BlackBull: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about BlackBull and its licenses.

BlackBull is a New Zealand-based broker offering financial services under multiple registrations.

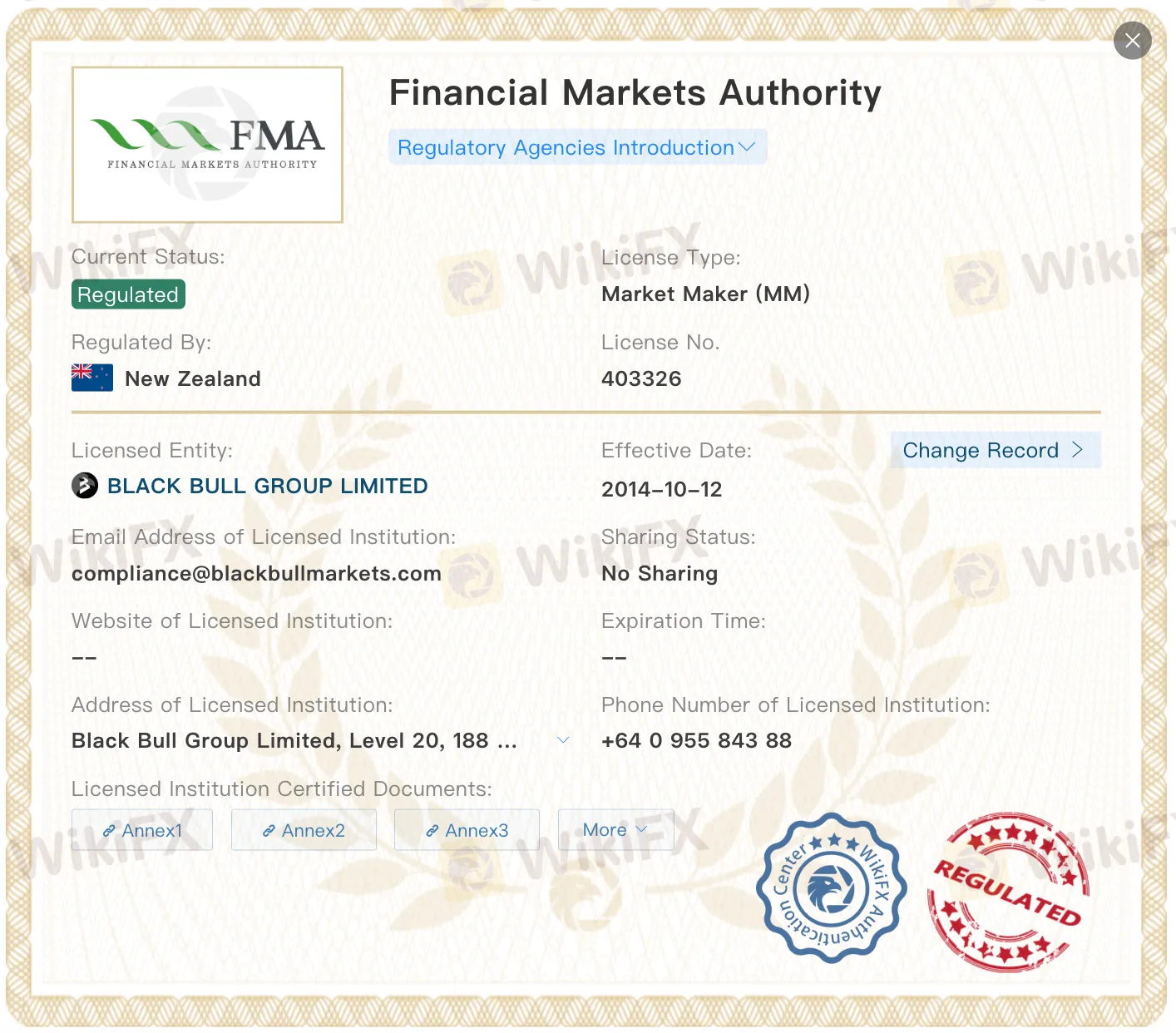

BlackBull is licensed by the Financial Markets Authority (FMA) in New Zealand under license number 403326. The FMA is New Zealand‘s official government agency overseeing financial markets, securities, and financial service providers. A license from the FMA generally signals a broker’s compliance with local regulatory standards, including client fund protection and transparent reporting.

In addition to its FMA license, BlackBull is also registered with the New Zealand Financial Service Providers Register (FSPR) under license number 1002113. The FSPR is a registry rather than a licensing authority. While it allows businesses to offer financial services, it does not supervise or regulate forex trading directly. Furthermore, WikiFX notes that BlackBulls activities may exceed the business scope covered by this registration. Traders should remain aware of this limitation when considering the level of oversight involved.

BlackBull also holds an offshore license from the Seychelles Financial Services Authority (FSA) under license number SD045. The FSA provides regulatory services for non-bank financial institutions but is generally considered to have less stringent supervision compared to onshore authorities. Offshore licenses can offer operational flexibility, but may also involve increased risks for retail traders due to limited investor protections.

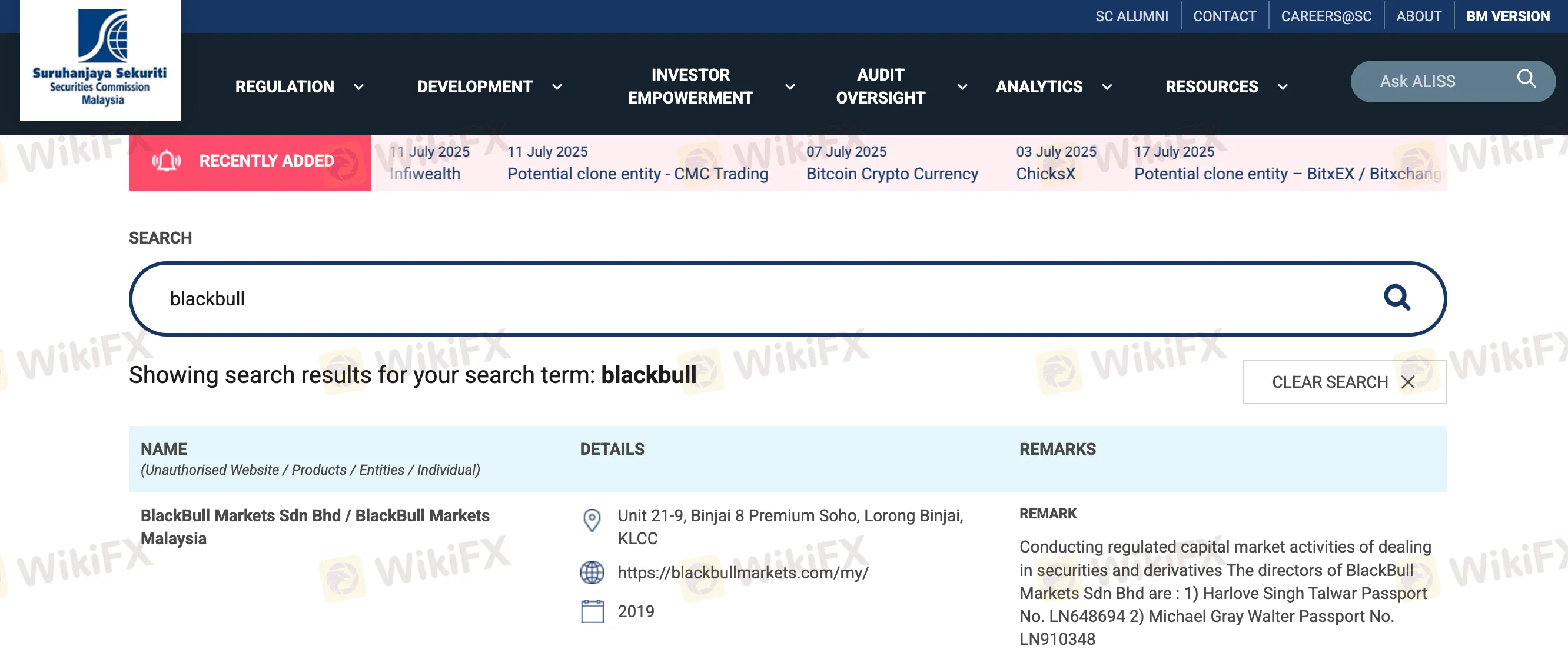

According to WikiFX, it has also been verified that BlackBull has been disclosed by The Securities Commission Malaysia, although specific details regarding this disclosure are not provided. Such listings typically occur when a broker is found operating in a region without appropriate local licensing.

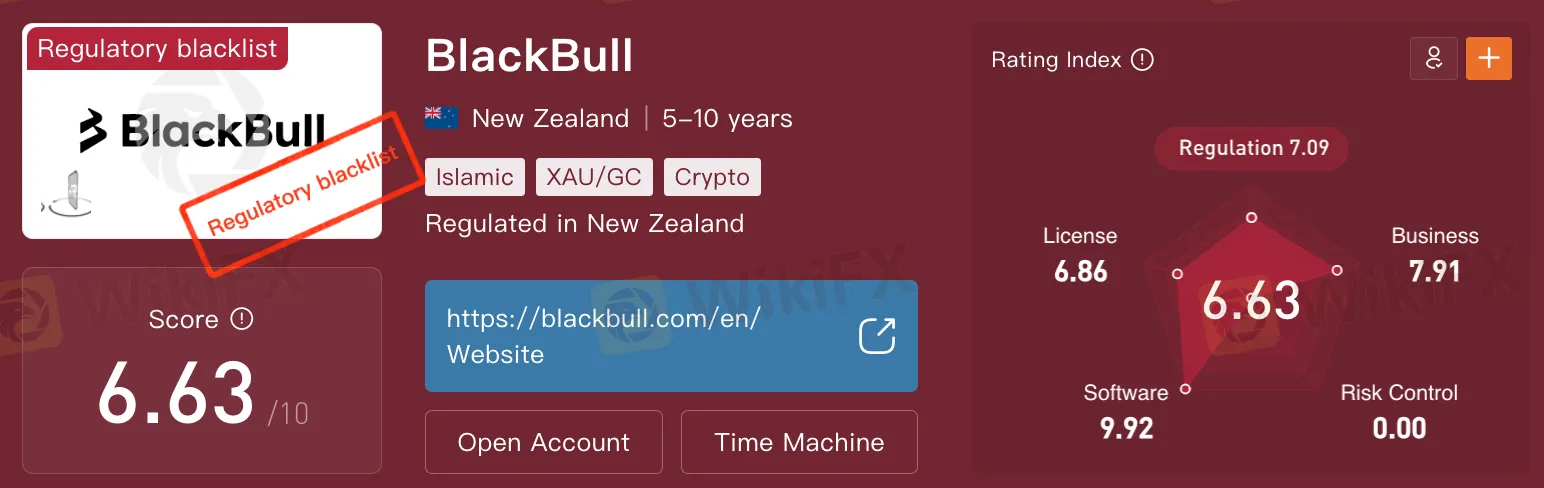

BlackBull has received a WikiScore of 6.63/10 on WikiFX. This rating reflects a mixture of strong and weak indicators. The presence of a valid FMA license supports regulatory confidence, but the use of offshore structures and exceeded business scope on the FSPR may warrant further scrutiny. WikiFX evaluates brokers based on regulatory status, operational transparency, trading environment, risk control, and customer feedback.

BlackBull offers financial services under multiple regulatory frameworks. While its FMA license adds credibility, the reliance on offshore licenses and the scope of activity beyond the FSPR listing raise important considerations for traders. Anyone considering opening an account with BlackBull is encouraged to fully understand the structure of its licensing and the nature of protections available. As always, thorough due diligence is a key step in selecting a reliable trading platform.

Read more

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

GMO-Z.com Review: Do Traders Face Unfair Tax Payment on Withdrawals?

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

Pocket Broker Review: Why Traders Should Avoid It

Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

WikiFX Broker

Latest News

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

Merin Review (2025): Is it Safe or a Scam?

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Rate Calc