Pro FX Capital

Abstract:Founded in 2015 and based in the UK, Pro FX Capital is a growing force in the online forex trading market. It offers trading opportunities in Forex, commodities, and stocks, targeting a broad spectrum of traders with its array of account types such as Standard, Premium, and VIP. Pro FX Capital is distinguished by its high leverage of up to 1:500 and an accessible entry threshold with a $250 minimum deposit. It operates on the MetaTrader 4 platform, known for its ease of use and advanced features. However, its unregulated nature could be a cause for concern regarding the safety of client funds and the fairness of trading operations. Furthermore, the broker's restricted deposit and withdrawal methods, compulsory inactivity fees, and commissions for all account types, alongside a shortfall in educational materials.

| Aspects | Information |

| Company Name | Pro FX Options Ltd. |

| Registered Country/Area | United Kingdom |

| Founded Year | 2015 |

| Regulation | No Regulation |

| Tradable Assets | Forex, Commodities, Stocks |

| Account Types | Standard, Premium, VIP |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:500 |

| Spreads | From 0.5 pips |

| Trading Platforms | MetaTrader 4 |

| Demo Account | Available |

| Customer Support | Email: hello@profx.capital, Phone: +44 (0) 20 8150 6218 |

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Cards |

| Educational Resources | No Educational Resources |

Overview of Pro FX Capital

Established in 2015 and headquartered in the UK, Pro FX Capital has rapidly emerged as a significant entity in the online forex trading industry. It appeals to a broad range of traders by offering assets like Forex, commodities, and stocks. The broker's various account options, which include Standard, Premium, and VIP accounts, are tailored to accommodate both beginners and seasoned traders. With a minimum deposit of $250, Pro FX Capital provides considerable leverage up to 1:500 and attractive spreads starting from 0.5 pips.

Pro FX Capital's choice of the MetaTrader 4 platform aligns with industry standards, offering a blend of user-friendliness and advanced functionalities. The provision of a demo account is a thoughtful addition, particularly beneficial for new traders. Customer support is accessible through email and phone, ensuring a responsive user experience. A critical aspect for potential clients to consider is the lack of regulatory oversight at Pro FX Capital, which adds a layer of risk to trading engagements.

Pros and Cons

Pro FX Capital presents an array of features that might appeal to traders, such as the opportunity for ambitious trading through competitive leverage and a minimum deposit requirement that is easy to meet. The availability of a demo account, the option to select from various base currencies for accounts, and the ability to trade essential commodities are additional aspects that may entice traders. On the flip side, the absence of regulatory oversight is a significant concern, highlighting potential risks to capital security and the legitimacy of trade executions. The restricted regulatory protection offers insufficient defense against the unpredictability of the market and the possibility of the broker's financial failure. The brokerage's limited options for deposits and withdrawals could pose an inconvenience for traders desiring more fluidity in managing their funds. A dearth of educational materials could leave new traders in search of direction and learning opportunities. Policies that impose inactivity fees and commissions across all account types have the potential to diminish traders' returns. In addition, the constrained avenues for customer support leads to prolonged resolution times for concerns and inquiries, which could affect the quality of the trading experience.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Is Pro FX Capital legit or a scam?

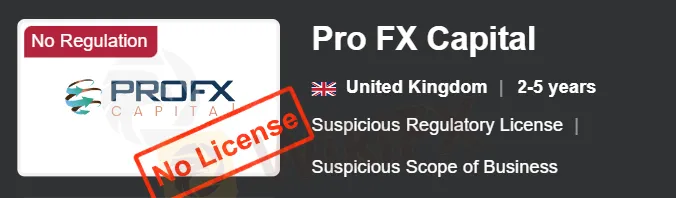

Pro FX Capital is an unregulated brokerage, which implies notable risks for traders. The absence of oversight by any established financial regulatory body means there's no guarantee of compliance with standard industry norms concerning financial soundness, security, clarity in operations, and equitable trading practices. This unregulated nature could pose risks including fund security, trade execution integrity, and the broker's overall reliability. Lack of regulation equates to reduced safeguards against malpractices and potential financial losses.

Market Instruments

Pro FX Capital presents a well-rounded selection of market instruments, encompassing multiple asset classes to suit a wide range of trading preferences:

Forex: The broker offers access to a broad spectrum of currency pairs in the Forex market, including major, minor, and exotic pairs, appealing to traders with different strategies and risk appetites.

Commodities: Commodities trading with Pro FX Capital features key commodities like gold, silver, oil, and natural gas, allowing traders to speculate on their price fluctuations driven by global economic trends.

Stocks: The broker facilitates trading in stocks of leading global companies, offering traders opportunities to engage with the dynamic stock market and capitalize on the movements in company share prices.

Account Types

Pro FX Capital offers a range of account types to satisfy different trading needs and preferences:

Standard Account: This account requires a minimum deposit of $250 and offers a maximum leverage of 1:500. The spreads begin at 1.7 pips, and the commission charged is $10 per lot traded. It's a good choice for beginners or those new to forex trading, as it offers basic features and tools.

Premium Account: With a minimum deposit of $500, the Premium Account also provides a maximum leverage of 1:500. Spreads are tighter, starting at 1.2 pips, and the commission is reduced to $6 per lot traded. This account is better suited for more experienced traders who can take advantage of the tighter spreads and lower commissions.

VIP Account: This is created for professional traders and requires a substantial minimum deposit of $8,000. It maintains the maximum leverage of 1:500. The VIP account offers the lowest spreads, starting at just 0.5 pips, and the commission is further reduced to $3 per lot traded. It's ideal for traders with significant trading volumes seeking the lowest spreads and commissions.

In addition to these, Pro FX Capital also provides a Demo Account that allows traders to practice strategies and get familiar with the platform without any financial risk.

| Category | Standard Account | Premium Account | VIP Account |

| Minimum Deposit | $250 | $500 | $8,000 |

| Maximum Leverage | 1:500 | 1:500 | 1:500 |

| Spreads | Starts at 1.7 pips | Starts at 1.2 pips | Starts at 0.5 pips |

| Commission | $10 per lot | $6 per lot | $3 per lot |

| Suited For | Beginners/New to forex | Experienced traders | Professional traders with high volumes |

How to Open an Account with Pro FX Capital?

To open an account with Pro FX Capital, follow these steps:

Visit the Broker's Website: Navigate to Pro FX Capital's website and click on the 'Register' button.

Fill Out the Registration Form: Provide your personal details, including full name, email address, phone number, and country of residence. Create a unique username and password.

Email Verification: After submitting the registration form, verify your email by clicking on the link sent to your inbox.

Complete Account Verification: Provide additional information for verification, such as ID and proof of address.

Fund Your Account: Once verified, fund your account with the required minimum deposit using your preferred payment method (bank transfers, credit/debit cards, or e-wallets).

Start Trading: Log into the Pro FX Capital trading platform with your credentials. If new to trading, try to practice on the demo account first.

Leverage

Pro FX Capital provides a diversified leverage structure, appealing to various trading needs. The maximum leverage offered is 1:500, available across different account types. This high degree of leverage is particularly appealing to professional traders and scalpers but comes with a note of caution owing to the increased risk of significant losses, especially for less experienced traders.

Spreads & Commissions

Pro FX Capital provides various options in spreads and commissions to suit various trading needs. The brokerage structures its fees as follows:

Standard Account: Features spreads from 1.7 pips and charges a commission of $10 per lot.

Premium Account: Offers tighter spreads beginning at 1.2 pips, with a reduced commission of $6 per lot.

VIP Account: Built for high-volume traders, this account offers ultra-low spreads starting at 0.5 pips and a minimal commission of $3 per lot.

This tiered approach allows traders to select an account that aligns with their trading strategy and volume, ensuring a cost-effective trading experience.

Other Fees

Pro FX Capital incorporates several non-trading fees:

Swap Rates: These fees apply to positions held overnight, varying based on the specific currency pair and the direction of the trade.

Inactivity Charges: Accounts not showing any trading activity over an extended period are subject to a monthly inactivity fee, reducing the account balance.

Fees on Transactions: Both deposit and withdrawal transactions incur certain fees, which are dependent on the chosen transaction method, including bank transfers and card payments.

Trading Platform

Pro FX Capital utilizes the widely acclaimed MetaTrader 4 platform, known for its:

Ease of Use: MT4's interface is constructed to be intuitive, attending to both novice and seasoned traders.

Chart Customization: The platform offers extensive options for chart customization, along with a comprehensive set of technical indicators and drawing tools for thorough market analysis.

Expert Advisors (EAs): MT4 supports automated trading strategies, allowing traders to automate their trading processes using EAs.

Cross-Device Trading: MT4 is available on desktop, mobile, and tablet devices, offering flexibility and convenience for trading on-the-go.

Robust Trading Tools: The platform includes essential trading tools like real-time news updates, an economic calendar, and distinctive order types, enhancing the trading experience.

Deposit & Withdrawal

For Pro FX Capital, the deposit and withdrawal system is intended to provide convenience and flexibility to its clients. The broker offers a range of deposit methods, including bank transfers and credit/debit card transactions. These methods satisfy to a wide range of client preferences and provide various options for funding trading accounts.

Additionally, the broker is expected to ensure fast and efficient processing times for both deposits and withdrawals, typically within one business day. The security of transactions is a priority, with advanced encryption technology likely used to protect sensitive financial information.

Customer Support

Pro FX Capital provides customer support primarily through email and phone. Clients can reach the support team via email at hello@profx.capital or by phone at +44 (0) 20 8150 6218. This approach ensures a direct line of communication for clients seeking assistance with their trading accounts, platforms, or any other service-related queries.

Conclusion

Pro FX Capital, a UK-based entity founded in 2015, provides a variety of trading opportunities in Forex, commodities, and stocks, appealing to different traders with its range of account types. The broker's advantages include its high leverage up to 1:500, an accessible minimum deposit requirement of $250, and the provision of a demo account for practice. It also leverages the widely-used MetaTrader 4 platform, ensuring a balance between ease of use and advanced features.

Conversely, the lack of regulatory oversight at Pro FX Capital is a prominent issue, introducing risks related to fund security and fair trade practices. This concern is compounded by limited methods for fund deposits and withdrawals and a scarcity of educational materials. Additionally, the broker's policy of imposing inactivity fees and uniform commissions across account types may not align with the cost-efficiency expectations of some traders.

FAQs

Q: What trading opportunities does Pro FX Capital provide?

A: Pro FX Capital offers trading in Forex, commodities, and stocks, accommodating a range of trading styles and preferences.

Q: What are the different account options at Pro FX Capital?

A: The broker offers Standard, Premium, and VIP accounts, each tailored to different trading experiences and investment sizes.

Q: What's the required initial deposit for Pro FX Capital?

A: To start trading with Pro FX Capital, a minimum deposit of $250 is required for a Standard account.

Q: Is there a practice trading option available at Pro FX Capital?

A: Yes, Pro FX Capital offers a demo account for risk-free practice and strategy development.

Q: Which platform is used for trading at Pro FX Capital?

A: Trading at Pro FX Capital is conducted on the MetaTrader 4 platform, recognized for its ease of use and comprehensive features.

Q: What is the highest leverage available at Pro FX Capital?

A: The broker provides a high leverage option of up to 1:500, suitable for various trading strategies but with a note of caution as a result of potential risks.

Q: How can support be contacted at Pro FX Capital?

A: The support team at Pro FX Capital is accessible via email at hello@profx.capital and phone at +44 (0) 20 8150 6218.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. Readers are strongly advised to verify updated details directly with the company before making any decisions, as the responsibility for utilizing the information herein rests solely with the reader.

Read more

Seaprimecapitals Withdrawal Problems: A Complete Guide to Risks and User Experiences

Worries about Seaprimecapitals withdrawal problems and possible Seaprimecapitals withdrawal delay are important for any trader. Being able to get your money quickly and reliably is the foundation of trust between a trader and their broker. When questions come up about this basic process, it's important to look into what's causing them. This guide will tackle these concerns head-on, giving you a clear, fact-based look at Seaprimecapitals' withdrawal processes, user experiences, and trading conditions. Most importantly, we'll connect these real-world issues to the single most important factor behind them: whether the broker is properly regulated. Understanding this connection is key to figuring out the real risk to your capital and making a smart decision.

iFX Brokers Review: Do Traders Face Withdrawal Issues, Deposit Credit Failures & Free Coupon Mess?

Have you had to pay several fees at iFX Brokers? Had your trading profit been transferred to a scamming website, causing you losses? Failed to receive withdrawals from your iFX Brokers trading account? Has your deposit failed to reflect in your trading account? Got deceived in the name of a free coupon? Did the broker officials not help you in resolving your queries? Your problems resonate with many of your fellow traders at iFX Brokers. In this iFX Brokers review article, we have explained these problems and attached traders’ screenshots. Read on!

NinjaTrader Exposed: Why Traders are Calling Out NinjaTrader’s Lifetime Plan & Chart Data

Did NinjaTrader onboard you in the name of the Lifetime Plan, but its ordinary customer service left you in a poor trading state? Do you witness price chart-related discrepancies on the NinjaTrader app? Did you have to go through numerous identity and address proof checks for account approval? These problems occupy much of the NinjaTrader review online. In this article, we have discussed these through complaint screenshots. Take a look!

Questrade Review Pros, Cons and Regulation

Is Questrade legit? Yes—CIRO regulated broker offering stocks, ETFs, forex, CFDs, bonds, and more with low fees and modern platforms.

WikiFX Broker

Latest News

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Interactive Brokers Expands Access to Taipei Exchange

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

eToro Cash ISA Launch Shakes UK Savings Market

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

Rate Calc