Tell LTD Named by DFSA for Posing as Licensed Firm

Abstract:DFSA issued a warning naming Tell LTD for false license claims. Discover the risks of broker impersonation and how to protect your funds.

Warning overview

The Dubai Financial Services Authority (DFSA) has issued an investor alert naming Tell LTD for impersonating a DFSA-authorised firm. The alert explains that the operators use DFSAs name and regulatory language to look legitimate while not appearing on the DFSA Public Register.

Typical touchpoints include polished websites, social-media ads, unsolicited emails or messaging-app outreach, and follow-up calls by “account managers” who push quick onboarding. Victims are urged to transfer money to third-party accounts or to send crypto to wallets the promoters control.

The warning stresses a few essentials: being “based in Dubai” or citing the DIFC in marketing does not equal DFSA authorisation; screenshots of “certificates,” licence numbers pasted on webpages, or logos embedded in PDFs are not proof of a licence; and investors should treat any request for remote-access apps or identity documents as a red flag. The regulator urges the public to refuse payments, preserve evidence (URLs, emails, wallet addresses, phone numbers), and report the incident.

How to recognise an impersonation playbook

Scams that pretend to be regulated usually follow repeatable patterns. Watch for these tells:

- Name mismatch. The company name on the website or contract doesnt match any entry in an official register; the legal entity changes across pages, footers, or bank beneficiary details.

- Look-alike domains. One-letter swaps, extra hyphens, or different TLDs that mimic a known brand.

- Fuzzy “proof.” Blurry “licences,” unverifiable licence numbers, or links to self-hosted “verification” pages rather than an official register.

- Payment detours. Requests for crypto, e-wallets, or transfers to private/overseas accounts that dont match the named firm.

- Pressure and promises. Pushy deadlines, “limited slots,” or claims of effortless returns.

- No audit trail. Missing client agreements, no complaints procedure, generic webmail addresses, and phone numbers that constantly change.

If just one of these shows up, pause. If several appear together, walk away.

One-stop verification with WikiFX

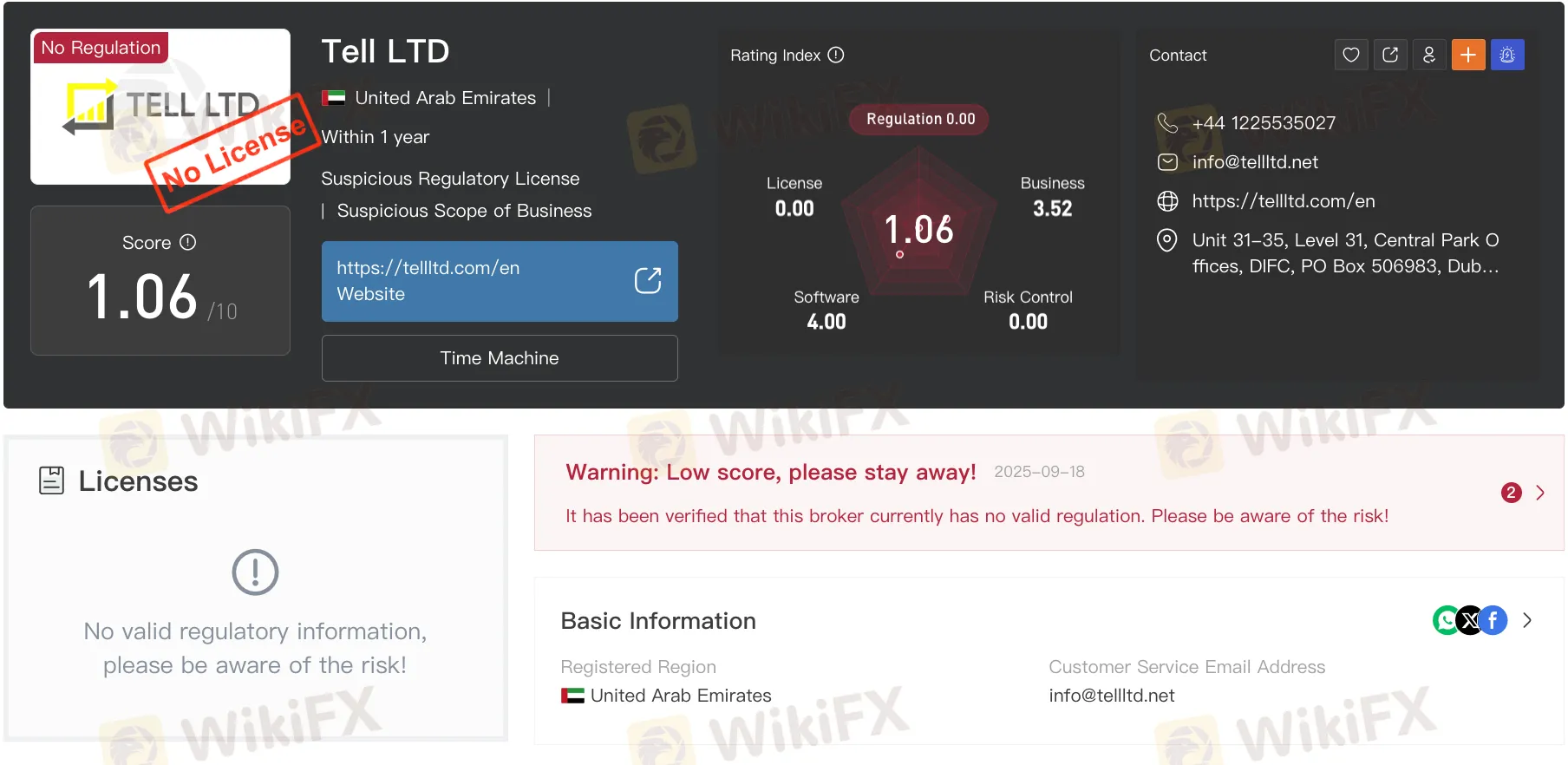

Before you fund any account, run a background check on WikiFX. The platform aggregates licence status, risk alerts, and user exposures across regions in a single broker profile.

For Tell LTD, the WikiFX page does not show a DFSA licence—in fact, it shows no valid authorisation from recognised regulators. That alone is a deal-breaker for risk-aware traders. Use the broker profile to read recent exposure posts, compare entity names, and confirm whether the website youre viewing matches any licensed corporate body. If the licence section is blank or labelled “unverified/revoked,” treat it as a hard stop.

Read more

Does WealthFX Generate Wealth or Losses for Traders? Find Out in This Review

The name WealthFX sounds appealing for all those wishing for a rewarding forex journey. However, behind the aspiring name are multiple complaints against the Comoros-based forex broker. These trading complaints dampen the broker’s reputation in the forex community. In this WealthFX review article, we have shared some of these complaints here. Take a look!

CySEC Flags 21 Unauthorized Broker Websites in 2025 Crackdown

CySEC warns investors about 21 unauthorized broker websites in 2025, including potential clones of major brands. Verify your broker’s license to avoid scams.

FONDEX Review: Do Traders Really Face Inflated Spreads & Withdrawal Issues?

Does FONDEX charge you spreads more than advertised to cause you trading losses? Does this situation exist even when opening a forex position? Do you witness customer support issues regarding deposits and withdrawals at FONDEX broker? Does the customer support official fail to explain to you the reason behind your fund loss? In this article, we have shared FONDEX trading complaints. Read on!

Metadoro Review: Pending Withdrawals, Fund Scams & High Slippage Keep Traders on Edge

Do you fail to withdraw your funds from your Metadoro forex trading account? Does the forex broker manipulate figures to cause you losses? Does the high slippage erode your capital and make it difficult for you to close your order at the optimum rate? These are some startling issues you and many other traders are facing on the Metadoro trading platform. In this Metadoro review article, we have shared some complaints for you to look at. Read on!

WikiFX Broker

Latest News

150 Years Of Data Destroy Democrat Dogma On Tariffs: Fed Study Finds They Lower, Not Raise, Inflation

The Debt-Reduction Playbook: Can Today's Governments Learn From The Past?

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

Amillex Withdrawal Problems

IEXS Review 2025: A Complete Expert Analysis

IEXS Regulation: A Complete Guide to Its Licenses and Safety Warnings

Oil and gas giant Wood plc sold to Dubai engineering firm

FONDEX Review: Do Traders Really Face Inflated Spreads & Withdrawal Issues?

Rate Calc