The "Verify Until You Quit" Strategy: Why Winning Traders Are Being Locked Out of IQ Option

Abstract:IQ Option presents itself as a titan of the industry—slick apps, massive advertising campaigns, and an "AA" influence ranking that spans the globe. But beneath this polished veneer, our investigative team has uncovered a disturbing pattern emerging from hundreds of trader complaints. The data suggests a "roach motel" operational model: deposits are instant, but for a growing number of profitable traders, the exit doors are bolted shut.

IQ Option presents itself as a titan of the industry—slick apps, massive advertising campaigns, and an “AA” influence ranking that spans the globe. But beneath this polished veneer, our investigative team has uncovered a disturbing pattern emerging from hundreds of trader complaints. The data suggests a “roach motel” operational model: deposits are instant, but for a growing number of profitable traders, the exit doors are bolted shut.

Anonymity Disclaimer: All cases detailed below are based on real records lodged with WikiFX. Identities have been obscured to protect the traders involved.

The “Profit Punishment” Phenomenon

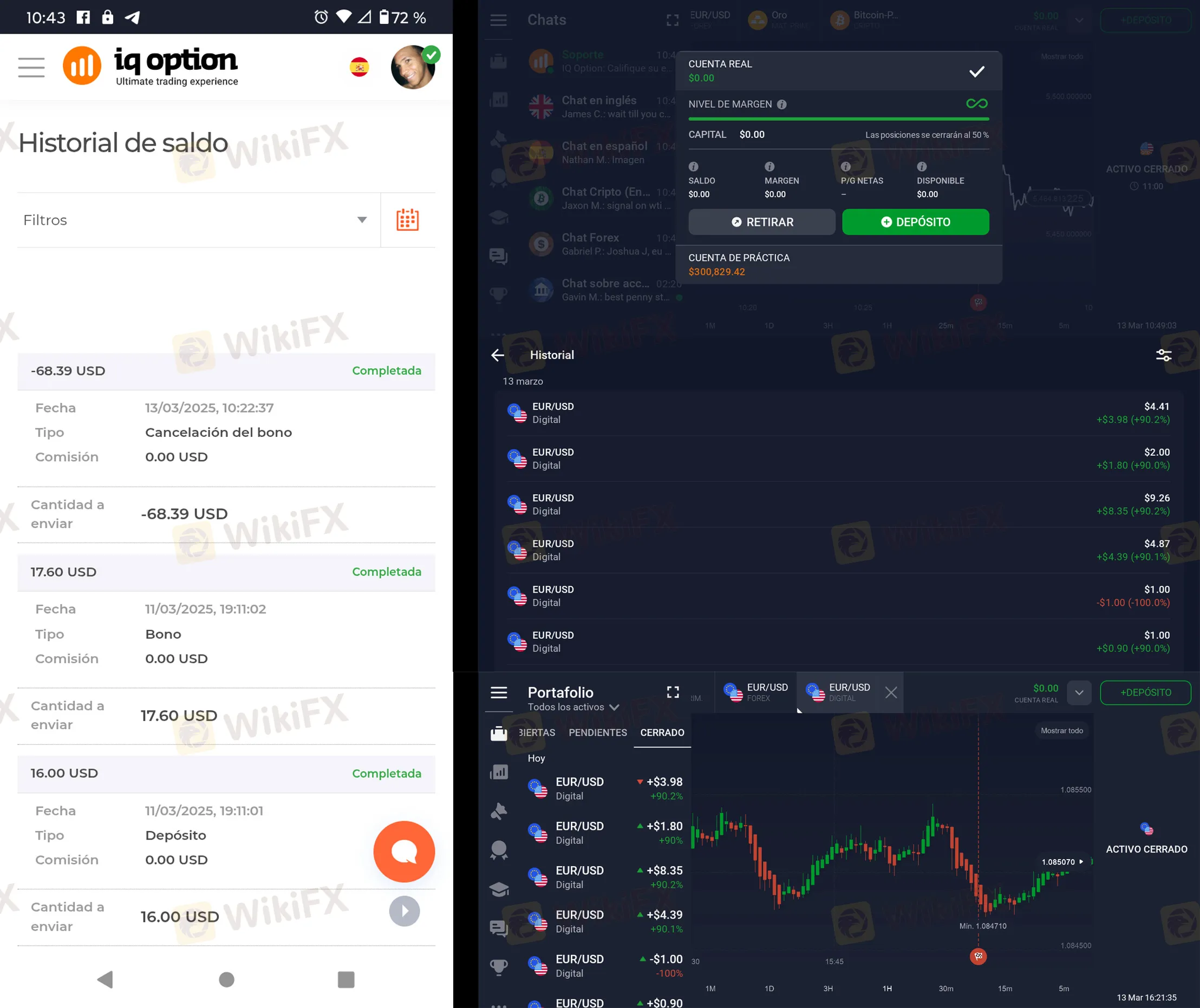

In the world of trading, the ultimate goal is to win. However, recent records from 2025 indicate that on this platform, winning may be the quickest way to get banned.

Our analysis of recent inputs reveals a terrifying correlation: as soon as a trader generates significant profit, technical barriers appear instantly. One trader, who participated in a monthly tournament in September 2025, reported earning a substantial prize. Instead of a payout, they faced a brick wall. The platform allegedly requested a cascade of verification documents. Once provided, communication was cut, and the account was blocked. The profit—and the initial deposit—remained inside.

This is not an isolated incident. Reports from October 2025 describe traders growing their accounts from small deposits (e.g., $20 to over $50) only to find their withdrawal function disabled. When they attempted to transfer funds to bank cards, the transactions were marked as “Failed,” yet no explanation was given. Shortly after, access to the accounts was restricted entirely.

The Administrative Labyrinth

When silence doesn't work, the platform appears to deploy bureaucratic hurdles designed to exhaust the trader.

The “Time Travel” Verification

In a baffling case recorded in February 2025, a trader looking to withdraw funds was suddenly required to verify every credit card they had ever used to deposit funds over the history of their account. This included requests for photos of cards from four years ago—cards that had long since been destroyed, expired, or lost. Because the trader could not physically produce a plastic card from 2021, their current funds were held hostage.

The Bonus Trap

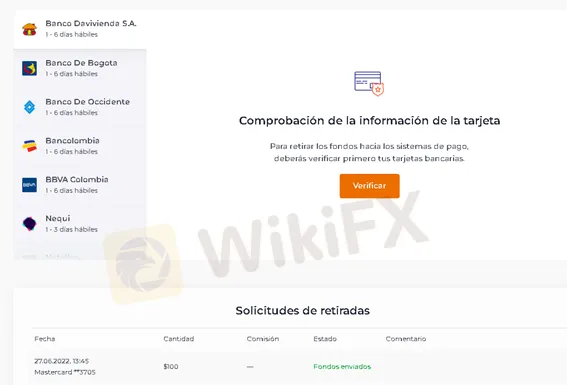

Another disturbing mechanism involves the weaponization of bonuses. A case from March 2025 highlights a trader who accepted a small deposit bonus (approx. $17). After trading their account up to nearly $70, they decided to cancel the bonus to free up their withdrawal. The terms implied that only the bonus amount would be deducted. Instead, upon cancellation, the entire balance was wiped to zero, including the trader's own capital and profits.

Regulatory Reality vs. Marketing Myth

IQ Option operates under a complex regulatory framework. While they tout their “regulated” status loudly, a closer look at the WikiFX regulatory database reveals a fractured picture. Traders must understand that a license in one jurisdiction does not guarantee safety in another, especially when warnings are flashing elsewhere.

The Regulatory Breakdown:

- Cyprus (CySEC):

- Status: Regulated (License 247/14)

- Reality: While this is a valid Tier-2 license, it primarily protects European clients. It has not prevented the deluge of complaints regarding withdrawal failures from other regions.

- Malaysia (SCM):

- Status: Unauthorized / Investor Alert List

- Meaning: The Malaysian Securities Commission has explicitly flagged this entity for carrying out capital market activities without authorization.

- Singapore (MAS):

- Status: Investor Alert List

- Meaning: The Monetary Authority of Singapore has warned that this entity may be perceived as licensed when it is not.

Silence from the Support Team

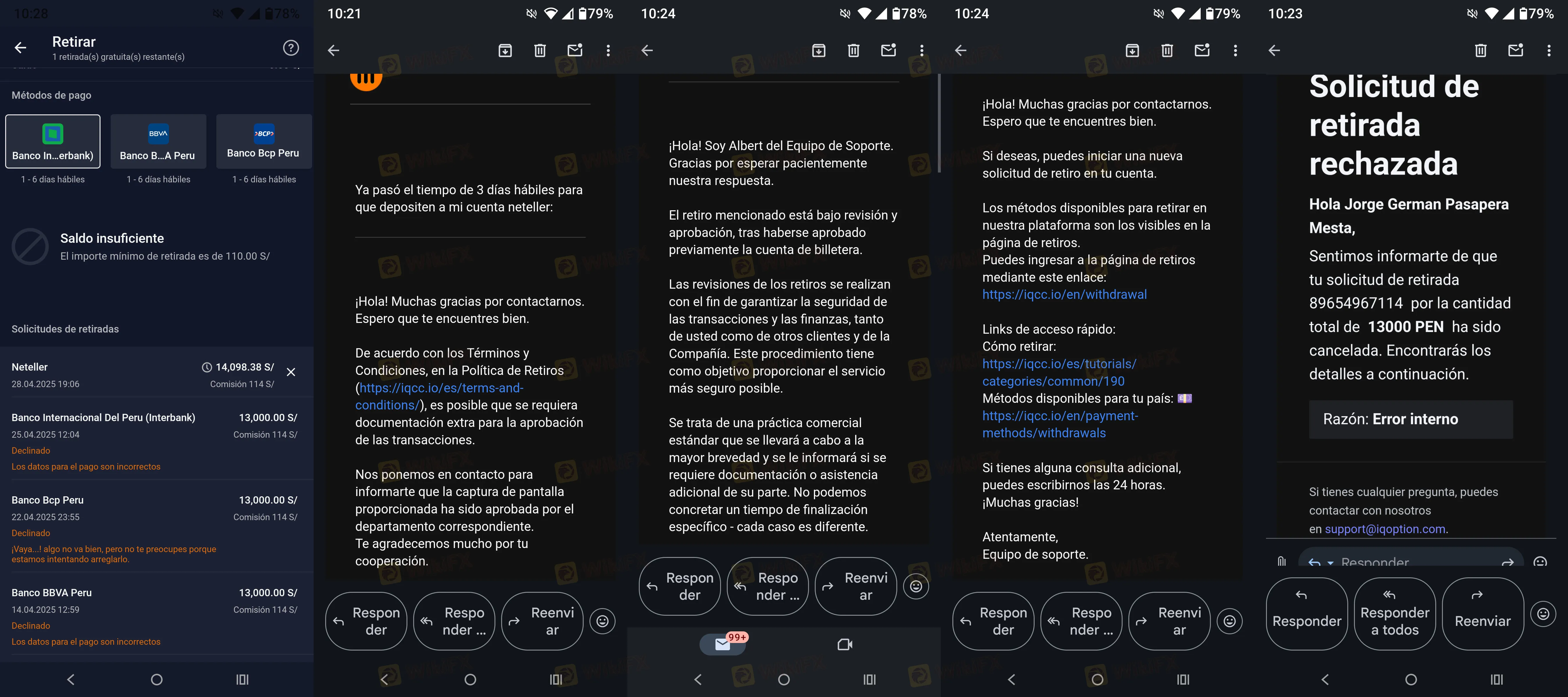

A recurring theme in almost every complaint from late 2024 through 2025 is the degradation of customer support. Traders report that the “Live Chat” functions work perfectly when asking how to deposit. However, once a withdrawal inquiry is lodged, response times stretch from hours to weeks.

One trader noted in May 2025 that after their withdrawal was canceled three times without reason, they sent all requested documents to the support email. The verification team confirmed receipt and approval, yet the withdrawal remained “frozen” for weeks. Eventually, the support team simply stopped replying.

Risk Warning

WikiFX Score: 5.47 / 10

While IQ Option holds a valid regulatory license in Cyprus, the sheer volume of severe complaints regarding withdrawals—specifically targeting profitable accounts—poses a critical risk. The existence of a license has not shielded recent traders from losing access to their capital.

The level of risk associated with this broker is currently High. Please exercise extreme caution.

Read more

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

SGFX Regulation Uncovered: A Complete Guide to Its Licenses and Company Status

Checking if a broker is properly regulated is the most important thing you can do to protect your trading capital. Before investing in a trading account, you need to research the broker carefully. This is not just a good idea - it's absolutely necessary. This guide looks at SGFX, also called Spectra Global, which is a new company in a busy forex trading market. We need to look closely at what it claims about its regulation. While SGFX does have a license from an offshore location, our research has found some serious warning signs that potential traders need to know about. This article gives you a straightforward, fact-based look at SGFX's licenses, company structure, and risks, so you can make a smart decision. Checking things yourself is important, and websites like WikiFX are helpful tools for traders to research a broker's background and regulatory status before investing.

Optimax Trade Exposed: Capital Loss, Withdrawal Blocks & Alleged Fund Scams

Lost more than you deposited at Optimax Trade? Have you lost trades by acting upon the wrong advice shared by the broker executive? Witnessed constant MT4 login issues with the forex broker? Is your fund loss due to a lack of risk management tactics by Optimax Trade? Did you receive a poor response from the Optimax Trade Customer Support officials on your trading queries? In this Optimax Trade review article, we have explained several trading issues faced by traders. Keep reading!

Digital Trading FX Review: Traders Allege Withdrawal Denials & Fund Blockage

Has Digital Trading FX locked your funds in the name of a fake fixed deposit that you never opened? Waited unsuccessfully for the fund release until its maturity? Failed to receive earnings from the broker despite multiple attempts? Is the company’s customer support service executive unresponsive to your forex trading queries? In this Digital Trading FX review, we have investigated different complaints about the broker. Take a look!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc