Unicorn Securities

Abstract:Incorporated in Hong Kong since 2004, Unicorn Securities is regulated by SFC. It is a securities company providing investment products and services such as Stocks, Options, ETFs, Private equity funds, etc. There are also 3 types of accounts for traders to choose from.

| Unicorn SecuritiesReview Summary | |

| Founded | 2004 |

| Registered Country/Region | Hong Kong |

| Regulation | Regulated |

| Market Instruments | StocksOptionsETFPrivate equity funds |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Min Deposit | No limit |

| Customer Support | Phone: +852-3421-1271+852-2156-7907 |

| Email: chankarlun@gmail.com | |

| Physical Address: Room 503, General Commercial Building, 156-164 Des Voeux Road Central, Central, Hong Kong | |

Unicorn Securities Information

Incorporated in Hong Kong since 2004, Unicorn Securities is regulated by SFC. It is a securities company providing investment products and services such as Stocks, Options, ETFs, Private equity funds, etc. There are also 3 types of accounts for traders to choose from.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | No trading platform is provided |

| No deposit and withdrawal method information |

Is Unicorn Securities Legit?

| Regulated Country/Region |  |

| Regulated Authority | SFC |

| Regulated Entity | Unicorn Securities Company Limited |

| License Type | Dealing in futures contracts |

| License Number | ACD947 |

| Current Status | Regulated |

What Can I Trade on Unicorn Securities?

Unicorn Securities offers investment products including stocks, options, ETF and private equity funds.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Options | ✔ |

| ETF | ✔ |

| Private equity funds | ✔ |

| Forex | ❌ |

| Precious metals & Commodities | ❌ |

| Indices | ❌ |

| Bonds | ❌ |

Account Types

There are 3 Account types at Unicorn Securities: Cash Account, Reg T Margin Account and Portfolio Margin Account.

The cash account has no limit on the deposit threshold; Reg T margin account deposit requirements are $2000 to $25,000; A portfolio margin account requires more than $25,000.

Unicorn Securities adopts the electronic account opening method. You need to prepare your ID card and address proof as account opening materials.

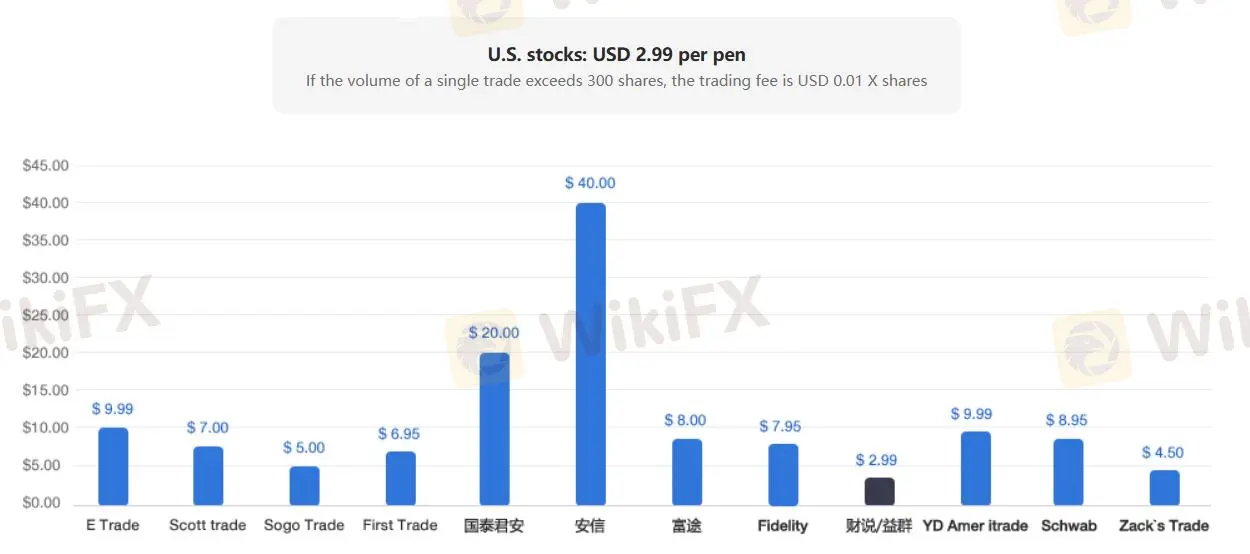

Unicorn Securities Fees

Unicorn Securities charges $2.99 per trade for US stocks. For a single trade of more than 300 shares, the fee is $0.01 times the number of shares;

HKD 30.00 per transaction, the single transaction fee is the transaction amount multiplied by 0.1%, the minimum amount is HKD30, in addition, the Hong Kong government charges the transaction amount multiplied by 0.1097% stamp duty and handling fee.

Read more

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Failing to transfer funds into or out of your Moneycorp trading account? Have you faced a sudden account closure by a United Kingdom-based forex broker? Has the broker’s customer support service failed to resolve your queries? Did their behavior remain far from good while addressing your queries? You are not alone! Many traders have questioned such alleged trading practices by the broker. In this Moneycorp review article, we have highlighted some of their complaints. Read on!

Saracen Markets Review: Regulated or Scam Alert?

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

FXRoad Exposure Review: Withdrawal & Safety Risks Explained

FXRoad exposure review: withdrawal red flags, offshore status, and safety risks explained. Learn what to watch for and how to protect your funds—read now.

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

When people who invest ask, "Is Arena Capitals safe or a scam?" the proof shows we need to be very careful. This broker works without proper rules from top financial authorities, gets very low safety scores from independent financial watchdogs, and many users have serious complaints about them. The information available to everyone suggests that giving your capital to this company could lead to losing it all. This analysis doesn't guess - it looks at these important warning signs. We will look at real facts, study actual user reviews that show big problems with taking out funds, and give a clear answer based on evidence about whether Arena Capitals can be trusted. This article gives you the facts you need to make a smart choice and keep your funds safe from an unregulated, high-risk business.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc