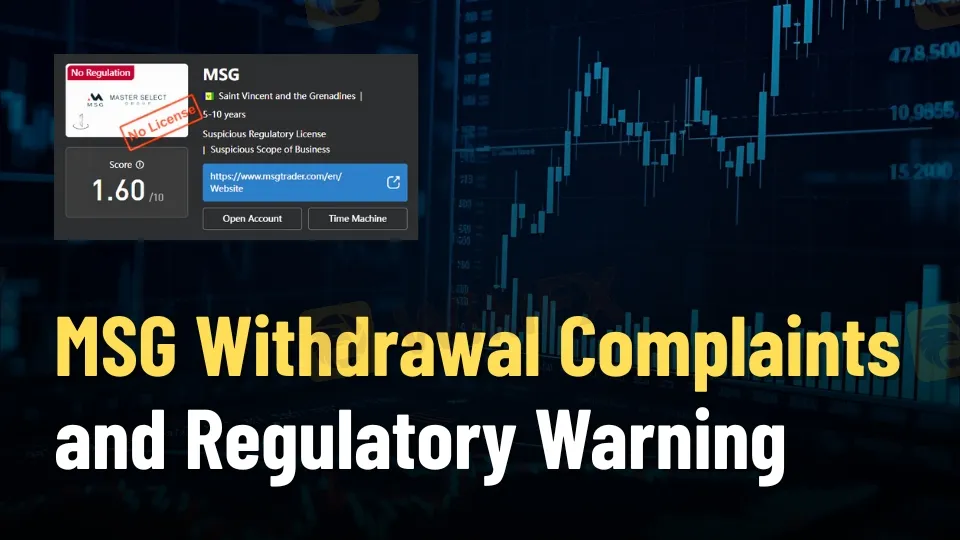

MSG Withdrawal Complaints and Regulatory Warning

Abstract:MSG (Master Select Group) withdrawals denied. Broker is unlicensed and unregulated. NFA license claim unverified.

MSG (Master Select Group) has become the subject of mounting complaints from traders who report repeated withdrawal denials. Several investors claim that requests to withdraw balances—ranging from $3,000 to over $20,000—were rejected without explanation. Screenshots and transaction logs show accounts locked or balances reduced to zero after attempted withdrawals.

What is MSG Master Select Group?

MSG Master Select Group, also referred to as MSG Broker, promotes multi-asset CFD and forex trading, highlighting access to forex, indices, commodities, US stock CFDs, metals, oil, and cryptocurrencies through MetaTrader platforms with “razor sharp pricing” and “low spreads” messaging across its site footprint. The brand lists operating history of 5–10 years, a Saint Vincent and the Grenadines registration, and contact via cs@msgtrader.com, while marketing global access and top-tier liquidity without providing verifiable, active top-tier licenses in core jurisdictions where it claims presence. Public dossier materials also point to multiple related domains and infrastructure, including msgtrader.com and msgforex.com, reinforcing the need for domain-level due diligence by prospective account holders.

Licensing Status, Claims, and Verifications

The firm publicly claims an NFA license with ID 0558525; however, a search via the NFA‘s BASIC system returns no firm-level match tied to MSG, rendering this claim unverified for U.S. retail-facing permissions or membership standing. In Vanuatu, regulatory records indicate “Current Status: Revoked” for a named entity under VFSC oversight, signaling the loss of authorization and heightened counterparty risk for clients relying on that license for protection. An Australian angle appears through a separate licensed entity, Kohle Capital Markets Pty Ltd (AFSL 489437), surfaced in proximity to MSG materials; this license does not establish authorization for MSG and is flagged as “Unverified” within the compiled record, so it should not be construed as regulatory cover for MSG’s operations.

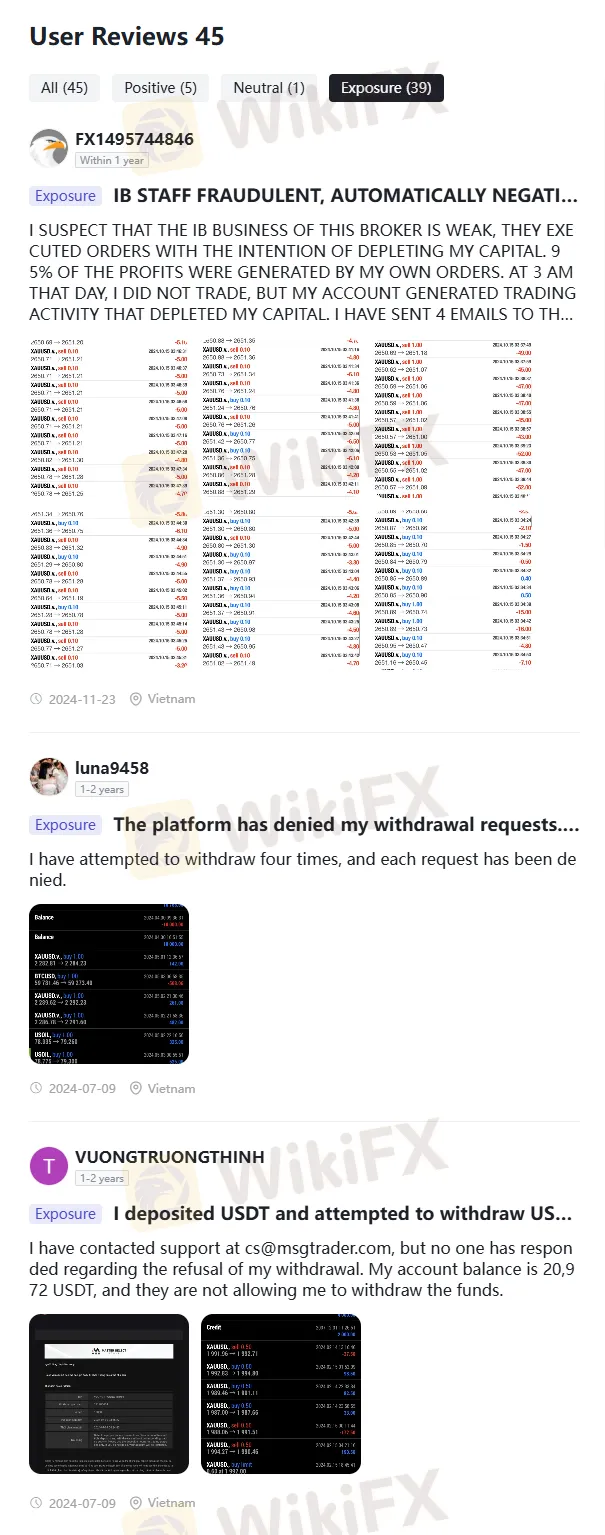

Withdrawal Complaints and User Exposures

Multiple first-hand user reports cite denied withdrawal requests despite material balances, with one report describing four successive denial events when attempting to withdraw 3,000 USDT from an account showing roughly 20,972 USDT remaining. Another account documents the inability to withdraw after purported payment-gateway “maintenance” delays, followed by support deflections to an introducing broker and later unexplained account changes, culminating in a missing balance without a recorded withdrawal entry in the platforms ledger view. Additional exposure narratives allege IB misconduct, unsolicited trades outside user activity hours, negative balance events, and long periods without customer service replies, all of which align with high operational risk flags for retail clients and partners.

Platform Claims vs. Operational Realities

Marketing pages emphasize “unbeatable spreads,” “lightning trades,” and a “hassle-free” experience across forex, metals, oil, indices, crypto, and US stocks via MetaTrader 4, presenting a familiar performance-led proposition to active traders chasing low latency and tight pricing. Contrastingly, venue checks list an Australian office address that “does not exist,” and external listings cluster MSG under “No Regulation/Suspicious” status with very low trust scores, creating a clear disconnect between promotional copy and verifiable operational substance. For traders, this gap matters: without confirmed, in-force licenses, dispute resolution frameworks, and client-fund protections typical of top-tier regulators are absent, leaving users to rely entirely on the brokers internal policies and goodwill.

Risk Assessment for Prospective Clients

- Regulatory authentication: The NFA ID claim remains unverified; reliance on this number for compliance comfort is unsafe for U.S. users or anyone seeking recognized oversight.

- Jurisdictional cover: Revocation signals in Vanuatu and the absence of active, attributable Tier‑1 authorizations materially increase counterparty and asset-safekeeping risks.

- Withdrawals and recourse: Repeated, documented denial of withdrawals, delayed support, and unexplained ledger changes are consistent with severe operational governance issues that can result in permanent loss of funds.

- IB channel risks: Reports of IB‑linked misconduct, including alleged auto-trades and account handling anomalies, add another layer of exposure for clients onboarded via referral networks.

Bottom Line for Traders

MSG Master Select Group is presented as a multi-asset CFD venue with broad market access, but the weight of evidence—unverified NFA claim, revoked VFSC status, “no regulation” listings, and persistent withdrawal complaints—places it squarely in high-risk territory for retail traders and IBs. Until there is transparent proof of active, recognized regulation and a clean record of timely, audited withdrawals, capital at MSG should be considered at elevated risk of delay or loss despite the platforms tight-spread marketing.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc