Trade Capitol

Abstract:Trade Capitol, a trading name of Eunoia Group LLC, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:600 and floating spreads on the Webtrader trading platform via three different live account types, as well as 24/5 customer support service.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No regulation |

| Market Instrument | Forex, commodities, indices and stocks |

| Account Type | Beginner, Premium and Business |

| Demo Account | N/A |

| Maximum Leverage | 1:600 |

| Spread (EUR/USD) | 3 pips |

| Commission | no |

| Trading Platform | Webtrader |

| Minimum Deposit | $250 |

| Deposit & Withdrawal Method | MasterCard, Maestro, Visa and Wire Transfer |

Trade Capitol, a trading name of Eunoia Group LLC, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:600 and floating spreads on the Webtrader trading platform via three different live account types, as well as 24/5 customer support service. Here is the home page of this brokers official site:

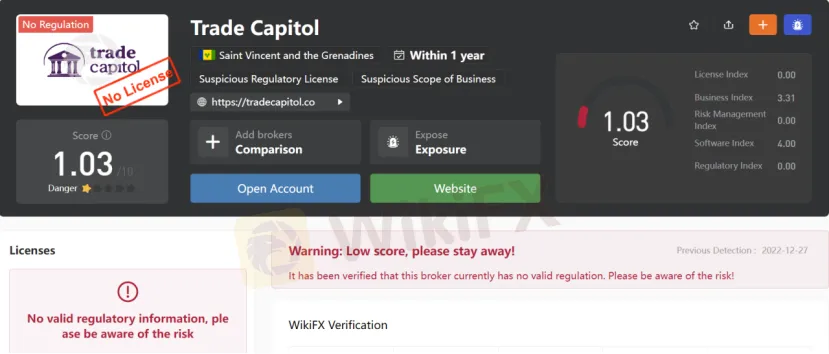

As for regulation, it has been verified that Trade Capitol currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.03/10. Please be aware of the risk.

Market Instruments

Trade Capitol advertises that it offers access to a wide range of trading instruments in financial markets, including Forex, commodities, indices and stocks.

Account Types

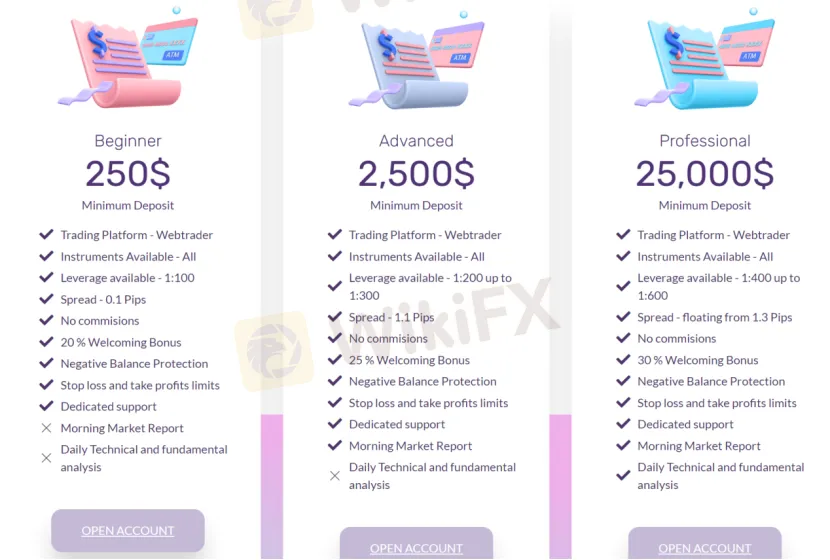

Trade Capitol claims to offer three types of trading accounts, namely Beginner, Premium and Business, with minimum initial deposit requirements of $250, $2,500 and $25,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The specified leverage for different account types at Trade Capitol varies between 1:100 and 1:600. Clients on the Beginner account can experience leverage of 1:100, and the Premium and Business accounts can enjoy a higher leverage of 1:200-1:300 and 1:400-1:600 separately. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

Spreads on the Beginner account are advertised as 0.1 pips, while 1.1 pips on the Premium account and floating from 1.3 pips on the Business account. However, in the trading platform, we see a spread of 3 pips, which is much higher than they advertised on the site. All charging no commissions.

Trading Platform Available

Instead of the world's most advanced and popularly-used MT4 and MT5 platforms, Trade Capitol gives traders a Webtrader. Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

From the logos shown at the foot of the home page on Trade Capitols official website, we found that this broker seems to accept deposits and withdrawals via MasterCard, Maestro, Visa and Wire Transfer. The minimum initial deposit requirement is said to be $250.

Bonus & Fees

Trade Capitol claims to offer different welcome bonuses for different account types. Specifically, a 20% welcome bonus on the Beginner account, a 25% welcome bonus on the Premium account and a 30% welcome bonus on the Business account. However, the bonus can only be withdrawn when a high minimum traded volume requirement of 25 times the bonus amount plus the deposit is achieved.

It also charges an inactivity fee. Inactive accounts are charged an extremely high fee of 10% of the balance monthly.

Customer Support

The only way you can get in touch with Trade Capitol is via email: support@tradecapitol.co. However, this broker doesnt disclose other more direct contact information like telephone numbers or the company address that most transparent brokers offer.

Pros & Cons

| Pros | Cons |

| • Multiple trading instruments, account types and payment options offered | • No regulation |

| • High minimum deposit ($250) | |

| • Wide spreads |

Frequently Asked Questions (FAQs)

| Q 1: | Is Trade Capitol regulated? |

| A 1: | No. It has been verified that Trade Capitol currently has no valid regulation. |

| Q 2: | Does Trade Capitol offer the industry-standard MT4 & MT5? |

| A 2: | No. Instead, Trade Capitol offers a Webtrader. |

| Q 3: | What is the minimum deposit for Trade Capitol? |

| A 3: | The minimum initial deposit at Trade Capitol to open the most basic account is $250. |

| Q 4: | Does Trade Capitol charge a fee? |

| A 4: | Like every forex broker, Trade Capitol charges a spread fee, which is uncompetitive, but no commission will be charged. It also charges an inactivity fee. |

| Q 5: | Is Trade Capitol a good broker for beginners? |

| A 5: | No. Trade Capitol is not a good choice for beginners. Not only because of its unregulated condition, but also because of its high initial deposit and uncompetitive trading conditions. |

Read more

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

BitPania Review 2026: Is this Broker Safe?

Rate Calc