Cube Forex

Abstract:Cube Forex, operated by Cube Global Impex Limited and headquartered in Hong Kong, offers trading in a limited selection of assets, primarily focusing on USD/EUR pairs. The platform provides several account types—Silver, Gold, Platinum, and Ultimate—each tailored to different trading preferences. With a low minimum deposit requirement of $200 and high maximum leverage of 1:1000, Cube Forex fit for both cautious and aggressive traders. Notably, the absence of regulatory oversight may pose risks related to investor protection. While offering popular MT4/MT5 trading platforms and no commissions on trades, Cube Forex lacks formal payment methods and educational resources, relying instead on social media for customer support. Additionally, the platform does not provide bonus offerings, making it suitable for straightforward trading without additional incentives.

| Cube Forex | Basic Information |

| Company Name | Cube Global Impex Limited |

| Founded in | 5-10 years |

| Headquarters | Hong Kong |

| Regulations | Not Regulated |

| Tradable Assets | USD / EUR |

| Account Types | Silver, Gold, Platinum, Ultimate |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:1000 |

| Minimum Spread | From 1.3 |

| Trading Platforms | MT4/5 |

| Customer Support | Social media: Twitter, Facebook |

Overview of Cube Forex

Cube Forex, operated by Cube Global Impex Limited and headquartered in Hong Kong, offers trading in a limited selection of assets, primarily focusing on USD/EUR pairs. The platform provides several account types—Silver, Gold, Platinum, and Ultimate—each tailored to different trading preferences. With a low minimum deposit requirement of $200 and high maximum leverage of 1:1000, Cube Forex fit for both cautious and aggressive traders. Notably, the absence of regulatory oversight may pose risks related to investor protection. While offering popular MT4/MT5 trading platforms and no commissions on trades, Cube Forex lacks formal payment methods and educational resources, relying instead on social media for customer support. Additionally, the platform does not provide bonus offerings, making it suitable for straightforward trading without additional incentives.

Regulation

Cube Forex operates without regulation, as indicated by the provided information. This means that the company is not subject to supervision or guidelines enforced by any financial regulatory authority. Trading with an unregulated broker like Cube Forex carries inherent risks for investors, including potential issues related to transparency, security of funds, and dispute resolution mechanisms.

Pros & Cons

Cube Forex presents several notable advantages and drawbacks for traders considering its platform. On the positive side, Cube Forex offers high leverage up to 1:1000, providing traders with the potential to maximize their trading positions with a smaller initial investment. Additionally, a low minimum deposit requirement of $200 makes it accessible to a broader range of traders. However, potential clients should be mindful of certain limitations. Cube Forex operates without regulation, which can impact investor protection and accountability. The platform also offers a limited selection of tradable assets, primarily focusing on the USD/EUR pair, which may restrict diversification opportunities for traders. While it supports Expert Advisors (EAs) for automated trading strategies, the absence of formal payment methods could present challenges for clients seeking secure and convenient fund transfer options.

| Pros | Cons |

|

|

|

|

|

|

Market Instruments

Cube Forex focuses its trading offerings primarily on the USD/EUR currency pair. This limited selection of tradable assets underscores its specialization in forex trading, particularly between the US Dollar (USD) and Euro (EUR). By concentrating on this currency pair, Cube Forex aims to cater to traders interested in major currency exchanges, providing focused opportunities for speculation and investment within the forex market. However, potential clients should consider the platform's narrower scope compared to brokers offering a broader range of assets, which may impact diversification strategies depending on individual trading preferences and goals.

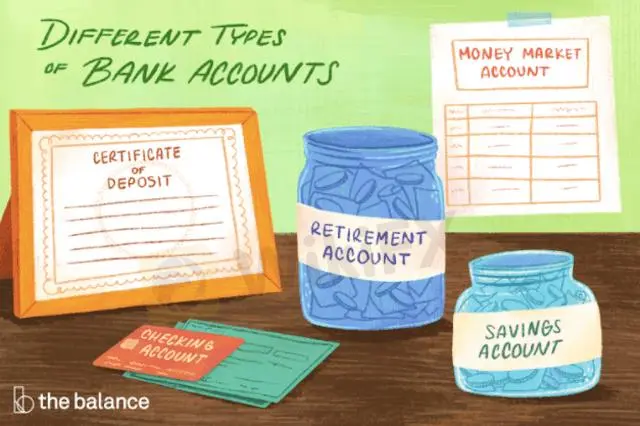

Account Types

Cube Forex offers a tiered system of account types tailored to accommodate various trading preferences and experience levels. The range includes Silver, Gold, Platinum, and Ultimate accounts, each offering distinct features and benefits. These account tiers likely differ in terms of trading conditions such as leverage options, minimum deposit requirements, and possibly additional perks such as personalized support or access to educational resources. This tiered structure allows traders to choose an account type that aligns with their specific trading goals and risk tolerance.

| Account types | Silver Account | Gold Account | Platinum Account | Ultimate Account |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

| Minimum Deposit | $200 | $200 | $200 | $200 |

| Minimum Spread | From 1.3 | From 1.3 | From 1.3 | From 1.3 |

| Products | USD / EUR | USD / EUR | USD / EUR | USD / EUR |

Leverage

Cube Forex offers a maximum leverage of 1:1000, providing traders with the opportunity to significantly amplify their trading positions relative to their initial margin deposit. This high leverage ratio allows traders to potentially enhance their trading profits with a smaller capital outlay.

Spreads & Commissions

Cube Forex offers a competitive trading environment with a minimum spread starting from 1.3 pips, reflecting the difference between buy and sell prices.

Trading Platform

Cube Forex utilizes the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, renowned for their robust features and user-friendly interfaces. These platforms are widely recognized in the industry for their advanced charting tools, technical analysis capabilities, and support for automated trading through Expert Advisors (EAs).

Deposit & Withdrawal

Cube Forex maintains a straightforward approach to deposit and withdrawal processes, setting a minimum deposit requirement of $200.

Customer Support

Cube Forex provides customer support primarily through social media platforms such as Twitter and Facebook.

Twitter: https://twitter.com/cube_forex

Facebook: https://www.facebook.com/CubeFxGlobal/

Conclusion

In conclusion, Cube Forex offers a focused trading experience primarily centered on the USD/EUR currency pair with competitive trading conditions such as high leverage up to 1:1000 and minimal spreads starting from 1.3 pips. The platform offers with a low minimum deposit requirement of $200 and supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, known for their robust features and versatility. However, potential clients should consider the lack of regulatory oversight, limited tradable assets beyond USD/EUR, and the absence of formal payment methods as factors impacting their decision. Cube Forex provides accessible customer support through social media channels, Twitter and Facebook.

FAQs

- Is Cube Forex regulated by any financial authority?

No, Cube Forex operates without regulatory oversight.

- What is the minimum deposit required to open an account with Cube Forex?

The minimum deposit required to start trading with Cube Forex is $200.

- What trading platforms does Cube Forex support?

Cube Forex supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

Read more

ForexDana Exposure: Do Traders Witness Fund Scams & Deposit Credit Failures?

Did your deposited amount fail to reflect in the ForexDana forex trading account? Failed to receive an adequate response from the broker’s customer support officials? Do you think that it is a clone firm that cheats traders? Were you fascinated by the profit shown on the trading platform, but could not withdraw funds? Have you been lured into trading by a deposit bonus that does not work in real-time? In this ForexDana review article, we have investigated some complaints against the broker.

SOLIDARY P R I M E Review: Reported Fund Scams & Poor Customer Support

Have you witnessed a complete fund scam experience when trading with SOLIDARY PRIME? Did you have a PAMM account that disappeared suddenly on the broker’s trading platform? Is the SOLIDARY PRIME customer support team inept in handling your trading queries? Did the broker deceive you on binary options? These complaints are showing up on broker review platforms. In this SOLIDARY PRIME review article, we have investigated some of the complaints against the broker. Take a look!

DBInvesting Forex Scams: User Exposure and Reviews

DBInvesting Forex scams exposed: offshore regulation, fake offices, and withdrawal issues. Read the full scam report now.

Quotex Forex Scam Reports: Fraudulent Practices Revealed

Traders expose Quotex's forex scam tactics: fake tasks, tax demands, and withheld funds. Broker remains unregulated and unsafe.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Rate Calc