Alert: OspreyFX Unexpected Account Locked & Server Issues

Abstract:Beware of the challenges faced by OspreyFX users, including account lockouts, login issues, and withdrawal limits, in this insightful article. Learn about the risks of unregulated online trading platforms and discover key steps for safe trading.

Introduction

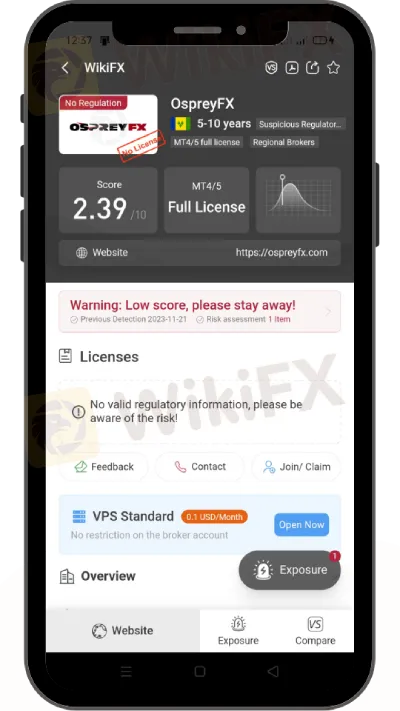

In today's fast-paced financial world, the stability and reliability of online trading platforms are of paramount importance. OspreyFX, an Electronic Communication Network (ECN) broker, has recently come under public scrutiny. Based initially in Saint Vincent and the Grenadines, a locale not known for stringent financial regulations, OspreyFX operates without the oversight typical of regulated entities. This article aims to shed light on the issues arising on social media platforms, particularly Twitter, regarding OspreyFX's practices.

Understanding OspreyFX

OspreyFX offers traders access to various financial markets through its online platform. The lack of regulatory oversight, however, poses significant risks to its users. These include potential data breaches, unfair trading practices, and operational inconsistencies.

Emerging Issues

The concerns raised by OspreyFX users on social media platforms are varied and serious:

Unexpected Account Lockouts: Traders report unannounced and inexplicable blockages in accessing their accounts, leading to significant distress and financial uncertainty.

Login Challenges: Instances of users being unable to log into their accounts disrupt trading activities and raise questions about the platform's reliability.

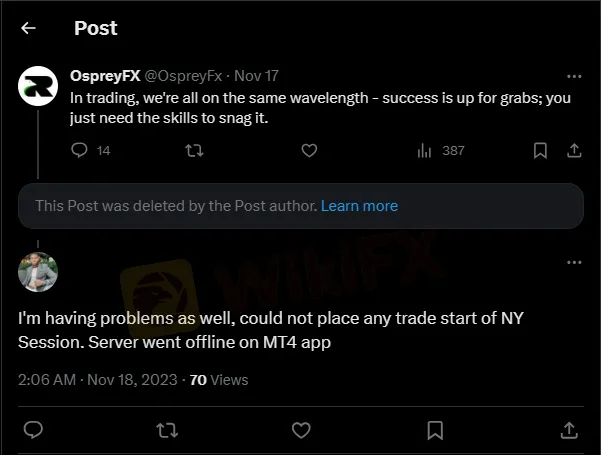

Server Instability: Frequent technical issues and server downtimes have hindered the trading experience, leading to potential financial losses.

Unauthorized Account Migration: Accounts being moved to trade lockers without user consent or prior notification have caused confusion and mistrust among users.

Withdrawal Caps: Restrictions on the amount of funds that can be withdrawn have raised serious concerns about liquidity and financial control.

Images shown below were posted by OspreyFX traders who had experienced such issues.

Image #1

Image #2

Image #3

Image #4

The Risks of Unregulated Trading

The issues with OspreyFX exemplify the broader risks associated with unregulated online trading platforms. These risks include:

Operational Risks: Without regulatory oversight, operational processes can be inconsistent, leading to issues like those currently faced by OspreyFX users.

Financial Security: The lack of regulation raises questions about the safety of funds and the integrity of financial transactions.

Data Privacy: In the absence of regulatory compliance, there's an increased risk of data breaches and misuse of personal information.

Safe Trading Practices

To navigate the complex world of online trading safely, traders should:

Conduct Thorough Research: Before engaging with any trading platform, it's crucial to investigate its regulatory status and reputation.

Read Terms and Conditions Carefully: Understanding the fine print can prevent unexpected issues like unauthorized account changes or withdrawal limits.

Use Secure Connections: Accessing trading accounts through secure, private networks is essential for protecting sensitive information.

Maintain Detailed Records: Keeping comprehensive records of all trading activities and communications can provide crucial evidence in case of disputes.

OspreyFX Responsibilities

In response to these issues, it's imperative for OspreyFX to take immediate and transparent action. Addressing user concerns, improving operational reliability, and enhancing communication channels should be top priorities.

The general public must be informed of the complexities of Internet trading, particularly the hazards associated with unregulated platforms. This understanding is critical for making educated judgments and protecting one's financial interests.

Conclusion

The challenges faced by OspreyFX users serve as a reminder of the importance of due diligence in the online trading sector. Understanding and mitigating the risks associated with unregulated platforms are crucial for a secure trading experience. This press release serves not only to inform about the specific issues with OspreyFX but also to educate the public about the broader risks in the online trading world.

Read more

WikiFX Trending Topics Analyst Initiative

Share Your Expertise on What’s Moving the Market.

Aximtrade Exposure: Growing Allegations of Withdrawal Denials by Traders

Is your Aximtrade withdrawal application pending for months despite everything right from your end? Even after months, do you still see the withdrawal application under review while logging in to the trading platform? Or does the broker official tell you that the withdrawal is approved, but give you the excuse of the payment provider’s unavailability? These issues have allegedly become the norm at Aximtrade, a Saint Vincent and the Grenadines-based forex broker. In this Aximtrade review article, we have highlighted numerous complaints that need your attention.

Big Boss Review: Examining Withdrawal Denials & Profitable Record Deletion Claims

Did you fail to receive profits from Big Boss, a Comoros-based forex broker? Did the broker delete your profitable forex transactions so that you cannot withdraw your gains? Did you face an account freeze after making profits on the trading platform? These are some allegations we found while investigating the broker. In this Big Boss review article, we have shared some complaints traders have made against the company. Take a look!

ICM Broker Review: Scams & Alerts Exposed

Uncover ICM Broker scams and alerts: deposit delays, withdrawal blocks, and trader complaints despite regulation. WikiFX App reveals risks to help you trade more safely.

WikiFX Broker

Latest News

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Is The US Dollar About to Crash?

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

Rate Calc