WikiFX Broker Assessment Series | Is ZFX Reliable?

Abstract: In this article, we will look in-depth at ZFX, examining its key features.

In this article, we will look in-depth at ZFX, examining its key features.

About ZFX

Name: ZFX

Registered Country: /Region: United Kingdom

Website: www.zealmarkets.com

Phone: +44(0)2071579968;

Address: No. 1 Royal Exchange, London, EC3V 3DG, United Kingdom; Office 1, Unit 3, 1st Floor, Dekk Complex, Plaisance, Mahe, Seychelles; Suite C, Orion Mall, Palm Street, Victoria, Mahe, Seychelles

Email: support@zfx.co.uk; cs@zfx.com

In an era of advancing technology and prevailing investment trends, many individuals have turned to using their smartphones for the stock market, futures, and forex trading. Consequently, they encounter a crucial question: “How to choose a broker?” As a result, they often seek advice from platforms like Forex Scam Alert. Given the recent influx of inquiries regarding ZFX Mountain and Sea Securities, today we will share insights on how to evaluate this platform.

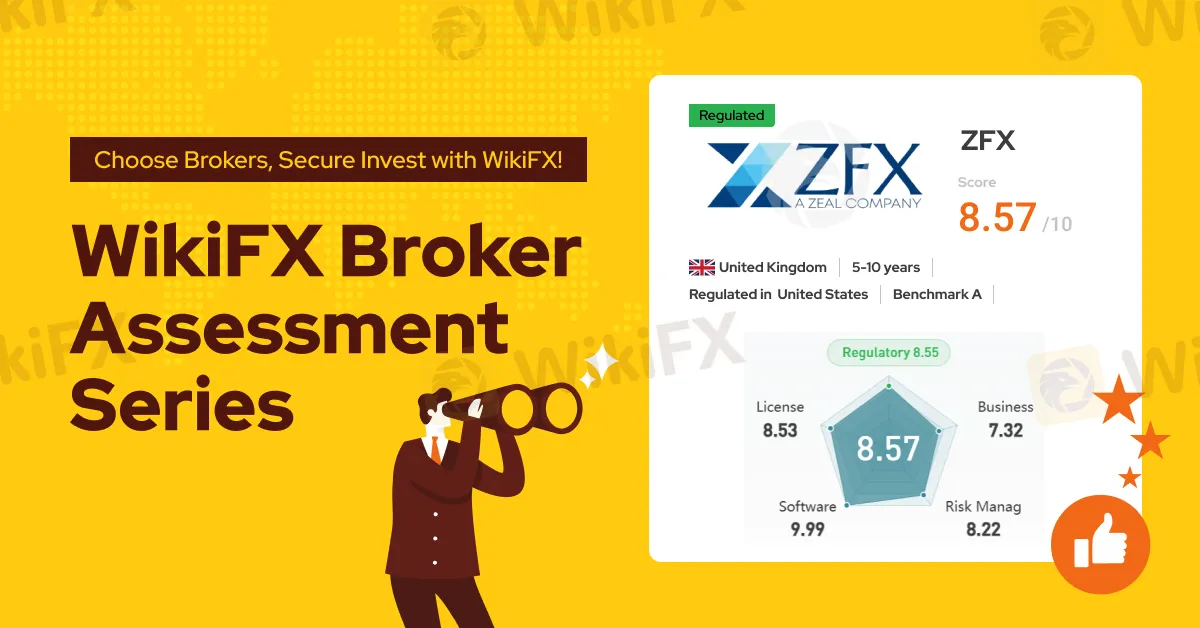

A search on WikiFX reveals that ZFX, a forex broker established for 5-10 years, employs the main trading software MT4/MT5. It holds a direct license from the UK's Financial Conduct Authority (FCA) and is regulated by the Seychelles Financial Services Authority (FSA) offshore. Additionally, it offers a “100% official intervention for complaints” service. WikiFX gives this broker a favorable score of 8.57/10.

Currently, ZFX offers three types of accounts for investors to choose from ECN, standard STP, and micro. The micro account has a minimum deposit limit of $50, a maximum leverage of 1:2000, and a minimum spread of 1.5. Both ECN and standard STP accounts have a maximum leverage of 1:500, with minimum spreads of 0.2 and 1.3 respectively, and require minimum deposits of $1000 and $200. All accounts support EA services.

ZFX's trading environment has an overall rating of AA, ranking 39th out of 130 brokers. Trading speed and costs are rated as A, while overnight costs and software disconnection are rated as AA, with the average disconnection frequency being deemed perfect.

On-Field Survey

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

WikiFX did make an on-site survey on ZFX in May 2022 and successfully found their office.

Conclusion

Based on the above findings, ZFX, regulated by the UK's FCA, demonstrates a strong performance in its trading environment, making it a high-quality broker. Investors can decide whether to use it based on their circumstances. If you still want to learn about other brokers, consider using the “Broker Inquiry” feature on the WikiFX app to confirm relevant regulatory information, trading environments, and ratings, helping you find the ideal platform for your needs.

Read more

Vonway Review: A Series of Unfair Account Suspension & Withdrawal Denial Complaints

Have made substantial profits through Vonway, but could not withdraw? Initiated the Vonway withdrawal request, but the same was denied on the grounds of hedging violation? Were your trade orders executed at an unfair price? Have you faced a trading account suspension by the broker without any explanation? These have allegedly become regular for many traders here. In this Vonway review article, we have shared a list of the top complaints against the forex broker.

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Attracted to Advanced Markets for the expert-led copy trading experience? Did you earn profits from the copy trade executed by the expert hired by the forex broker? But did the broker question some trades even though you paid the performance fee to the expert? Is the trade order execution time too slow at Advanced Markets? Do you witness high slippage issues? You are not alone! Many traders have shared these concerns online. In this Advanced Markets review article, we have described some complaints. Take a look!

Is WisunoFX Safe? An Unbiased 2025 Assessment of Platform Risks and Red Flags

Is WisunoFX a safe broker for your money? The answer is not simple. After looking at everything carefully, the platform gets a score of 7.21 out of 10. This means it has both good points and serious risks. For traders who want to research before investing, WisunoFX has two sides: it offers good trading conditions, but it also has some structural and regulatory issues that need careful thought. The broker has been operating for 5-10 years and has built up a presence in the market. However, it's officially labeled as a "Medium potential risk" platform, which cannot be ignored. Before investing, it's important to compare its good points with its bad ones.

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

When evaluating any trading company, it is essential to conduct a thorough WisunoFX regulation check first. This broker operates under two distinct sets of rules, which you must understand carefully. First, it has a license from the Cyprus Securities and Exchange Commission (CySEC), which is a trusted European regulator. Second, it has another license from the Financial Services Authority (FSA) in Seychelles, which is located offshore. These two licenses don't give traders the same level of protection. The CySEC license means the broker must follow strict European Union financial rules, while the FSA license has much less supervision. This guide will explain what each license means to traders, look at the company structure behind the brand, and examine the safety factors every potential client should think about.

WikiFX Broker

Latest News

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

9X Markets Review: Is It Reliable?

IQ Option Review: Real User Experiences

Bessent to propose major overhaul of regulatory body created from financial crisis

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

The case for more Fed rate cuts could rest on a 'systematic overcount' of jobs numbers

Rate Calc