Fullerton Markets

Abstract:FULLERTON is a trading platform founded in 2015, registered in Saint Vincent and the Grenadines. It operates without regulatory oversight and offers access to a diverse range of market instruments, including forex, metals, indices, commodities (crude oil), cryptocurrencies, and stocks. The platform supports high leverage of up to 1:500, with spreads starting at 0.1 pips. Trading is conducted on the MT5 platform. FULLERTON offers two specific account types: the Cent Account and the MAM Swap Free Account.

| FULLERTON Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Not Regulated |

| Market Instruments | Forex, Metals, Indices, Commodities (Crude Oil), Cryptocurrencies, Stocks |

| Demo Account | / |

| Leverage | Up to 1:500 |

| Spread | From 0.1 pips |

| Trading Platform | MT5 |

| Minimum Deposit | / |

| Customer Support | Live chat |

| Phone: +44 20 3808 8261 | |

| Email: support@fullertonmarkets.com | |

| Social Media: Facebook, YouTube, LinkedIn, Instagram | |

| Company Address: Nerine Chambers, P.O. Box 905, Road Town, TortolaBritish Virgin Islands | |

| Regional Restrictions | Iran, Cuba, Sudan, Syria, North Korea |

FULLERTON Information

FULLERTON is a trading platform founded in 2015, registered in Saint Vincent and the Grenadines. It operates without regulatory oversight and offers access to a diverse range of market instruments, including forex, metals, indices, commodities (crude oil), cryptocurrencies, and stocks. The platform supports high leverage of up to 1:500, with spreads starting at 0.1 pips. Trading is conducted on the MT5 platform. FULLERTON offers two specific account types: the Cent Account and the MAM Swap Free Account.

Pros and Cons

| Pros | Cons |

| Various trading markets | Unregulated status |

| MT5 supported | Regional restrictions |

| Multiple payment options | |

| No withdrawal fees | |

| Live chat support |

Is FULLERTON Legit?

FULLERTON operates without any regulatory oversight. Operating trading on this platform might not be safe for you.

What Can I Trade on FULLERTON?

Traders on FULLERTON get access to a diverse range of market instruments, including forex, metals, indices, commodities (Crude Oil), cryptocurrencies, and stocks.

| Trading Assets | Available |

| forex | ✔ |

| metals | ✔ |

| indices | ✔ |

| commodities (crude oil) | ✔ |

| cryptocurrencies | ✔ |

| stocks | ✔ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

Account Type

FULLERTON offers a Cent Account is a trading account where balances and transactions are denominated in USD cents(CNT). This means that if you deposit $10, your account balance will show as 1,000 CNT.

FULLERTON also offers a MAM Swap Free Account. However, at the moment, FULLERTON only offers Swap-Free accounts for eligible Shariah retail traders with VAR and/or RAW trading accounts. Fullerton Markets does not offer swap-free accounts for MAM and Investor accounts.

Leverage

FULLERTON provides leverage of up to 1:500. It is important to note that higher leverage carries increased risks, and you should exercise caution when trading at such levels.

Spreads

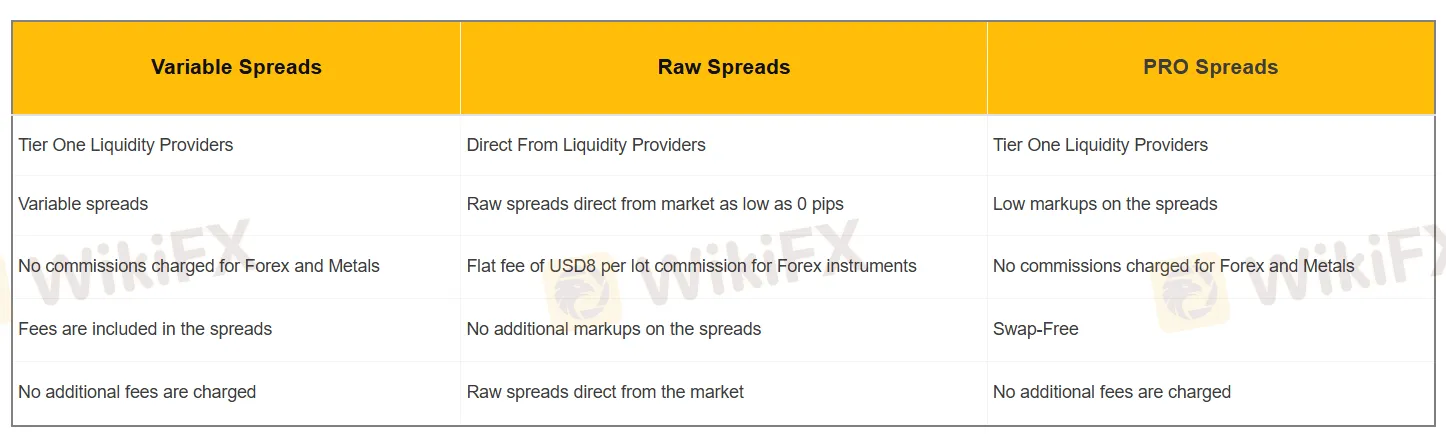

FULLERTON offers three types of spreads: Variable Spreads, Raw Spreads, and PRO Spreads. Each type of spread comes with distinct features regarding spreads, liquidity providers, and commissions.

Variable Spreads:

- Uses Tier One Liquidity Providers.

- Offers variable spreads.

- No commissions are charged for Forex and Metals.

- Fees are included in the spreads.

- No additional fees are charged.

Raw Spreads:

- Provides raw spreads directly from liquidity providers.

- Raw spreads can be as low as 0 pips.

- Charges a flat fee of USD8 per lot commission for Forex instruments.

- No additional markups on the spreads.

- Raw spreads are direct from the market

PRO Spreads:

- Uses Tier One Liquidity Providers.

- Offers low markups on the spreads.

- No commissions are charged for Forex and Metals.

- Swap-free trading.

- No additional fees are charged.

Trading Platform

FULLERTON offers the well-known MT5 (MetaTrader5), which is a trading software widely used for online trading in forex, CFDs, and other financial markets.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Traders get access to payment options including Credit Card, Sticpay, Digital Wallet, Cryptocurrency, and Bank Transfer. It also claims that fees are 100% covered by Fullerton Markets.

The minimum deposit is USD 100 or its equivalent in any other currency. Meanwhile, the minimum withdrawal varies based on the certain payment option or currency.

| Payment Methods | Minimum Withdrawal |

| Credit Card | No minimum amount |

| Sticpay | No minimum amount |

| Digital Wallet | USD 100 |

| Cryptocurrency | USD 200 |

For Local Transfer:

| Country of Location | Minimum Withdrawal | Maximum Withdrawal |

| Malaysia | MYR 50 | MYR 25,000 |

| Vietnam | VND 300,000 | VND 200,000,000 |

| Thailand | THB 500 | THB 250,000 |

| Indonesia | IDR 200,000 | IDR 100,000,000 |

| Philippines | 2,500 PHP | 130,000 PHP |

| China | CNY 100 | CNY 49,999 |

| Myanmar | 500 MMK | 20,000,000 MMK |

| Cambodia | 100,000 KHR | 60,000,000 KHR |

| Laos | 200,000 LAK | 150,000,000 LAK |

| India | 850 INR | 1,000,000 INR |

| Kenya | 10 KES | 10,000,000 KES |

| Nigeria | 100 NGN | 10,000,000 NGN |

| South Africa | No Minimum | 5,000,000 ZAR |

Read more

4T Review: Traders Report Deposit Pressure, Fund Scams & Withdrawal Issues

Did the 4T broker deny you withdrawals after you made profits following a spell of losses? Were your funds suspiciously deleted from the broker’s trading platform? Does the forex broker tell you to deposit more once you lose capital? Have you witnessed fund misappropriation by the 4T officials? You are not alone! Many traders have expressed these concerns online. We have investigated some of the complaints in this 4T review article. Have a look!

ROCK-WEST User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

When dealing with online trading, checking things carefully isn't just a good idea - it's necessary to protect your capital. This leads us to an important question that many potential traders are asking: Is ROCK-WEST safe or scam? The answer isn't simply yes or no. To make a smart decision, you need to look beyond marketing claims and examine real facts and actual user experiences. This article provides a thorough, fact-based look into ROCK-WEST's business profile and reputation. Our goal is to help you, the trader, make a good decision. We will carefully examine the broker's regulatory status, its official rating, and most importantly, the user reviews and serious complaints sent to the financial broker checking platform, WikiFX. By looking at the positive feedback, the serious accusations and the company's official responses, we will build a complete and balanced view of the risks and benefits of trading with ROCK-WEST.

ROCK-WEST Regulation: Understanding Its License and Company Information

For any trader, the most important question about a broker is whether it is properly regulated. When it comes to ROCK-WEST, the answer is complicated and needs careful study. At first glance, ROCK-WEST is a broker regulated offshore, with a license from the Seychelles Financial Services Authority (FSA). However, this basic fact comes with serious risks that potential clients need to understand. The broker has a low trust score and many user complaints on global checking websites. These are not small problems; they show major issues with keeping funds safe and running the business properly. This article will break down the details of ROCK-WEST's license, company structure, and user reviews to give a clear, fact-based picture of what trading with this company really means. Based on information from the global broker checking platform WikiFX, ROCK-WEST's profile brings up several questions that traders need to think about. This shows how important it is to use checking tools before inves

Is ROCK-WEST Legit or Fake? A Simple Guide for Traders

The question of whether ROCK-WEST is legit doesn't have a simple "yes" or "no" answer. From a basic standpoint, it is a registered company. However, looking deeper shows several important factors that should make any potential trader very careful. Our first analysis, based on public information from regulatory agencies and user review platforms, points to two major areas of worry. First, the broker is regulated offshore. This setup naturally lacks the strong investor protections and safety programs offered by top-level financial authorities. Second, its profile shows a large number of user complaints, especially about the most basic parts of trading: depositing and withdrawing. These elements combine to create a high-risk situation, raising serious questions about the broker's overall trustworthiness and how well it operates. This article will break down these issues to give you the clarity needed to make a smart decision.

WikiFX Broker

Latest News

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Rate Calc