Will Trump “TACO” Before the July 9 Deadline?

Abstract:TACO stands for “Trump Always Chickens Out”After officially signing the “Big Beautiful Bill” into law, Trump is now shifting his focus entirely to enforcing reciprocal tariffs. The U.S. has sent lette

TACO stands for “Trump Always Chickens Out”

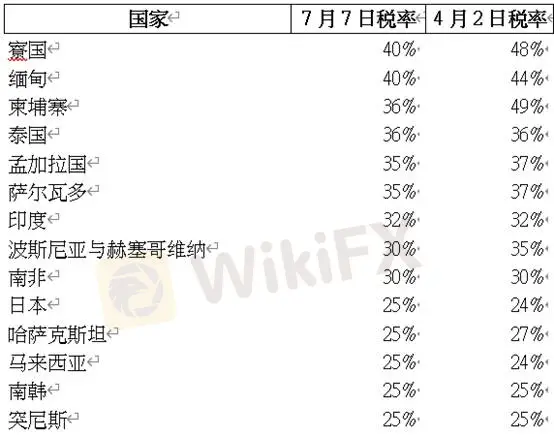

After officially signing the “Big Beautiful Bill” into law, Trump is now shifting his focus entirely to enforcing reciprocal tariffs. The U.S. has sent letters to 14 countries notifying them of new tariff rates set to take effect on August 1. This sudden move has once again triggered a short-term wave of panic in global markets.

Major U.S. Index Performance:

Philadelphia Semiconductor Index: -1.88%, closing at 5,541.20

S&P 500: -0.79%, closing at 6,229.98

Nasdaq Composite: -0.79%, closing at 22,685.57

Dow Jones Industrial Average: -0.94%, closing at 44,406.36

Risk Sentiment Indicators:

VIX (Fear Index): +1.77%, closing at 17.80

Gold: Rebounded from below $3,300/oz to above $3,340/oz

(Figure 1: S&P 500 Sector Heatmap; Source: FINVIZ)

Among the 14 countries receiving tariff letters, Japan has drawn the most market attention. While the initial tariff rate on April 2 was 24%, post-negotiation, it was raised to 25%—a surprising move. This suggests Trump is pushing even harder for reciprocal trade deals. Moreover, he indicated that nations overly friendly with BRICS countries could face an additional 10% tariff hike. If retaliatory measures are taken, the U.S. could double tariffs from their July 7 baseline rates.

(Figure 2: Trump's Tariff Letter Dispatch; Source: Internal Compilation)

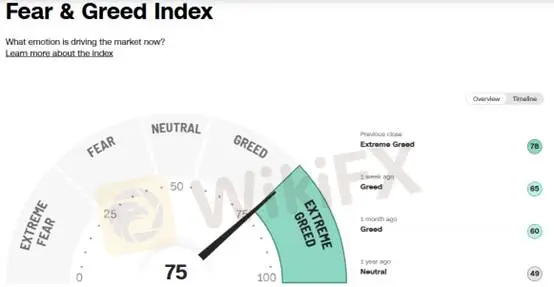

Amid record highs for risk assets this month, the Fear & Greed Index had climbed to an “extreme greed” level. However, due to recent Trump-related developments, the index has cooled slightly from 78 to 75.

(Figure 3: Fear & Greed Index; Source: CNN)

The market remains volatile and unpredictable. From our perspective, while the situation is uncomfortable, patience is still warranted. With the start of Q3 seeing fresh record highs, it's crucial to note that U.S. equity valuations are now at their most expensive in over a decade. Investors must focus on waiting for a correction in the P/E ratio—a key investment theme for the rest of the year.

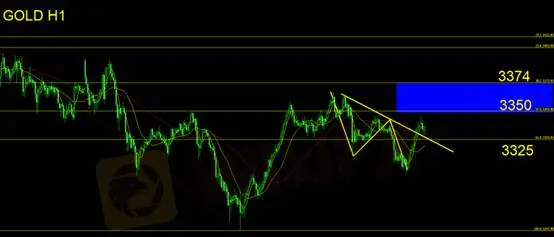

Weve shifted from a bearish to a neutral stance on gold. Ongoing global trade tensions have injected uncertainty, causing gold prices to lose short-term direction. With inconsistent trends, intraday traders are advised to stay on the sidelines and wait for clearer signals before making any moves.

Technical Analysis: Gold (XAU/USD)

On the hourly chart, gold has shown a two-stage decline. After breaking below $3,300/oz, it reversed upward, now showing a choppy and directionless pattern. The bearish strategy planned yesterday now requires revision. Gold is likely to consolidate between $3,325 and $3,374 this week. Overtrading should be avoided—investors are better off taking a cautious “wait-and-see” approach until a clearer trend emerges.

Support: $3,325

Resistance: $3,350 / $3,374

Risk Disclaimer: The above views, analyses, studies, prices, or other information are provided for general market commentary only. They do not represent the stance of this platform. All viewers should assess risks independently. Please trade with caution.

WikiFX Broker

Latest News

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Rate Calc