Tradersway Broker Review 2025

Abstract:This article is a review of TradersWay. TradersWay remains notable for its unregulated status and high‐risk trading conditions. Below, we provide an impartial overview of TradersWay’s key features, trading conditions, platform offerings, fees, and community feedback.

This article is a review of TradersWay. TradersWay remains notable for its unregulated status and high‐risk trading conditions. Below, we provide an impartial overview of TradersWays key features, trading conditions, platform offerings, fees, and community feedback.

Regulatory Status and Corporate Background

- Unregulated Operation

TradersWay is not overseen by any major financial regulator (FCA, CySEC, ASIC, etc.). This absence of oversight means that standard safeguards—negative balance protection, segregated client funds, formal dispute resolution mechanisms—may not apply. Prospective clients should carefully weigh the lack of regulatory recourse against the brokers trading conditions.

- Company Profile

Headquartered offshore, TradersWay positions itself as a cost‐efficient gateway to global markets. However, public details on the firms ownership structure and financial standing are limited.

Account Types and Leverage

- Demo Account

A free demo account is available with virtual funds, allowing traders to test strategies across all supported instruments without risking real capital.

- Live Accounts

- Leverage: Up to 1:1000 on forex and select instruments, significantly higher than typical regulated‐broker limits (e.g., ESMAs 30:1 cap for retail FX).

- Minimum Deposit: No official minimum—clients can fund accounts with as little as USD 10, though small balances may incur additional margin pressure under high leverage.

Trading Platforms and Instruments

- Platforms

- MetaTrader 4 & 5 (MT4/MT5): Industry‐standard desktop, web, and mobile clients, offering Expert Advisor (EA) support, technical indicators, and strategy backtesting.

- cTrader: Enables Level II pricing, advanced order types, and algorithmic trading via cAlgo.

- Market Coverage

- Forex: Major, minor, and exotic currency pairs.

- Precious Metals: Gold, silver, platinum.

- Energies: Crude oil, natural gas.

- Cryptocurrencies: BTC, ETH, LTC, and others (as CFDs).

Costs: Spreads, Fees, and Commissions

- Spreads

- From 0 pips: On major forex pairs, under the brokers RAW pricing model. Average spreads tend to widen during volatile sessions.

- Commissions

- Withdrawal Fee: A flat 1.5% fee applies to certain withdrawal methods (e.g., credit/debit card transfers). Wire transfers and some e‐wallet withdrawals may be exempt or charged differently—clients should verify at the time of request.

- Overnight Swaps & Inactivity

- Standard interbank swap rates apply for positions held past the daily rollover.

- Inactivity fees may be imposed after 90 days without a trade.

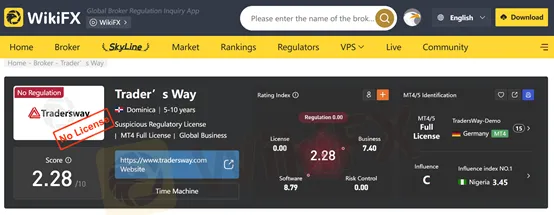

WikiFX Rating

WikiFX assigns TradersWay a rating of 2.28 / 10, reflecting its unregulated status, limited transparency, and mixed client feedback. This score places it in the lower tier of global CFD brokers.

Community Feedback and User Experiences

TradersWays high‐leverage offering appeals to certain high‐risk traders, while the 0-pip spreads and multiple platform choices are often cited as positives in online discussions. Conversely, the 1.5% withdrawal fee and lack of regulatory protections draw consistent criticism.

Conclusion

TradersWay caters to a niche segment of traders seeking aggressive leverage and a variety of trading platforms. However, its unregulated status and certain fees warrant careful due diligence. Prospective clients should balance the brokers low spreads and high leverage against the potential risks of trading with an entity outside the purview of recognized financial authorities. If you have traded with TradersWay, please share your experiences on WikiFX. Your reviews help fellow traders make more informed decisions.

Read more

AssetsFX Review – What Traders Are Saying & Red Flags to Watch

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

ROCK-WEST Complete Review: A Simple Guide to Its Trading Platforms, Costs, and Dangers

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

FX Movers: Yen Soars on Intervention Watch; CAD Tumbles on Trade Threats

Gold Pierces $5,000 Milestone; Pan African Resources Signals Cash Flow Surge

PRCBroker Review: Where Profitable Accounts Go to Die

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

USD Outlook: Markets Eye 'Politicized' Fed Risks as Tariff Impact Deepens

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

Rate Calc