Neotrades Review: Traders Claim Profit Cuts, False Assurances & Unfair Terms

Abstract:Do you feel constant pressure from Neotrades to deposit your forex capital? Were you given a false assurance by the broker on recovering your trade losses? Have all your profits been wiped to ZERO on the Neotrades login? Does the Mauritius-based forex broker apply stringent terms and conditions for profit withdrawals? In this Neotrades review article, we have showcased these complaints. Read them below.

Do you feel constant pressure from Neotrades to deposit your forex capital? Were you given a false assurance by the broker on recovering your trade losses? Have all your profits been wiped to ZERO on the Neotrades login? Does the Mauritius-based forex broker apply stringent terms and conditions for profit withdrawals? In this Neotrades review article, we have showcased these complaints. Read them below.

Explaining the Top Forex Trading Complaints Against Neotrades

The Constant Deposit Pressure & False Promise Accusation

Many traders complain about the constant deposit pressure they face from Neotrades officials. These officials allegedly claim that they would help the client recover their trade losses. As clients trade, earn profits & sometimes lose trades. However, the officials backtrack by not fulfilling the promises made earlier.

Unfair Terms & Conditions Imposed for Neotrades Withdrawals

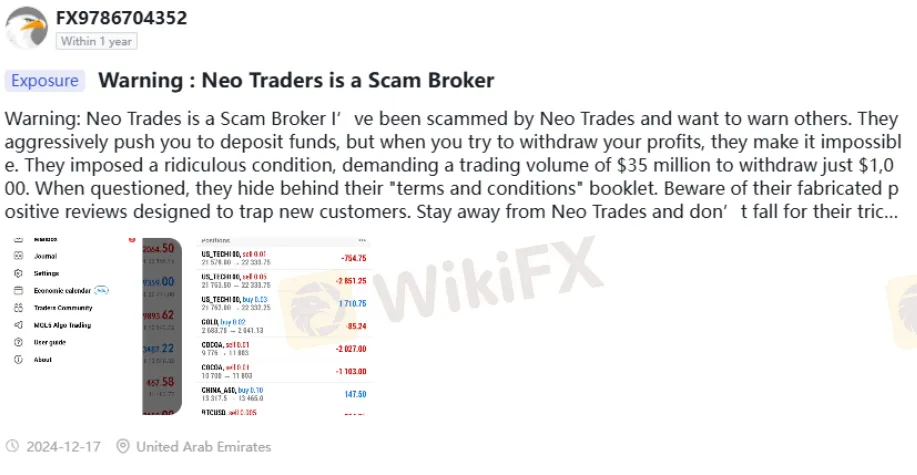

Neotrades allegedly imposes unfair terms and conditions as traders seek to withdraw profits. In a shocking revelation, a trader claimed that the broker stipulated a trading volume of $35 million to withdraw $1,000. As the terms & conditions were found to be bogus, the trader sought a booklet that specifies such a requirement. However, the broker official does not hand it to the trader, prompting him to share a negative Neotrades review.

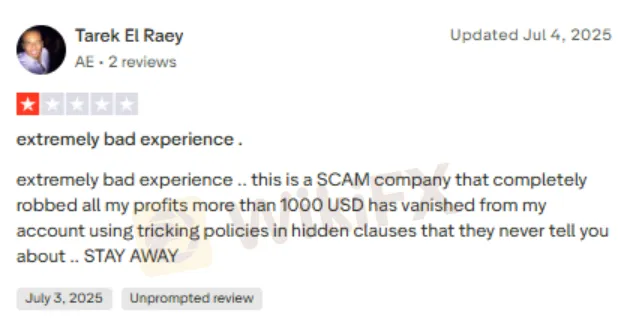

The Fund Scam Complaint

Several traders complain about increasing cases of fund scams in the name of hidden terms and conditions that the broker allegedly refuses to share with them at the beginning. As a result, the broker is able to scam many traders. In one such case, a trader was robbed of $1,000 due to this. Sharing the review the trader gave to Neotrades online.

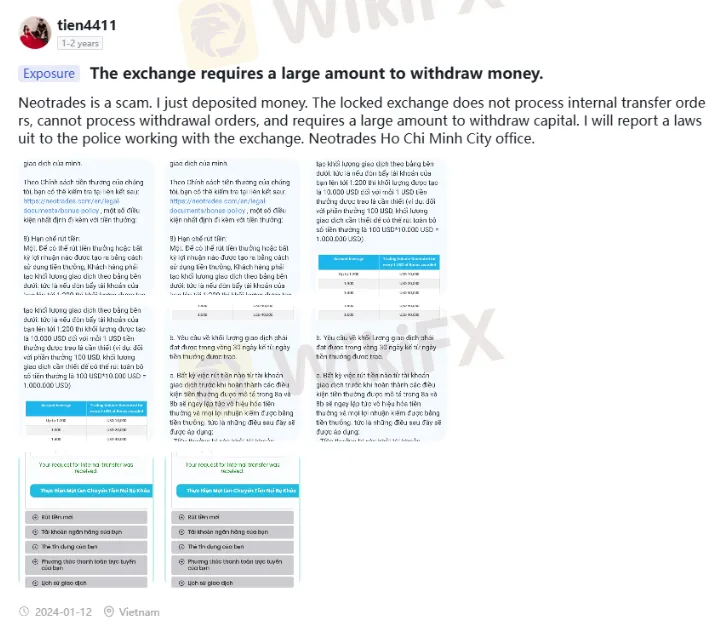

One Trader, Multiple Complaints

A trader shared a shocking revelation on how Neotrades has been unsuccessful in ensuring internal fund transfers and withdrawals. The trader got angrier with the requirement of putting in a large capital to withdraw funds. Here is a screenshot where the trader explained the financial misery at Neotrades.

The Review of Neotrades by WikiFX: Score & Regulatory Details

The complaints shared above reflect Neotrades unprofessional trading behavior that prevents traders from unleashing their trade potential. By placing questionable restrictions on withdrawals, pressuring traders to deposit more, and scamming them eventually, the broker has earned a bad reputation in the forex community. The WikiFX team did not find a valid license for Neotrades in its investigation. As a result, our team could only give it a score of 1.50 out of 10.

Check the latest forex updates, news, tips and insights on these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G).

Read more

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Failing to transfer funds into or out of your Moneycorp trading account? Have you faced a sudden account closure by a United Kingdom-based forex broker? Has the broker’s customer support service failed to resolve your queries? Did their behavior remain far from good while addressing your queries? You are not alone! Many traders have questioned such alleged trading practices by the broker. In this Moneycorp review article, we have highlighted some of their complaints. Read on!

Saracen Markets Review: Regulated or Scam Alert?

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

FXRoad Exposure Review: Withdrawal & Safety Risks Explained

FXRoad exposure review: withdrawal red flags, offshore status, and safety risks explained. Learn what to watch for and how to protect your funds—read now.

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

When people who invest ask, "Is Arena Capitals safe or a scam?" the proof shows we need to be very careful. This broker works without proper rules from top financial authorities, gets very low safety scores from independent financial watchdogs, and many users have serious complaints about them. The information available to everyone suggests that giving your capital to this company could lead to losing it all. This analysis doesn't guess - it looks at these important warning signs. We will look at real facts, study actual user reviews that show big problems with taking out funds, and give a clear answer based on evidence about whether Arena Capitals can be trusted. This article gives you the facts you need to make a smart choice and keep your funds safe from an unregulated, high-risk business.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Rate Calc