May 26, 2023-MHM European Perspective

Abstract:Spot gold bottomed out during the Asian session on Friday (May 26) and is currently trading around $1,949.16 per ounce.

Market Overview

Spot gold bottomed out during the Asian session on Friday (May 26) and is currently trading around $1,949.16 per ounce. On the one hand, the delay in the debt ceiling negotiations to reach an agreement, market concerns have picked up, giving gold prices the opportunity to rally. In addition, before the gold price held the 100-day average, some short orders profit taking to leave the field, also to provide support to gold prices. However, overnight U.S. economic data better than market expectations, the market on the Fed's June interest rate hike is expected to further heat up, U.S. bond yields rose sharply to nearly two and a half months high, which is expected to limit the rebound space of gold prices.

This trading day will usher the monthly rate of U.S. durable goods orders in April, the annual rate of U.S. PCE price index in April, the monthly rate of U.S. personal spending in April and other data. Market influence is large, investors need to be concerned. The data on durable goods orders is expected to be slightly more favorable to gold prices, but the PCE and personal spending data is expected to be more favorable to gold prices.

U.S. crude oil has rebounded slightly and is currently trading near $72.08 per barrel. The pullback in the dollar has provided some rebound momentum to oil prices. Oil prices plunged more than 3% overnight as the Russian deputy prime minister downplayed the prospect of further production cuts by OPEC+ at next week's meeting on the one hand and market expectations for a June Fed rate hike on the other, with the dollar index hitting a new high of more than two months.

Markets continue to focus on the U.S. debt ceiling negotiations, with President Biden and Republican House Speaker McCarthy appearing to be close to an agreement to cut spending and raise the debt ceiling, but there are some concerns in the market and investors will need to watch for further related news.

In addition, watch for changes in U.S. crude oil drilling data this trading day.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on May 26, Beijing time.

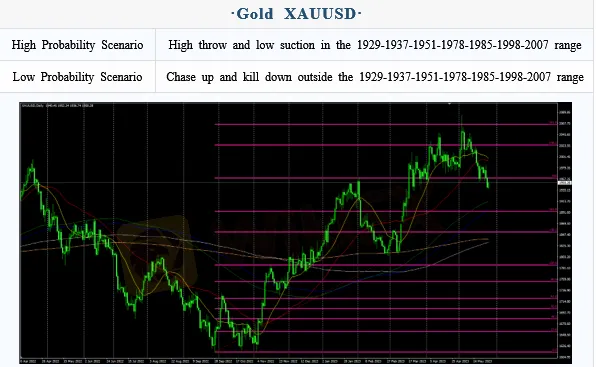

Intraday Oscillation Range: 1929-1937-1951-1978-1985-1998-2007

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1929-1937-1951-1978-1985-1998-2007 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 26. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 21.5-22.3-23.1-23.9-24.5

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 21.5-22.3-23.1-23.9-24.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 26. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 26. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0570-1.0690-1.0755-1.0830-1.0950

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0570-1.0690-1.0755-1.0830-1.0950 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 26. This policy is a daytime policy. Please pay attention to the policy release time.

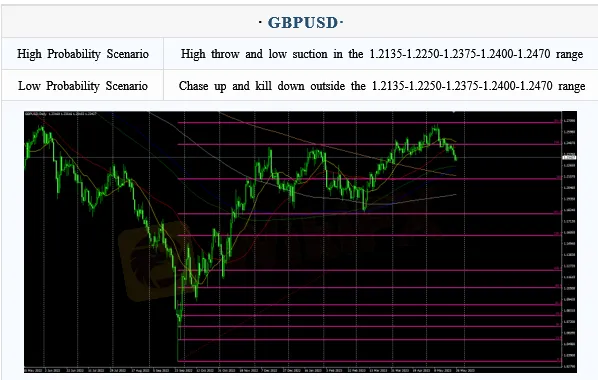

Intraday Oscillation Range: 1.2135-1.2250-1.2375-1.2400-1.2470

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2135-1.2250-1.2375-1.2400-1.2470 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 26. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Consumer Credit Smashes All Estimates As Monthly Credit Card Debt Unexpectedly Surges By Most In 2 Years

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Metals Massacre: Silver Plunges 40% on Margin Hikes; Gold Rejects $5,000

TradeEU Review: Safety, Regulation & Forex Trading Details

Resource Sentiment Dampened as Rio Tinto-Glencore Merger Talks Implode

GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

Jetafx Review 2026: A Trader's Warning on Regulation and High-Risk Signals

Emerging Markets: NGO Capital Injection Highlights NGN Liquidity Flows

Italian Regulator Moves to Block Seven Unauthorised Investment Websites

NNPC and Edo State agree on New 10,000 bpd Refinery Project

Rate Calc