Unauthorized Entities On The FCA Warning List

Abstract:The Financial Conduct Authority (FCA) has a list of businesses and persons it has identified as possibly operating without its authorization and oversight, or about whom it has concerns for other reasons. The list's purpose is to safeguard consumers and the integrity of the UK financial system by assisting them in avoiding doing business with these companies and persons. It is continuously updated, and customers are recommended to consult it before participating in any financial activities.

FCA stands for Financial Conduct Authority, a regulatory authority in the United Kingdom that monitors financial markets and corporations to ensure they function in a fair, transparent, and consumer-friendly manner. To safeguard customers from financial loss, the FCA offers warnings about possible scams, fraudulent activity, and other dangers. These warnings are available on the FCA's website and are often disseminated via the media and other means to reach a broad audience.

On January 20, 2023, a list of unlicensed brokers was issued.

MONTGOMERY KENT INSURANCE

naslsportline@insurer.com

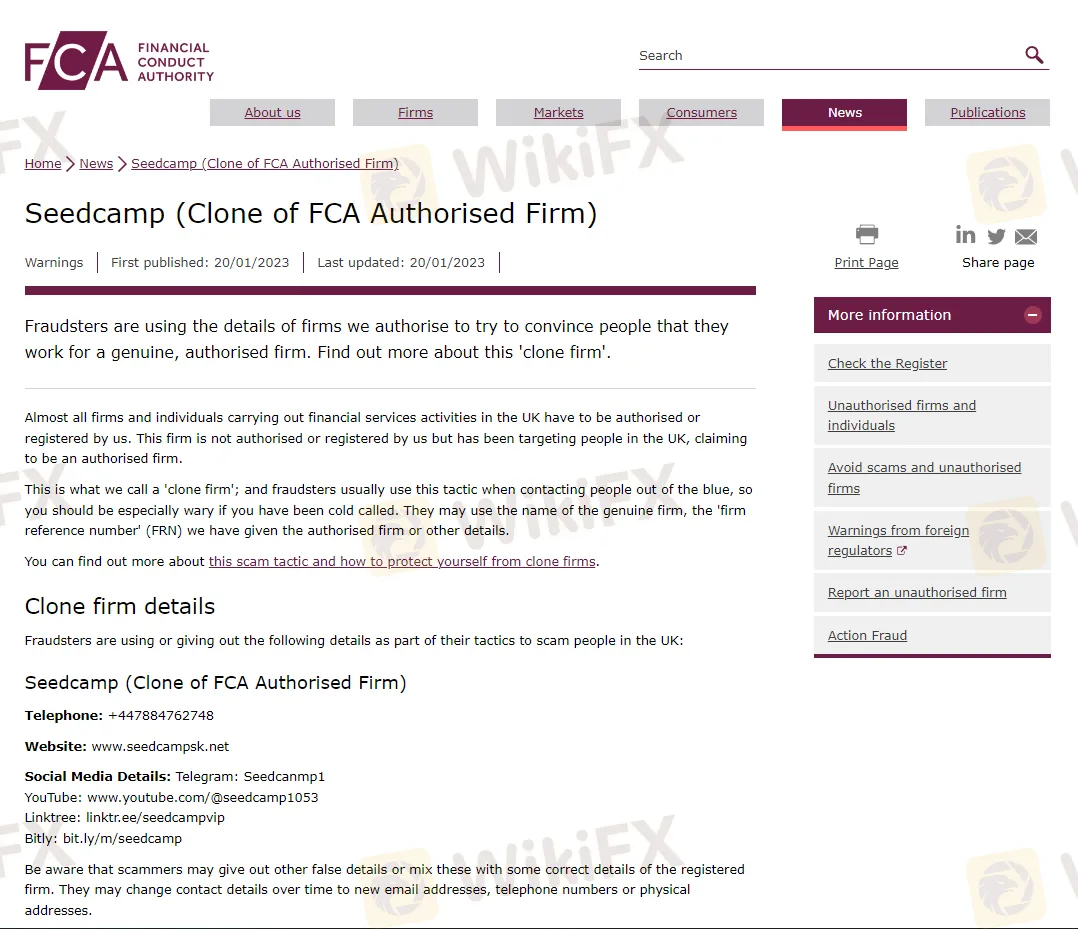

SEEDCAMP

ROIFX

SMART COIN TRADE FX

TRADEBITFINEX

CRYPTO ALPHA FX TRADE

INSTANT TRADES FX

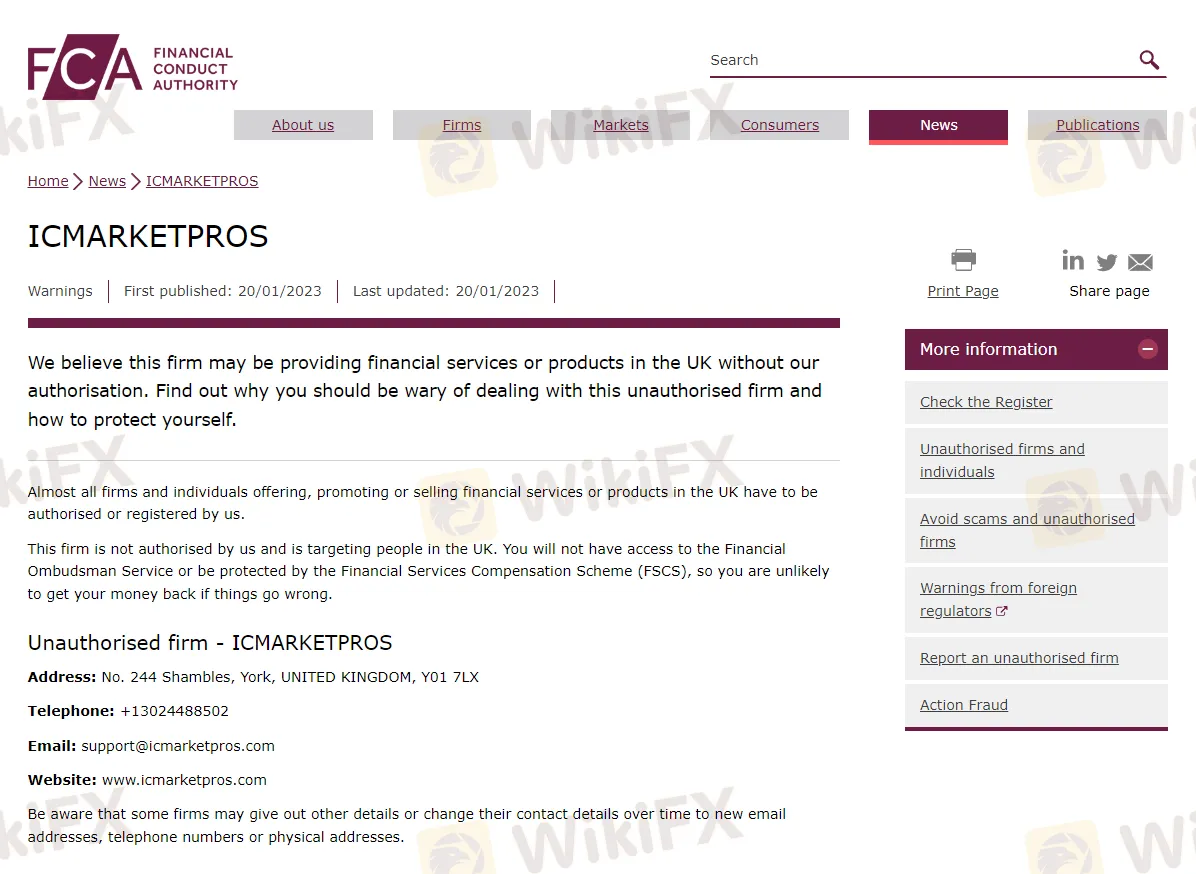

ICMARKETPROS

The FCA's warning lists feature a variety of companies and persons that the FCA has recognized as potentially endangering consumers. These are some examples:

Unauthorized companies: These are firms that have not been approved by the FCA to perform regulated activities in the UK yet continue to provide financial services to customers. Consumers should be especially wary of these companies since they are not subject to FCA inspection and may not be functioning in accordance with legislation.

Fraudulent websites: These are sites classified by the FCA as being used in fraudulent activities such as phishing schemes or impersonating legal businesses. Customers should use caution when providing personal or financial information to these websites.

Clone firms: These are businesses that use the name and contact information of legal businesses to deceive customers into believing they are dealing with a legitimate organization. Consumers should verify the FCA's list of approved businesses to establish the legitimacy of any company with which they are contemplating doing business.

Suspicious investment schemes: These are investment schemes flagged by the FCA as possibly fraudulent or high-risk. Consumers should be cautious of these scams and perform their own research before investing.

Enforcement actions: These are businesses and people that have received FCA enforcement action, such as fines or penalties, for failing to comply with rules. Customers should exercise caution while doing business with these companies and persons.

In addition, the FCA provides consumer warnings and press releases to keep consumers aware of any substantial dangers to consumers and financial markets. It is strongly advised to check the FCA's warning lists and alerts on a frequent basis and to exercise caution before doing business with any entity or person on the list.

Final words

Consumers should be aware of the FCA warning lists and check them on a frequent basis to ensure they are not doing business with organizations or persons who have been warned as possibly fraudulent or acting illegally. The FCA's warning lists, which are available on their website, contain information on unlicensed businesses and persons, as well as firms and individuals against whom the FCA has initiated enforcement action. It's also important to remember that just because a company or person is on the FCA's warning list doesn't always indicate they're doing things unlawfully or fraudulently, so customers should proceed with care and do their own investigation before doing business with them.

Stay tuned for more FCA warning lists of brokers.

You can install the WikiFX App on your mobile phones through the download link below, or from the App Store or Google Play Store.

Download link: https://www.wikifx.com/en/download.html

Related broker

Read more

WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

TopstepFX Review: Investigating Fund Withdrawal Denial Claims & Other Trading Issues

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

PXBT Review: A Seychelles-Based Trap for Your Capital

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

FX Markets: Aussie Dollar Breaks 0.7100, Yen Rallies on Political Shifts

Anzo Capital Detailed Analysis

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

CFI Detailed Analysis

Beware ThinkMarkets: Forex Fraud Cases Exposed

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc