Is Capital.com Safe for Traders?

Abstract:In online trading, danger rarely arrives with flashing red lights. More often, it hides behind a sleek, professional-looking platform with just one click away from taking your deposit and disappearing into the digital shadows. Today, the broker under WikiFX’s spotlight is Capital.com. Keep reading to discover whether it’s truly as safe as it seems.

In online trading, danger doesn‘t always announce itself with flashing red lights. Sometimes, it hides behind a sleek, professional-looking platform with just one click away from taking your deposit and vanishing into the digital shadows. Every year, countless traders learn the hard way that the broker they trusted wasn’t as safe as it seemed. The difference between protecting your capital and losing it often comes down to one crucial decision: choosing the right broker.

One name making waves in trading circles is Capital.com. Its discussed in forums, advertised across social media, and praised in trading communities. But is the hype deserved? Is Capital.com truly a safe place for traders or just another polished façade waiting to crack under pressure? The answer lies in its regulatory backbone and in whether traders know how to verify it.

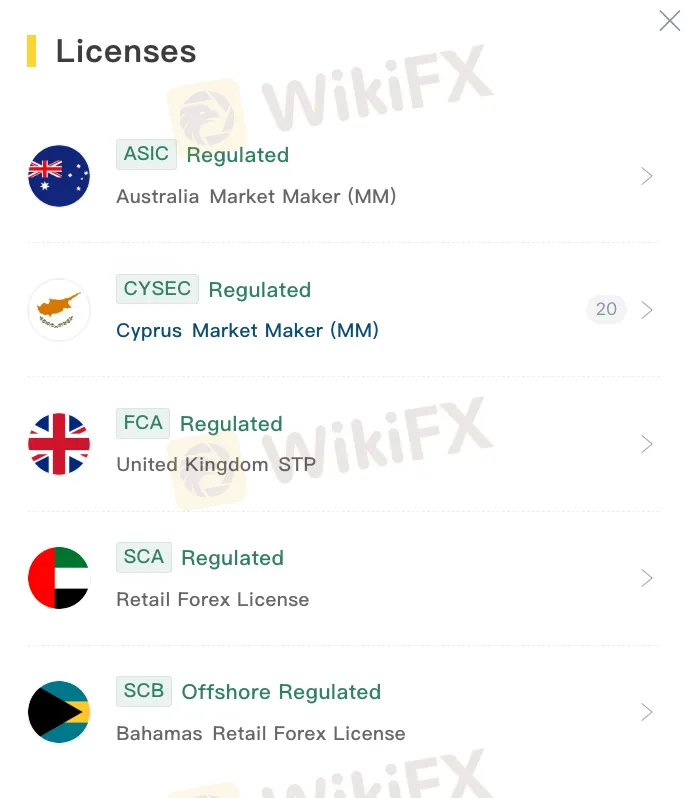

Capital.com wears its regulatory credentials proudly. The broker holds five active licences from some of the world‘s most reputable financial watchdogs, including the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC). These arent just decorative s; each regulator enforces strict rules designed to protect client funds and keep operations transparent.

One of the most notable is its ASIC licence, number 513393. ASIC is known globally as one of the toughest financial regulators, ensuring companies treat clients fairly, follow strict operational standards, and safeguard customer funds. Passing ASICs scrutiny is a strong signal of credibility.

Capital.com is also regulated by CySEC, under licence number 319/17. CySEC operates within the MiFID II framework, which standardises investor protection and transparency rules across the European Economic Area. For traders, this means a high level of protection when dealing with a CySEC-authorised broker.

In the UK, Capital.com operates under licence number 793714 from the FCA. The FCA is widely regarded as one of the strictest regulators in the world, requiring brokers to operate transparently, keep client funds separate from company funds, and meet stringent financial stability requirements. Traders with an FCA-licensed broker can feel confident theyre dealing with a company that plays by the rules.

The broker has also expanded into the Middle East, securing a licence from the Securities and Commodities Authority (SCA) in the United Arab Emirates, under licence number 20200000176. The SCA enforces international compliance standards, ensuring financial firms in the UAE operate with integrity and transparency, which is a key safeguard in this fast-growing market.

Lastly, Capital.com holds a licence from the Securities Commission of the Bahamas, with registration number SIA-F245. While the Bahamas has historically been seen as an offshore hub, its financial laws have tightened in recent years to improve investor protection and combat misconduct. This shows Capital.coms commitment to building a truly global regulatory footprint.

This network of licences paints a picture of a broker committed to compliance, but here‘s where traders must stay alert: regulation alone doesn’t guarantee safety. Brokers can change, rules can shift, and even reputable firms can run into problems. Too many traders skip due diligence, relying solely on first impressions or marketing claims. That‘s a dangerous gamble, and it’s exactly how people lose their hard-earned money.

This is why professional traders turn to WikiFX before investing a single dollar. WikiFX lets you instantly verify a brokers licensing status, review any regulatory warnings, and read real trader feedback - all for free! In seconds, you can uncover hidden risks, spot red flags, and confirm whether a broker truly operates under the licences it claims.

In online trading, information isn‘t just power, but ultimate protection. Skipping this step is like driving at night without headlights: you might make it a short distance, but disaster is inevitable. Whether you’re considering Capital.com or any other broker, take five minutes to check them on WikiFX. That single action could save you from costly mistakes as well as give you the confidence to trade knowing exactly who youre dealing with.

Read more

Rebelsfunding Exposed: Unfair Account Blockage, Frequent Platform Freeze, Unethical Operations

Facing serious safety concerns with the Rebelsfunding trading account? Does the Slovakia-based forex broker surprise you by blocking your account? Does the platform freeze frequently and stop you from placing trades? Does the buy/sell button deactivate once you hit profits? Facing app loading issues and detail errors? You need to reach the higher authorities ASAP. Failure to do so may result in fund losses. Many of its clients have complained about the broker online. In this article, we have shared their complaints. Take a look.

ADCB Faces Customer Backlash on All Fronts: Check Top Complaints

Is your banking experience with ADCB far from ideal? Facing constant delays in credit card application approvals? Have you witnessed the stoppage of SMS from the bank for transactions? Does the customer service team fail to respond to your queries? These issues have become increasingly common for ADCB customers. A lot of them, understandably so, have criticized the bank on review platforms. Keep reading to know the top complaints against it.

FX Live Capital Review: Regulation Status & 4 Facts You Must Know

This article is a review of FX Live Capital. It reveals many facts about the broker, including issues with its regulation and red flags that it tries to hide. This is a scam alert article, and traders and investors should read it until the end.

Forex Market Time Converter Explained: Trading Hours, Sessions & More

The forex market is full of opportunities for traders with operations spanning 24 hours a day, five days a week. You might be in India or Russia but you can always trade on forex globally. Forex trading sessions usually overlap globally, allowing you to maximize your trade potential. The major trading centres are Tokyo, London, New York and Sydney. But how will you know the forex trading sessions across different zones? Simple, use the forex market time converter tool. It lets you know the trading hours (open and close times) globally.

WikiFX Broker

Latest News

Axi CCO Louis Cooper to Retire in Sept 2025

Pros, Cons & Reality of Investing in Forex

WikiEXPO 2025 Cyprus “Welcome Party” Kicks Off Tonight in Limassol

Revealing the Binany Scam: Withdrawal Denials, Deposit Credit Issues & More

Vault Markets Review: Complaints, Withdrawal & Regulation Concerns Revealed!

Firstrade Review 2025: Login, Regulation, and Risk

Colmex Pro Review: Regulation, Fees, Platform Logins, and Safety

GO Markets Launches Signal Centre with Acuity

Drawdown in Forex Trading Explained: Definition, Concept & Importance

Kanak Capital Markets Exposed: Mounting Fraud Allegations Leave Traders Unsafe

Rate Calc