User Reviews

More

User comment

5

CommentsWrite a review

2024-02-29 19:48

2024-02-29 19:48 2023-02-22 09:51

2023-02-22 09:51

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index0.00

Business Index7.49

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Osprey Limited

Company Abbreviation

OspreyFX

Platform registered country and region

Saint Vincent and the Grenadines

Company website

X

Company summary

Pyramid scheme complaint

Expose

| OspreyFXReview Summary | |

| Founded | 2018 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | 120+, Forex, Metals, Cryptocurrencies, Indices, Shares, Energies, Futures |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.4 pips |

| Trading Platform | TradeLocker |

| Min Deposit | $25 |

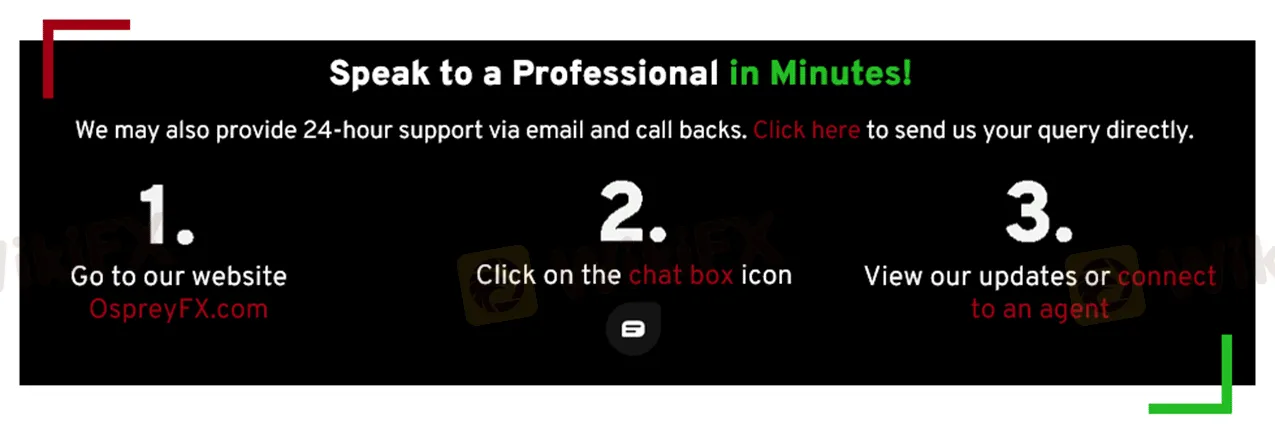

| Customer Support | Contact Form |

| Social Media: Facebook, Instagram, Twitter, Discord, Telegram | |

OspreyFX is an unregulated online trading platform that provides access to multiple financial instruments, such as Forex, Metals, Cryptocurrencies, Indices, Shares, Energies, and Futures. Alongside its four main account types based on an ECN account, the platform also offers a demo account for practice trading.

| Pros | Cons |

| Multiple account types | Commission charged |

| No deposit or withdrawal fee on most occasions | Unregulated |

| Wide range of tradable assets | |

| Demo account available |

No. OspreyFX is not a licensed broker, which makes it risky to invest in this platform.

OspreyFX assets to offer over 120 market instruments, including Forex, Metals, Cryptocurrencies, Indices, Shares, Energies, and Futures.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| cryptocurrencies | ✔ |

| stocks /shares | ✔ |

| indices | ✔ |

| energies | ✔ |

| futures | ✔ |

| commodities | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

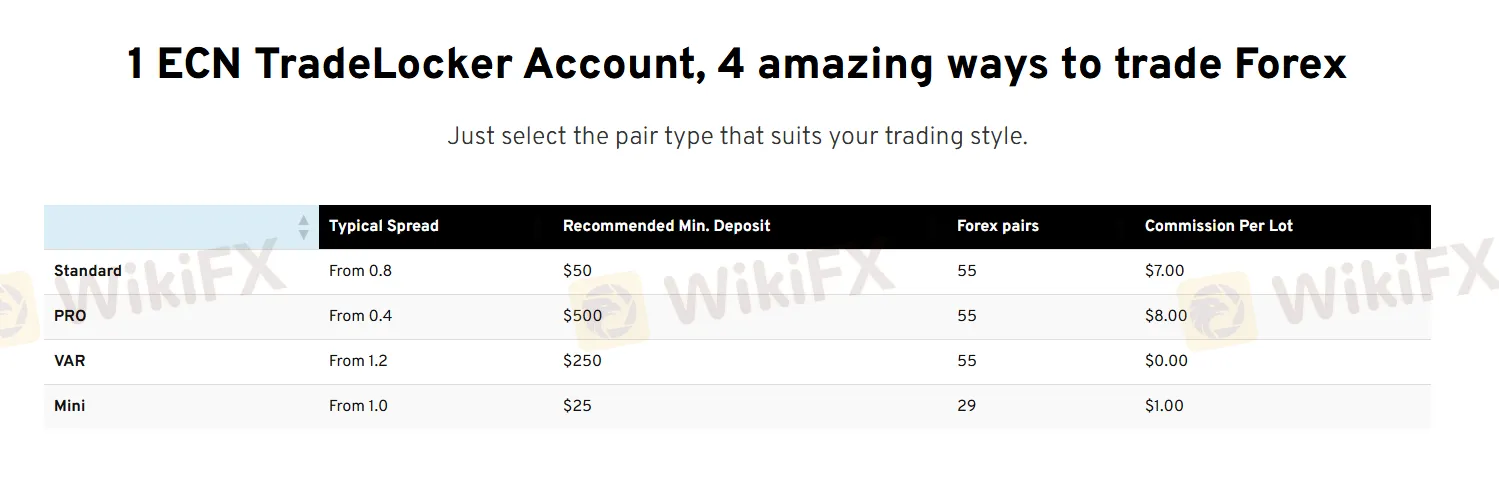

OspreyFX offers various account types on its platform.

| Account Type | Typical Spread | Min. Deposit | Forex Pairs | Commission Per Lot |

| Standard | From 0.8 | $50 | 55 | $7.00 |

| PRO | From 0.4 | $500 | 55 | $8.00 |

| VAR | From 1.2 | $250 | 55 | $0.00 |

| Mini | From 1.0 | $25 | 29 | $1.00 |

OspreyFX offers a leverage ratio of up to 1:500, which means that traders can open positions up to 500 times the value of their account balance.

Account Commission

| Account Type | Commission(USD/EUR/GBP/CAD/AUD) | Commission(Bitcoin) |

| Standard | 7.00 | 1500 BIT |

| PRO | 7.00 | 1500 BIT |

| VAR | 0 | 0 BIT |

| Mini | 1.00 | 15 BIT |

Deposit and Withdrawal charges

OspreyFX charges $25 for banking fees for withdrawals of up to 5K.

The trading platform OspreyFX offers is TradeLocker, which is a widely recognized platform in the forex industry, famous for its advanced charting capabilities, technical analysis tools, and customizable interface.

| Trading Platform | Supported | Available Devices | Suitable for |

| TradeLocker | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | Desktop, Mobile, Web | Experienced trader |

| MT4 | ❌ | Desktop, Mobile, Web | Beginner |

| Trading View | ❌ | Desktop, Mobile, Tablets, Web | Beginner |

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Cryptocurrency | 10 | 0% | The same day |

| Credit/Debit Card | 10 | 0% | The same day |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Cryptocurrency | 10 | 0% | The same day |

| Credit/Debit Card | 10-25 | 0% | / |

| Wire Transfer | 10 | $25 for banking fees on withdrawals of up 5K | 1 business day |

Note: There may be fees associated with the payment method provider themselves with an incoming transaction. Processing fees apply to cryptocurrency deposits originating from their respective processing networks. OspreyFX is not responsible for any network fees deducted from any transactions.

Many websites highlight this fact that OspreyFX is a Unregulated broker . Reviews from users are mixed - some positive, others raising concerns. Now, we're presenting an article based on thorough research that will reveal the reality of this platform. Read the article until the end and be cautious.

WikiFX

WikiFX

This article discusses whether OspreyFX MT4 is suitable for scalping and day trading.

WikiFX

WikiFX

OspreyFX sparked controversy by making a bold move this week: opting to replace the well-established MetaTrader 4 and 5 (MT4/MT5) with its in-house platform, TradeLocker. Despite being marketed as an advanced trading experience, this transition has triggered a wave of complaints from users, casting doubt on the broker's future and signalling potential concerns.

WikiFX

WikiFX

Beware of the challenges faced by OspreyFX users, including account lockouts, login issues, and withdrawal limits, in this insightful article. Learn about the risks of unregulated online trading platforms and discover key steps for safe trading.

WikiFX

WikiFX

More

User comment

5

CommentsWrite a review

2024-02-29 19:48

2024-02-29 19:48 2023-02-22 09:51

2023-02-22 09:51