Spotpromarkets

Abstract:Spotpromarkets is a broker based in the United Kingdom. It is currently regulated by 3 different institutions, but the regulatory status of this broker is flagged as a "Suspicious Clone" by all the authorities.

Note: The details presented in this review are subject to potential modifications due to the ongoing updates to the company's offerings and policy adjustments. Additionally, the relevance of this review's information may be influenced by the original publication date, as service details and policies may have evolved since that time. Hence, it's crucial for readers to seek out the most current information directly from the company prior to making any decisions or initiating actions based on this review. The responsibility for utilizing the information provided herein lies entirely with the individual reader.

Should there be any discrepancies between visual and written materials in this review, the written information takes precedence. Nonetheless, for a more comprehensive understanding and updated details, accessing the company's official website is highly recommended.

| Spotpromarkets Review Summary | |

| Registered Country/Region | United Kingdom |

| Regulation | CYSEC/FCA/ASIC (Suspicious Clone) |

| Market Instruments | Forex, Spot Metals and CFDs on US and UK Stocks, Spot Indices and Commodities, etc. |

| Services | Forex Trading, Investment Planning, Bitcoin Mining/Transaction |

| Demo Account | Not Mentioned |

| Leverage | 1:50 (Default) |

| Margin Rate | 0% |

| Spread | Not Mentioned |

| Commission | No |

| Trading Platform | Not Mentioned |

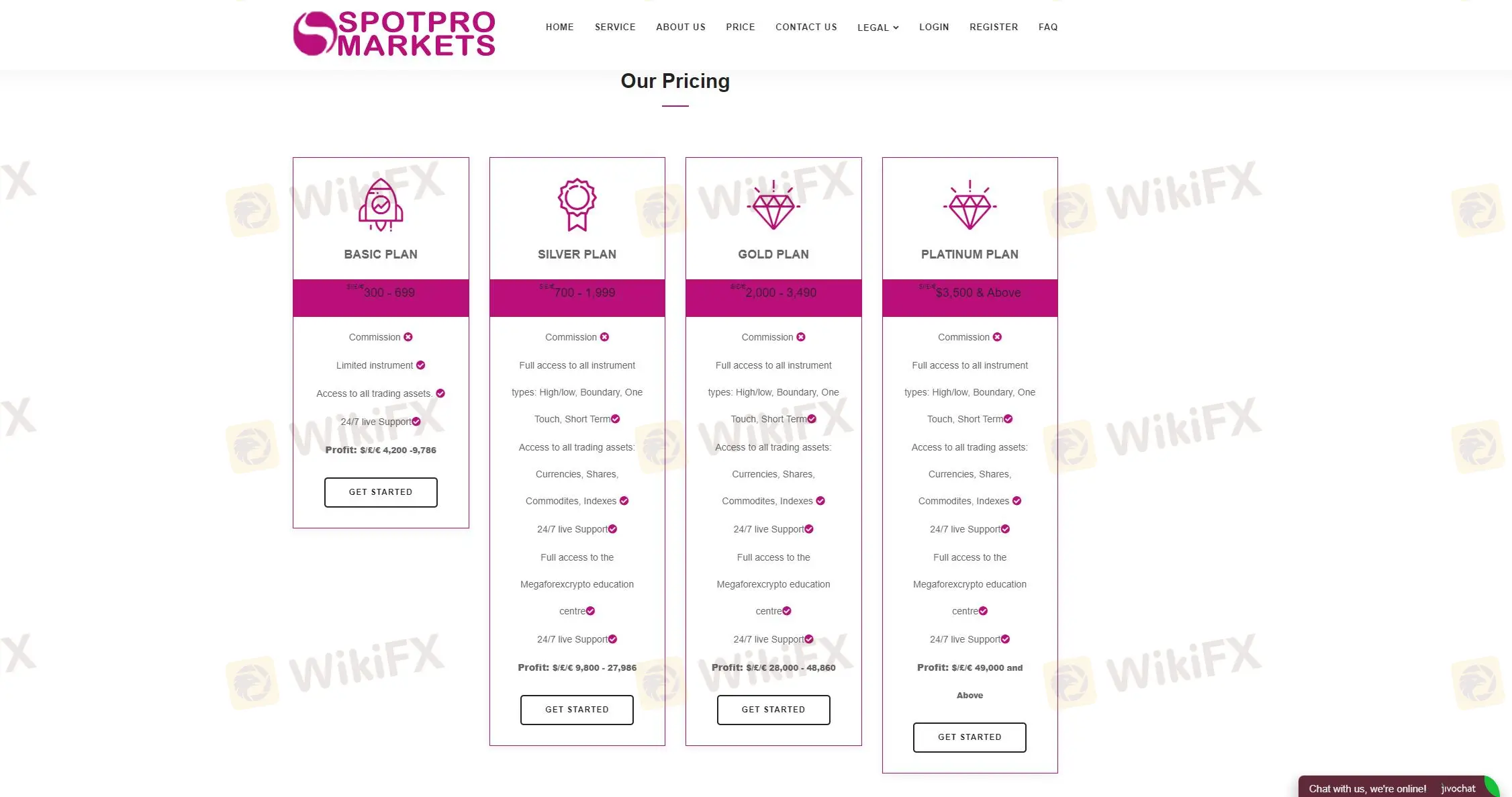

| Minimum Deposit | $/£/€ 300 |

| Customer Support | 24/7 - Live Chat, Email: Support@Spotpromarkets.com, |

| Company Address | 124 City Road, London, United Kingdom, EC1V 2NX |

What is Spotpromarkets?

Spotpromarkets is a broker based in the United Kingdom. It is currently regulated by 3 different institutions, but the regulatory status of this broker is flagged as a “Suspicious Clone” by all the authorities.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

24/7 Customer Support with Live Chat: 24/7 customer support around the clock enables users to receive immediate assistance whenever required.

Zero Margin Rates: The 0% margin rate allows traders to operate without having to set aside additional funds to maintain their positions.

Free Commission: Trading without commission fees reduces the cost per trade, increasing net profits for traders.

Cons:

Suspicious Cloned Regulations: Suspicious cloned regulatory licenses can concern users about its legitimacy and safety.

Is Spotpromarkets Legit?

Regulatory Sight:

Spotpromarkets is flagged as a “Suspicious Clone” by several reputable financial regulatory bodies across different jurisdictions, which presents potential issues with its legitimacy and authenticity. These are the licenses of Spotpromarkets:

Cyprus Securities and Exchange Commission (CySEC)

Current Status: Suspicious Clone

License Type: Market Making (MM)

License No.: 124/10

Financial Conduct Authority (FCA)

Current Status: Suspicious Clone

License Type: Market Making (MM)

License No.: 705428

Australia Securities & Investment Commission (ASIC)

Current Status: Suspicious Clone

License Type: Market Making (MM)

License No.: 443670

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures:

Segregated Accounts: Spotpromarkets uses segregated accounts to manage client funds. In this way, clients' money is kept separate from the company's operational funds. Segregating accounts is a standard practice in the finance industry, designed to protect client assets by ensuring that these funds are not used for any operational expenses or investments by the brokerage.

SSL (Secure Sockets Layer) Security: The platform employs SSL encryption technology to safeguard data transmission, particularly sensitive financial information such as credit card details. SSL encryption ensures that all data transferred between the client's browser and the broker's servers remains private and integral, providing a secure environment for online transactions.

Services

Forex Trading: Spotpromarkets provides access to the forex market, allowing traders to buy and sell currency pairs. Clients can trade major, minor, and exotic currency pairs here.

Investment Planning: The broker offers investment planning services to help clients develop and manage their investment portfolios.

Bitcoin Mining/Transaction: Spotpromarkets also ventures into the cryptocurrency space by offering services related to Bitcoin mining and transactions.

Pricing Plans

Spotpromarkets offers 4 pricing plans for different needs. The more expensive the plan is, the more features and profits it can enjoy. The plans include Basic, Silver, Gold, and Platinum. The minimum deposit required to open a basic plan is $/£/€ 300. Users can choose the pricing plan that suits their capital scale.

Leverage & Margin

Spotpromarkets provides a default leverage of 1:50. This means that traders can control a position up to 50 times their actual invested capital. For example, with an investment of $1,000, a trader can hold a position valued at $50,000. The margin rate at Spotpromarkets is set at 0%. This unusually low margin rate implies that there is no additional percentage required from the traders capital to hold a position, which is atypical because most brokers use the margin rate to ensure that there is adequate capital in the account to sustain potential losses.

Customer Support

Spotpromarkets offers round-the-clock support, so users can get help at any time, regardless of their time zone or trading hours. For real-time assistance, clients can use the live chat feature available on the Spotpromarkets website. Clients can also reach out to the support team via email at Support@Spotpromarkets.com. What's more, Spotpromarkets is headquartered at 124 City Road, London, United Kingdom, EC1V 2NX.

Conclusion

As a broker, Spotpromarkets does not charge any commission and the margin rate it provides is at 0%. However, its regulatory licenses are suspected to be clones. In this case, we do not recommend it to any user.

Frequently Asked Questions (FAQs)

Question: Is Spotpromarkets regulated?

Answer: No, it is not regulated.

Question: Is there any commission charged?

Answer: No, there is not any commission.

Question: What is the margin rate provided by Spotpromarkets?

Answer: The margin rate provided is at 0%.

Question: What is the minimum deposit required to open an account?

Answer: The minimum deposit required is $/£/€ 300.

Question: What is the leverage provided by Spotpromarkets?

Answer: The leverage provided by Spotpromarkets is by default at 1:50.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

Biggest 2025 FX surprise: USD/JPY

NFA Charges Japan’s Forex Wizard and Mitsuaki Kataoka With Delaying Withdrawal Requests

Why Your Entries Are Always Late (And How to Fix It)

【WikiEXPO Global Expert Interviews】Robert Hahm: From Asset Management to AI Innovation

Treasury vs. Fed: Bessent leads Trump's Campaign to Reshape US Monetary Policy

Ceasefire on the Brink: 14 Nations Condemn Israel as Geopolitical Risk Premiums Rise

Ringgit hits five-year high against US dollar in holiday trade

Rate Calc