IFC Markets

Abstract: IFC Markets, founded in 2006 and registered in Turkey, offers over 650 market instruments, high leverage up to 1:400, and various account types on NetTradeX, MT4, and MT5 platforms with a minimum deposit of $1.

| IFC MARKETS Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Turkey |

| Regulation | Suspicious clone (FSC) |

| Market Instruments | Currencies, stocks, commodities, metals, indices, ETFs, cryptos, and crypto futures |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Leverage | 1:1 - 1:400 |

| Spread | Fixed (from 1.8 pips) |

| Floating (from 0.4 pips) | |

| ECN (from 0.0 pips) | |

| Trading Platform | NetTradeX, MetaTrader 4, MetaTrader 5 |

| Minimum Deposit | $1 |

| Customer Support | Tel: +442039661649, +447723581740 |

| Email: tur@ifcmarkets.com | |

IFC MARKETS Information

IFC Markets, founded in 2006 and registered in Turkey, offers over 650 market instruments, high leverage up to 1:400, and various account types on NetTradeX, MT4, and MT5 platforms with a minimum deposit of $1.

Pros and Cons

| Pros | Cons |

| Various trading markets | Suspicious clone FSC license |

| Demo accounts available | |

| MT4 and MT5 platforms available | |

| Low minimum deposit |

Is IFC MARKETS Legit?

IFC Markets' regulatory status is listed as “Suspected Clone,” regulated by the British Virgin Islands Financial Services Commission (FSC) under a Retail Forex License with license number SIBA/L/14/1073.

| Regulatory Authority | British Virgin Islands Financial Services Commission (FSC) |

| Current Status | Suspicious clone |

| Regulated by | The Virgin Islands |

| Licensed Entity | IFCMARKETS. CORP. |

| Licensed Type | Retail Forex License |

| Licensed Number | SIBA/L/14/1073 |

What Can I Trade on IFC MARKETS?

IFC Markets offers over 650 trading instruments, including currencies, stocks, commodities, metals, indices, ETFs, cryptos, and crypto futures.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| ETFs | ✔ |

| Cryptos | ✔ |

| Crypto futures | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

IFC Markets offers various account types across its trading platforms (NetTradeX, MT4, MT5). Demo accounts and Islamic accounts are also available.

On NetTradeX:

| Account Type | Standard - Fixed & Floating | Beginner - Fixed & Floating | Demo - Fixed & Floating |

| Balance currency | USD, EUR, JPY, uBTC | ||

| Initial deposit | 1 000 USD/EUR, 100 000 JPY | 1 USD/EUR, 100 JPY | - |

| Maximum equivalence | - | 5 000 USD | - |

| Leverage | 1:1 - 1:200 | 1:1 - 1:400 | |

| Minimum fixed spread | 1.8 pips | ||

| Min. dynamic spread | 0.4 pips | ||

| Short margin (Stop out) level | 10% | ||

| Minimum trading volume (forex) | 10 000 units | 100 units | |

| Market news ticker | + | + | - |

| Operation system | Hedged/Netting | ||

On MetaTrader 4:

| Account Type | Standard Fixed | Micro-Fixed | Demo-Fixed | PAMM-Fixed |

| Balance currency | USD, EUR, JPY | USD | ||

| Initial deposit | 1 000 USD/EUR, 100 000 JPY | 1 USD/EUR, 100 JPY | - | 100 USD |

| Maximum equivalence | - | 5 000 USD/EUR, 500 000 JPY | - | - |

| Leverage | 1:1 - 1:200 | 1:1 - 1:400 | 1:1 - 1:200 | |

| Minimum fixed spread | 1.8 pips | |||

| Short margin (Stop out) level | 10% | |||

| Minimum trading volume (forex) | 0.1 lot | 0.01 lot | ||

| Market news ticker | + | + | - | + |

| Operation system | Hedged | |||

On MetaTrader 5:

| Account Type | Standard Floating | Micro Floating | Demo-Floating | PAMM - Floating | Standard-ECN | Demo-ECN |

| Balance currency | USD, EUR, JPY | |||||

| Initial deposit | 1 000 USD/EUR, 100 000 JPY | 1 USD/EUR, 100 JPY | - | 100 USD/EUR, 10 000 JPY | 1 000 USD/EUR, 100 000 JPY | - |

| Maximum equivalence * | - | 5 000 USD/EUR, 500 000 JPY | - | - | - | - |

| Leverage *** | 1:1 - 1:200 | 1:1 - 1:400 | 1:1 - 1:200 | |||

| Min. dynamic spread | 0.4 pips | 0.0 pips | ||||

| Short margin (Stop out) level | 10% | |||||

| Minimum trading volume (forex) **** | 0.1 lot | 0.01 lot | 0.1 lot | |||

| Market news ticker | + | + | - | + | + | - |

| Operation system ***** | Hedged/Netting | Hedged | Hedged/Netting | |||

| Commission based on trading volume | - | - | - | - | 0.005% | |

Leverage

IFC Markets offers high leverage up to 1:400. Higher leverage can improve profit potential while also increasing risk, therefore appropriate risk management is crucial.

IFC MARKETS Fees

IFC Markets offers competitive trading conditions with various spread types, including fixed (from 1.8 pips), floating (from 0.4 pips), and ECN (from 0.0 pips), with no hidden commissions.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| NetTradeX | ✔ | PC, iOS, Android, Windows Phone, Windows Mobile | / |

| MetaTrader 4 | ✔ | PC, WebTerminal, macOS, iOS, Android, MultiTerminal | Beginners |

| MetaTrader 5 | ✔ | PC, WebTerminal, macOS, iOS, Android | Experienced traders |

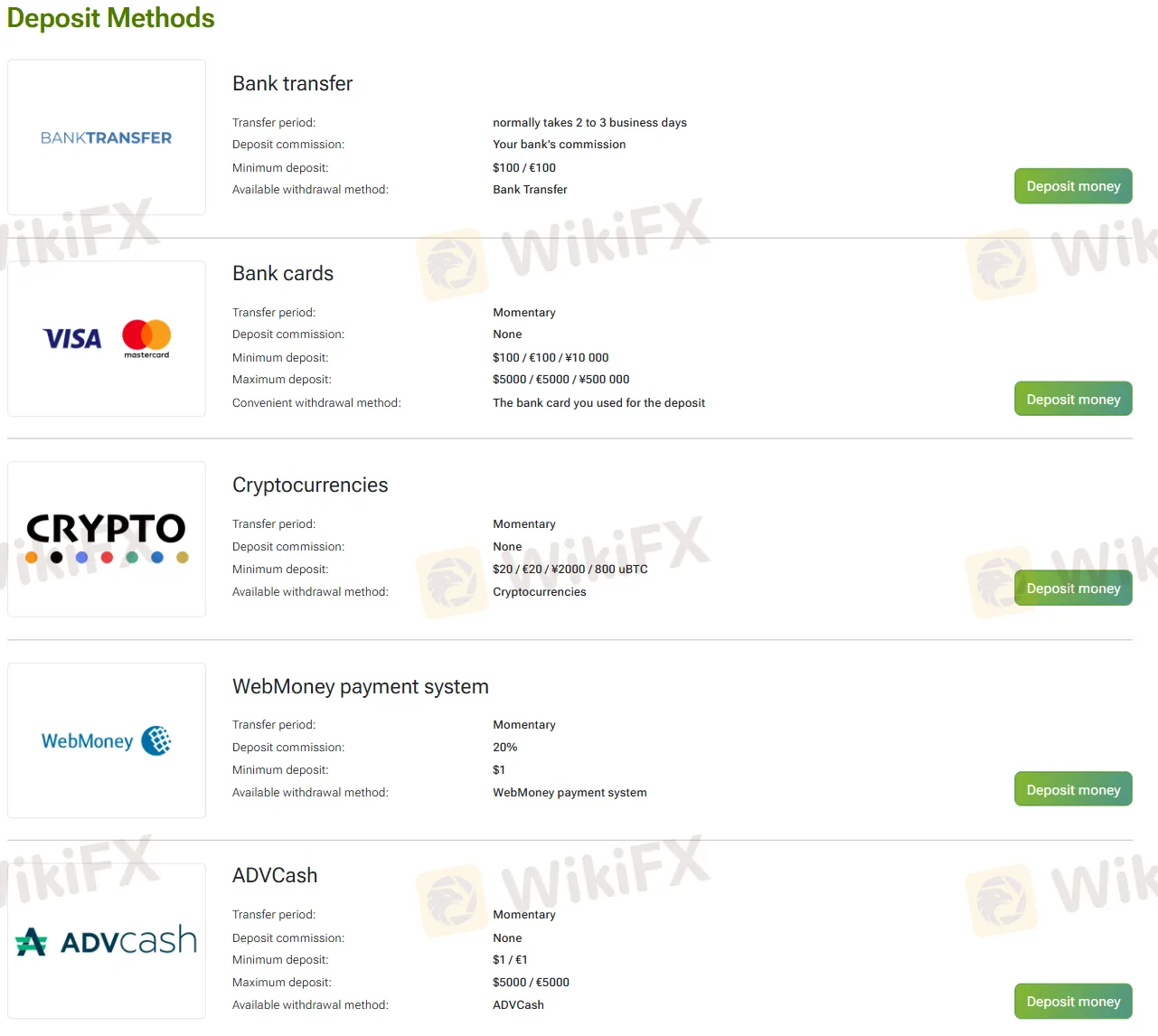

Deposit and Withdrawal

IFC Markets generally has no deposit or withdrawal fees for most methods, with minimum deposits as low as $1 for certain account types.

Deposit Options

| Deposit Options | Minimum Deposit | Deposit Fees | Deposit Time |

| Bank transfer | 100 USD/EUR | Your bank's commission | Normally 2 to 3 business days |

| Bank cards (VISA/Mastercard) | 100 USD/100 EUR, 10 000 JPY | 0 | Momentary |

| Cryptocurrencies | 20 USD/EUR, 2 000 JPY, 800 uBTC | 0 | |

| WebMoney payment system | 1 USD | 20% | |

| ADVCash | 1 USD/EUR | 0 |

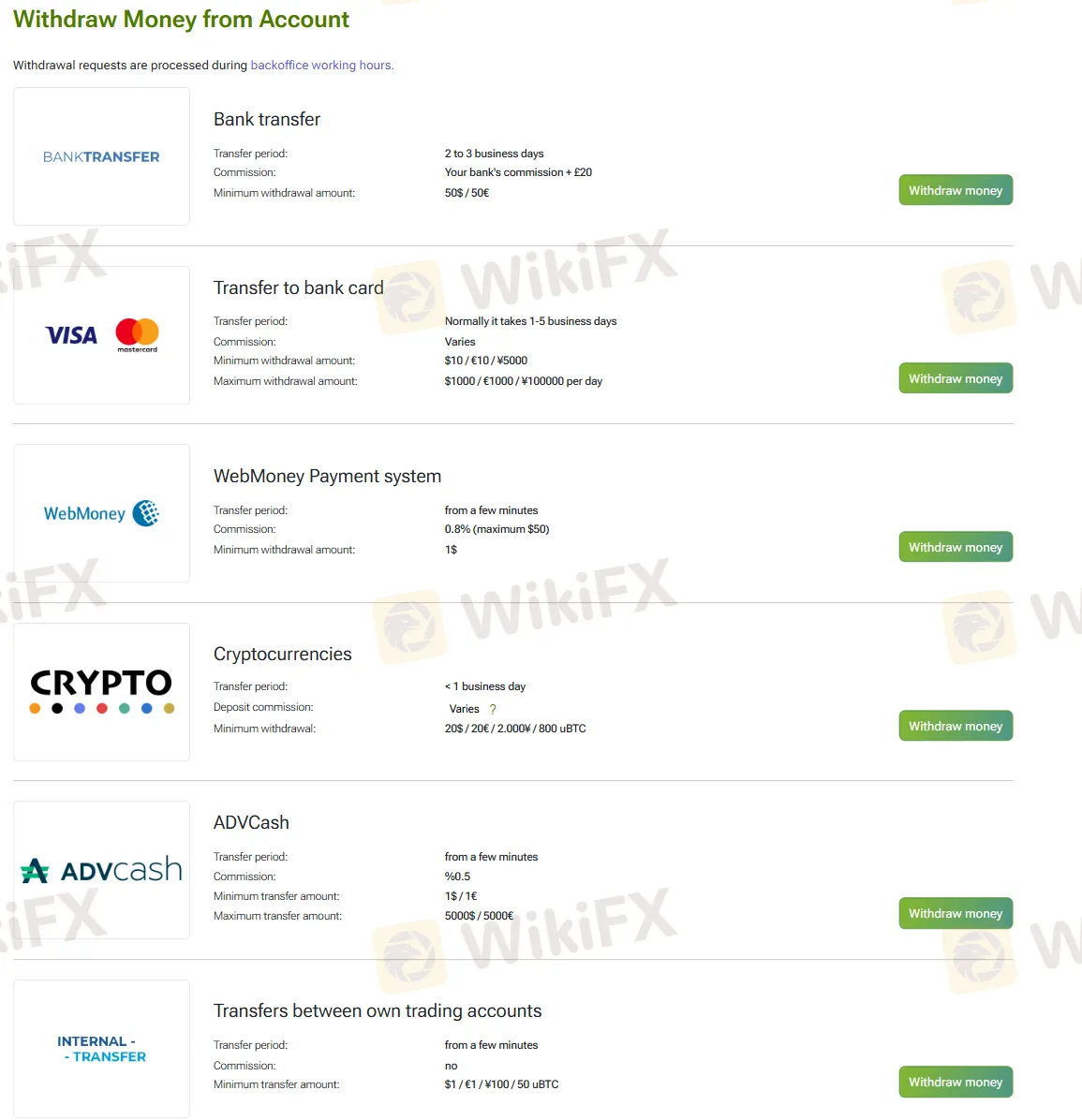

Withdrawal Options

| Withdrawal Options | Minimum Withdrawal | Withdrawal Fees | Withdrawal Time |

| Bank transfer | 50 USD/EUR | Your bank's commission + £20 | 2 - 3 business days |

| Transfer to bank card (VISA/Mastercard) | 10 USD/EUR, 5 000 JPY | Varies | Normally 1-5 business days |

| WebMoney Payment system | 1 USD | 0.8% (maximum $50) | From a few minutes |

| Cryptocurrencies | 20 USD/EUR, 2 000 JPY, 800 uBTC | Varies | < 1 business day |

| ADVCash | 1 USD/EUR | 0.50% | From a few minutes |

| Transfers between own trading accounts | 1 USD/EUR, 100 JPY, 50 uBTC | 0 |

WikiFX Broker

Latest News

Gold and Silver Buckle Under BCOM Rebalancing Weight Ahead of Critical NFP

Why Southeast Asia Can’t Stop Online Scams

Trump Triggers Fiscal Jitters with $1.5tn Defense Ambition Funded by Tariffs

Is GMG Safe or a Scam? A 2026 Deep Dive

Pocket Broker Review: Why Traders Should Avoid It

FBS Review: The "Balance Fixed" Trap and the $30,000 Ghost Candle

Is Assexmarkets Legit or a Scam? 5 Key Questions Answered (2025)

TibiGlobe Review 2025: Institutional Audit & Risk Assessment

TEMO Review 2025: Institutional Audit & Risk Assessment

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

Rate Calc