Emperor Futures Limited

Abstract: The Securities and Futures Commission (SFC) oversees Emperor Capital, a financial services company situated in Hong Kong. It has had a Type 2 Futures license since 2005. It provides a wide range of investment services, such as trading stocks and futures, accessing stocks around the world, managing wealth and assets, and corporate finance. It has a lot of different platforms and financial products, however it doesn't offer demo or Islamic accounts.

| Emperor Capital Review Summary | |

| Founded | 1993 |

| Registered Country/Region | Bermuda |

| Regulation | SFC |

| Market Instruments | Securities, Futures, Bonds, ETFs |

| Demo Account | ❌ |

| Trading Platform | eGOi, SP Trader, SP Trader Pro HD, Lightning Platform, Emperor TradeGo |

| Minimum Deposit | HKD 10,000 |

| Customer Support | Phone: (852) 2919 2919 |

| WhatsApp: (852) 6661 8717 | |

| Email: esl.cs@EmperorGroup.com | |

Emperor Capital Information

The Securities and Futures Commission (SFC) oversees Emperor Capital, a financial services company situated in Hong Kong. It has had a Type 2 Futures license since 2005. It provides a wide range of investment services, such as trading stocks and futures, accessing stocks around the world, managing wealth and assets, and corporate finance. It has a lot of different platforms and financial products, however it doesn't offer demo or Islamic accounts.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | No demo account option |

| Broad range of financial products and services | Some platforms only support Chinese language |

| Multiple trading platforms including mobile and desktop | Complex fee structure |

Is Emperor Capital Legit?

Emperor Capital is regulated and legal. Famous Hong Kong financial regulator the Securities and Futures Commission (SFC) licenses Emperor Futures Limited. License AAJ095 is a Type 2 futures license. The license is “Regulated” and effective since 2005-03-02.

What Can I Trade on Emperor Capital?

Emperor Capital provides a wide range of worldwide financial services and products, including securities and futures trading, wealth and asset management. Clients have access to Hong Kong and foreign markets, as well as risk management, portfolio diversification, and strategic investment planning tools.

| Trading Instruments | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

Account Type

Emperor Capital offers two main types of live trading accounts: Personal/Joint Account for individual investors and Corporate Account for institutional or business clients. Their web site doesn't say anything about demo accounts or Islamic (swap-free) accounts right now.

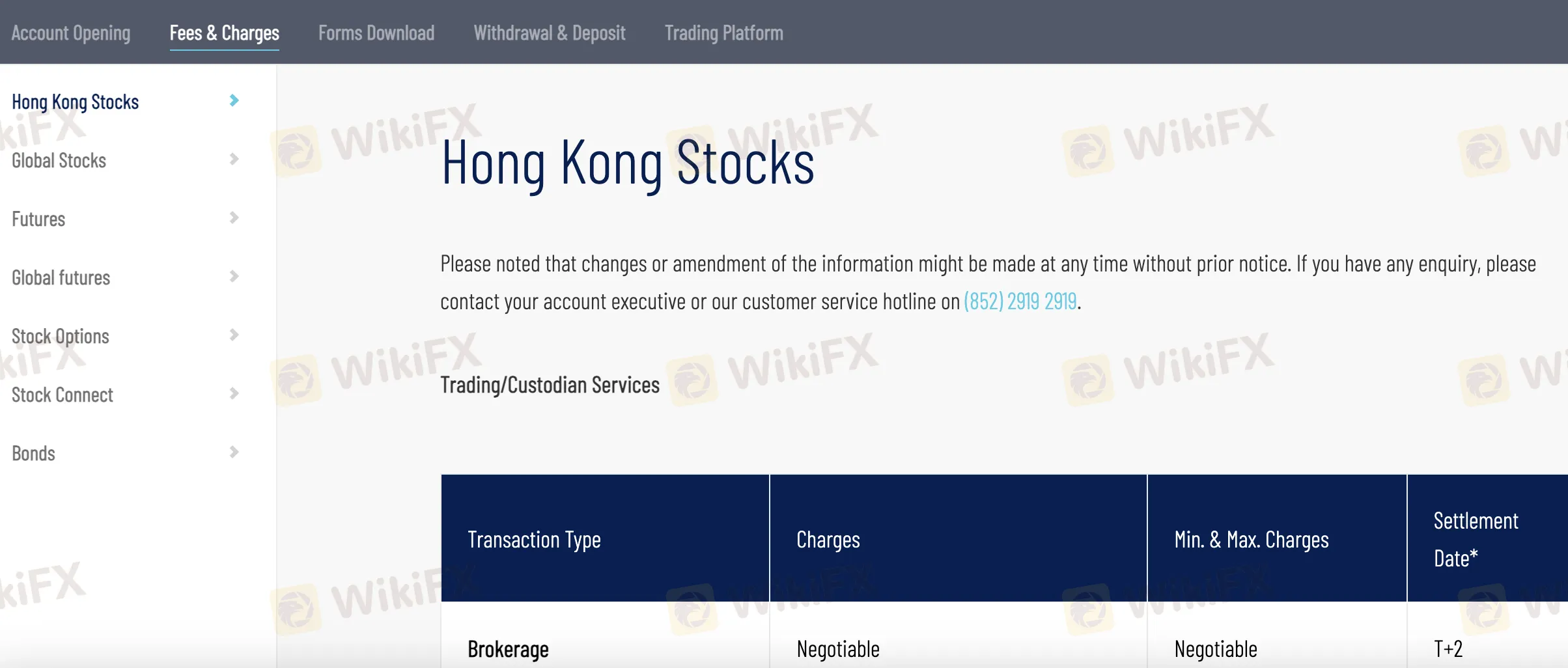

Emperor Capital Fees

Emperor Capitals fee structure for trading and non-trading services is largely in line with industry norms for Hong Kong-based brokers. While brokerage is negotiable, clients should be aware of multiple regulatory and handling charges that can add up, especially for corporate actions or margin accounts.

| Category | Fee Type | Charge |

| Trading (HK Stocks) | Brokerage | Negotiable |

| Stamp Duty | 0.1% (Min. HK$1, rounded up) | |

| Transaction Levy | 0.00% | |

| FRC Levy | ||

| Trading Fee | 0.01% | |

| CCASS Fee | 0.002% (Min. HK$2, Max. HK$1,000) | |

| Custody & Margin | Stock Custody (margin) | HK$0.015 per lot |

| Bond Custody | Free–HK$50/month (depends on client type) | |

| Coupon Interest Collection | 0.5% (Min. HK$50, Max. HK$1,000) | |

| Margin Interest | Prime + 3% | |

| Corporate Actions | IPO Application (Margin) | HK$100 per transaction |

| Grey Market | 0.05% on top of brokerage | |

| Rights Subscription | HK$0.8 per lot + HK$100 handling | |

| Privatization/Exchange/Bonus | HK$2–50 per lot (varies by action) | |

| Dividends | Cash Dividend | 0.5% (Min. HK$20, Max. HK$15,000) |

| Bonus Shares | HK$2 per lot (Min. HK$20, Max. HK$500) | |

| Other Fees | Statement Reprint | HK$80/month |

| Dormant Account | HK$100/year | |

| Stock Withdrawal | HK$5 per lot (Min. HK$50) | |

| Bounced Cheque | HK$200 | |

| Mailing Statement | HK$20/month |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| eGOi | ✔ | Mobile (iOS, Android) | All-in-one platform for HK stocks, options, futures, global stocks |

| SP Trader | ✔ | Desktop (Windows) | Stock options and HK/global futures traders |

| SP Trader Pro HD | ✔ | Mobile (iOS, Android) | On-the-go futures and options trading |

| Lightning Trading Platform | ✔ | Desktop (Chinese only) | Global stock traders (US, Singapore, China B shares) |

| Emperor TradeGo | ✔ | Mobile (Chinese only) | Mobile trading for global stocks |

Deposit and Withdrawal

Emperor Capital does not charge deposit or withdrawal fees. The minimum deposit amount is HKD 10,000.

Deposit Options

| Deposit Method | Minimum Deposit | Maximum Deposit | Deposit Fees | Deposit Time |

| eDDA Instant Deposit | No minimum (HKD only) | / | 0 | Instant to a few minutes |

| FPS (Faster Payment System) | / | / | Same day if before 6:00 p.m. | |

| Bank Transfer (ATM/Online/etc.) | / | / | Same day (if before cut-off) | |

| Cheque Deposit | HKD 10,000+ preferred | / | Possible fee if no cheque image (HK$200) | Up to 14 business days (if issues) |

| e-Cheque | / | / | 0 | Same or next business day |

| Cash Deposit | / | HK$100,000/day | Same day (with identity proof) |

Withdrawal Options

| Withdrawal Method | Withdrawal Fees | Withdrawal Time |

| Online Trading Platform | 0 | Same day if before 11:00 a.m. |

| Phone Instruction | Same day or next day | |

| Bank Cheque to Registered Account | Same day (selected banks), otherwise next day |

Read more

BlackBull: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about BlackBull and its licenses.

Dark Side of AETOS: They Don’t Want You to Know

AETOS is an Australia-based broker. All over the internet, you will find positive reviews about this broker, but no one is talking about the risks involved with AETOS. However, we have exposed the hidden risks associated with AETOS

Contemplating Investments in Quotex? Abandon Your Plan Before You Lose All Your Funds

Have you received calls from Quotex executives claiming to offer you returns of over 50% per month? Do you face both deposit and withdrawal issues at this company? Or have you faced a complete scam trading with this forex broker? You're not alone. Here is the exposure story.

15 Brokers FCA Says "Are Operating Illegally" Beware!

If a reputable regulator issues a warning about unlicensed brokers, it's important to take it seriously — whether you're a trader or an investor. Here is a list you can check out- be cautious and avoid getting involved with these scam brokers.

WikiFX Broker

Latest News

Scam Alert: Revealing Top Four Forex Scam Tactics Employed to Dupe Investors

Meta says it won't sign Europe AI agreement, calling it an overreach that will stunt growth

Ether and trading stocks take the crypto spotlight as Congress passes historic stablecoin bill

Inflation outlook tumbles to pre-tariff levels in latest University of Michigan survey

Peter Thiel-backed cryptocurrency exchange Bullish files to go public on NYSE

What a Trump, Powell faceoff means for your money

Ether takes crypto spotlight as Congress passes historic stablecoin bill

Lead Prices Remain in the Doldrums Despite Seasonal Expectations

Myanmar Tin Ore Shipments from Wa Region Set to Resume

Major U.S. Banks Plan Stablecoin Launch Amid Crypto Regulations

Rate Calc