Scandinavian Capital Markets Exposed: Traders Cry Foul Play Over Trade Manipulation & Fund Scams

Abstract:Does Scandinavian Capital Markets stipulate heavy margin requirements to keep you out of positions? Have you been deceived by their price manipulation tactic? Have you lost all your investments as the broker did not have risk management in place? Were you persuaded to bet on too risky and scam-ridden instruments by the broker officials? These are some burning issues traders face here. In this Scandinavian Capital Markets review guide, we have discussed these issues. Read on to explore them.

Does Scandinavian Capital Markets stipulate heavy margin requirements to keep you out of positions? Have you been deceived by their price manipulation tactic? Have you lost all your investments as the broker did not have risk management in place? Were you persuaded to bet on too risky and scam-ridden instruments by the broker officials? These are some burning issues traders face here. In this Scandinavian Capital Markets review guide, we have discussed these issues. Read on to explore them.

Elaborating on the Top Complaints Against Scandinavian Capital Markets

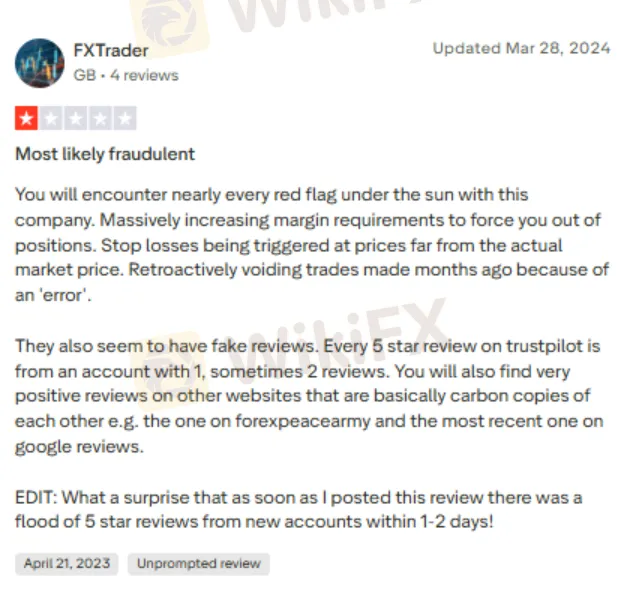

The Illegitimate Margin Demand and Price Manipulation by Scandinavian Capital Markets

A trader reported that the broker stipulates massively high margin requirements, allowing it to dethrone many out of positions. As per the admission, the broker initiates stops well before the price reaches the level, piling on losses for traders. Check out the complaint below.

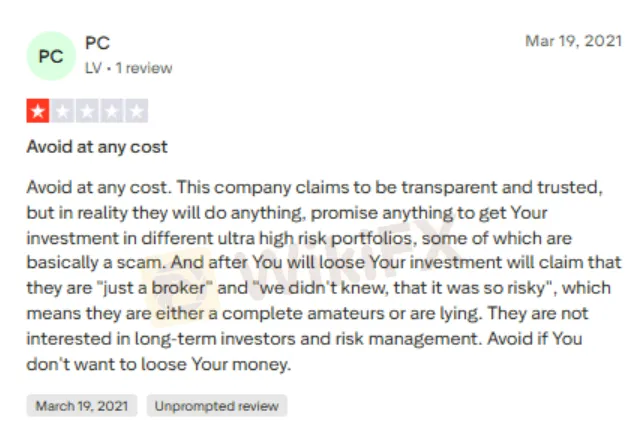

The Fund Loss Complaint

A trader admitted having lost all of his funds and cited that the broker did not have risk management strategies in place. Concerned by the brokers lacklustre approach, the trader shared the Scandinavian Capital Markets review online. Here is the screenshot.

Scandinavian Capital Markets Officials Promise a Lot, Deliver Little to Thing, Say the Trader

Scandinavian Capital Markets is reported to be carrying a false impression of being transparent and trustworthy. In reality, as traders say, the broker does everything needed to draw your investments. Depending on the situation, the broker puts the collected capital in even ultra-risky portfolios; some of them are, in fact, outright scams, a trader alleged when sharing the Scandinavian Capital Markets review. Here is what the trader shared through this complaint.

Scandinavian Capital Markets Review by WikiFX: Check the Score & Regulatory Status

The complaints against the Sweden-based forex broker demanded a detailed investigation, including proof of its regulatory supervision status. Our investigation revealed that the broker was unregulated, explaining why traders could not feel transparency and trust when trading through Scandinavian Capital Markets. The team thus gave it a score of 2.33 out of 10.

Catch the latest forex updates non-stop on these dedicated chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join the group/s following these instructions below.

Read more

WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

SEVEN STAR FX Exposure: Do Traders Face Account Blocks & Withdrawal Denials?

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

WikiFX Broker

Latest News

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Rate Calc