Santander Exposed: Withdrawal Denials & Poor Customer Support Service Trap Traders

Abstract:Scam allegations never stop for Santander, a UK-based forex broker. According to traders, its officials work in unity to trick them into investing and dupe them later. The cases of withdrawal delays and poor customer support service have been highlighted by traders on various broker review platforms. So, if you wish to partner with Santander for forex trading, think again! In this article, we will highlight the comments made by the traders here. Read on!

Scam allegations never stop for Santander, a UK-based forex broker. According to traders, its officials work in unity to trick them into investing and dupe them later. The cases of withdrawal delays and poor customer support service have been highlighted by traders on various broker review platforms. So, if you wish to partner with Santander for forex trading, think again! In this article, we will highlight the comments made by the traders here. Read on!

Top Complaints Against Santander You Should Know

Only Deposits, No Withdrawals

Santanders officials believe in attracting deposits from traders, and they manage to do so using fake promises. As the deposits come and some trading happens, its officials will take illegitimate control of the entire operations and start liquidating positions, leaving traders with nothing to withdraw.

A Police Case Registered Against Santander

Among the many complaints, we found one where the trader was persuaded to download the MT5 platform and conduct copy trading. However, the malicious marking made by Santander made the trader liquidate positions. According to the admission, the brokers website was also hacked, disallowing the trader from withdrawing. Frustrated by the turn of events, the trader filed a police complaint against Santander. Here is what he expressed.

Malicious K-Line Wipes Out Trader Accounts

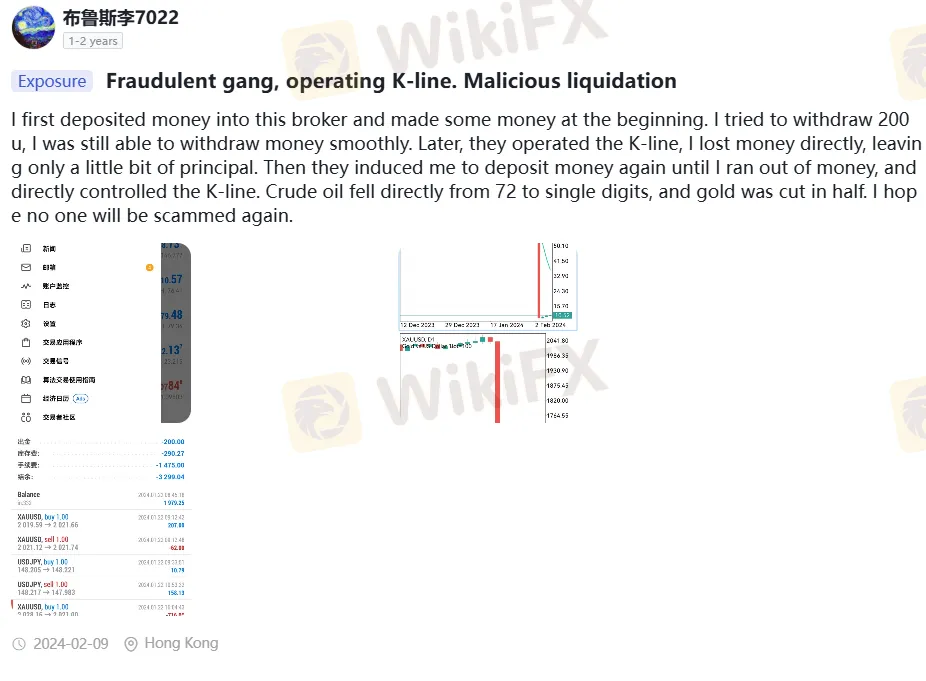

There are traders who managed to withdraw earlier but later got trapped by Santander as it deployed malicious tactics to dupe traders. One trader admitted that Santander deployed K-line maliciously to wipe out almost the entire account balance. However, the officials made the trader deposit further until the balance became NIL. Here is how the incident unfolded for the trader.

The Root Cause of Problems at Santander

It is because Santander has failed to gain the status of a regulated broker. None of the competent financial authorities recognizes it for transparent forex trading. Partnering with it will only result in losses and scams for the trader. As losses mounted, the experience worsened for traders, prompting the WikiFX team to assign Santander a poor score of 3.24 out of 10.

Want to explore the forex world 24x7? Join WikiFX Masterminds today.

Here is how you can join it.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Great, you have become a community member.

Read more

OmegaPro Exposed- 5 Red Flags You Shouldn't Ignore

If prominent regulators around the world issue warnings against a broker, you must take those warnings seriously and avoid such brokers. OmegaPro is one of the brokers that many regulators have warned about. In this article, we’ll show you the red flags of OmegaPro to give you a scam alert.

FRAUD ALERT: 6 Warning Signs Firstrade Is a Scam

Pay Attention! In this article, You will learn 6 clear reasons why Firstrade is considered a scam.

AMEGA Under Scanner: Traders Cry Over High Spreads, Withdrawal Issues & Poor Customer Service

Are high forex spreads affecting your trading at AMEGA? Do AMEGA officials keep denying your fund withdrawal request? Not satisfied with the overall customer support service of this forex broker? Try your best to get your funds and move out before it gets all worse for you! Traders have been filing complaint after complaint against this broker on several review platforms. Read on as we reveal scam-related activities initiated by the broker.

Are You Trading with FXPRIMUS in Malaysia?!

Malaysian retail traders still using FXPRIMUS should be aware that the broker has been named on the Securities Commission Malaysia (SC) Investor Alert List for carrying out unlicensed capital market activities.

WikiFX Broker

Latest News

European leaders to join Zelensky at White House meeting with Trump

Where is ThinkMarkets Broker Licensed to Operate?

Modi gives tax boon to India's economy amid Trump tariff tensions

Bybit Exposed: Traders Hit Hard by Withdrawal Denials, Account Bans & More

Walmart's view on tariff impacts will move this week's markets

Powell's speech this week could give housing a welcome boost

Trader in Thane Duped of ₹4.11 Cr in Online Scam

BlackBull Markets and CopyTrade Market Formalise Integration

IG Japan Ends Discount Program on Aug 17

Plus500 Launches $90 Million Share Buyback Programme

Rate Calc