Prochoice

Abstract:Prochoice started in 2009 and is situated in Cyprus. The Cyprus Securities and Exchange Commission (CySEC) has given this investment firm a license. The company is a member of the Cyprus Stock Exchange (CSE) and a remote member of the Athens Stock Exchange (ASE), offering services such as trading in forex, commodities, indices, CFDs, and local/regional equities.

| Prochoice Review Summary | |

| Founded | 2009 |

| Registered Country | Cyprus |

| Regulation | CySEC |

| Market Instruments | Forex, Commodities, Indices, CSE, ASE, Shares |

| Demo Account | / |

| Leverge | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Tel: +357 24661192 |

| Fax: +357 24662464 | |

| Email: backoffice@pro-choice.com.cy | |

| Social Media: LinkedIn, Facebook, X | |

| Address: Ariadnis 21, Patsias Court 25, 2nd Floor, Office 202, 7060 Livadia, Larnaca, Cyprus | |

Prochoice Information

Prochoice started in 2009 and is situated in Cyprus. The Cyprus Securities and Exchange Commission (CySEC) has given this investment firm a license. The company is a member of the Cyprus Stock Exchange (CSE) and a remote member of the Athens Stock Exchange (ASE), offering services such as trading in forex, commodities, indices, CFDs, and local/regional equities.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | No information on trading details |

| Offers diversified products | Commission fees charged |

| Various contact channels | |

| Long operation history |

Is Prochoice Legit?

Yes, Prochoice is a regulated broker with a license number of 100/09 from the Cyprus Securities and Exchange Commission (CySEC).

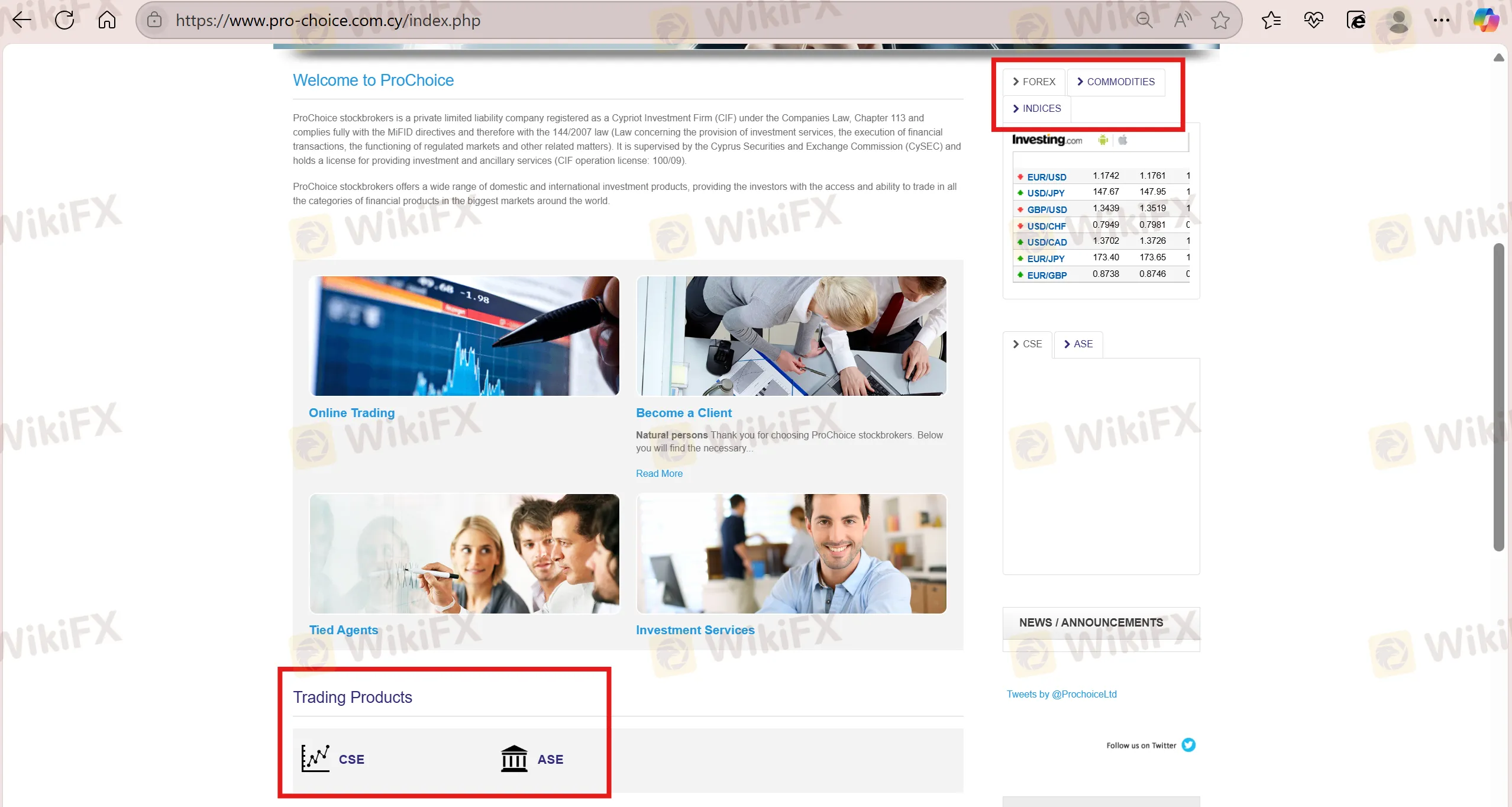

What Can I Trade on Prochoice?

Prochoice lets you trade fForex, commodities, indices, and CFDs, as well as invest directly in the Cyprus Stock Exchange (CSE) and the Athens Stock Exchange (ASE).

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| CSE | ✔ |

| ASE | ✔ |

| Shares | ✔ |

| ETFs | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

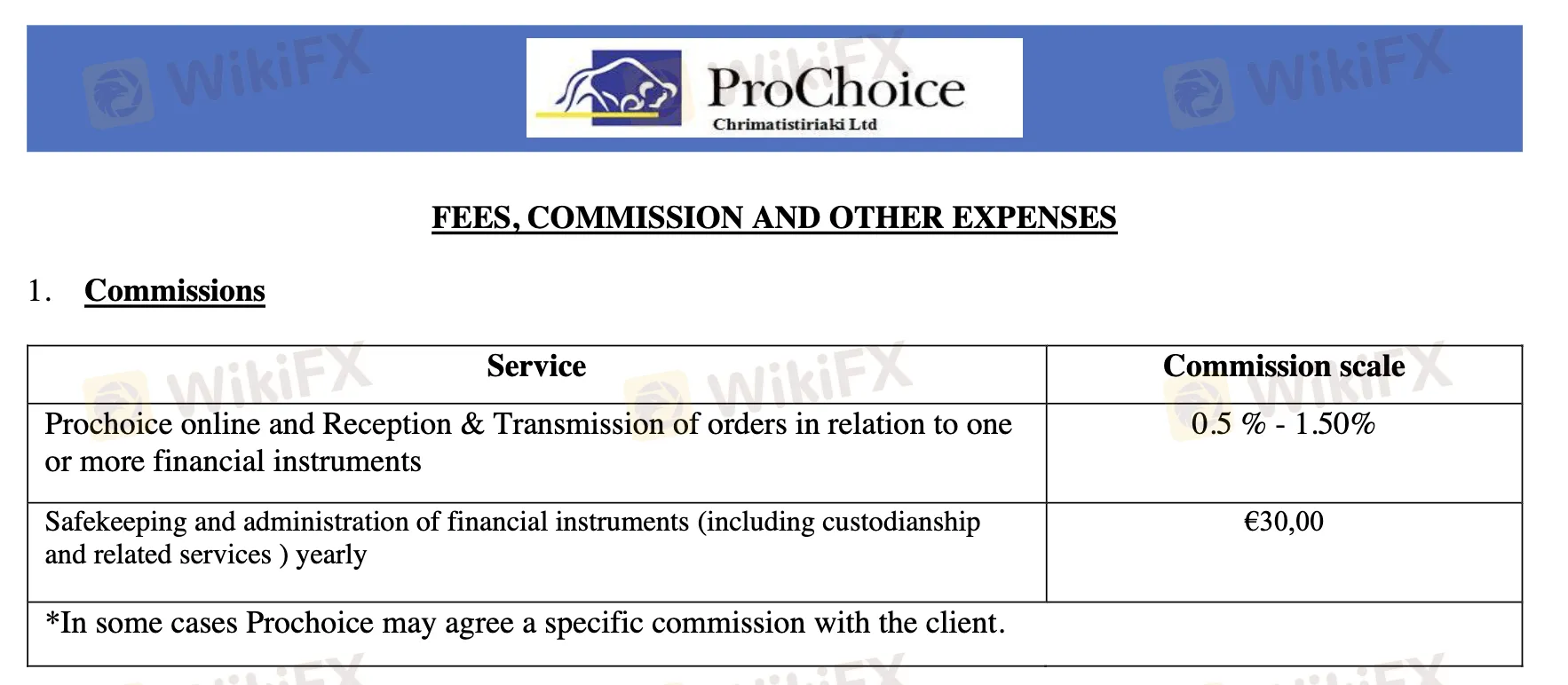

Prochoice Fees

Prochoice has set fees for trading and account services that are the same for everyone. Even though trading commissions and safekeeping costs are normal for the sector, some administrative fees (such handling documents or getting legal certification) may make the total cost higher, especially for less active clients.

| Fee Type | Details |

| Trading Commission (CSE/ASE) | 0.5% – 1.5% per order |

| Minimum Commission | €2.00 per transaction |

| Safekeeping Fee | €30.00 per year |

| CSE Transaction Fee | 0.0325% of value |

| ASE Sales Tax | 0.1% on sell orders |

| Account Opening Fee | €10.00 |

| Legal Document Certification | €20.00 per document |

| LEI Issuance (Legal Entity ID) | €100.00 |

| Transfer to Another Broker | €50.00 per transfer |

| Dormant Account Fee | Not specified |

Read more

NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

Is NaFa Markets Legit? A Complete Investigation

Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, "Is NaFa Markets legit?", the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

WikiFX Broker

Rate Calc