Market Hub

Abstract:Market Hub is an Indian financial services company founded in 2010 that offers a wide range of services, including professional advisory, portfolio management, and specialized financial solutions, as well as trading products such as stocks, futures and options, commodities, currencies, and mutual funds. The company offers a free Demat account and there is no minimum deposit requirement. However, Market Hub lacks regulation from regulators, which may be a cause for concern among traders. Although the company offers a variety of tools and services, such as algorithmic trading and margin trading, there is a lack of information transparency on its fee structure and account features.

| Market HubReview Summary | |

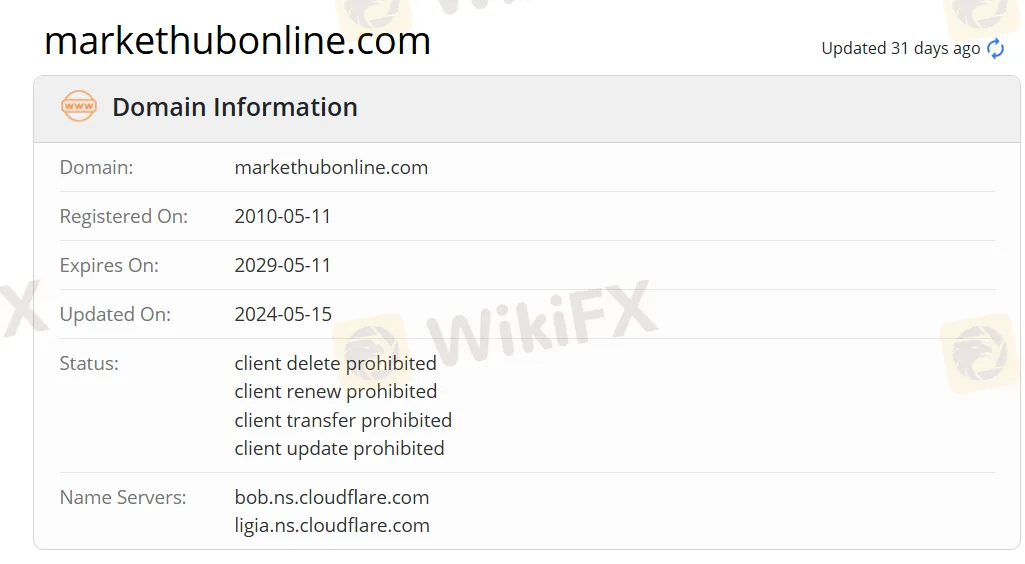

| Founded | 2010 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Market Instruments | Equities, Futures & Options, Commodities, Currencies, and Mutual Funds |

| Services | Professional consulting, portfolio management, and specialized financial services |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Market Hub APP |

| Minimum Deposit | $0 |

| Customer Support | Email: info@markethubonline.com |

| Tel: +91-9016130983 | |

| Tel: 0261-4060750/2462790 | |

| Fax: No.0261-2462791 | |

| Address: B-230-231, International Trade Center (ITC), Majura gate Crossing, Ring Road, Surat 395002, Gujarat, India | |

Market Hub Information

Market Hub is an Indian financial services company founded in 2010 that offers a wide range of services, including professional advisory, portfolio management, and specialized financial solutions, as well as trading products such as stocks, futures and options, commodities, currencies, and mutual funds. The company offers a free Demat account and there is no minimum deposit requirement. However, Market Hub lacks regulation from regulators, which may be a cause for concern among traders. Although the company offers a variety of tools and services, such as algorithmic trading and margin trading, there is a lack of information transparency on its fee structure and account features.

Pros & Cons

| Pros | Cons |

| No minimum deposit | Limited info on account features |

| Various trading instruments | Unclear fee structure |

| A variety of services | No regulation |

| No info on deposit and withdrawal |

Is Market Hub Legit?

Although Market Hub claims to be compliant. However, it is not regulated, and traders need to be cautious when trading.

What Can I Trade on Market Hub?

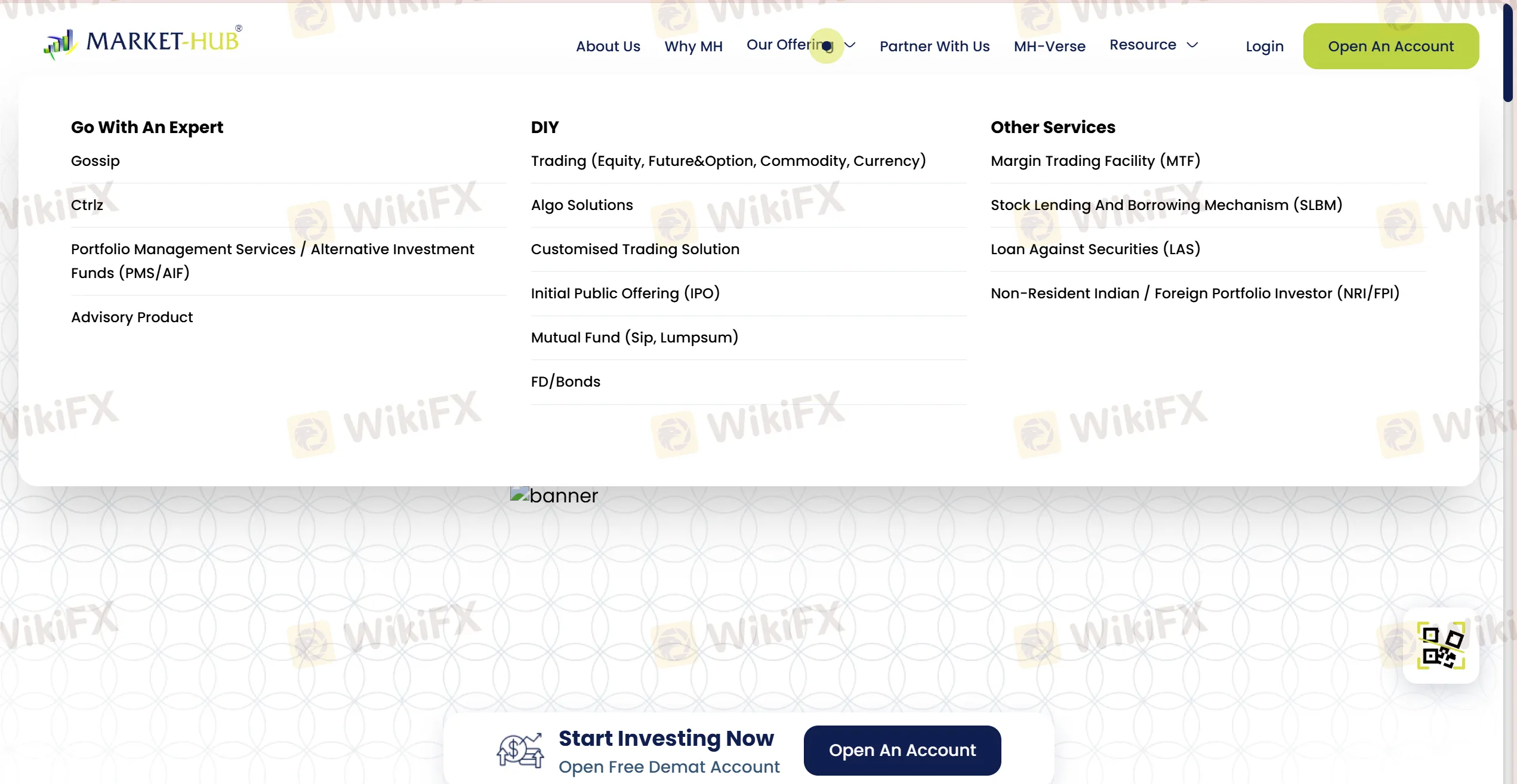

Market Hub offers three types of services and products, namely, 'Go with an Expert,' 'DIY,' and 'Other Services.' The main tradable products include Equities, Futures & Options, Commodities, Currencies, and Mutual Funds.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Options | ✔ |

| Equities | ✔ |

| Futures | ✔ |

| Mutual Funds | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

Services

The primary services provided are professional consulting services, portfolio management services, and specialized financial services.

| Category | Services/Products | Available |

| Go With An Expert | Gossip | ✔ |

| Ctrlz | ✔ | |

| Portfolio Management Services / Alternative Investment Funds (PMS/AIF) | ✔ | |

| Advisory Product | ✔ | |

| DIY | Trading | Equities, Futures & Options, Commodities, Currencies |

| Algo Solutions | ✔ | |

| Customised Trading Solution | ✔ | |

| Initial Public Offering (IPO) | ✔ | |

| Mutual Fund | SIP, Lumpsum | |

| FD/Bonds | ✔ | |

| Other Services | Margin Trading Facility (MTF) | ✔ |

| Stock Lending And Borrowing Mechanism (SLBM) | ✔ | |

| Loan Against Securities (LAS) | ✔ | |

| Non-Resident Indian / Foreign Portfolio Investor (NRI/FPI) | ✔ |

Account Types

Market Hub offers a Free Demat Account for users to start investing.

Fees

Minimum Deposit: The Market Hub account opening does not incur any fees, and the minimum deposit is zero.

Margin: The cash market sector is required to pay an upfront margin of 20% of the value of the transaction.

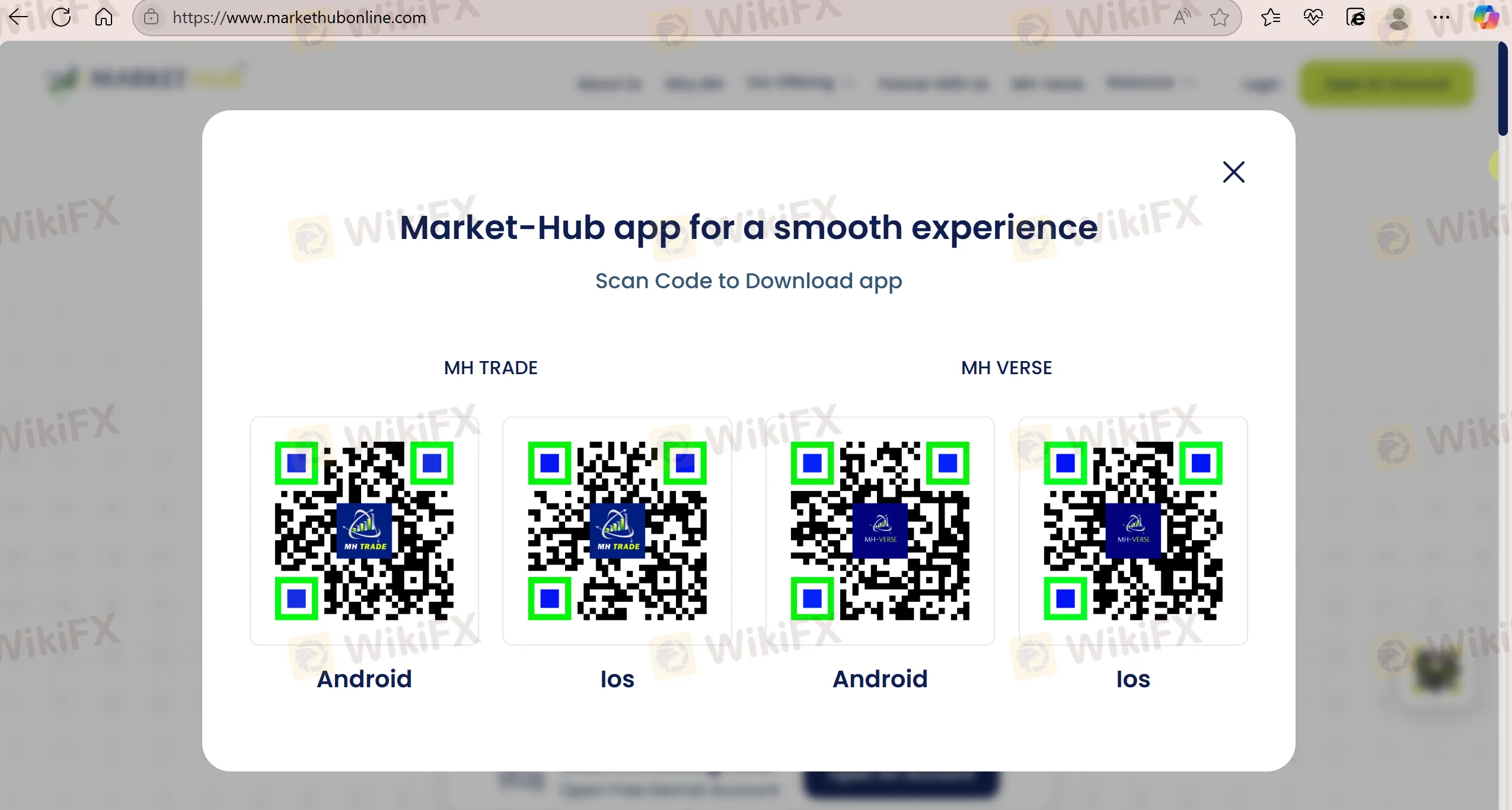

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Market Hub APP | ✔ | Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

WikiFX Broker

Latest News

Real Cases, Brave Voices: Turning Dealer Experiences into Rewards - and a Smarter Trading Community

Interactive Brokers Launches Connections for Cross-Asset Trading Insights

Hero FX Exposed: Withdrawal Denials, Trade Freezes & Scam Claims

Alert: FXClearing and Tech-RMS Took $500 in Forex Scam

SCAM ALERT! Swiss Watchdog FINMA Issues Fresh Warning on Suspicious Brokers

Is A Second Wave Of Inflation Coming?

Deepfake Scams Target Kiwi Investors on Facebook, WhatsApp

SEC Sues Carole Liston, Stock Purse Trading for $5.7M Fraud

The ‘Godfather of Japanese Stocks’ Scam Exposed Within Japan’s Chinese Community

Sony raises PlayStation 5 prices in US as tariff fears persist

Rate Calc