Royal Forex’s CySEC License Revoked: Can It Still Operate Legally?

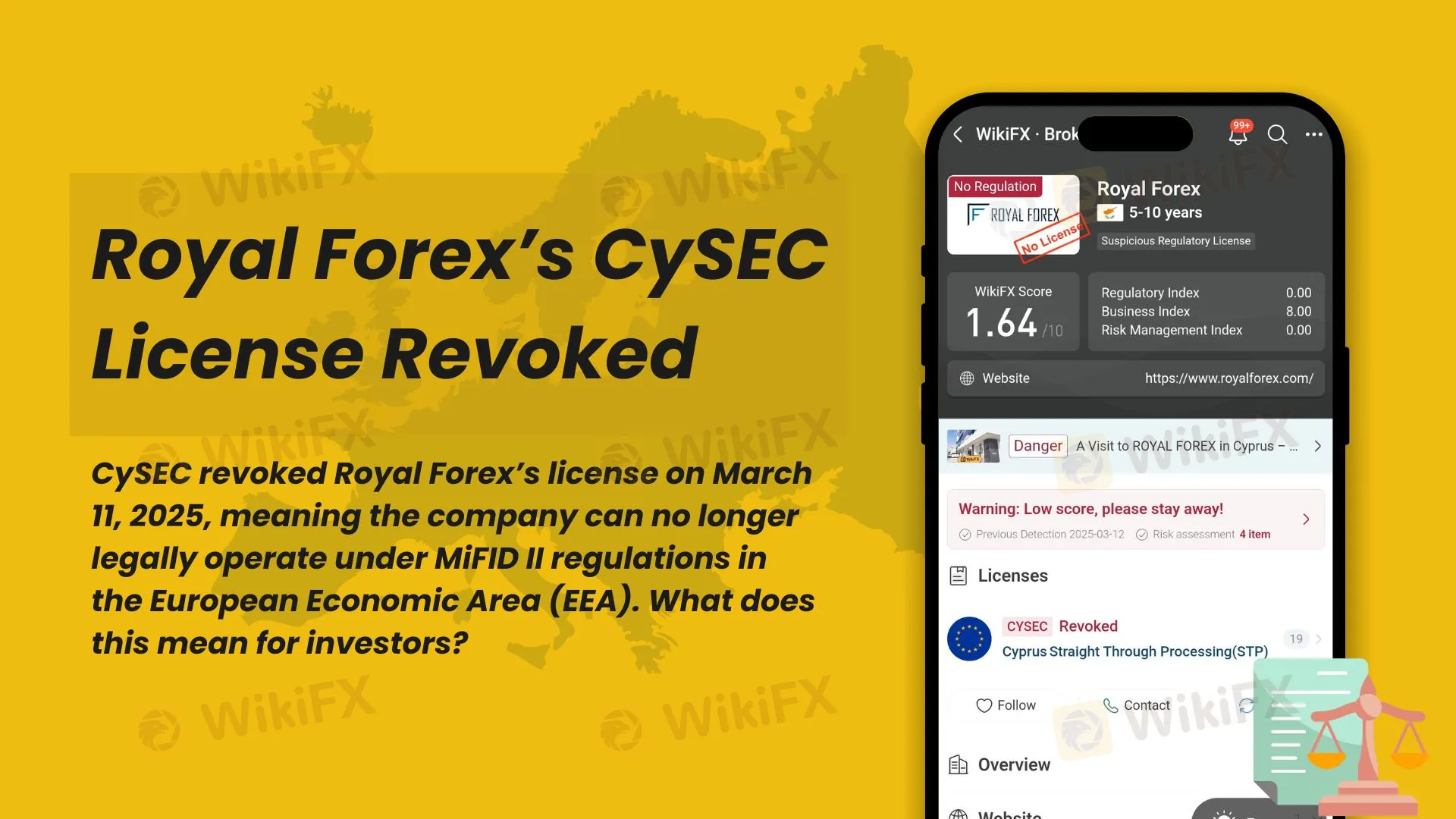

Abstract:CySEC revoked Royal Forex’s license on March 11, 2025, meaning the company can no longer legally operate under MiFID II regulations in the European Economic Area (EEA).

What Does CySECs License Revocation Mean for Royal Forex?

On March 11, 2025, the Cyprus Securities and Exchange Commission (CySEC) officially announced the revocation of Royal Forex Ltds Cyprus Investment Firm (CIF) license. The decision was made on February 24, 2025, under Section 8(1)(a) of the Investment Services and Activities and Regulated Markets Law of 2017 and Directive DI87-05, as Royal Forex voluntarily renounced its license.

While the withdrawal was voluntary, it means Royal Forex is no longer regulated under CySEC and cannot legally operate in the European Economic Area (EEA) under MiFID II regulations.

Background of Royal Forex: A Former Regulated Forex Broker

According to WikiFX, Royal Forex Ltd was a CySEC-regulated forex and CFD broker. It operated under CIF license number 269/15, issued on March 18, 2015, allowing it to provide Straight Through Processing (STP) services. The company was authorized to operate in 18 countries, including Austria, Belgium, Croatia, Denmark, Estonia, France, and Germany.

Where Cant Royal Forex Legally Operate After Losing CySEC Regulation

After losing CySEC regulation, Royal Forex will no longer be able to provide investment services in markets regulated under MiFID II, including EU countries, the European Economic Area (EEA), and major financial markets such as the United Kingdom. In these regions, only companies holding a compliant regulatory license can legally offer forex and contract for difference (CFD) trading services.

In the EU, MiFID II requires financial service providers to obtain regulatory approval from member states and comply with strict investor protection measures. With the loss of its CySEC license, Royal Forex can no longer operate under this framework, meaning investors will no longer have the protection of the EU legal system for their funds.

Following the loss of CySEC regulation, one of the biggest concerns for investors is the security of their funds. Under CySEC regulation, brokers were required to follow strict financial protection measures, including participation in the Investor Compensation Fund (ICF) and maintaining segregated client accounts.

With CySEC revoking its license, Royal Forex is no longer bound by these regulatory requirements, and investors may face the following risks:

• Lack of transparency in fund storage. Without regulatory oversight, the company may no longer be required to strictly segregate client funds from its operational funds, increasing the risk of fund mismanagement or misuse.

• No protection from the Investor Compensation Fund (ICF). Under CySEC regulation, investors were eligible for compensation of up to €20,000 in case of company insolvency. Without this safeguard, investors may not receive any reimbursement if the company faces financial difficulties.

• Limited legal protection. Under strong regulatory frameworks, investors could file complaints with regulators or seek legal recourse. Without CySEC oversight, legal remedies for financial disputes involving Royal Forex will be significantly reduced.

• Difficulty in tracking company operations. While regulated by CySEC, Royal Forex was required to submit regular financial reports to ensure compliance. Without regulatory supervision, the company may no longer disclose financial data, making it difficult for investors to assess its financial health.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc