User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.33

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

IFC MARKETS

Company Abbreviation

IFC MARKETS

Platform registered country and region

Turkey

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| IFC MARKETS Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Turkey |

| Regulation | Suspicious clone (FSC) |

| Market Instruments | Currencies, stocks, commodities, metals, indices, ETFs, cryptos, and crypto futures |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Leverage | 1:1 - 1:400 |

| Spread | Fixed (from 1.8 pips) |

| Floating (from 0.4 pips) | |

| ECN (from 0.0 pips) | |

| Trading Platform | NetTradeX, MetaTrader 4, MetaTrader 5 |

| Minimum Deposit | $1 |

| Customer Support | Tel: +442039661649, +447723581740 |

| Email: tur@ifcmarkets.com | |

IFC Markets, founded in 2006 and registered in Turkey, offers over 650 market instruments, high leverage up to 1:400, and various account types on NetTradeX, MT4, and MT5 platforms with a minimum deposit of $1.

| Pros | Cons |

| Various trading markets | Suspicious clone FSC license |

| Demo accounts available | |

| MT4 and MT5 platforms available | |

| Low minimum deposit |

IFC Markets' regulatory status is listed as “Suspected Clone,” regulated by the British Virgin Islands Financial Services Commission (FSC) under a Retail Forex License with license number SIBA/L/14/1073.

| Regulatory Authority | British Virgin Islands Financial Services Commission (FSC) |

| Current Status | Suspicious clone |

| Regulated by | The Virgin Islands |

| Licensed Entity | IFCMARKETS. CORP. |

| Licensed Type | Retail Forex License |

| Licensed Number | SIBA/L/14/1073 |

IFC Markets offers over 650 trading instruments, including currencies, stocks, commodities, metals, indices, ETFs, cryptos, and crypto futures.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| ETFs | ✔ |

| Cryptos | ✔ |

| Crypto futures | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

IFC Markets offers various account types across its trading platforms (NetTradeX, MT4, MT5). Demo accounts and Islamic accounts are also available.

On NetTradeX:

| Account Type | Standard - Fixed & Floating | Beginner - Fixed & Floating | Demo - Fixed & Floating |

| Balance currency | USD, EUR, JPY, uBTC | ||

| Initial deposit | 1 000 USD/EUR, 100 000 JPY | 1 USD/EUR, 100 JPY | - |

| Maximum equivalence | - | 5 000 USD | - |

| Leverage | 1:1 - 1:200 | 1:1 - 1:400 | |

| Minimum fixed spread | 1.8 pips | ||

| Min. dynamic spread | 0.4 pips | ||

| Short margin (Stop out) level | 10% | ||

| Minimum trading volume (forex) | 10 000 units | 100 units | |

| Market news ticker | + | + | - |

| Operation system | Hedged/Netting | ||

On MetaTrader 4:

| Account Type | Standard Fixed | Micro-Fixed | Demo-Fixed | PAMM-Fixed |

| Balance currency | USD, EUR, JPY | USD | ||

| Initial deposit | 1 000 USD/EUR, 100 000 JPY | 1 USD/EUR, 100 JPY | - | 100 USD |

| Maximum equivalence | - | 5 000 USD/EUR, 500 000 JPY | - | - |

| Leverage | 1:1 - 1:200 | 1:1 - 1:400 | 1:1 - 1:200 | |

| Minimum fixed spread | 1.8 pips | |||

| Short margin (Stop out) level | 10% | |||

| Minimum trading volume (forex) | 0.1 lot | 0.01 lot | ||

| Market news ticker | + | + | - | + |

| Operation system | Hedged | |||

On MetaTrader 5:

| Account Type | Standard Floating | Micro Floating | Demo-Floating | PAMM - Floating | Standard-ECN | Demo-ECN |

| Balance currency | USD, EUR, JPY | |||||

| Initial deposit | 1 000 USD/EUR, 100 000 JPY | 1 USD/EUR, 100 JPY | - | 100 USD/EUR, 10 000 JPY | 1 000 USD/EUR, 100 000 JPY | - |

| Maximum equivalence * | - | 5 000 USD/EUR, 500 000 JPY | - | - | - | - |

| Leverage *** | 1:1 - 1:200 | 1:1 - 1:400 | 1:1 - 1:200 | |||

| Min. dynamic spread | 0.4 pips | 0.0 pips | ||||

| Short margin (Stop out) level | 10% | |||||

| Minimum trading volume (forex) **** | 0.1 lot | 0.01 lot | 0.1 lot | |||

| Market news ticker | + | + | - | + | + | - |

| Operation system ***** | Hedged/Netting | Hedged | Hedged/Netting | |||

| Commission based on trading volume | - | - | - | - | 0.005% | |

IFC Markets offers high leverage up to 1:400. Higher leverage can improve profit potential while also increasing risk, therefore appropriate risk management is crucial.

IFC Markets offers competitive trading conditions with various spread types, including fixed (from 1.8 pips), floating (from 0.4 pips), and ECN (from 0.0 pips), with no hidden commissions.

| Trading Platform | Supported | Available Devices | Suitable for |

| NetTradeX | ✔ | PC, iOS, Android, Windows Phone, Windows Mobile | / |

| MetaTrader 4 | ✔ | PC, WebTerminal, macOS, iOS, Android, MultiTerminal | Beginners |

| MetaTrader 5 | ✔ | PC, WebTerminal, macOS, iOS, Android | Experienced traders |

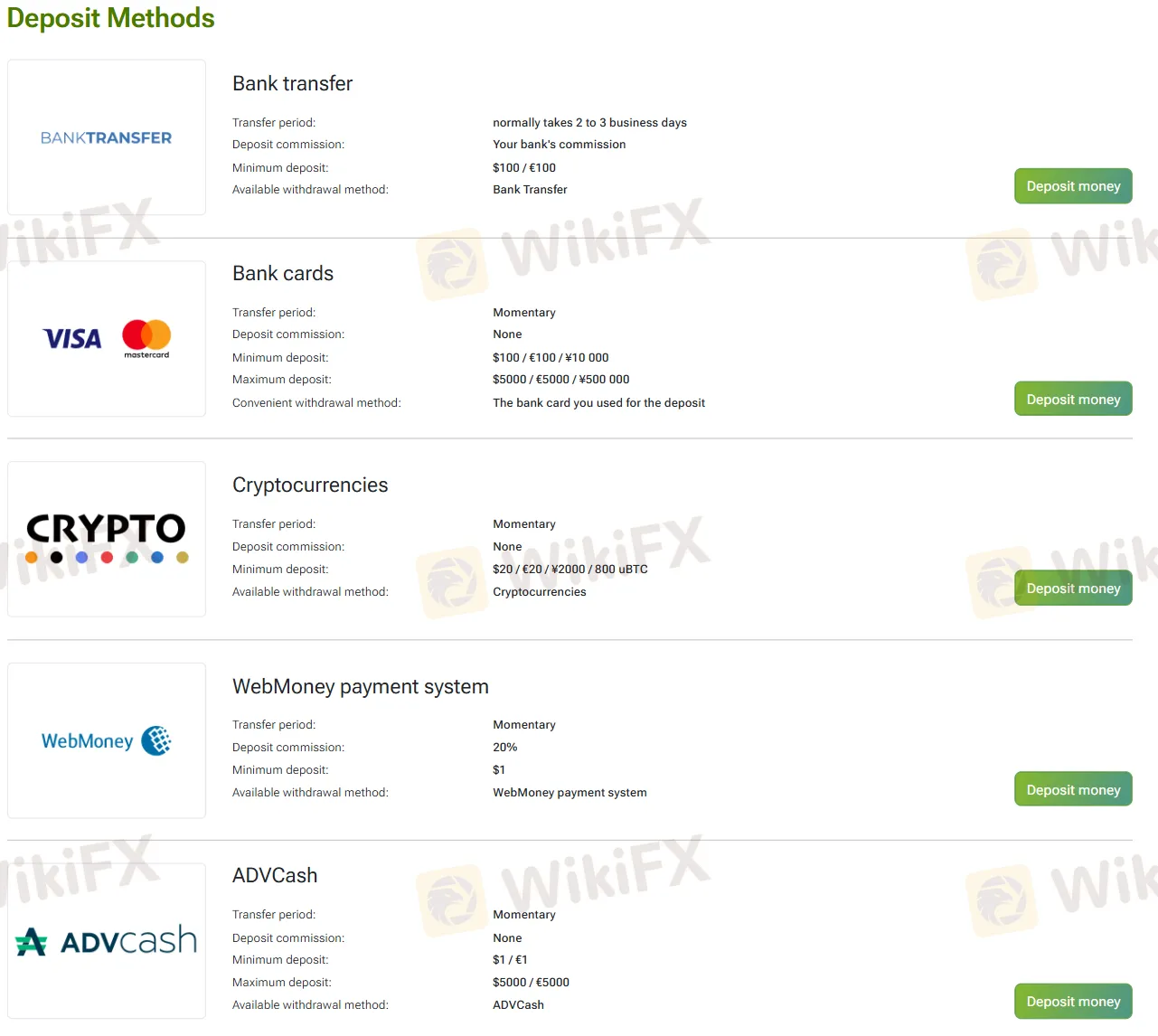

IFC Markets generally has no deposit or withdrawal fees for most methods, with minimum deposits as low as $1 for certain account types.

Deposit Options

| Deposit Options | Minimum Deposit | Deposit Fees | Deposit Time |

| Bank transfer | 100 USD/EUR | Your bank's commission | Normally 2 to 3 business days |

| Bank cards (VISA/Mastercard) | 100 USD/100 EUR, 10 000 JPY | 0 | Momentary |

| Cryptocurrencies | 20 USD/EUR, 2 000 JPY, 800 uBTC | 0 | |

| WebMoney payment system | 1 USD | 20% | |

| ADVCash | 1 USD/EUR | 0 |

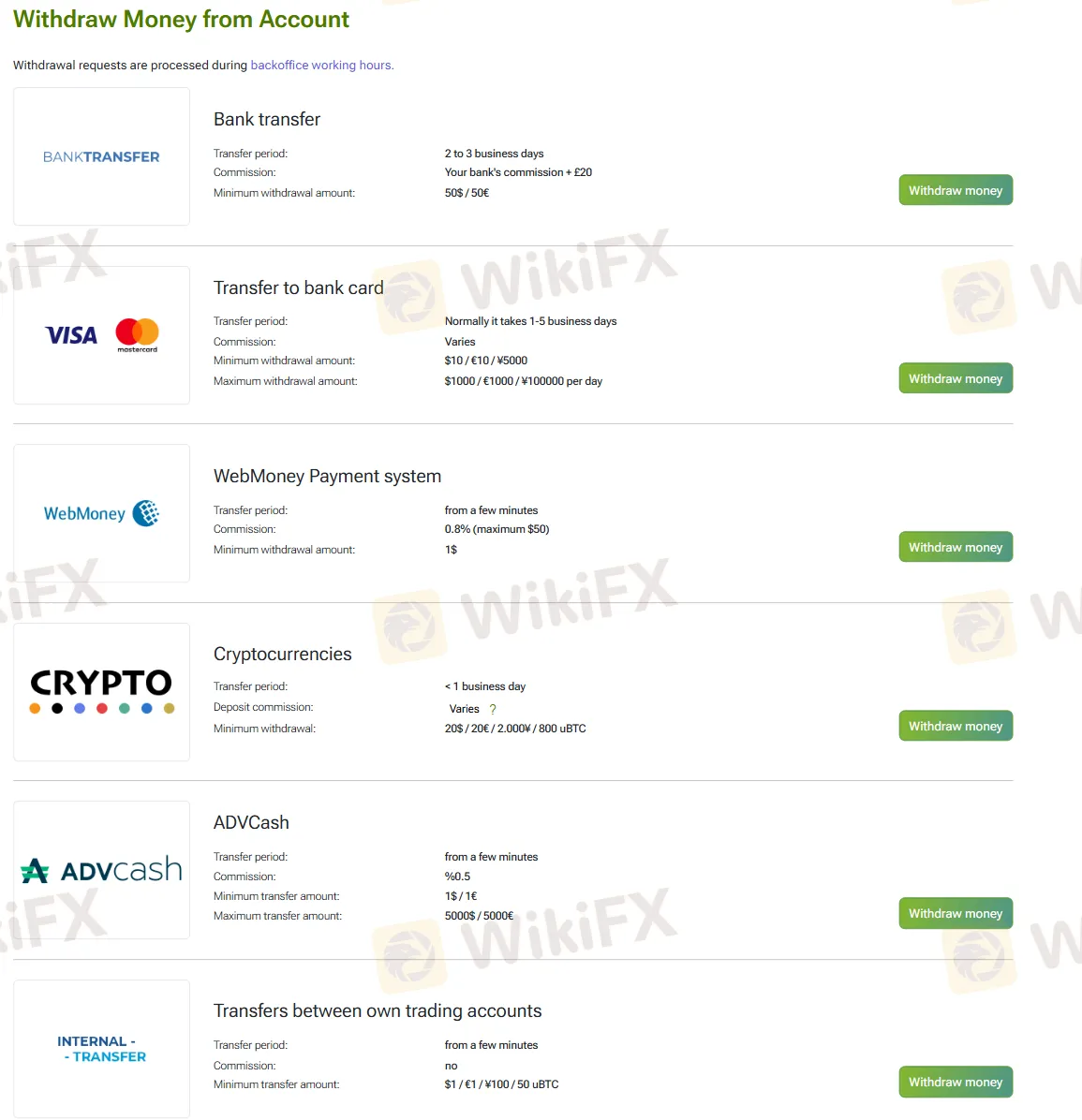

Withdrawal Options

| Withdrawal Options | Minimum Withdrawal | Withdrawal Fees | Withdrawal Time |

| Bank transfer | 50 USD/EUR | Your bank's commission + £20 | 2 - 3 business days |

| Transfer to bank card (VISA/Mastercard) | 10 USD/EUR, 5 000 JPY | Varies | Normally 1-5 business days |

| WebMoney Payment system | 1 USD | 0.8% (maximum $50) | From a few minutes |

| Cryptocurrencies | 20 USD/EUR, 2 000 JPY, 800 uBTC | Varies | < 1 business day |

| ADVCash | 1 USD/EUR | 0.50% | From a few minutes |

| Transfers between own trading accounts | 1 USD/EUR, 100 JPY, 50 uBTC | 0 |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment