Vida Markets Review: Serious Warning Signs and Customer Problems Revealed

Abstract:This 2026 Vida Markets review gives you a complete, fact-based look at this broker to answer one important question: Is this broker safe for traders? We looked at public information, government records, and many user reports to give you a clear and fair assessment. The most important finding is that this broker has an extremely low trust score of 2.16 out of 10 from WikiFX, a global financial regulation inquiry app. This score comes with a clear warning: "Low score, please stay away!" This poor rating isn't random - it emerges from serious problems with regulations, including a canceled license, and many customer complaints. These complaints claim serious wrongdoing related to keeping funds safe, canceling profits, and unfair trading practices. This review will break down these warning signs in detail, giving you the information you need to make a smart decision about your capital's safety.

Taking a First Look

This 2026 Vida Markets review gives you a complete, fact-based look at this broker to answer one important question: Is this broker safe for traders? We looked at public information, government records, and many user reports to give you a clear and fair assessment. The most important finding is that this broker has an extremely low trust score of 2.16 out of 10 from WikiFX, a global financial regulation inquiry app. This score comes with a clear warning: “Low score, please stay away!” This poor rating isn't random - it emerges from serious problems with regulations, including a canceled license, and many customer complaints. These complaints claim serious wrongdoing related to keeping funds safe, canceling profits, and unfair trading practices. This review will break down these warning signs in detail, giving you the information you need to make a smart decision about your capital's safety.

What They Promise vs What's Real

To give you a clear picture, we made a table that compares what Vida Markets advertises with what actually happens based on records and regulations. This side-by-side comparison clearly shows the big risks hiding behind their marketing promises.

| Pros (Advertised Features & Associated Risks) | Cons (Documented Red Flags) |

| Multiple Trading Instruments (Forex, Crypto, Stocks, Commodities, Indices, etc.) | Severe Regulatory Warnings: License revoked by VFSC and “Exceeded” status from FSCA. |

| High Maximum Leverage (Up to 1:1000, which carries *extremely high risk* of rapid losses) | High Potential Risk Warning: Officially flagged by regulatory data platforms. |

| Multiple Platform Options (MT4, MT5) | Over 10 Verified User Complaints: Allegations of profit cancellation, price manipulation, and withdrawal issues. |

| RAW and STP Account Types (With advertised low spreads) | No Physical Office Found: An on-site visit in South Africa found no company presence, raising transparency concerns. |

| Swap-Free Account Option (Available for specific regions) | Offshore Registration: Registered in Anguilla, offering minimal client fund protection. |

| White Label Platforms: Uses non-proprietary MT4/MT5 licenses, which can indicate a less established operation. |

Concerning Government Approval Status

A broker's approval from government agencies is the foundation of whether you can trust it. For Vida Markets, this foundation is broken and unreliable. Looking closely at its history with government agencies shows multiple serious violations and a setup that gives little to no protection for traders' capital. This isn't about small rule-breaking but major failures that should worry any potential investor.

Canceled and Exceeded Licenses

The most serious warning signs come from this broker's problems with two different government agencies.

First, its license with South Africa's Financial Sector Conduct Authority (FSCA) is marked with an “Exceeded” status. The licensed company, VIDA GLOBAL MARKETS (PTY) LTD, holds license number 42734 for a Derivatives Trading License (EP). The “Exceeded” status means the broker is doing more than what their license allows. This is a serious rule violation that shows they don't respect legal boundaries and might be offering services they're not legally allowed to provide.

Even more alarming is the broker's history with the Vanuatu Financial Services Commission (VFSC). On August 30, 2023, the VFSC issued a “Notice of Revocation of the Financial Dealers License” for Vida Markets. Having a license revoked is one of the most serious punishments a government agency can give. It means it completely lost approval from that area, often because of major violations of financial laws or operating standards.

Offshore Registration Dangers

Vida Markets is registered in Anguilla, an offshore location known for loose financial oversight and minimal rules. Unlike top-level areas such as the UK (FCA), Australia (ASIC), or Cyprus (CySEC), offshore zones such as Anguilla typically offer very weak, if any, client fund protection programs. This means that if the broker goes out of business, commits fraud, or engages in other financial wrongdoing, traders have virtually no legal way to get their deposited funds back. Choosing offshore registration is a deliberate strategy that puts the broker's operational ease over their clients' financial security.

No Verifiable Office

Being open and honest is key to becoming a legitimate financial services company. A verifiable physical address provides some accountability. However, an on-site investigation conducted by WikiFX investigators in South Africa to find the broker's listed office reached a clear conclusion: “A Visit to Vida Markets in South Africa - No Office Found.” Not being able to verify a physical presence for a company that handles client funds is a major warning sign. It raises serious questions about the broker's legitimacy, honesty and accountability, suggesting it may be little more than a virtual company with no real operational base.

These regulatory warning signs aren't just small details; they're critical risk indicators. Before considering any broker, it is essential to verify its current regulatory status on a trusted platform. You can check any broker's license and history on WikiFX to avoid such dangers.

A Pattern of Complaints

The serious regulatory problems surrounding Vida Markets appear to directly connect with many alarming user complaints. These aren't isolated incidents but form a disturbing pattern of alleged wrongdoing that shows the real-world consequences of trading with a high-risk company. By organizing these complaints, we can see a systematic approach to practices that harm traders.

Profit Cancellation Claims

One of the most serious claims against a broker is the arbitrary cancellation of legitimate profits. A verified complaint from a trader in India details a particularly bad case. The user deposited $2,500 and, through trading, made a profit of over $3,200. Then, the broker performed a “Cash adjustment pnl” of -$3,226.69, effectively wiping out the entire profit without any clear explanation. The user stated, “the money is just stolen from me.” This action, where earned profits are unilaterally removed from an account, points towards potential fund theft and a complete disregard for fair trading practices.

Price Manipulation Suspicions

Multiple reports from traders suggest a pattern of manipulative tactics designed to trigger losses. These include:

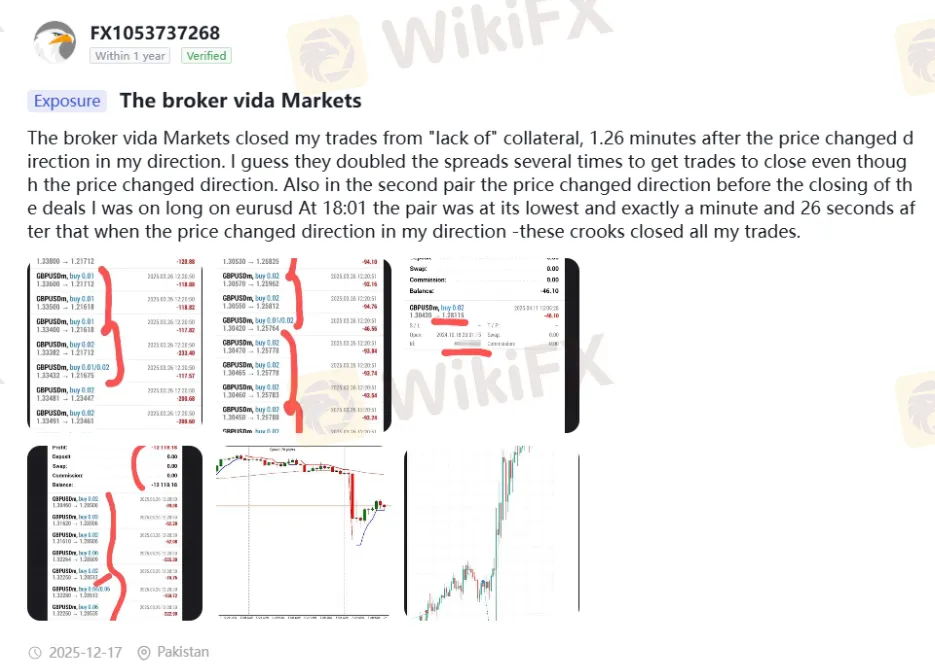

· Unfair Closures: One trader reported that their trades were closed due to a “lack of collateral” just 1.26 minutes after the price had moved in their favor. The user suspected that the broker artificially widened the spreads to trigger a margin call and close the positions, effectively preventing them from profiting from the favorable market move.

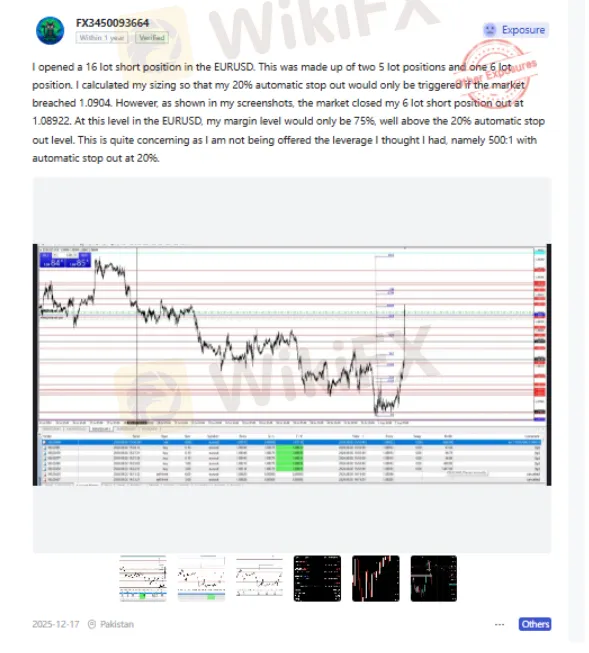

· Incorrect Stop-Outs: Another trader detailed how their short position in EUR/USD was stopped out too early. They had calculated that their 20% automatic stop-out level would only be triggered if the market reached 1.0904. However, the position was closed at 1.08922, a level where their margin should have been around 75%. This indicates that the broker was not honoring the agreed-upon leverage or margin rules, leading to an unjustified loss.

Execution at Fake Prices: A user reported that their EUR/USD positions were stopped out and executed at a price of 1.15553. After checking multiple independent market data sources, the trader confirmed that this price was never reached in the actual market. When questioned, the broker blamed “insufficient liquidity.” However, executing trades at prices that don't exist in the real market is a hallmark of a manipulative platform.

Widespread Access Problems

Beyond trade execution, numerous users have reported fundamental problems with account access and fund management.

· Blocked Accounts: One user's account, containing a significant investment, was blocked for over a year. The broker cited “suspected fraud” without providing any evidence and refused to return the funds, using vague terms in the client agreement to justify their actions.

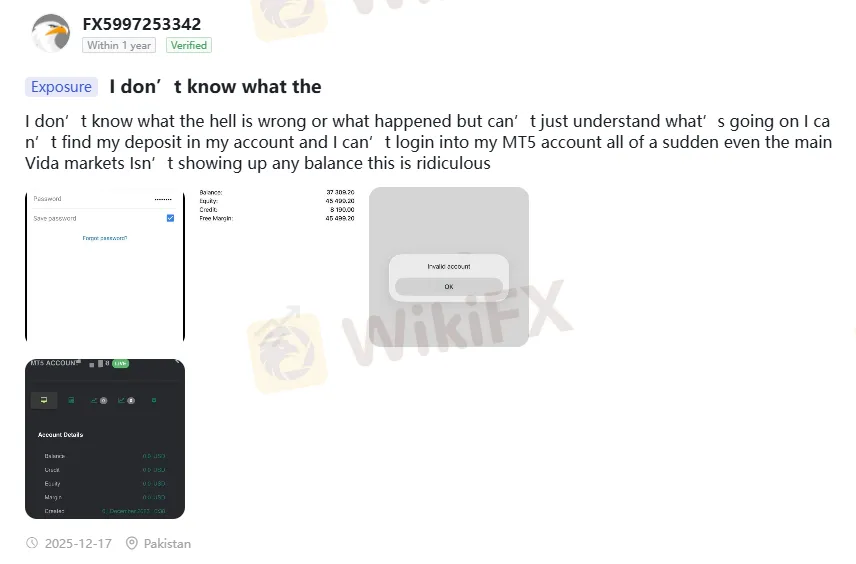

Login & Server Problems: Several traders have complained about suddenly being unable to log into their MT4 or MT5 accounts. The broker often blames prolonged “server maintenance,” leaving clients unable to manage their open positions or access their funds.

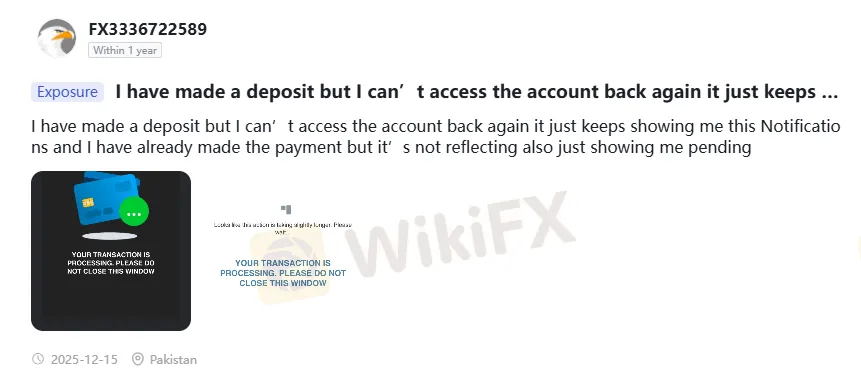

Deposits Not Showing Up: A recurring issue involves deposits that remain in a “pending” status for days, never appearing in the user's trading account. This leaves traders uncertain, with their funds stuck and no ability to trade or withdraw it.

These firsthand accounts highlight a disturbing pattern. Reading verified user reviews is a critical step in any broker evaluation. Platforms, such as WikiFX, consolidate these exposure reports, giving you a clear view of other traders' experiences before you commit your own capital.

A Closer Look at What It Offers

While a broker's trading conditions, such as account types and platforms, are important, they must be analyzed considering its regulatory status and user feedback. Attractive features can easily become tools for exploitation when offered by an untrustworthy company. Here, we examine the Vida Markets pros and cons with the previously established risks in mind.

Account Types Analyzed

Vida Markets promotes two primary account types, STP and RAW, with different spread and commission structures.

| Account Feature | STP Account | RAW Account |

| Advertised Spread | From 1.2 pips | From 0.1 pips |

| Commission | $0 | From $5/€5/£5 per lot |

| Maximum Leverage | 1:1000 | 1:1000 |

While the RAW account's advertised spread from 0.1 pips may seem appealing, traders should be extremely cautious. The numerous and detailed complaints regarding artificial spread widening, unfair stop-outs and execution at non-market prices strongly suggest that these ideal conditions may not be honored in a live trading environment. The advertised low spreads become irrelevant if the broker manipulates prices to the trader's detriment.

“White Label” Platforms

Vida Markets offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. However, regulatory data from WikiFX identifies these as “White Label” versions. This is a crucial distinction. A white label broker does not hold a full license from MetaQuotes, the developer of MT4/MT5. Instead, it leases the platform technology from another company that holds the main license. This often signifies a lower level of operational investment, less control over the trading server infrastructure, and a less established business model compared to brokers who invest in a full, proprietary license. This setup can make it easier for unscrupulous operators to set up and run a brokerage with minimal overhead.

The Leverage Risk

The broker advertises extremely high leverage, up to 1:1000. While high leverage can magnify potential profits, it equally and rapidly amplifies losses. For most retail traders, such a high leverage is a double-edged sword that dramatically increases the risk of a complete account wipeout from even minor market fluctuations. When offered by a broker with a revoked license, a history of non-compliance and numerous complaints of stop-out manipulation, such high leverage transforms from a trading tool into a significant danger. It creates a high-risk environment where traders are exceptionally vulnerable to the broker's questionable practices.

Final Verdict: Avoid

After a thorough examination of the available evidence, our conclusion is clear. The combination of severe regulatory failures, a lack of operational transparency and a consistent pattern of serious user complaints paints a clear picture of a high-risk operation. We cannot recommend Vida Markets under any circumstances.

To summarize the most damning evidence:

· No reliable regulation: The broker operates with a revoked license from the VFSC and an “Exceeded” status from the FSCA, offering no legitimate regulatory protection.

· A pattern of serious complaints: Verified user reports include credible allegations of profit theft, price manipulation, and unfair account closures.

· Lack of transparency: The company is registered in a weak offshore jurisdiction and has no verifiable physical office, indicating a deliberate avoidance of accountability.

· Extreme inherent risks: The offering of 1:1000 leverage, combined with the aforementioned poor practices, creates an unacceptably dangerous trading environment.

Given this overwhelming evidence, depositing funds and trading with Vida Markets poses an unacceptably high risk of financial loss.

Your financial security is paramount. The issues highlighted in this Vida Markets review underscore the importance of thorough due diligence. Always use an independent verification tool, such as WikiFX, to check a broker's regulatory status, history, and user reviews before you even consider opening an account. A few minutes of research can save you from significant financial loss.

Read more

Checking if Vida Markets is Real and Safe

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.

Vida Markets Regulatory Status

Picking a broker is one of the most important choices a trader can make. Beyond costs and trading platforms, the main protection for a trader's capital is the broker's regulatory status. A careful check of licenses, company registrations, and compliance history is not just smart; it is necessary. When it comes to Vida Markets, our review of public information shows major regulatory warning signs and a high-risk profile that should make any potential investor very careful. The main question of whether Vida Markets is a safe and regulated company is complicated, with an answer that points strongly toward a negative result. The broker's business structure is a mix of offshore registration, a license being used beyond its legal limits, and a recently canceled license from another country. This is made worse by an extremely low WikiFX score of 2.16 out of 10, a number that serves as an immediate and clear warning. Also, many serious user complaints create a worrying picture of the real tra

WikiFX Elite Club Focus | Jimmy: Trust is the Most Valuable Asset

WikiFX Elite Club Focus is a monthly publication tailored for members of the WikiFX Elite Club, highlighting the key figures, insights, and actions that are genuinely driving the forex industry toward transparency, professionalism, and sustainable development.

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

WikiFX Elite Club Focus | Jimmy: Trust is the Most Valuable Asset

Rate Calc