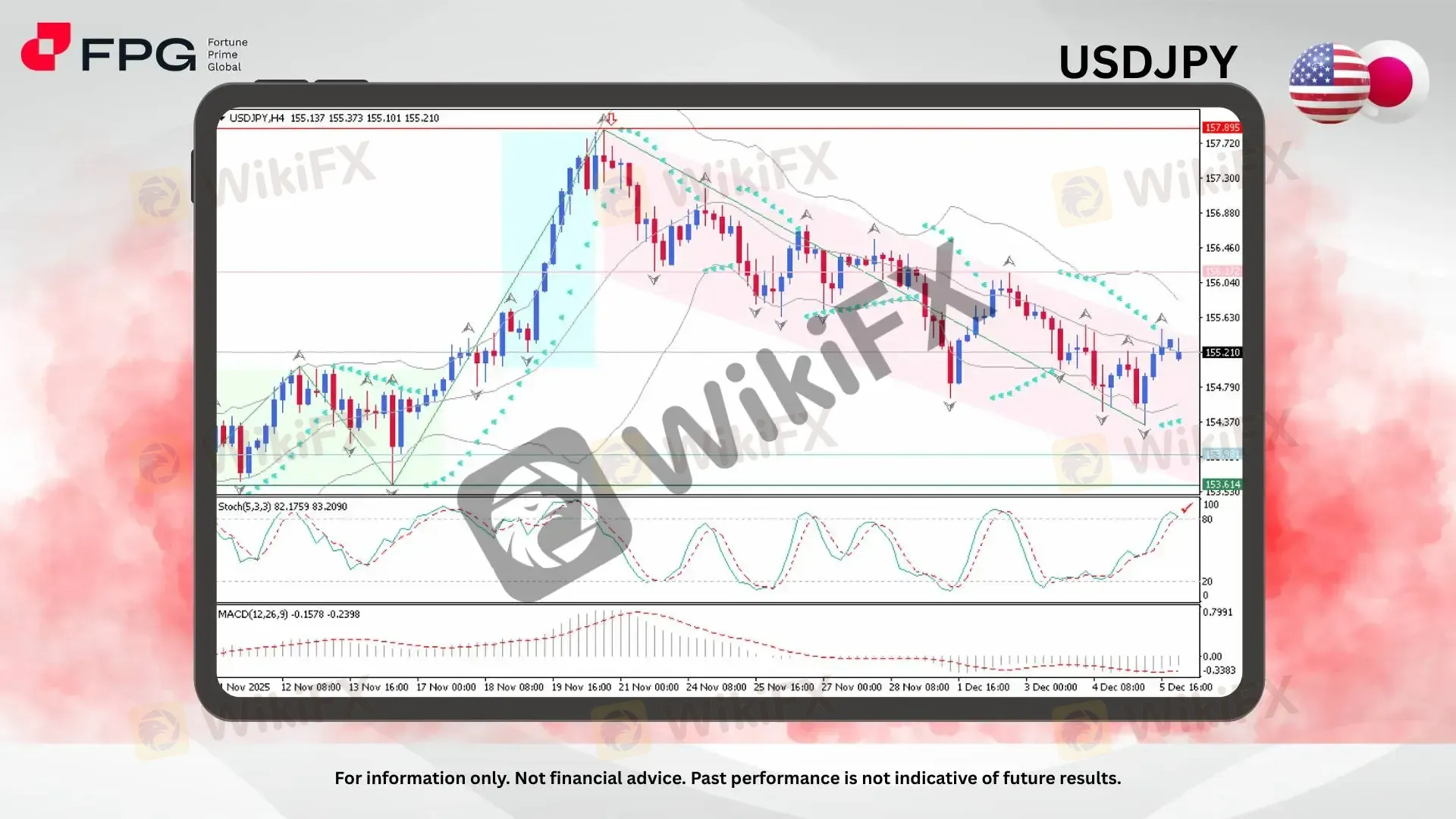

On the H4 chart, USDJPY continues to drift lower within a well-defined bearish channel, showing a consistent sequence of lower highs and lower lows. After the strong upward rally that pushed price toward 157.89, momentum has shifted into a corrective phase, with the pair gradually retracing down toward the current region around 155.21. The overall structure still reflects bearish pressure dominating the medium-term movement.

From a technical indicator standpoint, price is trading inside the lower half of the Bollinger Bands, reflecting sustained downside bias with limited attempts to break the mid-band resistance. The trendline from the recent peak remains intact, repeatedly rejecting upward attempts. Stochastic (5,3,3) is climbing into overbought territory, signaling that bullish pullbacks may be limited before sellers re-enter. Meanwhile, MACD (12,26,9) remains below the zero line, indicating that bearish momentum is still in control even though the histogram shows slight short-term weakening in downward pressure. As long as price remains within the descending channel and below key resistance near 156.17–156.50, the market structure favors continuation of the correction.

From a fundamental approach, the ongoing technical correction is consistent with evolving market sentiment toward USD strength and shifting expectations surrounding Bank of Japan policy. Statements from BOJ officials or changes in global risk appetite could quickly increase volatility while price remains within the current channel. Traders should closely monitor todays major economic releases from Japan and BOJ-related developments, as these factors may either support the prevailing bearish structure or spark a short-term rebound if the results deviate from expectations.

Market Observation & Strategy Advice

1. Current Position: USDJPY continues to move within a clear bearish channel on the H4 chart, currently trading near 155.21. Despite small rebounds, the broader structure still favors sellers with consistent lower highs and lower lows.

2. Resistance Zone: Key resistance sits around 155.60, aligned with the descending trendline. A stronger ceiling remains at 156.17, where price has previously been rejected.

3. Support Zone: Immediate support is found near 154.70 – 154.50. A deeper decline could target the more critical zone around 153.98 – 153.61.

4. Indicators: The indicators overall reinforce the bearish outlook. Stochastic is nearing overbought levels, suggesting limited upside potential, while the MACD remains below zero, confirming ongoing bearish momentum. The downward slope of the Bollinger Bands further supports the prevailing downtrend.

5. Trading Strategy Suggestions:

Buy on Dips: Only consider if price forms a clear bullish reversal around 153.98 – 153.60.

Breakout Confirmation: A break and close above 156.17 – 156.50 may open upside potential toward 157.10–157.89.

Reversal Opportunity: Look for bearish signals near 155.60 – 156.00 to rejoin the downtrend toward 154.70 and 154.50.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1648 +0.06%

GBP/USD 1.3332 +0.02%

Today's Key Economic Calendar:

JP: Current Account

JP: GDP Growth Annualized Final

JP: GDP Growth Rate QoQ Final

CN: Balance of Trade

CN: Exports & Imports YoY

DE: Industrial Production MoM

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

WikiFX Broker

Latest News

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

9X Markets Review: Is It Reliable?

IQ Option Review: Real User Experiences

Bessent to propose major overhaul of regulatory body created from financial crisis

The case for more Fed rate cuts could rest on a 'systematic overcount' of jobs numbers

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

Rate Calc