Oil Jumps Ahead of OPEC Meeting

Abstract:The U.S. dollar traded sideways ahead of the ADP Nonfarm Employment change data. The French political issue is easing and shall provide buoyancy for the euro. Oil jumped in the last session ahead of t

The U.S. dollar traded sideways ahead of the ADP Nonfarm Employment change data.

The French political issue is easing and shall provide buoyancy for the euro.

Oil jumped in the last session ahead of the OPEC+ meeting with the speculation of an extension for oil production cut.

Market Summary

The U.S. dollar held steady in the last session, with the dollar index (DXY) hovering near the 106.45 resistance level. The JOLTs job openings data exceeded market expectations at 7.744 million, yet investors adopted a cautious stance ahead of Friday's critical Nonfarm Payrolls (NFP) report.

Meanwhile, the euro recorded modest gains as political uncertainty in France eased, with market sentiment suggesting the crisis is nearing resolution. In contrast, the Australian dollar faced significant pressure during the Sydney session after disappointing GDP figures raised speculation of an accelerated monetary policy shift by the Reserve Bank of Australia (RBA).

In the commodity market, gold traded sideways, constrained by a lack of clear catalysts. However, oil prices surged sharply as markets anticipated the December 5 OPEC+ meeting. The world's largest oil cartel is expected to extend supply cuts into the first quarter of 2024, a move likely to bolster crude prices further.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (40.4%) VS -25 bps (59.6%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index remained flat but saw a slight rebound following the release of the US jobs report. Data from the Department of Labor revealed that JOLTs Job Openings rose significantly to 7.744M, surpassing market expectations of 7.510M and the previous reading of 7.372M. This stronger-than-expected data highlights resilience in the US labor market, just days before the November Nonfarm Payrolls report on Friday.

The Dollar Index is trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 51, suggesting the index might experience technical correction since the RSI retraced from overbought territory.

Resistance level: 106.85, 108.05

Support level: 105.80, 104.45

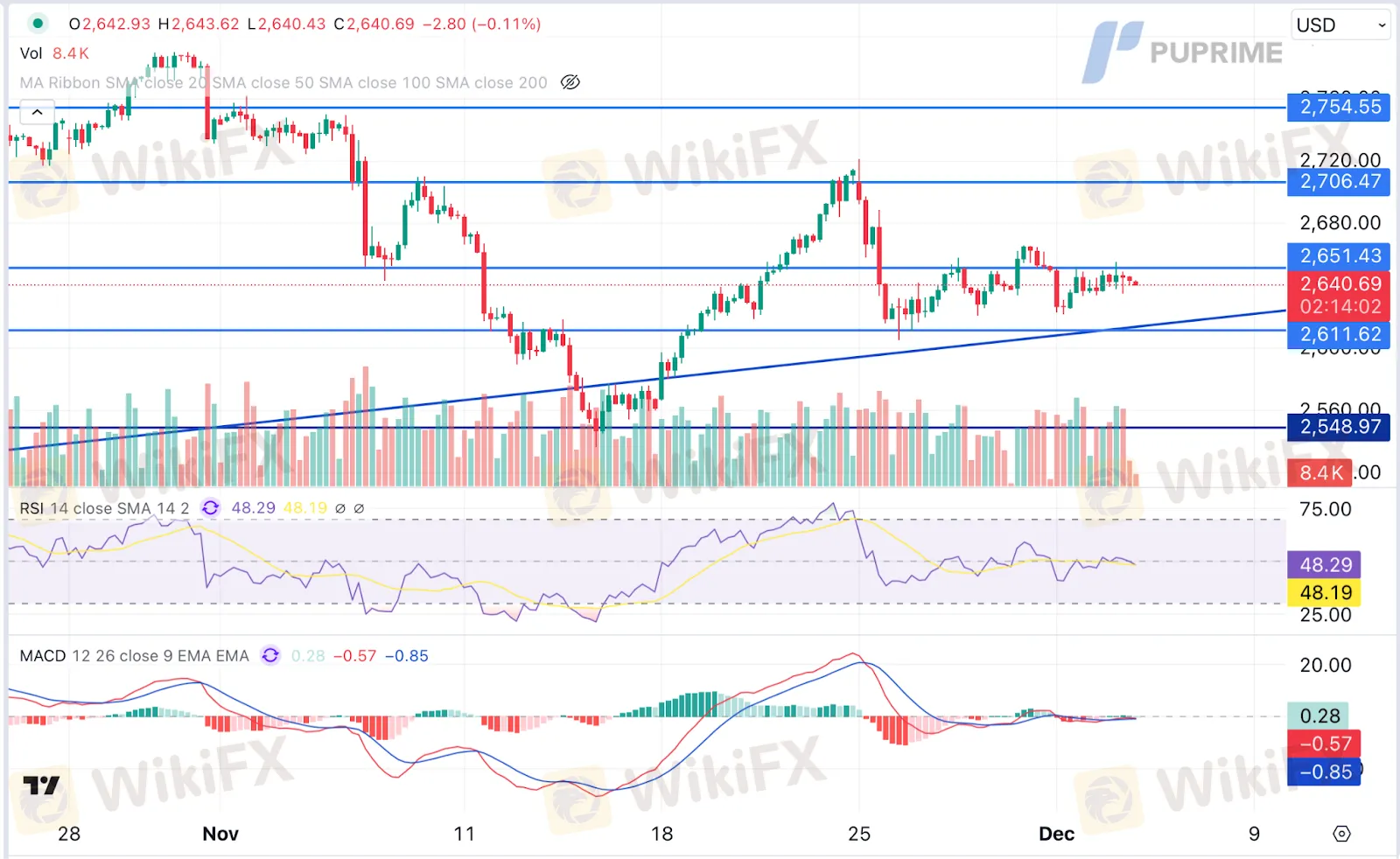

XAU/USD, H4

Gold prices remained flat, consolidating within a narrow range as investors maintained a cautious outlook amid mixed market sentiment. Renewed tensions in the Middle East, particularly Israel's ongoing strikes against Hezbollah despite the ceasefire agreement, have fueled safe-haven demand for gold. However, this bullish momentum was capped by the stronger-than-expected US job openings data, which bolstered the dollar and curbed gold's appeal.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the commodity might edge lower since the RSI stays below the midline.

Resistance level: 2650.00, 2705.00

Support level: 2610.00, 2550.00

GBP/USD,H4

The GBP/USD pair is trading near its next resistance level, exhibiting lower volatility in recent sessions. Both the Pound Sterling and the U.S. dollar lack clear catalysts, leaving the pair directionless for the time being. However, attention will shift to the upcoming U.S. ADP Nonfarm Employment Change data due later today. This report is expected to offer insights into the strength of the U.S. labour market and could provide a directional cue for the dollar, with potential implications for the pairs movement. Traders should remain vigilant for any significant surprises in the data.

The GBP/USD was trading sideways lately, giving the pair a neutral signal. However, the RSI is easing toward the 50 level while the MACD is heading below the zero line, suggesting that the bullish momentum is diminishing.

Resistance level:1.2700, 1.2790

Support level: 1.2620, 1.2505

CL OIL, H4

Crude oil prices rebounded amid renewed Middle East tensions, despite an announced ceasefire deal. Israel threatened to attack Lebanon if the truce with Hezbollah collapses. Strikes against alleged Hezbollah fighters continued, raising fears of further escalation. Meanwhile, top Lebanese officials called on the US and France to urge Israel to uphold the ceasefire. Additional support for oil prices comes from the anticipation that OPEC+ will extend supply cuts at its meeting on Thursday.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 71.30, 72.55

Support level: 69.60, 68.00

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc