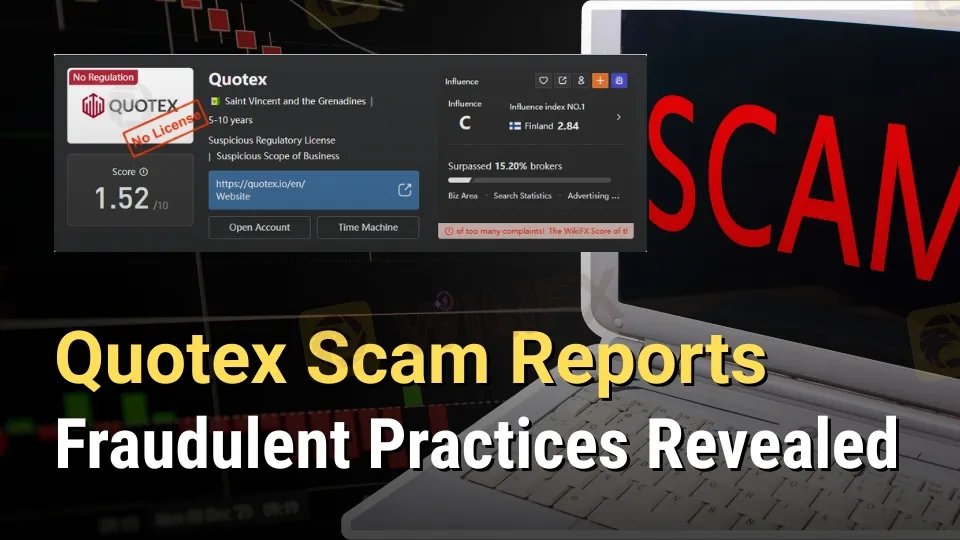

Quotex Forex Scam Reports: Fraudulent Practices Revealed

Abstract:Traders expose Quotex's forex scam tactics: fake tasks, tax demands, and withheld funds. Broker remains unregulated and unsafe.

Introduction

Quotex Broker Scams are raising alarms in the forex community. Traders worldwide report fraudulent tactics, such as withheld funds and demands for fake taxes. Because it is an unregulated broker, Quotex‘s manipulative practices highlight risks on such platforms. In this article, we review scam evidence, analyze the broker’s operations, and warn traders about the dangers of dealing with unregulated entities like Quotex.

Unregulated Broker Status Raises Red Flags

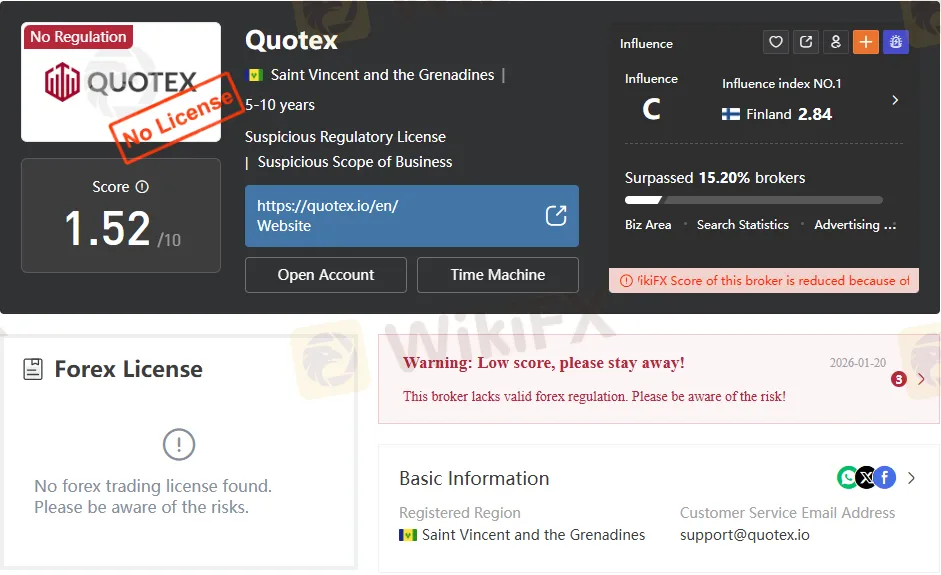

Quotex was founded in January 2020 and is registered in Saint Vincent and the Grenadines, a jurisdiction notorious for hosting unregulated brokers. The company operates without oversight from any recognized financial authority, leaving traders vulnerable to misconduct. Its regulatory status is explicitly listed as “Unregulated,” meaning there are no safeguards to protect client funds or ensure fair trading practices.

The absence of regulation is a significant concern. Regulated brokers must meet strict financial standards, maintain segregated accounts, and undergo audits. In contrast, Quotex has no accountability, allowing it to manipulate accounts, delay withdrawals, and impose arbitrary restrictions. Traders have reported that this lack of transparency and oversight enables fraudulent activity.

Affiliate Commission Withheld: $24,340 Stolen

One of the most striking cases involves an official Quotex affiliate partner who reported that the broker unlawfully withheld $24,340 in earned commissions. These funds were legitimate marketing revenues displayed in the affiliate dashboard, not trading losses. Despite multiple withdrawal requests, Quotex blocked access to the money without explanation.

This case shows that Quotex‘s fraudulent practices target both traders and partners. Affiliates, who promote the broker, also face financial manipulation. Withholding commissions reveals the company’s disregard for contracts and its readiness to exploit anyone on its platform.

Account Manipulation and Balance Discrepancies

Several traders have reported account manipulation, where balances mysteriously decrease without explanation. One trader described opening a $30 USDT trade that succeeded, leaving $150 USDT in the account. The next day, the balance had inexplicably dropped to $70 USDT.

When the trader contacted support to provide identification, the broker denied any knowledge of the issue. This incident demonstrates how Quotex may manipulate balances to reduce traders' profits, a practice associated with unregulated brokers exploiting limited oversight.

Deposits Accepted, Funds Not Credited

Another alarming case occurred in September 2023, when a trader deposited INR 4709 (approximately $50 USD) through a QR code provided by Quotex. The payment was successfully debited from the traders bank account, but the funds were never credited to the trading account.

Despite repeated messages to customer support, the trader received no resolution. This case highlights a tactic where brokers accept deposits but do not credit accounts, taking funds before trading begins.

Fake Tasks and Tax Demands Before Withdrawals

Multiple traders have reported being forced to complete fabricated “tasks” or pay taxes before withdrawing funds. One case involved a trader whose account balance grew significantly. When attempting to withdraw, the broker demanded additional deposits and tax payments.

Screenshots from victims show balances in the millions of Argentine pesos, yet withdrawals are blocked until taxes are paid. These demands are illegitimate, as regulated brokers never require traders to pay taxes directly. Taxes are handled by government authorities. Quotexs fake tax requirements are a clear scam to extort additional money.

Large-Scale Fraud: $43,000 Account Suspension

A trader from India reported depositing over $35,000 with Quotex and suffered $18,000 in losses without restrictions. Later, after depositing an additional $20,000, the account was suspended once profits began to accumulate. The total amount stolen was $43,000.

This case shows a pattern: Quotex lets traders lose freely but restricts or suspends accounts when they profit. Such conduct matches fraudulent brokers who manipulate outcomes to block withdrawals.

Company Profile and Risk Indicators

Quotex positions itself as a modern platform that offers access to currency quotes, stocks, cryptocurrencies, metals, oil, and gas. The broker highlights a demo account, 24/7 customer support via social media, and accepts a minimum deposit of $10. It also promises a 30% bonus on the first deposit.

However, beneath these marketing claims are risks: Unregulated status offers no trader protection.

- Suspicious business scope: Operating in multiple markets without licenses.

- Negative reviews: Numerous reports of withheld funds and manipulation.

- Opaque operations: No clear fee structure or live account details.

The brokers WikiFX score is 1.52/10, ranking in the bottom 85% of brokers. This score indicates low trust and reported misconduct.

Pros and Cons: Misleading Marketing

Quotex advertises several advantages, such as a demo account, 24/7 support, and deposit bonuses. However, these features are overshadowed by severe disadvantages:

- Unregulated operations

- Restrictions on US traders

- No transparency on fees or live accounts

- Multiple negative exposure reports

The so-called pros are marketing tools to attract unsuspecting traders, while the cons reveal the platform's high risk and lack of safety.

Domain and Operational Details

Quotex operates through the domain quotex.io, registered on January 6, 2020, and set to expire in 2026. The domain is hosted via Cloudflare servers, with restrictions such as “clientDeleteProhibited” and “clientTransferProhibited.”

These details show Quotex has secured its domain but not regulatory standing. The domain's longevity does not equal legitimacy; fraudulent brokers often keep websites active while exploiting traders.

Withdrawal Delays and Payment Issues

Quotex claims Visa withdrawals take 1–5 days. However, traders report delays or blocks, and often receive no response to support requests, leaving them without access to funds.

This difference between advertised withdrawal times and reported experiences highlights ongoing concerns with the brokers operations. Reliable brokers process withdrawals promptly, while delays can raise concerns regarding client funds.

Influence and Market Reach

Quotex has sought to expand its international presence, gaining exposure in countries such as India, Iraq, and Argentina. Despite these efforts, the influence index remains low—a score of 2.84 in Finland underscores this. The brokers global reach, however, does not equate to credibility, as its operations remain unregulated and suspicious.

The occurrence of complaints in multiple countries indicates that reported issues are not isolated, but may be part of a broader pattern.

Trader Experiences: A Pattern of Fraud

The reported cases reveal a pattern: Deposits accepted but not credited.

- Balances are manipulated to erase profits.

- Withdrawals blocked with fake tax demands.

- Accounts are suspended after profits accumulate.

- Affiliate commissions withheld without reason.

These experiences reveal Quotexs systematic scams. Its tactics maximize deposits and minimize withdrawals, ensuring losses for traders and affiliates while the company profits.

Why Unregulated Brokers Are Dangerous

Unregulated brokers like Quotex may take advantage of the lack of oversight to engage in practices that disadvantage traders. Without regulation, there are reduced mechanisms to protect traders, enforce transparency, or hold brokers accountable.

Traders who use unregulated brokers risk losing deposits, profits, and commissions. In the event of a dispute, no authority is available to intervene or provide compensation. This absence of protection creates increased risk.

Bottom Line

Quotex has been repeatedly exposed for fraudulent practices, including withholding affiliate commissions, manipulating account balances, making uncredited deposits, issuing fake tax demands, and suspending accounts after profits are realized. Operating without regulation, the broker poses significant risks to traders and affiliates alike.

The evidence presented suggests that Quotex may not be a reliable or trustworthy platform. Traders are advised to consider regulated platforms that provide greater transparency, accountability, and investor protection.

Read more

SOLIDARY P R I M E Review: Reported Fund Scams & Poor Customer Support

Have you witnessed a complete fund scam experience when trading with SOLIDARY PRIME? Did you have a PAMM account that disappeared suddenly on the broker’s trading platform? Is the SOLIDARY PRIME customer support team inept in handling your trading queries? Did the broker deceive you on binary options? These complaints are showing up on broker review platforms. In this SOLIDARY PRIME review article, we have investigated some of the complaints against the broker. Take a look!

DBInvesting Forex Scams: User Exposure and Reviews

DBInvesting Forex scams exposed: offshore regulation, fake offices, and withdrawal issues. Read the full scam report now.

Beware: NAGA Broker Blocks Withdrawals Reports Rising

Reports claimed NAGA has blocked some client withdrawals after profits, raising concerns about transparency and fund protection.

Market10 Review: Check Out the Latest Fund Scam Allegations Against the Broker

Have you lost funds using weak signals from Market10, a South Africa-based forex broker? Has the forex broker deliberately deducted profits from your forex trading account balance? Does the broker constantly delay your fund withdrawals? Did Market10 officials continuously call you to start investing with it and remain silent on your withdrawal requests? You are not alone! Many traders have reported these trading experiences on broker review platforms. We have shared some of their experiences in this Market10 review article. Read on to know the same.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Rate Calc