Tradersway Broker Review 2025

Abstract:This article is a review of TradersWay. TradersWay remains notable for its unregulated status and high‐risk trading conditions. Below, we provide an impartial overview of TradersWay’s key features, trading conditions, platform offerings, fees, and community feedback.

This article is a review of TradersWay. TradersWay remains notable for its unregulated status and high‐risk trading conditions. Below, we provide an impartial overview of TradersWays key features, trading conditions, platform offerings, fees, and community feedback.

Regulatory Status and Corporate Background

- Unregulated Operation

TradersWay is not overseen by any major financial regulator (FCA, CySEC, ASIC, etc.). This absence of oversight means that standard safeguards—negative balance protection, segregated client funds, formal dispute resolution mechanisms—may not apply. Prospective clients should carefully weigh the lack of regulatory recourse against the brokers trading conditions.

- Company Profile

Headquartered offshore, TradersWay positions itself as a cost‐efficient gateway to global markets. However, public details on the firms ownership structure and financial standing are limited.

Account Types and Leverage

- Demo Account

A free demo account is available with virtual funds, allowing traders to test strategies across all supported instruments without risking real capital.

- Live Accounts

- Leverage: Up to 1:1000 on forex and select instruments, significantly higher than typical regulated‐broker limits (e.g., ESMAs 30:1 cap for retail FX).

- Minimum Deposit: No official minimum—clients can fund accounts with as little as USD 10, though small balances may incur additional margin pressure under high leverage.

Trading Platforms and Instruments

- Platforms

- MetaTrader 4 & 5 (MT4/MT5): Industry‐standard desktop, web, and mobile clients, offering Expert Advisor (EA) support, technical indicators, and strategy backtesting.

- cTrader: Enables Level II pricing, advanced order types, and algorithmic trading via cAlgo.

- Market Coverage

- Forex: Major, minor, and exotic currency pairs.

- Precious Metals: Gold, silver, platinum.

- Energies: Crude oil, natural gas.

- Cryptocurrencies: BTC, ETH, LTC, and others (as CFDs).

Costs: Spreads, Fees, and Commissions

- Spreads

- From 0 pips: On major forex pairs, under the brokers RAW pricing model. Average spreads tend to widen during volatile sessions.

- Commissions

- Withdrawal Fee: A flat 1.5% fee applies to certain withdrawal methods (e.g., credit/debit card transfers). Wire transfers and some e‐wallet withdrawals may be exempt or charged differently—clients should verify at the time of request.

- Overnight Swaps & Inactivity

- Standard interbank swap rates apply for positions held past the daily rollover.

- Inactivity fees may be imposed after 90 days without a trade.

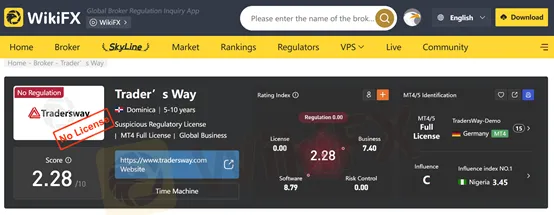

WikiFX Rating

WikiFX assigns TradersWay a rating of 2.28 / 10, reflecting its unregulated status, limited transparency, and mixed client feedback. This score places it in the lower tier of global CFD brokers.

Community Feedback and User Experiences

TradersWays high‐leverage offering appeals to certain high‐risk traders, while the 0-pip spreads and multiple platform choices are often cited as positives in online discussions. Conversely, the 1.5% withdrawal fee and lack of regulatory protections draw consistent criticism.

Conclusion

TradersWay caters to a niche segment of traders seeking aggressive leverage and a variety of trading platforms. However, its unregulated status and certain fees warrant careful due diligence. Prospective clients should balance the brokers low spreads and high leverage against the potential risks of trading with an entity outside the purview of recognized financial authorities. If you have traded with TradersWay, please share your experiences on WikiFX. Your reviews help fellow traders make more informed decisions.

Read more

Eightcap Review 2026: A Trader's Complete Guide to Its Strengths, Weaknesses and Warning Signs

Eightcap shows itself as an established worldwide Forex and CFD broker that started in Australia in 2009 and now helps clients around the world. Any trader's main question is whether they can trust it and rely on it. At first glance, the broker seems strong, but looking closer shows an important problem. It has licenses from top regulators, but at the same time, it has many serious complaints from users and official risk warnings. This mixed situation shows in its WikiFX score, which is currently 7.48 out of 10. This score has been lowered because of the many negative user reports. For any trader thinking about using this platform, understanding this main problem is very important. This review will examine its regulation, trading conditions, and real user feedback to give a clear answer. To see the newest user feedback and detailed scoring, you can view Eightcap's complete profile on WikiFX.

Managing Your Funds with Finalto: A Complete Guide to Deposits & Withdrawals

When choosing a broker, the most important question for any trader is: "How easy and safe is it to deposit and withdraw capital with Finalto?" How well a broker handles your capital and keeps it secure are essential factors that show whether you can trust it. This guide will give you a clear, detailed look at how Finalto handles deposits and withdrawals. Our review is based on verified regulatory information and real user experiences from 2025. We will look at the different methods, how fast they work, and what problems you might face. The key to safe trading is doing your research, especially checking if a broker is properly regulated, since this directly affects how safe your capital is. For any broker, you should always verify its claims. Before moving forward, traders should always use an independent checking platform. For a detailed check on Finalto's current status and regulatory licenses, platforms such as WikiFX are a must-have resource.

NSFX: A Closer Look on its Regulation and Reliability

Explore the NSFX review, focusing on NSFX regulation, WikiFX score, and recent warnings. Understand the risks associated with NSFX Forex trading and whether NSFX is a reliable broker for your investments.

ATC Brokers: Navigating Regulatory Landscape and Recent User Concerns

Explore a comprehensive ATC Brokers review, examining its WikiFX score, ATC Brokers regulation by the FCA and CIMA, and recent user complaints. Understand the implications for ATC Brokers Forex traders and make informed decisions about ATC Brokers login.

WikiFX Broker

Latest News

Middle East Geopolitical Crisis Triggers Energy Supply Disruption and Risk Repricing

Goldman Sachs: Qatari LNG Disruption to Persist Beyond Expectations

Crude Oil Rally Recedes as APAC Markets Stage Rebound

Can Traders Still Trust Their Forex Broker?

AI Infrastructure Enters Dual-Growth Cycle Amid Supply Chain Volatility

IQ Option Review: The High-Stakes Game Where the Only Winner is the House

Geopolitical Risk Reshapes Energy and Equity Markets: The 'Trump Playbook' in Focus

Cyprus Turns Market Abuse Whistleblowing Into Hard Law

7 Clear Signs You’re Ready to Enter Forex Market in 2026

traze Review 2026: Trading Conditions, Regulation & Real User Feedback

Rate Calc