Italy's CONSOB Blocks Five Unauthorized Investment Sites

Abstract:Italy's CONSOB has ordered the blocking of five investment websites for operating without authorization.

Recently, the Italian Companies and Exchange Commission (CONSOB) ordered the suspension of five investment websites that were operating without the necessary permits, stepping up its assault on unlawful financial activity. The “Decreto crescita,” also known as the “Growth Decree” (Law no. 58 of June 28, 2019, Article no. 36, paragraph 2-tendencies), which gives CONSOB the authority to order Internet service providers to impose restrictions on access from Italy to specific websites that provide financial services without authorization, is the basis for this action.

Affected websites include “Sigma Capital” (https://sigmacap.co), “Capitalpartners24” (https://capitalpartners24.eu), “Bcs-gm” (https://bcs-gm.com and related page https://my.bcs-gm.com), “SEGUROFX” (https://segurofx.com and related page https://my.segurofx.com), and “Mestieriplaza” (website www.mestieriplaza.com).

Italian customers may no longer access these websites as part of a continuous effort to protect investors from potentially fraudulent financial schemes.

The Growth Decree gave CONSOB the authority to impose these blockades in July 2019, and since then, the regulator has been successful in blocking off 1084 websites. This latest move comes only a week after the initiative last week, in which four other sites of a similar kind were also taken down.

Due to technological difficulties Internet service providers are facing, banning these websites is a complicated procedure that may take many days to complete. Once in place, however, the block essentially prevents access to these websites from inside Italy.

Investors are advised by CONSOB to proceed with extreme care and to use common sense when making financial choices. The regulatory body underscored the need of confirming the legal authorization of financial service providers and the publication of a prospectus for offers of financial products. These steps are essential for protecting investors' cash from dishonest companies operating online without permission from the authorities.

Related broker

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

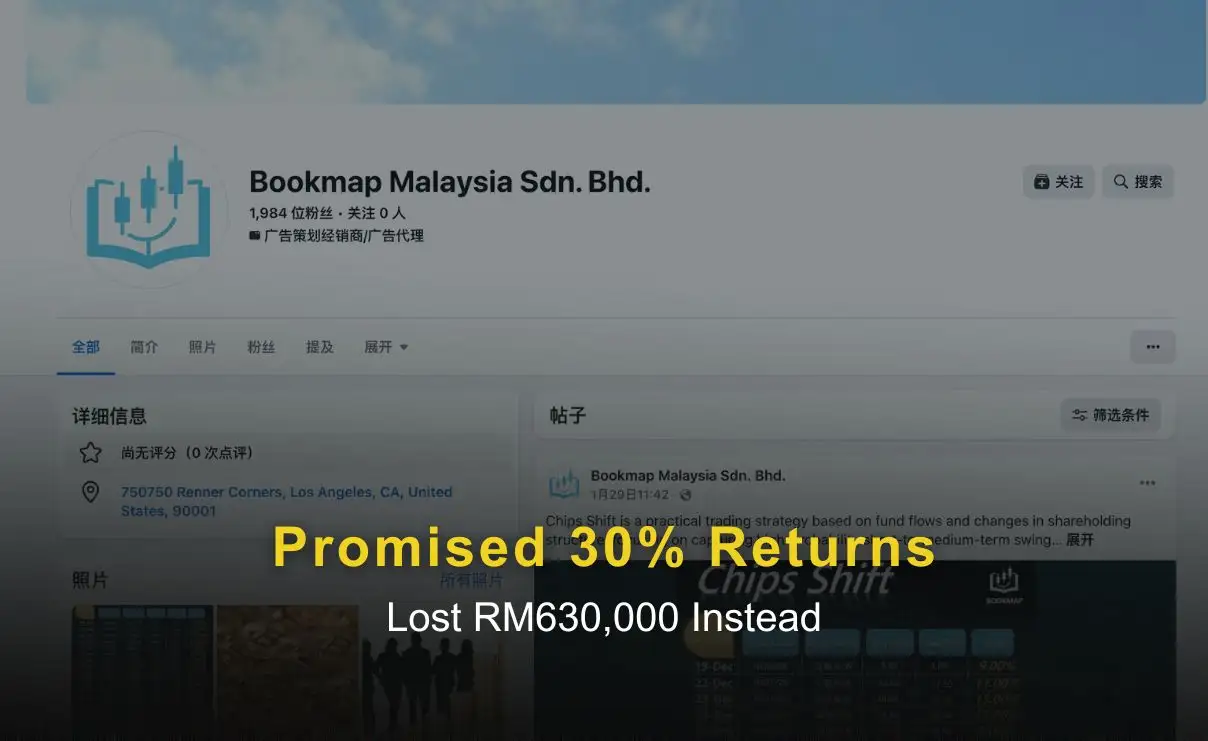

Promised 30% Returns, Lost RM630,000 Instead

A 57-year-old man in Kuantan lost over RM630,000 after being lured by a Facebook investment advertisement and directed to a fake trading app that displayed fabricated profits. The scam unraveled when withdrawal attempts triggered excuses and demands for additional fees, highlighting the risks of high-return promises and unverified platforms.

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

An in-depth look at a scalable fraud method in the forex sector, built on reusing the same website structure under different brand names.

Fidelity Exposure: Examining the Latest User Reviews on Withdrawal Denials & Trade Manipulation

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

WikiFX Broker

Latest News

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Promised 30% Returns, Lost RM630,000 Instead

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc