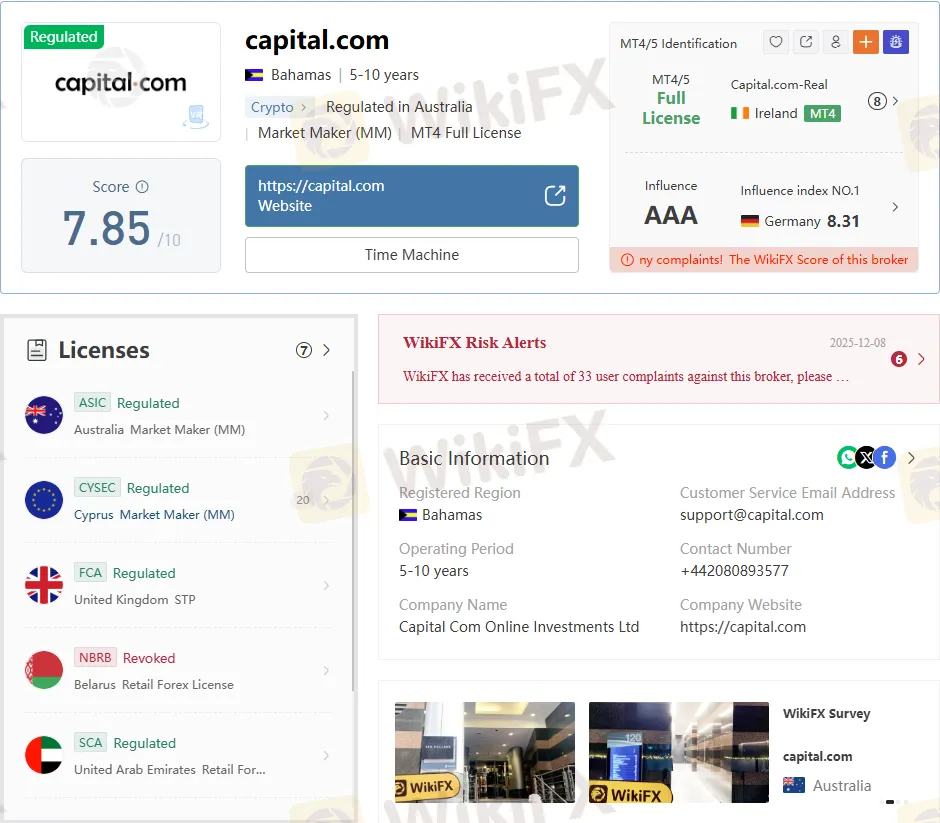

Is Capital.com Regulated? Full License Overview

Abstract:Capital.com is regulated by ASIC, FCA, CYSEC, UAE SCA Bahamas SCB. Explore its licenses and broker trustworthiness.

Capital.com stands out as a CFD broker with multi-jurisdictional oversight, serving over 787,000 traders who have executed more than 1 trillion in volume. Regulators like ASIC and FCA enforce strict client protections, making Capital.com Regulation a key draw for risk-conscious traders. This review digs into licenses, platforms, and costs drawn directly from verified records.

Capital.com Regulation Breakdown

Capital.com Regulation spans top-tier bodies, starting with ASIC in Australia (license 513393, CAPITAL COM AUSTRALIA PTY LTD, active since 2021). CYSEC in Cyprus (license 319/17, Capital Com SV Investments Ltd) covers 19 European countries, while FCA in the UK (793714, STP model) adds credibility for retail traders.

UAE's SCA (20200000176) and Bahamas SCB (SIA-F245, offshore) round out the list, with physical offices verified in London, Melbourne, and Limassol. No license sharing detected; all entities maintain independent compliance contacts like compliance@capital.com.

Domain ties to Cyprus registration since 2016 align with operational history, though some addresses lack on-site verification. Traders gain negative balance protection under these rules, unlike unregulated peers.

Capital.com Trading Instruments

Access 3,000+ CFDs on forex majors (EUR/USD at 0.6 pips), indices (US 500, UK 100), commodities (gold, oil), shares (Apple, Tesla), cryptocurrencies (Bitcoin, Ethereum), and ESG assets. No bonds, options, or ETFs, narrowing focus to high-liquidity markets versus eToro's broader ETF lineup.

| Asset Classes | Examples | Key Notes |

| Forex | EUR/USD, GBP/USD | Majors/minors/exotics; variable spreads |

| Indices | US Tech 100, DE40 | Global coverage, tight pricing |

| Commodities | Crude Oil, Gold | Energy, metals, agriculture |

| Shares | Amazon, Google | Popular globals via CFDs |

| Crypto | BTC, ETH | Volatile pairs, no direct ownership |

Execution averages 175ms on MT4 servers, outperforming many market makers.

Account Types at Capital.com

Minimum deposit hits just $10 (USD/EUR/GBP), beating competitors like IG's $250 threshold. Demo accounts offer $100,000 virtual funds indefinitely—ideal for testing. Live accounts lack tiered details, but pros access 1:3000 leverage (retail capped lower by rules).

Islamic swaps-free options are likely available per regional norms, though unconfirmed. Inactivity fee: $10 after 12 months. No multi-account tiers are publicized, unlike XM's standard/pro/vip spread.

Capital.com Platforms Reviewed

Proprietary web/desktop/mobile apps lead with 75+ indicators, risk tools, and seamless execution—named best for new investors. MT4 supports EAs, signals, and up to 1:200 leverage; TradingView integrates charts. No MT5, lagging Plus500's dual support.

| Platform | Devices | Best For |

| Web/Desktop | PC, Mobile | Beginners: Intuitive UI |

| MT4 | Desktop/Mobile/Web | EAs, signals |

| TradingView | All | Advanced charting |

| App | iOS/Android | On-the-go trades |

TradingView ratings hit 4.6/5; app downloads exceed 8 million.

Fees and Spreads on Capital.com

Zero commissions, deposit/withdrawal fees—earns via spreads (EUR/USD 0.6 pips average). Overnight funding applies (long/short dependent); guaranteed stops add premiums. Currency conversion possible; no opening/closing fees.

Compares favorably to Pepperstone (0.0 pips + commission), but watch swaps on holds. Transparent via real-time tools.

| Fee Type | Capital.com | Competor Avg. |

| Min Deposit | $10 | $250 |

| Spread (EUR/USD) | 0.6 pips | 0.8 pips |

| Inactivity | $10/year | $12/month |

| Withdrawal | Free | $15+ |

Capital.com Pros and Cons

Pros:

- Multi-regulator shield (ASIC/FCA/CySEC) with verified offices

- Low $10 entry, free funding, demo unlimited

- 3,000 instruments, fast 175ms execution

- 24/7 multilingual support (chat/phone/email)

- Robust education: Investmate app, guides, webinars

Cons:

- No MT5 or tiered accounts

- Swap/guaranteed stop costs add up

- Mixed reviews; some complaints on withdrawals

- Limited research vs. Trading 212

Deposits and Support at Capital.com

Fund via Visa, Apple Pay, wire, Trustly—no fees, instant cards. Withdrawals match, processed promptly per reviews. Support shines: live chat, +44 20 8089 7893, support@capital.com, social channels.

Bottom Line

Capital.com delivers legit value through Capital.com Regulation across ASIC, FCA, CySEC, SCA, SCB—backstopped by low barriers and vast CFDs. Suits beginners with demos/education, pros with high leverage/tools, but monitor extras like swaps. Outweighs risks for regulated access; 81-85% loss disclaimers underscore CFD hazards.

Read more

IG Boosts Cash Interest, Drops Account Fees for UK Investors

IG raises rates on uninvested cash and removes inactivity fees, joining a growing trend among brokers targeting UK retail investors.

Is SGFX Legit? A 2026 Deep Dive Investigation

Finding a trustworthy forex and CFD broker can be overwhelming, especially with new platforms constantly appearing. One name that has raised questions from traders is SGFX, also known as Spectra Global. With promises of advanced trading technology and competitive conditions, it might seem appealing. However, the important question remains: Is SGFX legit? This complete 2026 review looks beyond the marketing materials to provide a thorough, fact-based analysis. We will examine SGFX's company structure, check its regulatory claims, review its fee structure, and look at recent user feedback. Our goal is to give you the information needed to make a safe and smart decision about your trading capital.

SGFX Review 2026: A Trader's Warning on Spectra Global

If you are looking for an "SGFX Review" or want to know the "SGFX Pros and Cons," you have found an important resource. You probably want to know, "Is SGFX a safe and trustworthy broker?" Based on our detailed research, the answer is clearly no. While SGFX (also called Spectra Global) looks modern and professional, we have found serious warning signs that every potential investor needs to know about before investing. This review will get straight to the point. We will immediately discuss the main problems that make this broker extremely risky. These include weak and misleading regulation from offshore locations, questionable trading rules designed to get large deposits, and a worrying pattern of serious complaints from users, especially about not being able to withdraw. This article will give you a complete, fact-based analysis of how SGFX operates to help you make a smart and safe decision.

ZFX Review 2026: A Complete Guide to Trading Conditions, Costs & Safety

When traders look for trustworthy brokers in today's busy market, ZFX stands out as a major global company backed by the Zeal Group. The main question for anyone thinking about using them is simple: What is ZFX, and can you trust it? This broker has an interesting but important split personality. It works under a parent company that follows strict UK financial rules, but most regular customers actually sign up through a different offshore company. This creates a gap between how safe people think it is and how much protection traders actually get. The goal of this 2026 review is to give you a complete, fair look at ZFX's safety, costs, and features. We'll give you an honest view of what's good and bad about it, so you can make a smart choice based on facts, not advertising. Our analysis will look at its regulations, trading conditions, fees, and the important risks you need to know about.

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc