GX

Abstract:GX, the trading name of GS Brokers Capital Inc., is a brokerage company registered in the United Kingdom and currently does not maintain functional website, that's why we can only gather all the information in this article from Internet.

Note: GX's official website - https://www.gxbrokers.com/ is currently inaccessible normally.

| GX Review Summary | |

| Founded | / |

| Registered Country/Region | United Kingdom |

| Regulation | No regulation |

| Market Instruments | 2,100+, forex, CFDs, stocks and commodities |

| Demo Account | ❌ |

| Spread | From 0.2 pips (Forex) |

| From 0.4 pips (CFDs) | |

| Leverage | Up to 1:500 |

| Trading Platform | / |

| Min Deposit | USD 200 |

| Customer Support | Email: tradetoolspro@company.com |

| Address: 38 Ropery Rd Gateshead NE8 2HP United Kingdom | |

GX Information

GX, the trading name of GS Brokers Capital Inc., is a brokerage company registered in the United Kingdom and currently does not maintain functional website, that's why we can only gather all the information in this article from Internet.

The company offers trading services in CFDs, stocks and commodities. Minimum dpeosit is a little high at USD 200, with a tight spread from 0.2 pips.

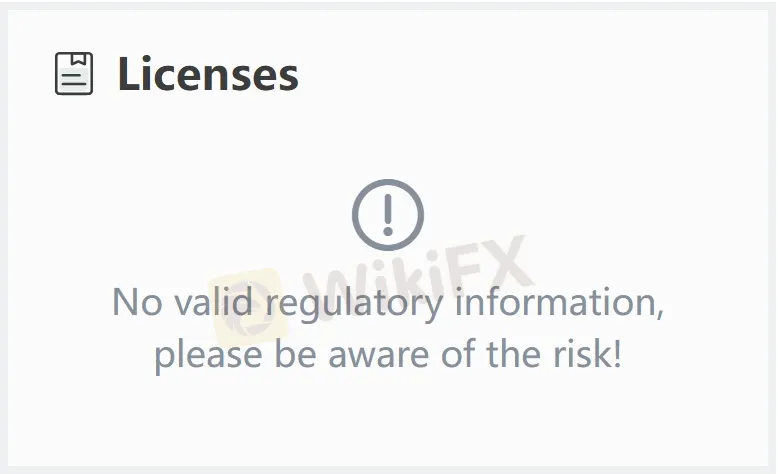

However, it cannot be negleceted that the broker currently operates without any valid regulation, which indicates possible less compliance to industry and customer protection.

What's worse, there are two complaints on WIkiFX about withdrawal issues, indicating unpleasant customer experience with this broker.

Pros and Cons

| Pros | Cons |

| Wide range of tradable assets | Inaccessible website |

| Tight starting spreads | No regulation |

| No demo accounts | |

| High minimum deposit | |

| WikiFX exposures about withdrawal issues |

Is GX Legit?

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of GX, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

What Can I Trade on GX?

GX claims to offer access to 2,100+ tradable assets to trade, including Forex, CFDs, stocks and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Fees

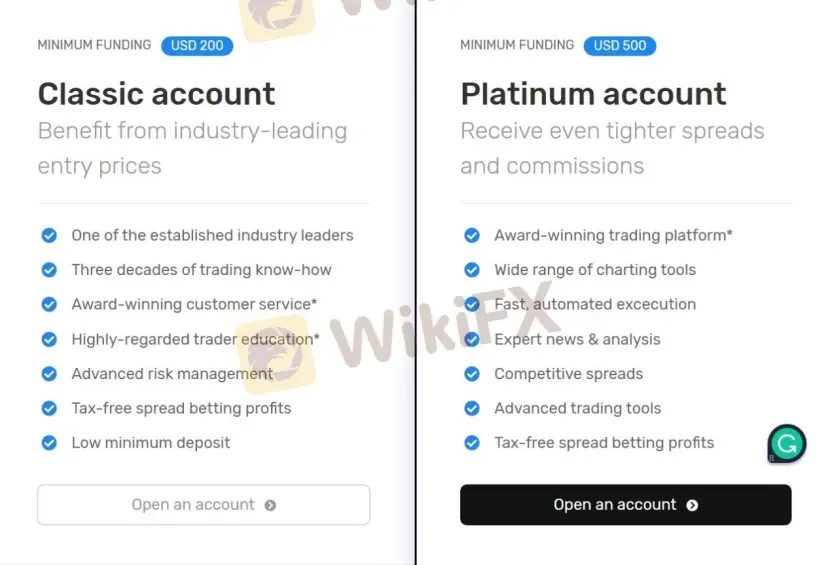

GX claims to offer two types of trading accounts, namely Classic and Platinum, with minimum initial deposit requirements of $200 and $500 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

| Account Type | Min Deposit |

| Classic | USD 200 |

| Platinum | USD 500 |

While spread and commission vary depending on the trading asset. For example, the spread is as low as 0.2 pips on forex, and from 0.4 pips on the CFDs. The commission is from $3 on US stocks and $1.25 per lot on commodities.

| Asset Class | Spread | Commission |

| Forex | From 0.2 pips | / |

| CFDs | From 0.4 pips | / |

| US stocks | / | From $3 |

| Commodities | / | From $1.25 per lot |

Leverage

The leverage provided by GX is capped at 1:500. Nevertheless, you should keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Read more

Seaprimecapitals Withdrawal Problems: A Complete Guide to Risks and User Experiences

Worries about Seaprimecapitals withdrawal problems and possible Seaprimecapitals withdrawal delay are important for any trader. Being able to get your money quickly and reliably is the foundation of trust between a trader and their broker. When questions come up about this basic process, it's important to look into what's causing them. This guide will tackle these concerns head-on, giving you a clear, fact-based look at Seaprimecapitals' withdrawal processes, user experiences, and trading conditions. Most importantly, we'll connect these real-world issues to the single most important factor behind them: whether the broker is properly regulated. Understanding this connection is key to figuring out the real risk to your capital and making a smart decision.

iFX Brokers Review: Do Traders Face Withdrawal Issues, Deposit Credit Failures & Free Coupon Mess?

Have you had to pay several fees at iFX Brokers? Had your trading profit been transferred to a scamming website, causing you losses? Failed to receive withdrawals from your iFX Brokers trading account? Has your deposit failed to reflect in your trading account? Got deceived in the name of a free coupon? Did the broker officials not help you in resolving your queries? Your problems resonate with many of your fellow traders at iFX Brokers. In this iFX Brokers review article, we have explained these problems and attached traders’ screenshots. Read on!

NinjaTrader Exposed: Why Traders are Calling Out NinjaTrader’s Lifetime Plan & Chart Data

Did NinjaTrader onboard you in the name of the Lifetime Plan, but its ordinary customer service left you in a poor trading state? Do you witness price chart-related discrepancies on the NinjaTrader app? Did you have to go through numerous identity and address proof checks for account approval? These problems occupy much of the NinjaTrader review online. In this article, we have discussed these through complaint screenshots. Take a look!

Questrade Review Pros, Cons and Regulation

Is Questrade legit? Yes—CIRO regulated broker offering stocks, ETFs, forex, CFDs, bonds, and more with low fees and modern platforms.

WikiFX Broker

Latest News

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Pepperstone CEO: “Taking Down Scam Sites Almost Every Day” Becomes “Depressing Daily Business”

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

eToro Cash ISA Launch Shakes UK Savings Market

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

Close Up With WikiFX —— Take A Close Look At Amillex

GGCC Bonus and Promotions: A Data-Driven Analysis for Experienced Traders

Rate Calc