May 29, 2023-MHM European Perspective

Abstract:Spot gold oscillated narrowly during the Asian session on Monday (May 29) and is currently trading near $1,946.45 per ounce.

Market Overview

Spot gold oscillated narrowly during the Asian session on Monday (May 29) and is currently trading near $1,946.45 per ounce. While the preliminary agreement reached in the U.S. debt ceiling negotiations weakened safe-haven buying demand for gold, safe-haven buying demand for the U.S. dollar also weakened, with the dollar index weakening slightly, providing support to gold prices. Gold prices held key support near the 100-day SMA last week and there is some chance of a short-term rebound adjustment.

U.S. crude oil is shaking slightly higher and is currently trading near $73.15 per barrel. The preliminary agreement reached in the U.S. debt ceiling negotiations eased market concerns about a debt default crisis, providing support to oil prices. Last week's data showed that U.S. crude oil drilling fell by 5 wells, with a cumulative decrease of 21 wells in May, recording the biggest monthly drop since June 2020. This implies a decline in crude oil supply going forward, also providing some support to oil prices.

However, the Russian side downplayed expectations of further production cuts last week. Expectations of a Fed rate hike in June are heating up, making the bulls still wary.

The U.S. stock market is closed this trading day for Memorial Day in the United States. The precious metals and energy markets will also be closed early, and there is no important economic data coming out, so market trading is relatively light. Investors need to pay attention to the news related to the U.S. debt ceiling agreement and changes in market sentiment.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on May 29, Beijing time.

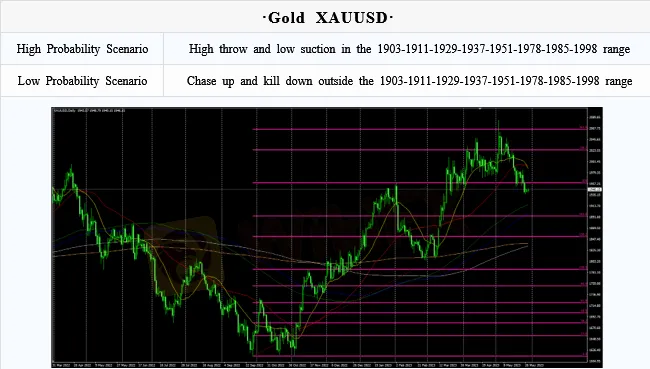

Intraday Oscillation Range: 1903-1911-1929-1937-1951-1978-1985-1998

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1903-1911-1929-1937-1951-1978-1985-1998 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 29. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5-25.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 29. This policy is a daytime policy. Please pay attention to the policy release time.

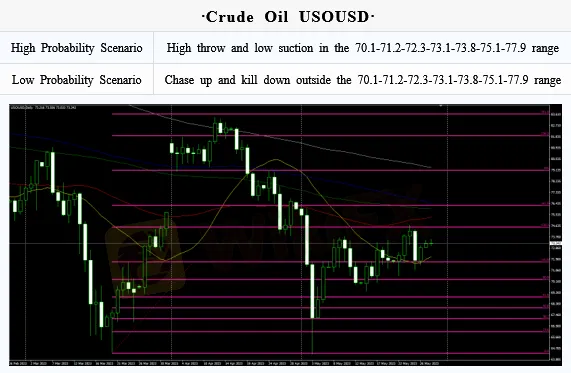

Intraday Oscillation Range: 70.1-71.2-72.3-73.1-73.8-75.1-77.9

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 70.1-71.2-72.3-73.1-73.8-75.1-77.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 29. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0570-1.0690-1.0755-1.0830-1.0950

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0570-1.0690-1.0755-1.0830-1.0950 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 29. This policy is a daytime policy. Please pay attention to the policy release time.

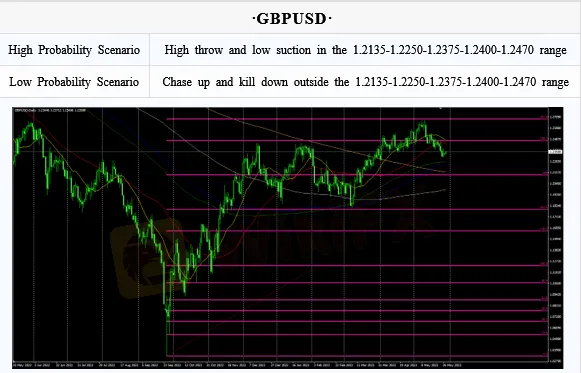

Intraday Oscillation Range: 1.2135-1.2250-1.2375-1.2400-1.2470

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2135-1.2250-1.2375-1.2400-1.2470 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 29. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Consumer Credit Smashes All Estimates As Monthly Credit Card Debt Unexpectedly Surges By Most In 2 Years

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Metals Massacre: Silver Plunges 40% on Margin Hikes; Gold Rejects $5,000

TradeEU Review: Safety, Regulation & Forex Trading Details

Resource Sentiment Dampened as Rio Tinto-Glencore Merger Talks Implode

GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

Jetafx Review 2026: A Trader's Warning on Regulation and High-Risk Signals

Emerging Markets: NGO Capital Injection Highlights NGN Liquidity Flows

Italian Regulator Moves to Block Seven Unauthorised Investment Websites

NNPC and Edo State agree on New 10,000 bpd Refinery Project

Rate Calc