WikiFX Review: Is CCAM Trustworthy?

Abstract:In today’s article, WikiFX will take you on a comprehensive review of CCAM to see if this broker is worth investing in.

About CCAM

CCAM is a forex broker based in Cayman Islands. The company name of this broker is City Credit Asset Management Co. Ltd. CCAM is newly-established and have trading experience of only less than one year. On its website, this broker did not emphasize when exactly this broker was founded. But we do know that the broker from the information on the bottom of the website.

We think this broker is established in 2017. The physical address of this broker is 4th Floor, Harbour Place, 103 South Church Street, Grand Cayman KY1-1002, Cayman Islands. WikiFX has given this broker a low score of 1.02/10.

Brand Story

On 17th November 2020, CCAM claimed it has been awarded the Best Hedge Fund Manager 2020 – Cayman Islands in Worldwide Finance Award 2020 hosted by Acquisition International.

Account Type & Minimum Deposit

Due to the lack of information on its website, we cannot find enough information about the account types and minimum deposit. However, clients still need to submit the account opening request in order to invest.

Customer Service

In addition to specify its physical address, CCAM also offers Telephone number 62-21-50889715. And email address: op-enquiry@ccaml.net. Clients can fill the enquiry to get more information.

Regulation

CCAM is not a regulated broker. CCAM claimed it to be administered by Cayman Islands Monetary Authority (CIMA) under the Securities Investment Business Law in Cayman. However, this claim is not reliable as we search no information about this broker on CIMA. This is a red flag you should consider before trading with CCAM.

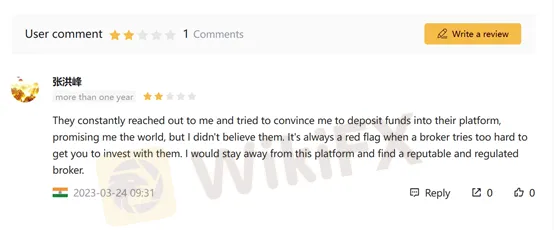

Feedback from Trader

WikiFX did not receive exposure related to this broker yet, butin the “User comment” section, one trader claims that the staffs of CCAM “constant reached out to him and tried too hard to persuade him to invest.” We think taat it is another red flag that traders need to be careful with.

Conclusion

CCAM is not a reputable broker as we consider it as an unregulated broker. And it has a fairly low score on WikiFX which makes the risk obvious. WikiFX advise traders to seek better alternatives.

Read more

4T Review: Traders Report Deposit Pressure, Fund Scams & Withdrawal Issues

Did the 4T broker deny you withdrawals after you made profits following a spell of losses? Were your funds suspiciously deleted from the broker’s trading platform? Does the forex broker tell you to deposit more once you lose capital? Have you witnessed fund misappropriation by the 4T officials? You are not alone! Many traders have expressed these concerns online. We have investigated some of the complaints in this 4T review article. Have a look!

ROCK-WEST User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

When dealing with online trading, checking things carefully isn't just a good idea - it's necessary to protect your capital. This leads us to an important question that many potential traders are asking: Is ROCK-WEST safe or scam? The answer isn't simply yes or no. To make a smart decision, you need to look beyond marketing claims and examine real facts and actual user experiences. This article provides a thorough, fact-based look into ROCK-WEST's business profile and reputation. Our goal is to help you, the trader, make a good decision. We will carefully examine the broker's regulatory status, its official rating, and most importantly, the user reviews and serious complaints sent to the financial broker checking platform, WikiFX. By looking at the positive feedback, the serious accusations and the company's official responses, we will build a complete and balanced view of the risks and benefits of trading with ROCK-WEST.

ROCK-WEST Regulation: Understanding Its License and Company Information

For any trader, the most important question about a broker is whether it is properly regulated. When it comes to ROCK-WEST, the answer is complicated and needs careful study. At first glance, ROCK-WEST is a broker regulated offshore, with a license from the Seychelles Financial Services Authority (FSA). However, this basic fact comes with serious risks that potential clients need to understand. The broker has a low trust score and many user complaints on global checking websites. These are not small problems; they show major issues with keeping funds safe and running the business properly. This article will break down the details of ROCK-WEST's license, company structure, and user reviews to give a clear, fact-based picture of what trading with this company really means. Based on information from the global broker checking platform WikiFX, ROCK-WEST's profile brings up several questions that traders need to think about. This shows how important it is to use checking tools before inves

Is ROCK-WEST Legit or Fake? A Simple Guide for Traders

The question of whether ROCK-WEST is legit doesn't have a simple "yes" or "no" answer. From a basic standpoint, it is a registered company. However, looking deeper shows several important factors that should make any potential trader very careful. Our first analysis, based on public information from regulatory agencies and user review platforms, points to two major areas of worry. First, the broker is regulated offshore. This setup naturally lacks the strong investor protections and safety programs offered by top-level financial authorities. Second, its profile shows a large number of user complaints, especially about the most basic parts of trading: depositing and withdrawing. These elements combine to create a high-risk situation, raising serious questions about the broker's overall trustworthiness and how well it operates. This article will break down these issues to give you the clarity needed to make a smart decision.

WikiFX Broker

Latest News

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Rate Calc