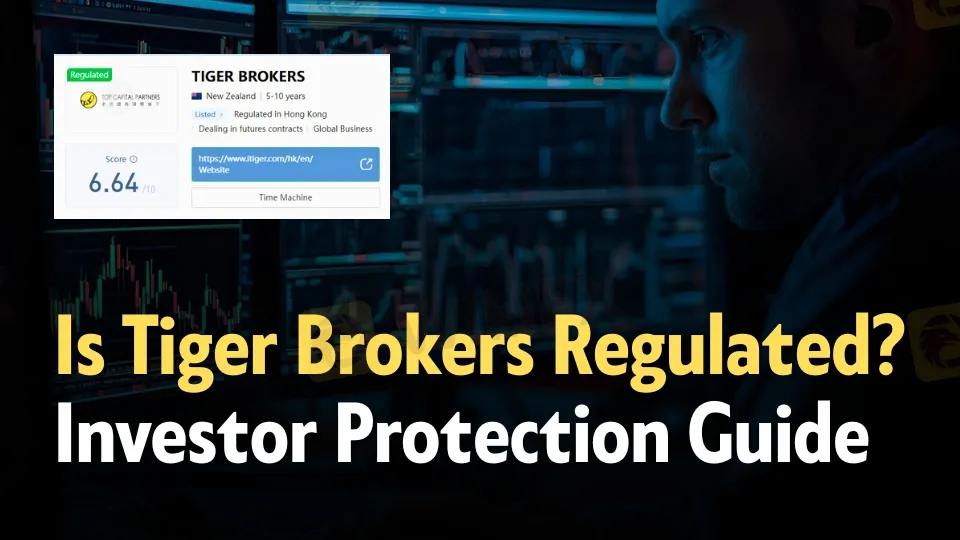

Is Tiger Brokers Regulated? Investor Protection Guide

Abstract:Tiger Brokers offers regulated trading in US, HK, SG stocks & futures. SFC-approved in HK (BMU940), FMA in NZ. No min deposit, competitive fees.

Tiger Brokers delivers regulated access to global stocks, futures, and more across key markets like the US, Hong Kong, and Singapore. Backed by licenses from bodies such as Hong Kong's SFC (license BMU940) and New Zealand's FMA, the broker stands out with no minimum deposits and low fees.

Tiger Brokers Regulation Overview

Tiger Brokers operates under multiple regulatory umbrellas, including a confirmed license from the Securities and Futures Commission (SFC) in Hong Kong. License BMU940, issued to Tiger Brokers HK Global Limited in 2018, covers dealing in futures contracts, with the entity based at a verified Hong Kong address. Additional oversight appears in New Zealand via the Financial Markets Authority for TIGER BROKERS NZ LIMITED (license 473106), though some international registrations like the US NFA (0328552 for US TIGER SECURITIES INC) remain unverified in public records.

This setup provides investor safeguards, such as segregated client funds and dispute resolution channels, but traders should confirm entity-specific protections based on their residency. Unlike unregulated offshore firms, Tiger Brokers Regulation ties directly to established jurisdictions, reducing risks of fund mismanagement.

Key Tiger Brokers Regulatory Licenses

- Hong Kong SFC (BMU940): Active since July 11, 2018; authorizes futures trading; contact via hk-compliance@tigerbrokers.com.hk.

- New Zealand FMA (473106): Covers financial services; entity at Level 27, 151 Queen Street, Auckland; phones include 0800 884 437.

- US NFA (0328552): Linked to US TIGER SECURITIES INC at 437 Madison Ave, New York; requires further verification for full compliance status.

Domain details trace to tigerbrokers.com.sg and itiger.com, registered under entities like Top Capital Partners Limited in New Zealand, operational for over five years. These licenses signal legitimacy, contrasting with brokers lacking tier-1 oversight.

Trading Instruments at Tiger Brokers

Access spans US stocks/ETFs/options/futures, Hong Kong equities/warrants/CBBCs, Singapore REITs/DLCs/futures, Australian stocks, and China A-shares via HKEX Northbound. Futures include equity, treasury, forex (micro pairs commission-free), index (e.g., China A50 from $0.99), energy (e-mini crude), agriculture (corn/wheat), and metals (micro gold).

Compared to peers like Interactive Brokers, Tiger Brokers emphasizes Asia-Pacific assets with competitive breadth, though forex depth lags majors like IG Group.

| Market | Key Instruments | Example Availability |

| US | Stocks, ETFs, Options, Futures | GME stock, OTC trades |

| Hong Kong | Stocks, Warrants, CBBCs, Futures | Stock options from 0.2x value |

| Singapore | Stocks, ETFs, REITs, Futures | DLCs, rights issues |

Tiger Brokers Account Types Explained

Two main options suit varied traders: cash accounts for basic buying/holding (1 lot minimum, no shorting or margin) and margin accounts unlocking full products with up to 14x intraday leverage or 12x overnight. Upgrades from cash to margin incur no fees, and neither requires minimum deposits—ideal versus brokers like Saxo Bank demanding $2,000+. 2,000+.

Both support unlimited orders, but margin opens futures/options are absent in cash setups.

Fees and Commissions Breakdown

Commissions beat industry averages: US stocks from $0.005/share, HK/Australia/China A-shares at 0.03x value, Singapore assets 0.04x. Options start at $0.65 US contract or 0.2x HK value; futures from $0.99 (micros free on some forex).

Extra charges like stamp duty apply, but no platform fees stand out. Versus eToro's spreads, Tiger Brokers' model favors active stock/futures traders.

| Asset Class | Commission Example |

| US Stocks/ETFs | $0.005/share min |

| Futures (Index/Energy) | $0.99–$8/contract |

| HK Warrants/CBBCs | 0.03x value |

Deposits, Withdrawals, and Platforms

No minimum deposits across USD/EUR/SGD/HKD/AUD; Singapore users enjoy instant DBS/POSB transfers (SGD), others 1-3 days via bank wire (USD $25 fee possible). Withdrawals mirror this—no Tiger fees, but third-party costs apply; processing hits 1-3 business days.

Tiger Trade platform powers all trades, with demo accounts for practice and 24/5 hours (asset-specific). Support runs weekdays via email (service@tigerbrokers.com.sg), phones (e.g., Singapore +65 6331 2277), and live chat.

Pros and Cons of Tiger Brokers

Pros:

- Zero minimum deposit lowers entry barriers.

- Competitive commissions on global stocks/futures.

- Regulated in HK/NZ with multi-market access.

- Free margin upgrades and demo trading.

Cons:

- Some licenses (e.g., US NFA) unverified, raising due diligence needs.

- Withdrawal fees from banks, not broker.

- Limited forex versus dedicated CFD brokers.

Bottom Line

Tiger Brokers Regulation anchors a solid choice for cost-conscious traders eyeing US/Asia stocks and futures, with SFC/BMU940 offering real protections absent in offshore alternatives. Its no-minimum, low-fee structure delivers value for beginners to pros, provided users verify regional entity compliance—outshining less transparent competitors in legitimacy and accessibility.

Read more

FXCM Broker ASIC Stop Order Halts CFD Sales

FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FortuixAgent Review: A Tale of Account Restrictions & Withdrawal Denials

Has your FortuixAgent app for forex trading been restricted? Does the broker not allow you to withdraw your initial deposits? Does the UK-based forex broker demand payment out of your earnings to allow withdrawals? These issues refuse to leave traders, as they come out expressing their frustration on broker review platforms. In this Fortuixagent review article, we have shared many complaints made against the broker.

Tauro Markets Review 2025: Unregulated Broker | Read This Before You Deposit

Tauro Markets claims to be a global forex and CFD broker, but upon closer examination of its operations, we find serious warning signs that every potential trader needs to be aware of. While they offer the well-known MT4 platform and various trading options, these advantages are completely overshadowed by one major problem: they have no real financial regulation at all. This Tauro Markets review gives you a complete analysis, focusing on the real risks and what they claim to offer, so you can make a smart decision. Our conclusion is simple: because this broker has no regulation, your capital is in serious danger, and anyone thinking about opening an account should be extremely careful.

Is FXCC Regulated? Full FXCC Regulation Overview

FXCC is licensed and regulated by CySEC. Understand its regulatory compliance, authorized jurisdictions, and investor protections.

WikiFX Broker

Latest News

Plus500 Allegations Exposed in Real Trader Cases

US Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

HEADWAY: The Fast Track to Financial Dead-Ends?

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Rate Calc