RoboMarkets Secures Dubai SCA Category 1 Licence

Abstract:RoboMarkets obtains Dubai SCA Category 1 licence, boosting its MENA brokerage expansion with full trading and securities dealer permissions.

RoboMarkets Expands to the Middle East with Top SCA Licence

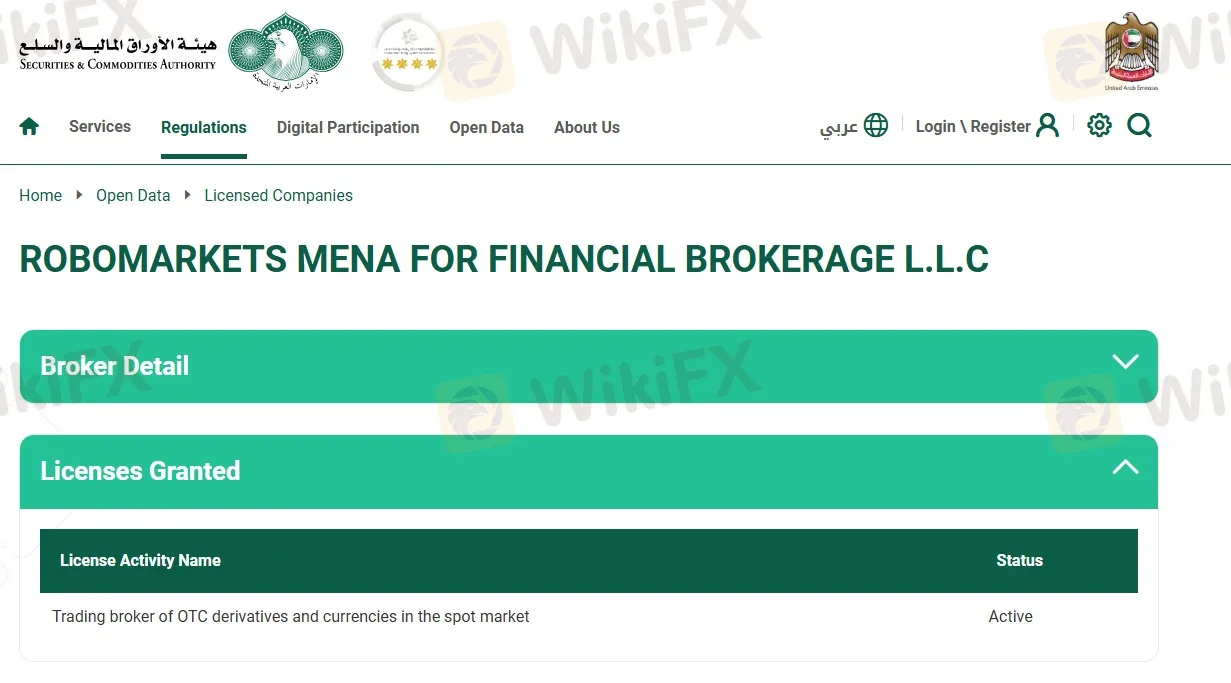

RoboMarkets has achieved a significant milestone in its Middle East expansion by securing a Category 1 licence from the Dubai Securities and Commodities Authority (SCA). The licence, awarded to its local entity RoboMarkets MENA for Financial Brokerage—established in July 2024—grants the broker wide-reaching permissions across trading and clearing functions.

Unlike many UAE forex and CFD brokers that operate under a limited Category 5 licence, RoboMarkets now holds one of the most comprehensive regulatory approvals available in Dubai. This Category 1 authorisation allows the company to act as a trading and clearing broker, securities dealer, trading broker in global markets, broker for non-exchange-traded derivatives, and spot FX trading in the UAE, as well as an on-market securities broker.

Competitive Market for CFD Brokers in Dubai

The move follows a steady influx of CFD brokers in Dubai seeking regulatory legitimacy through the SCA. Most competitors, including Exinity, VT Markets, Eightcap, EC Markets, and Taurex, have opted for Category 5 licences, which function similarly to introducing broker (IB) models. In contrast, only a handful of global leaders—such as Plus500 and XTB—have acquired the more advanced Category 1 SCA licence.

By joining this top tier of brokers, RoboMarkets positions itself as a stronger contender in the evolving financial brokerage sector in the Middle East, especially as investor appetite in Dubais retail and institutional trading markets continues to rise.

New Leadership and Strategic Focus

RoboMarkets‘ Dubai register also reflects new executive leadership, with Karine Ugarte taking charge as CEO of RoboMarkets MENA in May 2025. The appointment signals the company’s strategic push to deepen its footprint across the Gulf region.

This expansion comes after RoboMarkets reshaped its European operations in early 2025. The Cyprus-regulated unit, formerly active in retail CFDs, shifted exclusively to institutional clients, while its Germany-based entity pivoted to stock, bond, and ETF brokerage. Meanwhile, its Belize-regulated brand RoboForex continues to serve retail CFD traders offshore.

Industry experts note that holding an SCA Category 1 licence not only differentiates RoboMarkets from other trusted CFD brokers in the Middle East but also enhances investor confidence through stricter compliance and oversight structures applied under Dubais financial framework.\

About RoboMarkets

Founded in 2012, RoboMarkets is a European brokerage group offering access to multi-asset trading services, including stocks, ETFs, bonds, forex, and CFDs. The company operates under several regulatory frameworks worldwide, serving both retail and institutional clients, with a growing focus on innovation and global market expansion.

Read more

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

Does your deposit amount fail to reflect in your Exnova forex trading account? Does the same thing happen even when withdrawing? Does the Exnova bonus lure lead to a NIL account balance? Has the broker terminated your account without any explanation? These trading issues have become synonymous with traders here. Some traders have openly criticized the broker on several review platforms online. In this Exnova review article, we have highlighted the miserable forex trading experiences.

FXCM Broker ASIC Stop Order Halts CFD Sales

FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FortuixAgent Review: A Tale of Account Restrictions & Withdrawal Denials

Has your FortuixAgent app for forex trading been restricted? Does the broker not allow you to withdraw your initial deposits? Does the UK-based forex broker demand payment out of your earnings to allow withdrawals? These issues refuse to leave traders, as they come out expressing their frustration on broker review platforms. In this Fortuixagent review article, we have shared many complaints made against the broker.

Is Tiger Brokers Regulated? Investor Protection Guide

Tiger Brokers offers regulated trading in US, HK, SG stocks & futures. SFC-approved in HK (BMU940), FMA in NZ. No min deposit, competitive fees.

WikiFX Broker

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

The Problem With GDP

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

Tauro Markets Review: Tons of Withdrawal Rejections & Trading Account Terminations

Rate Calc