Should you buy the gold high?

Abstract:As gold prices continue to increase, investors wonder if they should boost their investment in the yellow metal in 2023. The pandemic and geopolitical tensions have caused economic uncertainty, leading to a surge in gold prices. The Reserve Bank of India (RBI) has even joined the gold-buying trend, purchasing 10 tonnes of gold in March 2023.

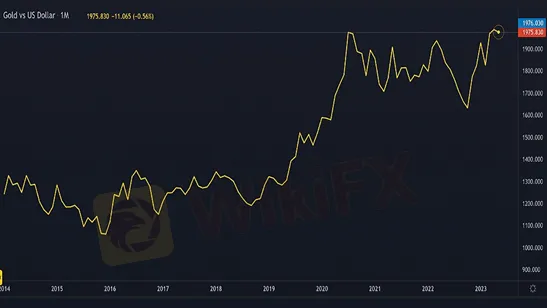

As gold prices continue to increase, investors wonder if they should boost their investment in the yellow metal in 2023. The pandemic and geopolitical tensions have caused economic uncertainty, leading to a surge in gold prices. The Reserve Bank of India (RBI) has even joined the gold-buying trend, purchasing 10 tonnes of gold in March 2023.

The world economy is showing a lot of uncertainty right now, causing traders to either take a break or put too much guesswork into their forecasting. In times of such uncertainty, gold has been a haven space to park wealth, but we are seeing gold holding in a high range already, and a recession or downturn hasn‘t even started. And then there’s the U.S. debt ceiling cracking under pressure. Will XAUUSD rise even higher or is it too late?

Gold outlook for 2023

Gold is one of the best-performing assets in 2023 for a reason. After a heavy dip in February, gold made a 14% rebounded up to near ATHs. This week we saw a downward correction, now trading at $1,975 per ounce, and some traders are wondering whether to buy or not. Is there more bullish momentum to come?

The independent provider of global investment research and advice, BCA Research Inc. sees gold climbing to the $2,200 level within 9 to 16 months, further claiming that $2200 is where gold should already be, based on their models.

Strong gold or weak dollar?

Gold's primary driver is the U.S. dollar, which has been weak for a while and considered by many to be overvalued by as much as 20%. Balance will eventually be restored, but such corrections usually happen because of a catalyst. Whats driving USD and making gold such an attractive investment?

Inflation

Another key driver for XAUUSD will be U.S. inflation data versus inflation expectations. There is a disconnect between what's happening to inflation and where inflation is heading, and this is making forecasting XAUUSD particularly difficult. In market history, gold has proven time and again its ability to keep value. If the U.S. is facing an aggressive downturn and inflation remains sticky, another breakout for gold is something to watch out for.

U.S. Debt ceiling

The U.S. has never defaulted on its debt, but some believe it might this time. If a country defaults on its debt, the currency collapses. Treasury Secretary Janet Yellen warns that the chance of a U.S. default scenario is around 10%, and the U.S. could run out of money by June 1. She also warns that if the U.S. debt ceiling is not lifted, it could trigger a constitutional crisis.

Negotiations for raising the debt ceiling are currently at an impasse. The House of Representatives passed a bill in April that would raise the debt ceiling, conditionally on extensive spending cuts, but U.S. President Joe Biden rejected that. If nothing is resolved by the deadline, watch out for volatile dollar depreciation as investors move to haven assets such as gold.

Conclusion

Gold is high, which is a bad time to go long… normally. There are no credible theories that would suggest gold will fall any time soon, but theres plenty of “cause & effect” data to suggest a rise. So yes, gold is high, but it could go higher.

As the U.S. economy weakens and the debt ceiling issues unveil the depth of the U.S. financials, those still invested in U.S.-based assets may start to get cold feet as the June deadline approaches. While Bitcoin is also expected to absorb some of the market shift, gold still has a better reputation than crypto.

Additionally, gold has a physical purpose that is tied to society. It has its own industrial demand, which includes medical, electronics, automotive, defense, and aerospace industries. Demand is rising, but world production is falling. Experts are saying that we may have already discovered and mined all of the world's major gold deposits.

The rate of gold mine discoveries has declined over the past three decades, despite miners pumping money into exploration. The market impact of approaching a “cap range” on gold will surely cause scarcity sentiment and may boost gold prices significantly.

Both gold and U.S.-related assets demand your attention and deep analysis.

Read more

WikiFX Launches “Let Trust Be Seen” Initiative Series Together with Industry Partners

Trust has always been a widely discussed topic in the forex industry. When genuine, rational voices are drowned out, market participants struggle to discern which information is trustworthy amid a sea of complex data. This difficulty in establishing trust has placed industry transparency at the forefront of attention.

UNIGLOBEMARKET Analysis Report

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.

uexo Analysis Report

uexo emerges as a recommended forex broker with a solid overall rating of 6.9 out of 10, demonstrating reliable performance that appeals to both novice and experienced traders. Based on a comprehensive analysis of 21 reviews, the broker maintains an impressively low negative rate of just 9.5%, with the sentiment distribution heavily favoring positive experiences—15 traders expressed satisfaction, 4 remained neutral, and only 2 reported negative encounters. Read on for more insights.

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

If you’re searching for an AMBER MARKETS review or wanting to know whether the AMBER MARKETS broker is regulated and trustworthy, this in-depth article breaks down everything you need to know before trading forex or CFDs with this broker.

WikiFX Broker

Latest News

Consumer Credit Smashes All Estimates As Monthly Credit Card Debt Unexpectedly Surges By Most In 2 Years

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Metals Massacre: Silver Plunges 40% on Margin Hikes; Gold Rejects $5,000

TradeEU Review: Safety, Regulation & Forex Trading Details

Resource Sentiment Dampened as Rio Tinto-Glencore Merger Talks Implode

GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

Jetafx Review 2026: A Trader's Warning on Regulation and High-Risk Signals

Emerging Markets: NGO Capital Injection Highlights NGN Liquidity Flows

Italian Regulator Moves to Block Seven Unauthorised Investment Websites

NNPC and Edo State agree on New 10,000 bpd Refinery Project

Rate Calc