PGFX

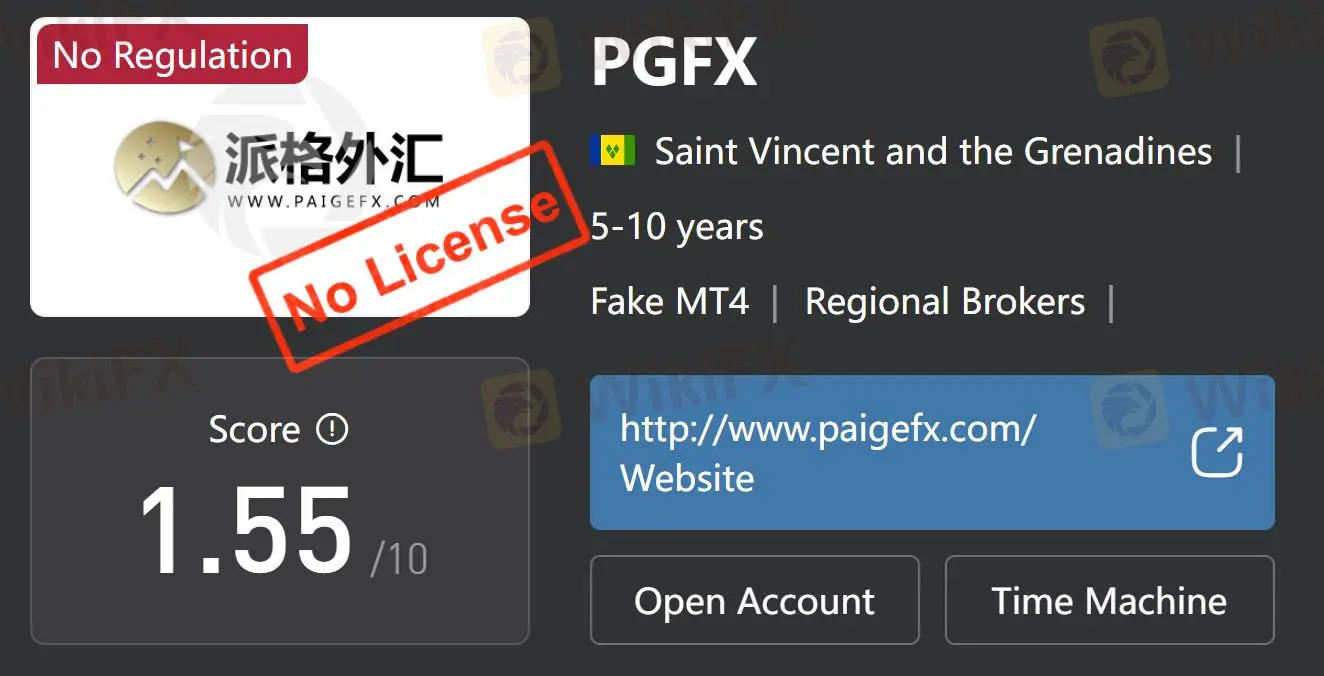

Abstract:Founded in 1999 and headquartered in Saint Vincent and the Grenadines, PGFX is an unregistered financial services business. Though it has a lengthy history, traders may be at danger due to insufficient control of regulations. By email atcs@paigefx.com, the company provides direct means of client inquiries and assistance.

Note:PGFX's official website:https://PGFX.io/is currently inaccessible normally.

| Aspect | Information |

| Company Name | PGFX |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 1999 |

| Regulation | Unregulated |

| Customer Support | Email: cs@paigefx.com |

PGFX Information

Founded in 1999 and headquartered in Saint Vincent and the Grenadines, PGFX is an unregistered financial services business. Though it has a lengthy history, traders may be at danger due to insufficient control of regulations. By email atcs@paigefx.com, the company provides direct means of client inquiries and assistance.

Is PGFX Legit or a Scam?

No financial law controls PGFX. Unregulated companies, traders lack fund security and financial guidelines, which could endanger them. Before dealing with PGFX, prospective traders should give these factors some thought.

Downsides of PGFX

PGFX lacks current regulatory information but is registered in Saint Vincent and the Grenadines, hence it runs without any control. Without control, traders run more danger, including less defense against market manipulation and fraud.

PGFX has been found to be using counterfeit versions of the well-known MetaTrader 4 trading tool. This begs major questions regarding the integrity and dependability of the trading environment, therefore maybe resulting in problems including manipulative trades or erroneous pricing.

PGFX has not included thorough corporate data including a physical location, phone numbers, or management information. This lack of openness could make it challenging for traders to confirm the validity of the company and might hinder the resolution of problems or conflicts.

Conclusion

Using fake MetaTrader 4 software and lacking corporate openness, PGFX, an unregistered broker in Saint Vincent and the Grenadines, Without control, traders run a danger of market manipulation and fraud. These problems should make traders pick dependable, open, and regulated brokers.

Read more

Checking if Vida Markets is Real and Safe

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.

Vida Markets Regulatory Status

Picking a broker is one of the most important choices a trader can make. Beyond costs and trading platforms, the main protection for a trader's capital is the broker's regulatory status. A careful check of licenses, company registrations, and compliance history is not just smart; it is necessary. When it comes to Vida Markets, our review of public information shows major regulatory warning signs and a high-risk profile that should make any potential investor very careful. The main question of whether Vida Markets is a safe and regulated company is complicated, with an answer that points strongly toward a negative result. The broker's business structure is a mix of offshore registration, a license being used beyond its legal limits, and a recently canceled license from another country. This is made worse by an extremely low WikiFX score of 2.16 out of 10, a number that serves as an immediate and clear warning. Also, many serious user complaints create a worrying picture of the real tra

Vida Markets Review: Serious Warning Signs and Customer Problems Revealed

This 2026 Vida Markets review gives you a complete, fact-based look at this broker to answer one important question: Is this broker safe for traders? We looked at public information, government records, and many user reports to give you a clear and fair assessment. The most important finding is that this broker has an extremely low trust score of 2.16 out of 10 from WikiFX, a global financial regulation inquiry app. This score comes with a clear warning: "Low score, please stay away!" This poor rating isn't random - it emerges from serious problems with regulations, including a canceled license, and many customer complaints. These complaints claim serious wrongdoing related to keeping funds safe, canceling profits, and unfair trading practices. This review will break down these warning signs in detail, giving you the information you need to make a smart decision about your capital's safety.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

South Africa's Reform Agenda Gains Traction, Business Sentiment Improves

4T Review 2026: Is this Forex Broker Legit or a Scam?

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

Rate Calc