U.S. September CPI Shows Little Change as Markets Price In Rate Cuts

Abstract:Inflation data offered reassurance that price pressures continue to ease, reinforcing expectations that the Federal Reserve is on track toward future rate cuts.The U.S. September CPI rose 3.02% year-o

Inflation data offered reassurance that price pressures continue to ease, reinforcing expectations that the Federal Reserve is on track toward future rate cuts.

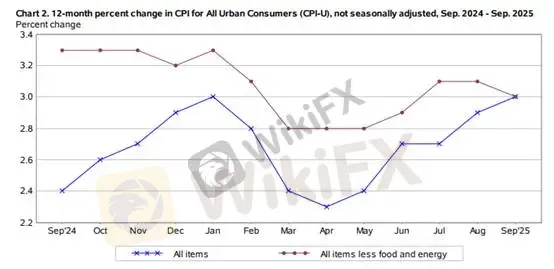

The U.S. September CPI rose 3.02% year-over-year, while core CPI increased 3.03%. Both figures came in line with market forecasts and showed slower monthly growth, with headline CPI up 0.31% and core CPI up 0.23%. Core inflation has clearly turned a corner: on an annualized basis, the 0.23% monthly increase implies a 2.4%–2.5% yearly pace, down from above 3%. Although the year-over-year core CPI still sits slightly above 3%, the short-term trend now points toward an annualized rate near 2.8%, confirming that inflationary pressures are easing.

This data supports the Fed‘s assessment that inflation is cooling and suggests there’s little cause for concern at this stage.

(Chart 1: CPI & Core CPI — Source: U.S. Bureau of Labor Statistics)

From a month-over-month perspective, both CPI and Core CPI showed slower growth. Prices for food, rent, and transportation rose at a slower pace than in August, helping consumers maintain higher disposable income. This offset the impact of rising energy costs, resulting in a healthier overall price balance.

(Chart 2: Month-over-Month CPI Change — Source: M Square)

According to CNBC‘s report “Here’s Where the Economy Is Starting to Show ‘K-Shaped’ Bifurcation”, the U.S. economy is experiencing a K-shaped divergence, where affluent consumers maintain strong purchasing power while lower-income households are cutting back.

Coca-Cola CEO James Quincey noted on CNBC‘s “Squawk on the Street” that premium products such as Topo Chico sparkling water and Fairlife protein shakes, which are favored by higher-income consumers, are driving the company’s sales growth.

McDonalds CEO Chris Kempczinski added that while the company continues to perform well among higher-income diners, lower- and middle-income customers are showing a “completely different” trend. He said last month, “Traffic from lower-income consumers has fallen by double digits — people are either skipping meals or eating at home instead.”

From the retail supply-side perspective, companies appear reluctant to raise prices amid weakening consumer demand. With end-market consumption softening, firms face a dilemma — unable to pass on higher costs through price hikes, yet under pressure from declining sales that erode profit margins.

Overall, the latest CPI report suggests a healthy inflation environment without signs of overheating or rapid decline. This allows the Fed to pursue more targeted policy adjustments amid a bifurcated consumer landscape. However, corporate earnings momentum may gradually slow, as the lagging effects of monetary policy continue to weigh on the economy.

Given that equity valuations remain elevated, investors should watch for potential profit-taking pressure following recent market rallies.

Currently, there appears to be limited incentive for safe-haven flows into gold. With rate cuts unlikely to dramatically alter inflation trends, theres little fundamental support for a sustained gold rally.

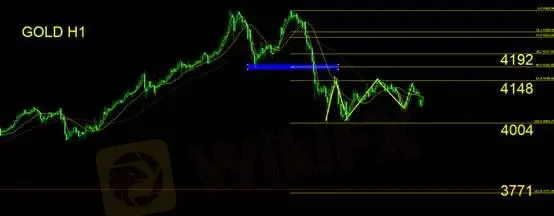

Gold Technical Analysis

On the hourly chart, gold has formed a double-top (M-shaped) pattern, consolidating below the neckline. The weekly chart confirms a bearish reversal, with a solid red candle and a bearish “mother-and-child” formation, signaling a potential turning point.

As long as prices fail to break above the $4,148 resistance, gold remains in a weak consolidation phase. Traders may consider short positions on rebounds, with downside momentum likely to accelerate if prices fall below $4,004.

Suggested stop loss: $25

Support: $4,004 / $3,771

Resistance: $4,148 / $4,192

Risk Disclaimer: The above analysis, commentary, and data are provided for general market information only and do not represent the views of this platform. All trading involves risk—please operate with caution.

WikiFX Broker

Latest News

Ringgit hits five-year high against US dollar in holiday trade

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc