How to Spot a Forex Scammer Before You Invest

Abstract:Learn how 7 signs to identify forex scammers using verified red flags like unregulated brokers, guaranteed returns, and withdrawal issues. Protect your investments with expert-backed strategies.

What Is a Forex Scammer?

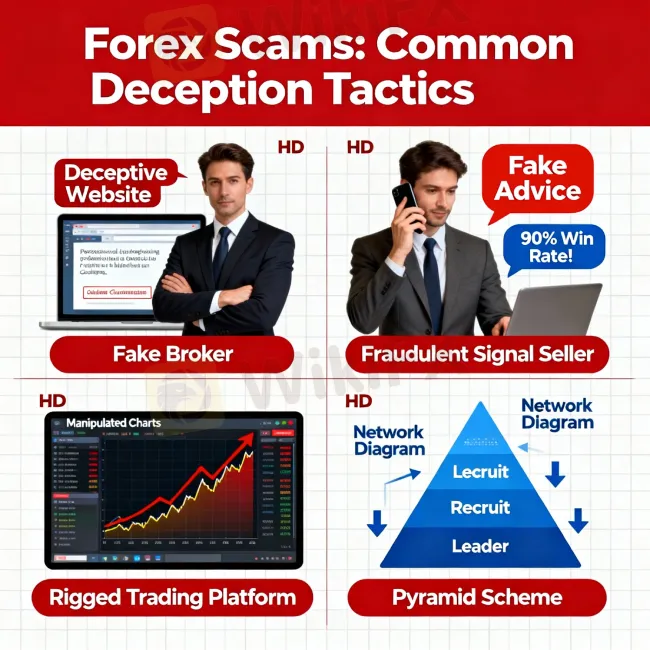

A forex scammer is an individual or organization that uses deceptive practices to trick investors into handing over money under the false promise of high returns from foreign exchange (forex) trading. These scams often involve fake brokers, fraudulent signal sellers, rigged platforms, or pyramid schemes that simulate profitability while siphoning funds. Unlike legitimate financial professionals who operate under strict regulatory oversight, forex scammers typically lack proper licensing, provide no verifiable track record, and use psychological manipulation to gain trust.

Forex trading itself is a legitimate global market where currencies are bought and sold, with an average daily volume exceeding $7 trillion as of 2024. However, its decentralized nature and high leverage options make it a prime target for fraud. According to the U.S. Commodity Futures Trading Commission (CFTC), forex fraud has consistently ranked among the top investment scams reported by consumers. The consequences for victims can be severe—loss of life savings, damaged credit, and emotional distress.

Understanding how to spot a forex scammer is not just about avoiding financial loss; it's a critical component of financial literacy. In educational contexts, teaching students to recognize investment fraud builds long-term decision-making skills and promotes responsible engagement with financial systems. As digital platforms expand access to trading, they also increase exposure to sophisticated scams that mimic real services.

This article outlines the most common types of forex scams, their warning signs, and actionable steps to verify legitimacy—empowering individuals to make informed, secure investment choices.

Red Flag 1: Promises of Guaranteed Profits

One of the most consistent indicators of a forex scam is the promise of guaranteed profits with little or no risk. Legitimate forex trading involves inherent volatility and uncertainty—market movements are influenced by geopolitical events, economic data, and central bank policies, none of which can be predicted with 100% accuracy. Any claim suggesting otherwise contradicts fundamental principles of finance.Scammers often use phrases like “risk-free returns,” “double your money in 30 days,” or “monthly gains of 20–30% guaranteed” to lure inexperienced investors. These claims exploit cognitive biases such as overconfidence and fear of missing out (FOMO), particularly targeting those new to investing. A 2024 Investopedia analysis emphasized that no trading strategy can eliminate market risk, and anyone asserting otherwise is likely engaging in fraud.

The reality is that even professional traders experience losing streaks. According to data from major regulated brokers, the majority of retail forex traders lose money over time due to leverage misuse and emotional decision-making. Therefore, when evaluating a forex opportunity, ask: Does this align with realistic market performance? If the answer is no, proceed with extreme caution.

To protect yourself, remember the basic rule of investing: higher potential returns always come with higher risk. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) require all financial advertisements to include risk disclosures for this reason. If a forex provider fails to mention risks or downplays them, its a strong signal of illegitimacy.

Red Flag 2: Lack of Regulatory Compliance

A legitimate forex broker must be registered with a recognized financial authority. Regulatory compliance ensures transparency, fair trading practices, and investor protection through mechanisms like segregated accounts and dispute resolution. Common regulators include the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) in the United States, the FCA in the United Kingdom, ASIC in Australia, and CySEC in Cyprus.

Scammers frequently operate without any license or falsely claim affiliation with these agencies. Some create fake registration numbers or clone websites of real firms—a tactic known as “firm mimicry”. The CFTC warns that investors should independently verify a brokers status through official regulator databases rather than relying on information provided by the broker.

For example, in 2022, Thailands Bank of Thailand issued a public alert after uncovering unlicensed operators like Forex-3D, which had no legal authorization to offer forex services. Similarly, the U.S. Securities and Exchange Commission (SEC) maintains a list of unregistered entities involved in forex fraud.

To check a brokers legitimacy:

- Visit the official website of the claimed regulator (e.g., nfa.futures.org for NFA).

- Search the brokers name or registration number.

- Confirm the scope of their license includes forex or derivatives trading.

If a broker resists verification, uses vague regulatory language (e.g., “internationally compliant”), or claims to be regulated in offshore jurisdictions with weak oversight, treat it as a red flag.

Red Flag 3: Pressure Tactics and Unsolicited Contact

Forex scammers often initiate contact through cold calls, social media messages, or dating apps—a method increasingly linked to “pig butchering” scams where fraudsters build romantic relationships before soliciting investments. These interactions are unsolicited and designed to create emotional urgency.

Once contact is made, scammers apply pressure to act quickly, using phrases like “limited-time offer,” “closing in 5 minutes,” or “only three spots left.” This tactic, known as FOMO (fear of missing out), prevents victims from conducting due diligence. The U.S. Secret Service and Financial Crimes Enforcement Network (FinCEN) have highlighted this pattern in recent fraud alerts, noting its prevalence in cross-border forex scams.

Legitimate financial professionals do not pressure clients into immediate decisions. Reputable brokers provide educational resources, demo accounts, and time to review terms. If someone insists you must invest now or lose the opportunity, it is almost certainly a scam.

Additionally, be wary if the person contacting you avoids video calls, refuses to share verifiable identification, or redirects communication to private channels like WhatsApp or Telegram. These behaviors isolate the victim from third-party verification and increase control over the narrative.

A 2024 Action Fraud report documented a case where a victim received a cold call offering forex investment advice, followed by demands for upfront tax payments to withdraw funds—resulting in a $50,000 loss. Such cases underscore the importance of resisting urgency and verifying every claim independently.

Red Flag 4: Inflated Spreads and Rigged Platforms

Some fraudulent brokers manipulate trading conditions to ensure client losses. One common technique is inflating bid-ask spreads—the difference between buying and selling prices—beyond normal market levels. For instance, while the typical spread for EUR/USD is 1–3 pips under standard conditions, scam brokers may show spreads of 7 pips or more, especially during news events.

This manipulation increases transaction costs significantly, eroding account balances over time. Since most retail traders rely on small price movements for profit, excessive spreads make consistent gains nearly impossible.

Beyond spreads, some platforms engage in price fixing, slippage manipulation, or outright trade rejection. These actions occur on proprietary or unregulated platforms where there is no independent audit trail. In extreme cases, trades are not executed at all—the platform merely simulates activity to give the illusion of trading.

To detect platform manipulation:

- Compare spreads across multiple reputable brokers.

- Use third-party tools to monitor real-time interbank rates.

- Test execution speed and fill quality on a demo account.

Regulated brokers connected to liquidity pools (like banks and institutional traders) offer transparent pricing. If a broker discourages demo testing or restricts withdrawal of demo profits, consider it a warning sign.

Red Flag 5: Withdrawal Difficulties and Hidden Fees

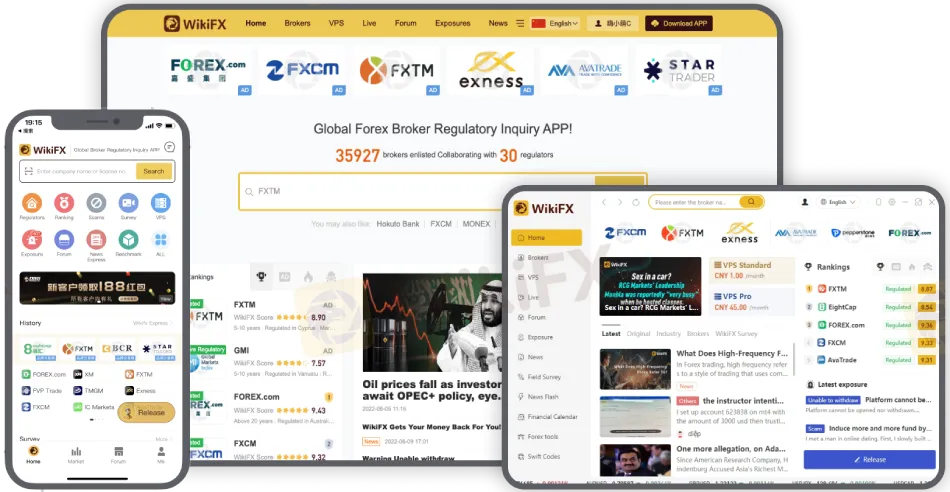

One of the clearest signs of a forex scam is the inability to withdraw funds. WikiFX reports that approximately 60% of forex scam complaints in 2023 involved denied or delayed withdrawals. Scammers often allow initial deposits and even small withdrawals to build trust, but once larger sums are invested, they impose obstacles.

Common tactics include:

- Demanding additional “taxes” or “verification fees” before releasing funds.

- Claiming technical issues or compliance delays.

- Requiring further deposits to “unlock” withdrawal privileges.

In one documented case, a U.S. trader was told he needed to pay a 15% “tax” to release his funds, with threats of IRS action if unpaid—a complete fabrication since the IRS does not collect fees for private brokers.

Legitimate brokers process withdrawals within a few business days and clearly outline procedures in their terms of service. Any request for extra payments to access your own money should be treated as fraud.

Before investing, review the brokers withdrawal policy and search online for user experiences. Independent forums like ForexPeaceArmy or Trustpilot can reveal patterns of withdrawal issues.

Red Flag 6: Fake Signal Sellers and Trading Bots

Signal sellers and automated trading robots are popular targets for fraud. Scammers sell subscriptions to “proven” trading signals or software that supposedly generate consistent profits with minimal effort. However, many of these services deliver random or outdated information, or worse, signals designed to cause losses.

Warning signs include:

- No verifiable performance history.

- Claims of 90%+ win rates or guaranteed profits.

- Wide stop-loss and narrow take-profit levels in sample trades increase the likelihood of loss.

Some robot vendors offer free trials—but only after signing up with a specific (often unregulated) broker, ensuring losses through manipulated execution.

To verify legitimacy:

- Request audited performance reports from independent sources.

- Test signals on a demo account for at least one month.

- Look for transparency about strategy logic and risk parameters.

Organizations like Dukascopy offer verified market analysis and signals as part of regulated services, contrasting sharply with opaque third-party providers.

Red Flag 7: Ponzi and Pyramid Schemes

Ponzi and pyramid schemes are prevalent in forex fraud. In a Ponzi scheme, returns to earlier investors are paid from new investors funds, not actual trading profits. Eventually, the scheme collapses when inflows slow, leaving most participants with losses.

Pyramid schemes focus on recruitment—participants earn commissions for bringing in new members rather than from trading success. These models violate securities laws and have no sustainable revenue source.

Both types often use forex as a cover story, claiming sophisticated algorithms or insider access. However, no real trading occurs; its simply a transfer of money from new victims to earlier ones.

The CFTC has issued warnings about hybrid scams combining forex branding with multi-level marketing structures, particularly targeting younger investors via social media.

Conclusion

Spotting a forex scammer requires vigilance, skepticism, and proactive research. Always verify regulatory status, question unrealistic promises, and avoid pressured decisions. Use demo accounts to test platforms, and never invest more than you can afford to lose.

Education is the strongest defense. By understanding the mechanics of fraud, investors can navigate the forex market safely and avoid becoming victims of increasingly sophisticated scams.

Read more

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

A 61-year-old former accountant in Johor lost RM469,875 after responding to a TikTok ad for Bursa Malaysia “investments,” communicating via WhatsApp, joining a chat group, and making 13 transfers to multiple company accounts. Scammers lured him with promises of 7%–15% returns and an initial “profit” payout of RM14,763 before pressing for more deposits

Should You Learn to Trade or Trust Someone with Your Money?

Should Malaysians develop their own trading skills or entrust their capital to professionals? Understanding the real risks behind both choices is essential to protecting your financial future!

Is Forex Trading a Scam or Do People Actually Make Money From It?

Mention the word forex in Malaysia, and you will often hear immediate reactions: “It is a scam”, “It is like a money game”, or “Everyone loses”. Is forex trading a scam, or do people actually make money from it?!

When the Licence Disappears: What Traders Overlook About Their Brokers

In the foreign exchange and online trading industries, regulation is often referred to as a technical requirement. Yet for traders of all levels, a broker’s regulatory status is one of the most fundamental markers of safety and transparency. When a broker loses its licence, it is never a minor administrative event. It signals structural problems that can place client funds and trading conditions at significant risk. Understanding why brokers lose their licences, what it means, and how traders can stay informed is essential in today’s rapidly shifting financial landscape.

WikiFX Broker

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

The Problem With GDP

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

Tauro Markets Review: Tons of Withdrawal Rejections & Trading Account Terminations

Rate Calc