FONDEX Review: Do Traders Really Face Inflated Spreads & Withdrawal Issues?

Abstract:Does FONDEX charge you spreads more than advertised to cause you trading losses? Does this situation exist even when opening a forex position? Do you witness customer support issues regarding deposits and withdrawals at FONDEX broker? Does the customer support official fail to explain to you the reason behind your fund loss? In this article, we have shared FONDEX trading complaints. Read on!

Does FONDEX charge you spreads more than advertised to cause you trading losses? Does this situation exist even when opening a forex position? Do you witness customer support issues regarding deposits and withdrawals at FONDEX broker? Does the customer support official fail to explain to you the reason behind your fund loss? In this article, we have shared FONDEX trading complaints. Read on!

Top FONDEX Trading Complaints

Inflated Spreads Make Traders Lose Capital

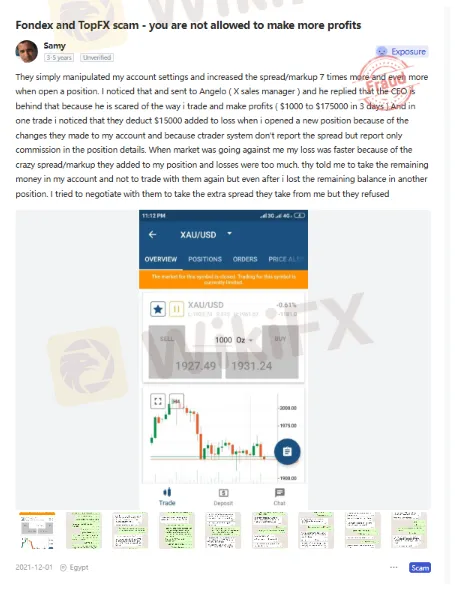

FONDEX forex management is often accused of driving manipulative trade practices by charging more spreads than advertised. According to a trader, FONDEX manipulated his account settings by charging spreads or markups seven times more than even when opening a position. The changes to the account setting is alleged to have resulted in losses worth $15,000 for the trader. Frustrated by the illegitimate losses, the trader reported the incident on WikiFX, the worlds leading broker regulation inquiry app.

No Reason Provided for the Heavy Trading Loss

A trader admitted having incurred a huge loss trading with FONDEX forex broker. However, whats saddened him more is the lack of an exact reason for the loss. Left utterly disappointed with the overall FONDEX trading experience, the trader shared this review of the broker.

Poor Customer Support Service Hurts Traders Further

While trade manipulation and subsequent fund scams have been halting traders‘ journey at FONDEX forex broker, the poor customer support service concerning deposits and withdrawals bothers them even more. Traders accuse the broker of failing to respond to their email queries. Here are multiple screenshots explaining how poor the broker’s customer support is.

The Lack of Effective Technical Analysis

A trader admitted that FONDEX forex broker recently updated its cTrader platform, preventing its clients from leveraging TradingCentral data. Further, the trader conceded that AutoChartist, used as of now, does not offer data insights as comprehensive as was the case with TradingCentral on the FONDEX trading platform. The lack of critical data insight forces the trader to share a slightly negative FONDEX review.

WikiFX Shares the FONDEX Review: Score & Regulatory Status

The complaints around trade losses, poor customer support service, and the lack of robust trading tools made the WikiFX team investigate FONDEX forex broker on several aspects, including its regulatory status. The investigation revealed that the broker has a suspicious regulatory license, potentially answering the reason behind traders losses. As a result, the WikiFX team gave FONDEX a poor score of 2.11 out of 10.

Stay updated about the forex brokerage landscape by joining any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

WikiFX Broker

Latest News

Renewable Grid Integration: Economics and Technology

Gold Rally Validated as Miners Forecast Doubled Earnings

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

Fraudsters Impersonate Hong Kong Monetary Authority Using Fake Websites and Login Pages

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

US and China Ramp Up Trade Incentives for African Markets

Is QUOTEX Broker Safe? Unauthorized Status Exposed

Rate Calc