Celer Coin

Abstract:Celer Coin was founded in Saint Vincent and the Grenadines in 2021. The greatest strength of Celer Coin is its various tradable assets. And the greatest weakness of it is the only way of customer support.

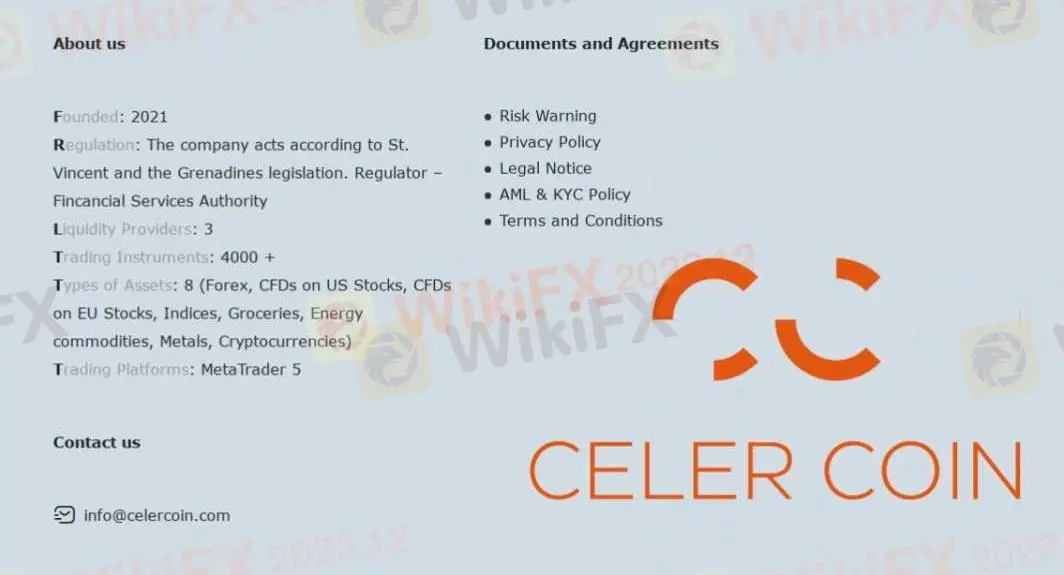

| Celer Coin | Basic Information |

| Founded in | 2021 |

| Registered in | Saint Vincent and the Grenadines |

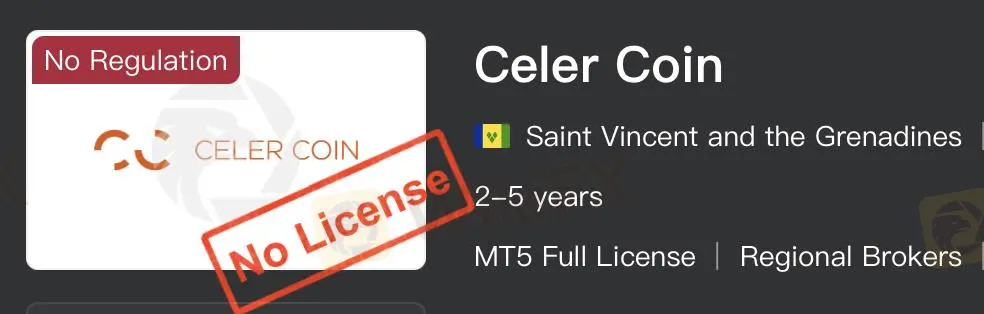

| Regulation | Not Regulated |

| Tradable Assets | Forex, shares, indices, futures, currencies, energies, metals |

| Leverage | 1:100 |

| Trading platform | MT5 |

| Customer Support | Email: info@celercoin.com |

| Offical website | Inaccessible |

Overview of Celer Coin

Celer Coin was founded in Saint Vincent and the Grenadines in 2021. The greatest strength of Celer Coin is its various tradable assets. And the greatest weakness of it is the only way of customer support.

Pros and Cons

| Pros | Cons |

| a lot of Assets | Lack of Regulation |

| Popular trading platform | Unavailable Website |

| Only one customer support |

Is Celer Coin. Legit?

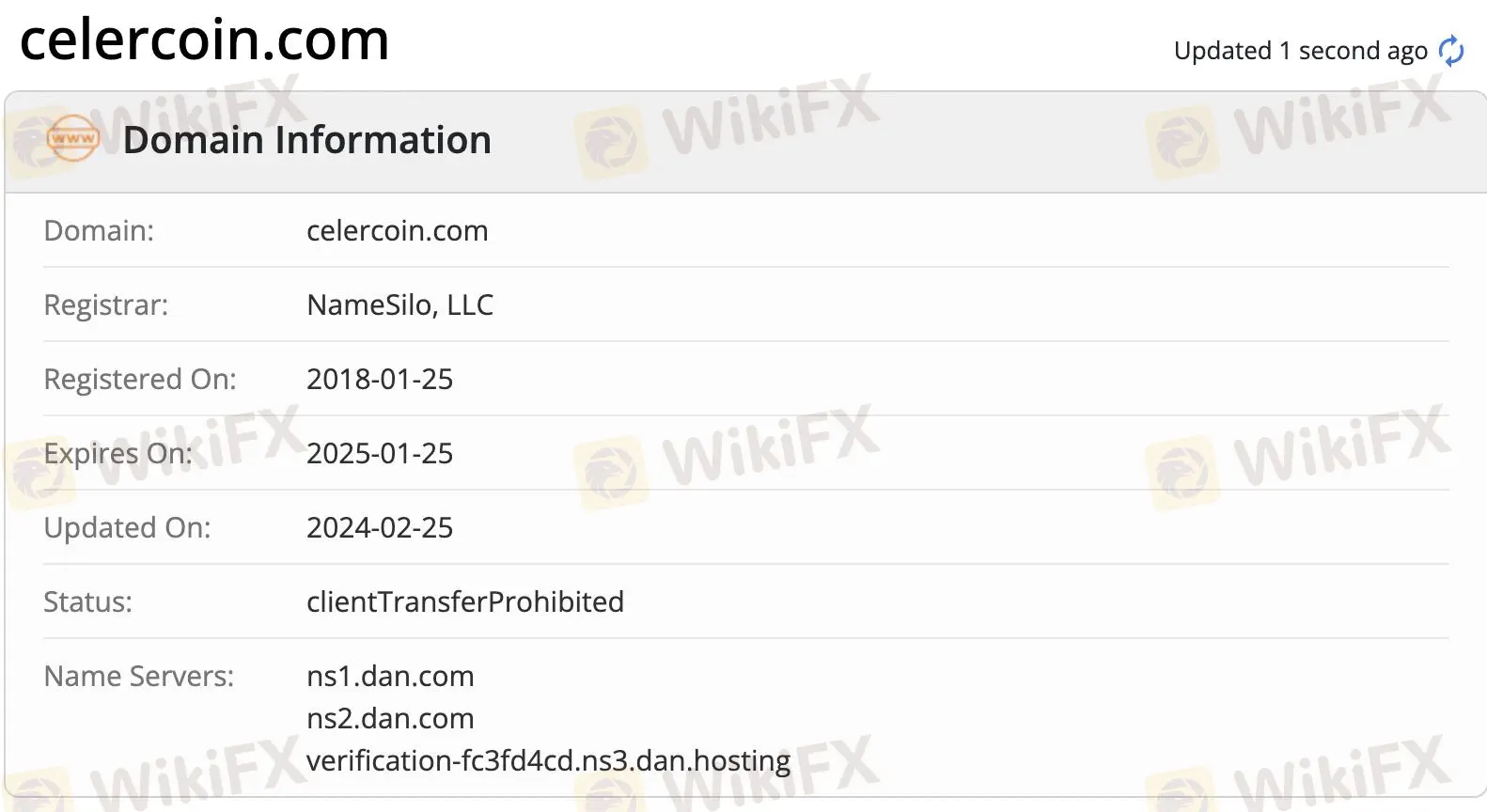

Celer Coin is owned and operated by NameSilo, LLC. We cannot find any information in the website of Financial Industry Regulatory Authority (FINRA), and it is also not regulated by FCA, NASD.

What Can I Trade on Celer Coin?

Celer Coin offers 70 pairs of market instruments to provide clients with diversified trading opportunities. The main instruments include forex, shares, indices, futures, currencies, energies, metals.

| Tradable Instruments | Supported |

| forex | ✔ |

| shares | ✔ |

| indices | ✔ |

| futures | ✔ |

| currencies | ✔ |

| energies | ✔ |

| metals | ✔ |

Trading Platform

| Trading Platform | Supported | Suitable for what types of traders |

| MT5 Windows | ✔ | Experienced traders, scalpers, swing traders, hedge fund managers |

| MT5 Mobile | ✔ | Traders on the go, scalpers, swing traders |

Deposit and Withdrawal

There was a deopist of the broker, and the minimum deposit is 250 US.

Deposit Options

| Deposit Options | Min. Deposit | Processing Time |

| Account fees | $250 | Within 2 working days |

Customer Service

Clients can contact this broker by only email.

| Contact Options | Details |

| Phone | ❌ |

| info@celercoin.com | |

| Support Ticket System | ❌ |

| Online Chat | ❌ |

| Social Media | ❌ |

| Supported Language | English |

| Website Language | English |

| Physical Address | ❌ |

The Bottom Line

Various tradable assets is Celer Coin's biggest advantage which offers many choies for some investors. However, the only customer spport is Celer Coin's biggest disadvantage that will leave customers with service quality problems. This broker is suitable for clients who don't pay attention to the service and the regulation's security..

FAQs

- Is Celer Coin safe?

No, it is not safe. Celer Coin is unregulated and customer support is limited. Investors' fund safety is not guarnteed.

- Is Celer Coin good for beginners?

No, it is not good for beginners because its minimum deposit is higher than other brokers, so beginners have to prepare adequate funds.

- Is Celer Coin good for day trading?

Yes, Celer Coin is suitable for day trading, because it can use the maximum possible execution speed to trade and withdrawl within 2 working days.

Read more

WikiFX Broker Assessment Series | FXTRADING.com: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of FXTRADING.com, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

WikiFX Broker Assessment Series | BDSwiss: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of BDSwiss, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Could IBKR Be the Next Big Trading Opportunity?

Goldman Sachs boosts Interactive Brokers' price target to $240, reflecting confidence in the firm's growth prospects and market performance.

FIBO Group Review 2025: Is This Forex Broker a Scam or Legit?

FIBO Group review 2025: Low WikiFX rating, offshore regulation, and withdrawal issues raise scam concerns. Explore pros, cons, and trader insights.

WikiFX Broker

Latest News

FIBO Group Review 2025: Is This Forex Broker a Scam or Legit?

The RM300 Mistake That Cost Her RM19,050

HDFC BANK: Is This Indian Bank Worth Your Money?

OANDA Japan Deletes Inactive Accounts, Urges Re-registration

Can these 10 Forex Brokers boost your money in 2025? Saxo, IB, eToro & More

Aurum Markets- Opportunity or Trap? Let's uncover

2025 FXPesa Latest Review

CNMV Warns of Clone Sites Targeting EU Investors

CONSOB Blocks Multiple Domains Linked to Five Unlicensed Platforms

Could IBKR Be the Next Big Trading Opportunity?

Rate Calc