TradersWay Broker Review 2025: Unregulated Status and Global Warnings You Shouldn’t Ignore

Abstract:Looking for a 2025 TradersWay broker review? This article reveals its unregulated status, official warnings from Spain and Malaysia, and the real risks facing traders today.

TradersWay presents itself as a flexible forex and CFD broker offering high leverage and easy access. But behind the glossy website lies a darker reality: the broker is unlicensed, flagged by multiple regulators, and carries serious risk for anyone trading through it.

This 2025 review offers verified information, sourced directly from government agencies and public records, to help you make an informed decision.

Official Alert from Malaysias Securities Commission

On January 1, 2023, The Securities Commission Malaysia (SC) issued a formal warning against TradersWay, placing the broker on its Investor Alert List.

The SC stated that TradersWay is carrying on unlicensed capital market activities, including dealing in securities and investment instruments without legal approval.

This designation means the broker is considered unauthorized and poses a threat to investor safety in Malaysia.

Public Warning from Spain‘s CNMV

Spain’s financial regulator, the Comisión Nacional del Mercado de Valores (CNMV), also issued a public warningagainst TradersWay in December 2019.

The CNMV clearly stated that TradersWay is not authorized to offer investment services or forex transactions within Spanish jurisdiction. This includes advisory services, derivatives, and margin-based forex activities.

TradersWay has made no public attempt to resolve or clarify these warnings as of 2025.

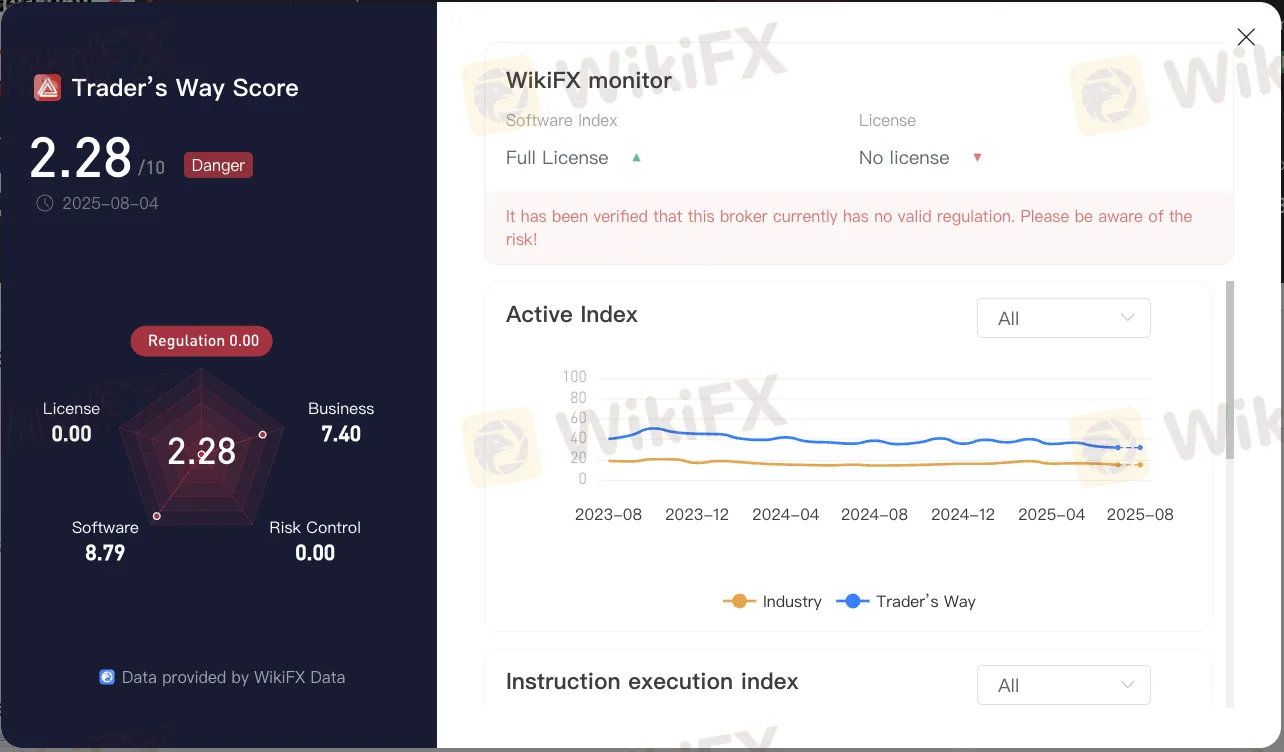

WikiFX Risk Report: 2.28 / 10 Rating

According to WikiFX (August 2025), TradersWays score is just 2.28 out of 10.

Breakdown highlights include:

- License: 0.00

- Regulation: 0.00

- Risk Control: 0.00

- Only Software & Business Indexes scored above average

This score reflects severe risk due to:

- No regulatory oversight

- No financial protection mechanisms

- No dispute arbitration channels

Traders trading with this broker do so entirely at their own risk.

Whats Missing: No License, No Oversight

TradersWay is not licensed by any top-tier authority. It is not listed by:

- FCA (UK)

- BaFin (Germany)

- CySEC (Cyprus)

- ASIC (Australia)

It also lacks registration with global platforms like the CFTC or NFA. In other words, it operates outside any recognized financial framework.

With no headquarters transparency, no complaints resolution channel, and no investor protection scheme, the risk of fund mismanagement or platform collapse is high.

Red Flags Summarized

- Multiple global warnings from financial regulators

- 0.00 regulatory score on WikiFX

- No verifiable license or jurisdiction disclosure

- Opaque operational entity (TW Corp.)

- High-leverage offerings with no risk control transparency

Conclusion

TradersWays unregulated status and repeated regulatory warnings make it a high-risk platform for any trader.

In 2025, where financial compliance and transparency are more important than ever, entrusting funds to an unlicensed offshore entity is a gamble with little upside and massive downside.

Before choosing a broker, verify its regulatory background—and prioritize safety over convenience.

FAQ

Q: Is TradersWay a regulated broker?

A: No. TradersWay has no valid financial license and is listed as unauthorized in multiple countries.

Q: Which regulators have warned about TradersWay?

A: The Securities Commission Malaysia and Spains CNMV have both issued public warnings against the broker.

Q: Can TradersWay legally offer forex services?

A: Without a license, it cannot legally operate in regulated markets. Users have no legal protection in case of disputes.

Q: What does WikiFX say about TradersWay?

A: It rates TradersWay at 2.28/10, with 0.00 in both regulatory and risk control indices.

Q: Are there safer alternatives?

A: Yes. Consider brokers licensed by FCA, BaFin, or CySEC. Use verification tools like WikiFX before opening an account.

Read more

AssetsFX Review – What Traders Are Saying & Red Flags to Watch

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

ROCK-WEST Complete Review: A Simple Guide to Its Trading Platforms, Costs, and Dangers

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

FX Movers: Yen Soars on Intervention Watch; CAD Tumbles on Trade Threats

Gold Pierces $5,000 Milestone; Pan African Resources Signals Cash Flow Surge

PRCBroker Review: Where Profitable Accounts Go to Die

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

USD Outlook: Markets Eye 'Politicized' Fed Risks as Tariff Impact Deepens

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

Rate Calc