New Stimulus from Tariffs? Trump Proposes $600 Cash Handouts

Abstract:As of January through July this year, U.S. government tax revenues reached $152 billion—double the amount collected from tariffs. If Donald Trump proceeds with distributing the tariff revenues as $600

As of January through July this year, U.S. government tax revenues reached $152 billion—double the amount collected from tariffs. If Donald Trump proceeds with distributing the tariff revenues as $600 cash handouts to Americans, it could significantly boost disposable income and savings. Should this become policy, we believe it could cushion the correction in risk assets and revitalize lackluster end-consumer demand in the second half of the year.

Previously, we highlighted that consumer spending may weaken in Q3 due to historically low savings rates. But what if Trump issues another $600 handout?

How Much Could a $600 Handout Lift the Savings Rate?

Taking June 2025 as the baseline, the U.S. personal savings rate stood at 4.5%. If the government distributes $600 to 250 million Americans, the total stimulus would reach $150 billion.

Assuming 30% of the cash is saved, an additional $45 billion would be added to the national savings pool. Meanwhile, disposable income would rise from $1.8 trillion to $1.95 trillion, lifting the savings rate to 6.81%—a 2.31 percentage point increase.

[Chart 1: Savings Rate vs. Personal Consumption Expenditure] Source: MacroMicro

While the policy is still under discussion, such a move would undeniably raise disposable income. Viewed from another angle, one-time handouts typically yield a fiscal multiplier of 1.2–1.5—meaning $1 of stimulus could generate $1.20–$1.50 in economic output.

That said, we believe the marginal utility of such a handout is far less than during the pandemic era. The U.S. economy is not in a recession, and the impact on GDP would be limited. A more effective tool would be interest rate cuts to lower spending costs.

New York Fed's Williams: Tariff Effects Will Take Time

John Williams, President of the New York Fed, recently remarked that it would take time for the effects of higher tariffs to materialize. Based on enacted and announced tariffs, the effective tariff rate is expected to reach 15% to 20%.

However, actual tariff revenues collected suggest lower effective rates. The share of net tariff revenues to total imports has risen from around 2.25% in Q1 to about 8% as of May.

Moreover, price transmission to domestic markets is delayed, partly due to businesses and consumers accelerating imports ahead of expected tariff hikes. This could postpone inflationary impacts, adding uncertainty to economic projections.

Williams estimates that such uncertainty, combined with reduced immigration (slowing labor force growth), will hold 2025 GDP growth to around 1%.

Outlook: Weak but Resilient Consumption Ahead

Assuming no $600 handout, GDP growth could remain at 1% this year, with inflation between 3% and 3.5%. By 2026, inflation is expected to cool to around 2.5%, and continued increases in disposable income could lead to modestly stronger consumer demand.

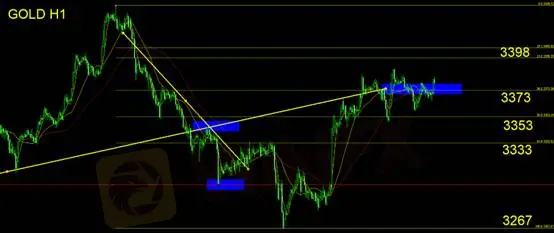

Gold Technical Analysis

On the hourly chart, gold appears to be forming a potential head-and-shoulders pattern, with price repeatedly testing the Fibonacci 61.8% resistance level at $3,373. The level has yet to be clearly confirmed as resistance, and price action suggests potential for a false breakout.

We recommend waiting for a confirmed downward reversal candlestick pattern on the hourly chart before initiating short positions. Suggested stop-loss: previous high at $3,390.

If price breaks below $3,373, look to short toward the $3,353 support level.

Support Levels: $3,373 / $3,353 / $3,333 / $3,267

Resistance Level: $3,398

⚠️ Risk Warning: The above analysis, data, and opinions are provided for general market commentary only and do not represent the stance of this platform. Trading carries risk. Please exercise caution.

WikiFX Broker

Latest News

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

WikiFX Wishes You a Happy International Women's Day

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

Oil prices jump above $100 for first time in four years

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

China Signals Tolerance for Slower Growth with Revised 2026 Outlook

Oil Surges as Qatar Warns of $150 Crude and 'Force Majeure' Across Gulf Exporters

JRJR Review: Safety, Regulation & Forex Trading Details

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

Rate Calc